If you have a collection on your credit report, you may be wondering how it may impact your FICO® Scores. Below we share answers to the most commonly asked questions about collections. As with any derogatory information, when reported, its impact on a FICO Score will gradually lessen over time as they age off the credit report.

Hey there, folks! If you’re staring at a collection account on your credit report, wondering if shelling out the cash to pay it off might somehow backfire and hurt your credit score even more, you ain’t alone. I’ve been there, stressing over every little ding on my credit, wondering if I’m just diggin’ a deeper hole. So, let’s get straight to the meat of it: Can paying off collections hurt your credit score? Nah, not usually. In most cases, paying off a collection account either helps your score or does nothing at all, depending on some nerdy credit scoring rules. But there’s a lotta layers to this onion, and I’m gonna peel ‘em back for ya with clear, no-BS details.

At our lil’ corner of financial wisdom, we’re all about keepin’ it real and helpin’ you navigate this credit maze Whether you’ve got one pesky collection or a whole stack of ‘em, I’m here to walk you through what happens when you pay, why it might not always “fix” things, and how to bounce back stronger Stick with me, and let’s dive into the nitty-gritty of collections and credit scores!

What the Heck Are Collection Accounts, Anyway?

Before we get into whether paying ‘em off can hurt ya, let’s make sure we’re on the same page about what a collection account even is. Simply put, it’s a debt you didn’t pay for a long-ass time—usually over 90 days past due. Your original creditor gets fed up and hands it over to a collection agency, or sometimes their own in-house debt hounds. These folks are relentless, blowin’ up your phone, spamming your mailbox, all to get that money.

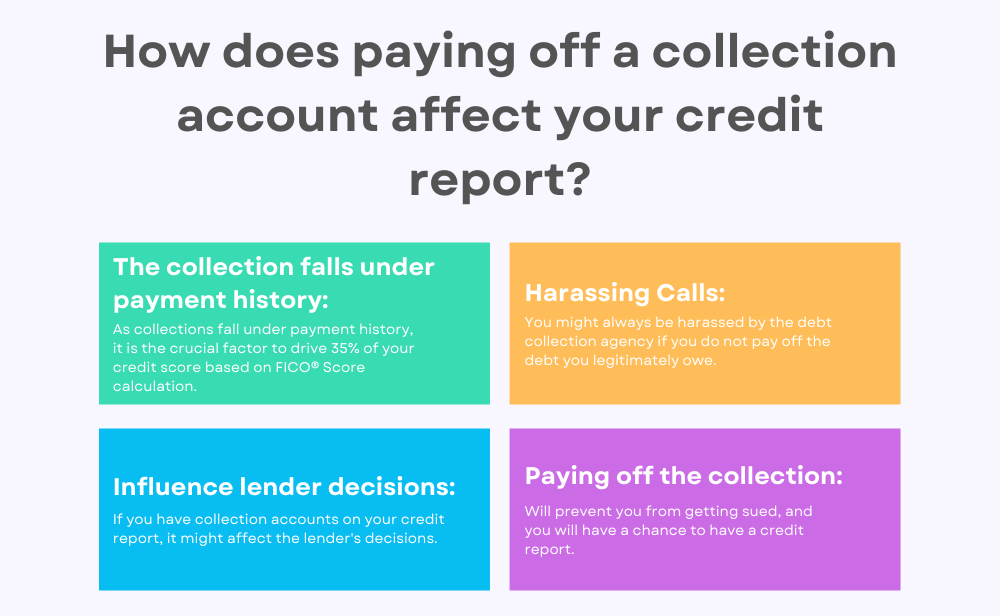

When a debt hits collections, it shows up on your credit report as a big ol’ red flag. It screams to lenders, “Hey, this person didn’t pay up!” And trust me, it stings. This mark falls under your payment history, which is a whopping 35% of your FICO score—the biggest chunk of how your creditworthiness is judged. So yeah, collections can tank your score faster than a lead balloon.

How Bad Do Collections Mess With Your Credit?

Let’s not sugarcoat it collections are a gut punch to your credit score. When that account first gets reported as “in collections” your score takes the hardest hit. Over time the damage fades a bit, but it’s still a black mark for up to 7 years from the first missed payment that led to this mess. That’s right—seven freakin’ years!

Here’s a quick rundown of why it hurts so bad:

- Payment History Rules All: Like I said, it’s 35% of your score. Missin’ payments and hittin’ collections is the worst sin in credit land.

- Lenders Hate It: Future creditors see this and think, “Will they skip out on me too?” It makes gettin’ loans or cards tougher.

- Long-Lasting Scar: Even if you pay later, the record sticks around for that 7-year stretch, unless it’s a special case like medical debt (more on that soon).

Now, the impact ain’t the same for everyone Some factors tweak how much it dings ya

- If it’s a tiny debt (like under $100), newer credit models might ignore it altogether.

- Medical debts got some special treatment lately—paid ones often don’t show up anymore, and unpaid ones under $500 might not either.

- The type of scoring model matters a ton (we’ll get to that in a sec).

