If you’re a high-net-worth individual seeking a sizable mortgage to purchase or refinance real estate, you need a high-net-worth mortgage. Traditional mortgages fall short and don’t take into consideration the complex financial situations of high-net-worth individuals (HNWIs).

This comprehensive guide delves into the intricate world of high-net-worth mortgages, exploring the creative programs available, their benefits, and the specific financial scenarios they address, making them a valuable tool for HNWIs in managing their real estate investments.

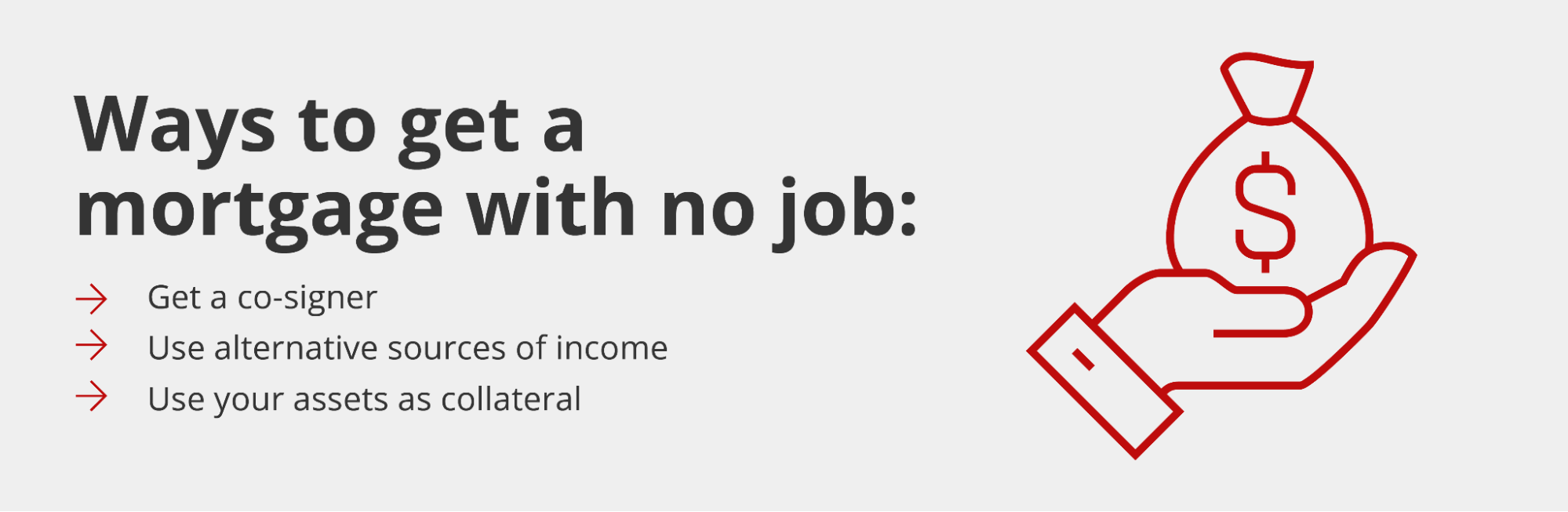

Getting a mortgage is usually contingent on having stable employment and income. However, there are some scenarios where you may be able to get a mortgage even if you don’t have a traditional job High net worth individuals with ample assets may qualify for specialized mortgage programs that don’t require traditional income documentation

What is High Net Worth?

High net worth generally refers to individuals with investible assets of at least $1 million or more, excluding primary residence. This can include stocks, bonds, mutual funds, cash accounts, and other liquid assets.

Having high net worth shows lenders you have substantial financial resources to pay back a mortgage even without steady employment income.

Mortgage Options for High Net Worth Borrowers

If you have high assets but limited income, here are some potential mortgage programs to consider:

Asset Depletion/Asset-Based Loans

With an asset depletion mortgage, the lender calculates your repayment ability based on your assets rather than your income. They determine the amount you qualify for by dividing your assets by the loan term.

For example, if you have $2 million in liquid assets and want a 30-year mortgage, the lender may calculate a qualifying “income” of $66,666 per year ($2 million / 30 years).

These loans require high down payments, often 50% or more of the home’s value.

