Having a high credit limit can be beneficial in many ways. It allows you to make large purchases without maxing out your card, helps maintain a healthy credit utilization ratio, and gives you access to better credit card rewards and offers. But what if your current limit seems too low for your needs? The good news is, in most cases, you can negotiate with your credit card issuer to increase your limit. Here’s everything you need to know about negotiating your credit limit.

How Credit Limits Are Determined

When you apply for a credit card, the issuer evaluates your creditworthiness to determine the limit they will approve you for The main factors considered are

-

Credit score – The higher your score, the more likely you’ll be approved for a higher limit. Good to excellent credit (scores above 670) have the best chances

-

Income – Your income level demonstrates your ability to responsibly manage credit. Higher incomes tend to qualify for higher limits.

-

Existing debt – Low debt-to-income ratio and credit utilization rate indicates you can take on more credit. High debt levels may result in lower limits.

-

Credit history – Good payment history and mix of credit types helps. Many new credit accounts or late payments may lower your limit.

-

Credit inquiries – Too many recent inquiries can signify credit hunger and lower your chances of a high limit.

So where you stand with these criteria will influence the initial limit you are given. But the good news is, you usually have options to increase it.

When To Request A Higher Limit

The best times to request a credit limit increase are when:

-

Your credit score has improved significantly.

-

Your income has increased. This signals you can manage more credit responsibly.

-

You’ve had a major life event resulting in increased expenses (marriage, childbirth, home purchase).

-

You have an upcoming big purchase that will require a higher limit.

-

It’s been at least 6-12 months since your last limit increase request.

Avoid requesting frequent increases as this can signal credit risk to issuers. Space out requests by 6 months to a year.

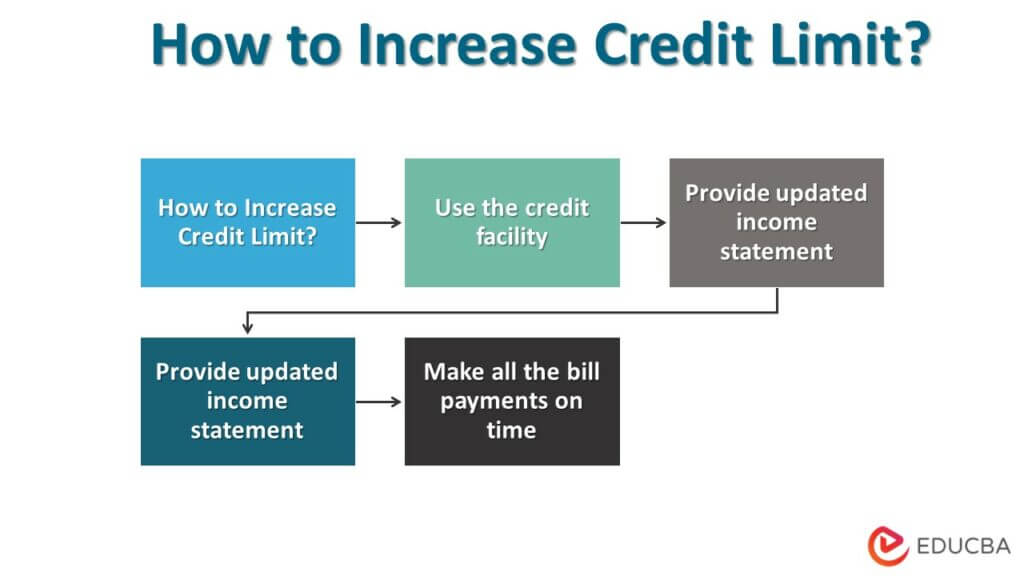

How To Ask For A Credit Limit Increase

Here are some easy ways to request a higher limit:

-

Online – Many issuer websites and apps have a “Request Credit Limit Increase” feature. Just log in and submit.

-

By phone – Call the number on the back of your card and ask. Be prepared with income/employment details.

-

Wait for automatic increase – Issuers often periodically bump limits for responsible cardholders.

-

Apply for new card – Getting approved for a new card gives you a higher combined limit. But new inquiries may temporarily lower your score.

When requesting, be polite and have documentation ready to verify income. Initial requests may trigger a hard inquiry. If denied, try other options.

Pros of A Higher Credit Limit

There are many benefits to raising your limit:

-

Increased purchasing power – Make bigger purchases and payments without maxing out cards.

-

Improved credit utilization – More available credit lowers your utilization ratio, boosting credit scores.

-

Access to better rewards – Higher limits may qualify you for elite cards with lucrative rewards and perks.