So, Can Paying Off Collections Actually Hurt Your Score?

Alright, let’s tackle the big question head-on. You might be thinkin’, “If I pay this off, will it somehow make things worse?” I get the worry—credit rules are weirder than a three-headed frog sometimes. But here’s the deal: Paying off a collection account generally does NOT hurt your credit score. In fact, it’s often a step in the right direction, though the benefit depends on a few things.

Here’s why it usually won’t hurt ya:

- Newer Scoring Models Are Kinder: Some of the latest credit scoring systems—like FICO 9, FICO 10, and VantageScore 3.0 or 4.0—don’t penalize you for paid collections. Pay it off, and they act like it never happened (for scoring purposes, at least).

- No Direct Penalty for Paying: Even in older models like FICO 8, which still counts paid collections against ya, paying doesn’t make your score drop further—it just don’t help neither.

- Special Rules for Medical Stuff: If your collection is medical, paying it might get it wiped off your report entirely, which is a win no matter how ya slice it.

Now, is there any chance of a downside? I ain’t gonna lie, there’s a tiny, rare glitchy scenario where somethin’ could go sideways. Like, if paying updates the account status on your report and a lender sees a “recent activity” flag, they might get twitchy. But that’s more about perception than an actual score drop, and it’s super uncommon. Bottom line: paying ain’t gonna hurt your score 99.9% of the time.

Why Paying Might Not Help as Much as You’d Hope

Here’s where it gets a lil’ tricky, fam. Even though paying off collections won’t hurt ya, it don’t always mean your score’s gonna skyrocket either. Let’s break down why:

- Older Scoring Models Don’t Care: If a lender uses FICO 8 (which a lotta them do), a paid collection still counts against you, just like an unpaid one. No bonus points for doin’ the right thing.

- It Stays on Your Report: Paid or not, most collections stick on your credit report for 7 years. It’ll show as “paid,” which looks better to human eyes, but the computer don’t always care.

- Other Factors Weigh In: If your credit’s already got other issues—like late payments or high card balances—paying one collection might not move the needle much.

Check out this lil’ table to see how different scoring models treat paid collections:

| Scoring Model | Effect of Paid Collections |

|---|---|

| FICO 8 | Still hurts your score, no change after paying. |

| FICO 9 & 10 | Ignores paid collections—score may improve! |

| VantageScore 3.0 & 4.0 | Ignores paid collections—score likely goes up. |

So, if a lender’s usin’ an older model, you might not see a bump right away. But don’t fret—newer models are gettin’ more popular, especially with big stuff like mortgages switchin’ over by 2025 or so.

Other Reasons Paying Collections Is Still a Smart Move

Even if your score don’t jump up overnight, I’m tellin’ ya, paying off that collection account is usually a damn good idea. Here’s why we at [Your Company Name] always push folks to clear these debts when they can:

- Dodgin’ Legal Drama: If you owe and the debt’s still within the statute of limitations, collectors could sue ya and garnish your wages. Payin’ stops that nonsense cold.

- No More Debt Musical Chairs: Collectors buy and sell debts all the time. Pay it, and you don’t gotta deal with a new jerk callin’ every month.

- Avoid Extra Fees: In many states, they can tack on interest and fees even after it’s in collections. Pay fast to keep that bill from balloonin’.

- Looks Better to Lenders: A “paid” collection on your report ain’t perfect, but it’s way better than “unpaid.” Some lenders, especially for mortgages, hate seein’ open bad debt.

I remember when I had a collection hangin’ over my head—payin’ it off didn’t fix my score right away, but man, the peace of mind from not gettin’ hounded was worth every penny.

Special Case: Medical Collections and New Rules

Now, lemme throw in a lil’ curveball about medical debts ‘cause they play by different rules. If your collection is from a hospital bill or doc visit, you got some advantages:

- Paid Medical Collections: These often get removed from your credit report altogether nowadays. No more scar after you pay!

- Unpaid Under $500: Many of these don’t even show up on your report, so they can’t hurt ya.

- Scoring Models Evolving: Newer systems either ignore medical collections or weigh ‘em less heavily than other debts.

There’s even talks of bigger changes, like rules to keep medical debt off reports entirely, but that’s still in the works and facin’ some legal pushback. For now, if your collection is medical, payin’ it is almost always a straight-up win.

What If Paying Ain’t an Option Right Now?

I get it—sometimes the cash just ain’t there. If you can’t pay off that collection yet, don’t beat yourself up. Here’s a couple things to keep in mind:

- Time Heals (Sorta): The hit to your score gets less painful as years pass. After 7 years, it drops off completely.

- Dispute Errors: If the collection ain’t legit or the amount’s wrong, dispute it with the credit bureaus. You got rights, fam!

- Focus Elsewhere: Work on other credit habits, like payin’ current bills on time, to offset the damage.

How to Boost Your Credit After Collections

Whether you’ve paid that collection or not, rebuildin’ your credit is the name of the game. We’ve seen folks climb outta credit holes with some simple moves, and I wanna share ‘em with ya:

- Pay Bills on Time, Every Time: Set up autopay or reminders. Late payments are the devil for your score.

