Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

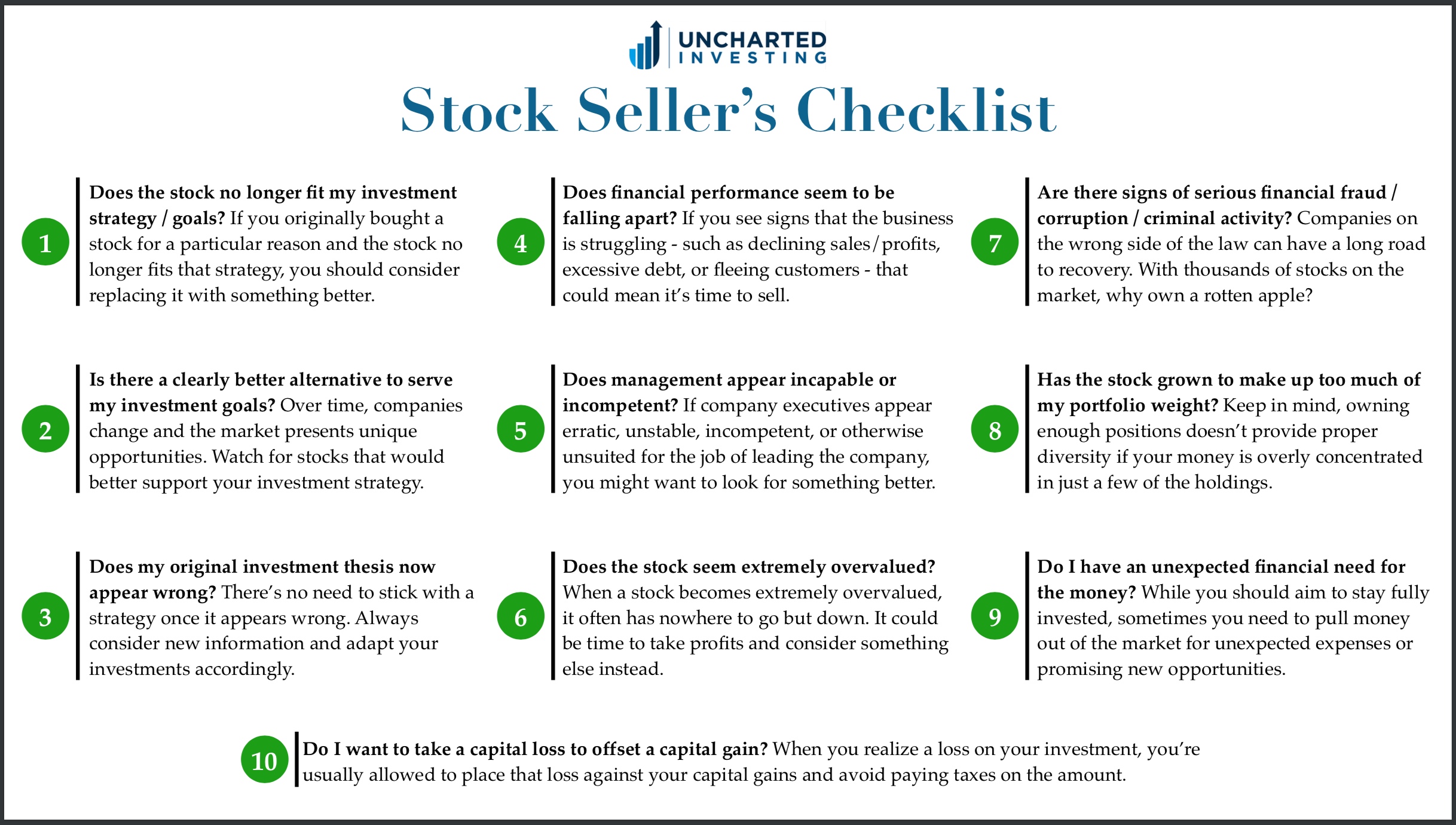

Theres a ton of information out there about buying stocks. Unfortunately, theres far less information about selling stocks.

That’s a mistake, as the sale is when you actually make money. Getting it right can be key to claiming your profits — or, in some cases, cutting your losses.

Hey there! I’m Dave, and today we’re diving into one of the most misunderstood stock trading strategies out there: selling stock before you actually own it. Sounds impossible, right? Well, it’s not only possible, but it’s a legitimate trading strategy called “short selling” that experienced investors use all the time.