Bank Statement Loans

Bank statement loans look at the regular deposits flowing into your bank accounts rather than traditional income sources.

The lender reviews one to two years of bank statements to calculate an average annual deposit amount to use for qualifying purposes. Bank statement loans are available for both personal and business bank accounts.

High assets and credit scores are usually required for these programs.

Private Banking and Wealth Management Mortgages

Many large banks have private banking divisions that cater to high net worth clients. These lenders take a more flexible approach and may offer specialized mortgage programs based on your assets and credit rather than verifiable income.

Mortgages through wealth management divisions often require you to have an established relationship and substantial assets with the bank.

Family Office Lending

For ultra-high net worth borrowers, some family offices and private banks offer lending services. These mortgages are secured by your investment portfolio rather than employment income.

They are highly customized loans targeted to borrowers with at least $10 million to $100 million in investable assets.

Pros and Cons of Mortgages for High Net Worth

Pros

- Qualify based on your assets rather than income

- Flexible documentation requirements

Cons

- Higher mortgage rates than conventional loans

- Require excellent credit

- Typically need higher down payments

- Limited lender options

While it is possible to get a mortgage without steady employment income, programs for high net worth borrowers have stricter criteria than standard loans. You’ll need pristine credit, significant assets, and likely a large down payment.

Shopping with an experienced mortgage broker can help you find a lender willing to consider your overall financial profile rather than just your employment income. But you may have fewer options and pay more in fees and mortgage interest rates compared to a traditional loan.

Alternatives to High Net Worth Mortgage Programs

If you don’t quite meet the requirements for a specialized high net worth mortgage, here are some other options that are less stringent on income documentation:

-

Stated Income Loans – With a stated income mortgage, you simply tell the lender your income without having to provide documentation to support it. However, you’ll still need strong credit and assets.

-

DSCR Investment Loans – Debt service coverage ratio (DSCR) loans look at the projected rents on an investment property rather than your personal income. A DSCR of at least 1.0 is usually required, meaning the expected rents equal or exceed the mortgage payment.

-

Paying Cash – If you have enough assets to buy a home outright without financing, this avoids income requirements altogether. Some high net worth buyers use cash to purchase vacation homes or investment properties.

-

Adding a Co-Borrower – Applying for a mortgage jointly with another borrower who has income can improve your chances of approval, even if you don’t have a job.

Key Takeaways

While uncommon, there are some scenarios where high net worth borrowers can qualify for a mortgage without traditional income sources:

-

Asset-based and bank statement loans use your assets rather than income to qualify.

-

Private banking divisions offer specialized lending for high net worth clients.

-

You’ll need excellent credit, substantial assets, and a large down payment.

-

Interest rates are typically higher than standard mortgage programs.

If you don’t meet high net worth loan requirements, alternatives like stated income or DSCR loans may be easier to obtain. Or consider paying cash or adding a co-borrower if buying without financing isn’t feasible.

Pledged assets: LTV tool

Similar to the asset depletion program, the pledged assets program allows you to use assets to qualify. However, there is an important difference. The asset depletion method is simply a calculation tool used by lenders to calculate your debt-to-income ratio, and no lien is placed on your assets. By contrast, the pledged assets program requires you to actually pledge the assets as collateral for the loan.

The main reason HNWIs pledge assets is to obtain higher loan-to-value (LTV), up to 90%.

Assets that can be pledged include cash, stocks, bonds, certificates of deposit (CDs), savings accounts, and mutual funds. However, it’s important to note that not all assets are eligible. Assets bought on margin, options, warrants, IRA assets, 401(k) assets, annuities, insurance benefits, and Section 529 or other education savings plans are typically excluded from being used as collateral.

One advantage of pledged asset programs is that the borrower doesn’t have to be the owner of the collateral. This means that family members, friends, or foundations and trusts may be able to assist by providing collateral for these loans.

Some creative lenders allow the pledging of more exotic assets, such as automobiles, art, antiques, jewelry, and royalty income streams.

Whereas the pledged assets program entails pledging non-real-estate assets such as stocks and savings accounts, the cross-collateralization program involves pledging real estate.