-

Emergency buffer – More available funds acts as a cushion for unexpected expenses.

-

Easier automation – Can set up higher autopay amounts for bills without exceeding limit.

Cons of A Higher Limit

There are a few potential downsides to be aware of:

-

Overspending risk – Having more available credit makes it easier to overspend. Requires discipline.

-

Lower score short-term – Hard credit inquiries from limit requests may temporarily knock a few points off your score.

-

Higher minimum payments – If you carry a balance, your minimum due each month will be higher.

-

Difficulty lowering later – Issuers don’t always allow lowering your limit back down easily.

-

Higher balances long-term – Research shows higher limits correlate to higher long-term balances carried.

Tips for Negotiating Your Credit Limit

Follow these tips to successfully negotiate a higher credit card limit:

-

Check your credit report – Ensure all information is accurate and maximize your score first.

-

Do your research – See what limits others have for cards similar to yours to set expectations.

-

Consider your needs – Set a goal limit based on upcoming expenses rather than applying for the maximum.

-

Provide documentation – Have recent pay stubs, tax returns, and bank statements ready.

-

Ask for a specific number – Don’t just ask for an increase, but request a particular limit amount.

-

Offer to move balances – Propose consolidating debt from other cards to show you’ll use the higher limit responsibly.

-

Request a lower hard inquiry limit – Ask if they can do a soft pull first to avoid an unnecessary hard inquiry.

-

Try again if denied – Don’t give up after the first attempt. Consider different cards or try again in 6 months.

Maintaining Good Credit Habits

Once approved for a higher limit, be sure to:

-

Use it judiciously – Only make purchases you can afford to pay off monthly. Don’t rack up debt.

-

Pay in full each month – Pay your statement balance off completely to avoid interest charges.

-

Set spending alerts – Have your issuer alert you if your balance exceeds a certain amount so you can adjust spending.

-

Check statements regularly – Review transactions frequently to ensure no fraudulent activity.

-

Keep utilization low – Try to keep your balance below 30% of your new limit.

-

Limit balance transfers – Move existing balances over slowly and systematically. Don’t max it out all at once.

-

Request occasional increases – Periodically ask for reasonable limit bumps to accommodate changing needs.

The Bottom Line

Negotiating a higher credit limit can unlock better rewards, improve your credit, and provide financial flexibility. Just be sure your income, credit score, and spending habits justify the increase. With a thoughtful approach, you can benefit from higher limits while maintaining stellar credit.

Become an authorized user on someone else’s account

If you have a trusted family member or friend whose credit card has a high limit, you could ask them to add you as an authorized user. This would allow the card to appear on your credit report and may help increase your available credit line.

Many credit cards offer free authorized user accounts and you dont need to use the card yourself to reap the benefits. Just be sure the primary cardholder pays their bills on time since their spending habits will directly impact your credit score.

Compare credit repair options

When you apply for a credit card, the issuer will ask for details regarding your current salary. If its been several years since you applied for a card or you recently started a new job with a higher salary, it can be advantageous to update your income information and request a credit limit increase.

Keep in mind, however, that if youre approved for a higher line of credit, it may still take several weeks to appear on your credit report. Also, your potential credit score increase will correlate with how much your credit utilization shifts. So, if you only receive a small increase, dont expect drastic changes to your credit score.

For example, if you have a $15,000 line of credit and are actively using $5,000 of it, your credit utilization ratio is 33%, which is considered high. If you can increase your credit line to $20,000, with the same $5,000 balance, your credit utilization would drop to 25%, below the 30% utilization ratio often recommended. While this dip in utilization will likely net you a few points on your credit score, increasing your credit limit while keeping your usage minimal is ideal.

7 Tips To Negotiate Your Credit Card Debt | Clever Girl Finance

FAQ

Can you negotiate a credit limit?

Otherwise, if you’d like an increase, you can contact your credit card company to request one. There are several actions you can take that will help you negotiate a higher credit limit. If you’re looking to raise your credit limit, aim to pay down some of your debt.

What is the credit limit for an $50,000 salary?

It boils down to your financial habits and income. A good rule of thumb is to aim for a credit limit that’s about 20-30% of your annual income. For example, if you make $50,000 a year, a good credit limit might be around $10,000 to $15,000.

Is it possible to lower your credit limit?

Credit card companies generally can increase or decrease credit limits, including reducing your credit limit so that you no longer have any available credit. If you no longer have any available credit, you cannot make any charges until you pay off some of your existing balance.

Is it a good idea to ask for a credit limit increase?

Receiving a credit limit increase can lower your credit utilization rate, which could positively impact your credit scores.