- Keep Card Balances Low: Try not to use more than 30% of your credit limit. It shows you’re in control.

- Don’t Apply for Too Much Credit: Every app means a hard inquiry, which can nick your score a bit. Only go for what ya need.

- Check Your Report: Look for mistakes. Dispute anything fishy—it’s free and can help.

I’ve messed up before by maxin’ out cards while ignorin’ a collection, and lemme tell ya, it was a slow crawl back. Focus on small, steady wins, and you’ll get there.

Common Myths About Collections and Credit Scores

There’s a ton of bunk info floatin’ around about collections, so let’s bust a few myths while we’re at it:

- Myth: “Payin’ a collection removes it from my report.” Nah, it stays for 7 years, marked as paid, unless it’s medical.

- Myth: “Payin’ always boosts my score.” Not true—depends on the scoring model.

- Myth: “Collections don’t matter after a while.” Wrong—they hurt less over time, but still count ‘til they fall off.

Don’t fall for the internet’s wild tales. Stick with what’s real, and you’ll make smarter moves.

Wrappin’ It Up: Should You Pay That Collection?

So, back to the biggie: Can paying off collections hurt your credit score? Like I’ve been sayin’, prolly not. It’s either gonna help (with newer scoring systems) or do nothin’ (with older ones). There ain’t no real evidence it’ll drag your score down, so don’t let that fear stop ya. Plus, the side perks—like avoidin’ lawsuits and lookin’ better to lenders—are worth it.

If you’re sittin’ on a collection account, weigh your options. Got the cash and wanna clear your name? Go for it. Strapped tight? Focus on other credit habits ‘til you can swing it. Either way, we’re rootin’ for ya to get that score back up and kick financial stress to the curb.

Got more questions about your specific situation? Drop a comment below, and I’ll do my best to help ya out. Let’s keep this convo goin’ and tackle this credit game together!

How do FICO® Scores consider third-party collections?

How the credit reporting agencies report collections and how FICO Scores consider third-party collection information has evolved and it can differ by the score version.

- Paid medical collection debt and medical collection debt <$500 are no longer being reported by the credit reporting agencies and therefore are not considered in the calculation of any version of the FICO Scores.

- Collections reported as paid in full are disregarded by FICO® Score 9 and the FICO® Score 10 suite.

- Collections reported with an original amount under $100 are disregarded by FICO® Score 8, FICO® Score 9 and the FICO® Score 10 suite.

- Unpaid medical collections >$500 are considered, but have less impact on the score within FICO Score 9 and the FICO Score 10 Suite compared to older FICO Score versions.

First-party collections are still treated as derogatory and are not afforded these special treatments.

Will paying off the balances owed on my third-party collections increase my FICO® Scores?

Paying off a collection could cause the score to increase, decrease or have no impact at all. It depends on the change in the information reported on the collection as well as the other information in the credit report. For example, this action would likely have a lower positive impact if the individual has a lot of other negative information on his/her credit report. On the other hand, if the collection is the only negative item being reported, paying it off could help to increase the score.

Paying Collections – Dave Ramsey Rant

FAQ

Will my credit score go up if I pay off collections?

What happens when you pay off collections?

Why did my credit score drop when I paid off a collection?

Credit utilization — the portion of your credit limits that you are currently using — is a significant factor in credit scores. It is one reason your credit score could drop a little after you pay off debt, particularly if you close the account.

Will paying off a collection remove it from my credit report?

Will paying off collections affect my credit score?

It depends on where your credit score stood prior to the collection account being reported. If you had stellar credit, your rating could drop by up to 100 points. However, the impact is not as significant if your credit score is already on the lower end. Paying off collections won’t improve your credit score right away.

Does paying a collection account improve your credit score?

“Fortunately, the impact does fade over time,” Noisette says. If you are paying other credit cards and bills on time, this will bolster your credit score in spite of collection debt, Noisette adds. “That can counteract the negative impact,” she says. Can Your Credit Improve if You Pay Your Collection Account?

How does a credit card collection affect your credit score?

It can decrease your credit score by up to 100 points because it affects your payment history, which is responsible for about 35% of your credit. In the past, a collection amount over $100, regardless of its payment status, could impact your credit for up to seven years from the date the account was sent to collections.

What happens if a collection account appears on your credit report?

A collection account on your report is one of the most harmful items that can appear on your credit, especially if your credit score was previously good. It can decrease your credit score by up to 100 points because it affects your payment history, which is responsible for about 35% of your credit.

Should you pay off a bill in collections?

Paying is often a good idea, not only because you presumably owe the debt they’re seeking or even because it will get the bill collectors off your back. There’s a chance, if no guarantee, that paying off an account in collections could benefit your credit score. How Do Collections Affect Your Credit?

Can a collection account hurt your credit score?

A collection account can hurt your credit score, but the extent of the damage depends on where your score was before the debt was sent to collections. “The better your score, the more significant the drop will be,” says Leslie Tayne, a financial attorney and founder and managing director of New York’s Tayne Law Group.