Cross-collateralization is a valuable program for HNWIs who already own a property and seek a loan to acquire another property. The already-owned property can be a primary residence, second home, or investment property, and can even be located in a different state. Ideally, the already-owned property is either held free and clear or there is enough equity built up.

With this approach, the lender takes a first lien position on both the newly purchased property and the cross-collateralized property.

The primary advantage of cross-collateralization is the ability to obtain up to 100% LTV (i.e., 0% down payment).

Lenders will offer 100% LTV for purchase transactions if there is proof of at least 12 months of post-closing reserves, and no gift funds are used.

Cross-collateralization can be applied not only to new purchases but also to refinances.

While the cross-collateralization program involves 2 properties, the rental portfolio loan is geared toward HNWIs with extensive portfolios of multiple rental investment properties.

A rental portfolio loan is a financial tool for HNWIs owning multiple rental properties (usually at least 5 to 7 properties). It consolidates any existing mortgages into one single loan, offering flexibility in terms and conditions. This streamlines monthly payments and simplifies debt management for the investor.

Read more about rental portfolio loans.

A no-ratio loan is a mortgage that does not require any calculation of the borrower’s debt-to-income ratio (DTI). Quite simply, there is no verification of employment or income required.

This approach is appealing to HNWIs who may have significant assets but prefer not to disclose their income or whose income might not qualify under traditional loan standards.

The main highlights of the no-ratio mortgage include:

• Jumbo loan amounts available up to $2 million • No DTI calculated • No income documentation required • No income calculation required • No employment verification required • Only applies to owner-occupied residential properties, i.e., primary residences or second homes • Not available for investment properties • Available for purchase, rate-and-term, and cashout refinance transactions

Learn more about how a no-ratio loan can benefit you.

Key takeaways on mortgages for high-net-worth individuals

Ready to work with a broker and see what opportunities high-net-worth mortgage lenders can offer you? Here are some key takeaways:

Specialized Financial Solutions: HNW mortgages are tailored to meet the unique financial needs of individuals with complex income streams and asset-rich profiles, providing a level of flexibility not typically found in standard mortgage products.

Diverse Mortgage Options: HNW mortgages offer a variety of options like asset depletion, pledged assets, cross-collateralization, rental portfolio loans, and no-ratio loans. These cater to different scenarios, whether borrowers are asset-rich but cash-poor, or they prefer not to disclose income or employment details.

Pros of HNW Mortgages: High-net-worth mortgages offer substantial flexibility, asset preservation, growth opportunities, tax benefits, and enhanced privacy, catering specifically to the complex financial scenarios and privacy needs of high-net-worth individuals.

Potential Drawbacks of HNW Mortgages: They can lead to potentially higher interest rates, a commitment to long-term debt, and significant collateral requirements, posing risks and considerations, especially for those seeking financial flexibility and stability.

Importance of Professional Advice: Navigating the complexities of HNW mortgages often necessitates the involvement of professional mortgage brokers who specialize in high-net-worth lending. Their expertise is crucial in finding the right lender, negotiating terms, and managing the intricacies of the mortgage process.

In summary, HNW mortgages offer bespoke solutions, allowing you to leverage your assets efficiently while providing flexibility and potential tax benefits. However, the complexity and potential for higher costs require careful consideration and expert guidance to ensure alignment with your broader financial strategy.

Can You Get a Mortgage Without a Job? Can I Get a Mortgage While on Unemployment?

FAQ

Can you get a mortgage with assets but no income?

You have a high net worth but no job.

If working is no longer necessary because you have enough money to live on, a no-doc mortgage loan may allow you to convert your assets into qualifying income.

Is it possible to get a mortgage without a job?

Yes, you can get a mortgage without a job, but you still need proof of ‘income’ from other sources. Many retired people do this and they’re no longer working a regular job, but have income streams coming in from investments.

Can you get a mortgage based on net worth?

Yes, individuals with high net worth can obtain a mortgage without traditional employment. Lenders offer special high-net-worth mortgages that consider assets and investments instead of regular income. These might include asset depletion or pledged assets, where the focus is on your assets, not your employment status.

Can I get a mortgage with no job but a large deposit?

You can get a mortgage with no job but a large deposit if it makes financial sense for you. If you have a good credit history, lenders may be willing to look past your unemployment if you have cash reserves that will help you pay for the loan.