When I first started investing, I was confused about this concept too. How can you sell something you don’t own? But once I understood the mechanics, it opened up a whole new perspective on trading.

What is Short Selling?

Short selling (or “shorting”) is essentially betting that a stock’s price will fall. Instead of the traditional “buy low, sell high” approach, short selling flips the script to “sell high, buy low.”

Here’s how it works in simple terms:

- You borrow shares from your broker

- You sell these borrowed shares at the current market price

- Later, you buy back the same number of shares (hopefully at a lower price)

- You return the borrowed shares to your broker and pocket the difference

So yes you can absolutely sell stock before buying it – that’s the essence of short selling!

A Simple Short Selling Example

Let’s say you think XYZ Company is overvalued at its current price of $100 per share

- You borrow 10 shares of XYZ from your broker and sell them at $100 each, pocketing $1,000

- A few weeks later, XYZ’s price drops to $80 per share as you predicted

- You buy 10 shares at $80 each, costing you $800

- You return the 10 borrowed shares to your broker

- Your profit is $200 ($1,000 – $800), minus any fees or interest

But what if the stock price rises instead? That’s where the big risk comes in!

The Risks of Short Selling

Short selling is WAY riskier than traditional investing. Here’s why:

-

Unlimited loss potential: When buying stocks normally, the worst case scenario is losing 100% of your investment. With short selling, there’s no theoretical limit to how high a stock price can rise, meaning unlimited potential losses.

-

Margin requirements: Short selling requires a margin account, which means you’re trading with borrowed money. This can amplify both gains and losses.

-

Short squeeze: If a heavily shorted stock starts rising rapidly, short sellers may rush to buy shares to cover their positions, driving the price even higher in a vicious cycle.

-

Timing challenges: Even if you’re right about a stock being overvalued, you might be wrong about when the price will fall. The market can stay irrational longer than you can stay solvent!

How to Actually Execute a Short Sale

If you’re still interested in trying short selling, here’s how the process typically works:

1. Set Up a Margin Account

You can’t short sell in a regular cash account or retirement accounts like IRAs. You’ll need a margin account with a broker that allows short selling.

2. Find a Stock to Short

Your broker must have shares available to borrow. Not all stocks can be shorted, especially smaller companies with limited float.

3. Place Your Order

When filling out the trade ticket, you’ll select “sell” even though you don’t own the shares. The order form will look similar to a regular sell order:

- Select “sell”

- Enter the stock symbol

- Choose number of shares

- Select order type (market, limit, etc.)

- Set time in force (day, good-til-canceled, etc.)

4. Choose the Right Order Type

Just like with regular stock sales, you have several order type options when short selling:

| Order Type | What It Is | When To Use It |

|---|---|---|

| Market order | Request to sell ASAP at best available price | When you want to short immediately regardless of exact price |

| Limit order | Request to sell only at specific price or better | When you want to short only if you can get a certain price or better |

| Stop order | Market order that executes if stock reaches set price | When you want to short only if stock rises to a certain price |

| Stop-limit | Combination of stop and limit orders | When you want more precise control over entry price |

5. Monitor Your Position Carefully

Unlike long-term investing where you can often “set it and forget it,” short positions require active monitoring due to their higher risk profile.

Alternatives to Short Selling

If short selling seems too risky (and for most beginners, it probably is), there are safer alternatives:

-

Put options: These give you the right (but not obligation) to sell a stock at a specific price within a set timeframe. Your loss is limited to the premium you pay for the option.

-

Inverse ETFs: These funds are designed to move in the opposite direction of a specific index or sector. They’re easier to trade and don’t require margin accounts.

-

Simply avoid overvalued stocks: Sometimes the best action is no action. If you think a stock is overvalued, you can simply avoid investing in it.

Important Considerations Before You Short

Before you jump into your first short sale, ask yourself:

- Do I fully understand the unlimited risk potential?

- Can I afford to lose more than my initial investment?

- Do I have experience with margin trading?

- Am I prepared to actively monitor this position?

- Is there a compelling reason why this stock will decline?

- Have I considered less risky alternatives?

The Psychology of Short Selling

I’ve noticed that short selling is psychologically challenging for many investors. Here’s why:

- It goes against the market’s general upward bias over time

- You’re fighting against companies that are actively trying to succeed

- The unlimited risk can cause extreme stress and poor decision-making

- There’s often social pressure against short sellers, who are sometimes viewed as hoping for failure

When Short Selling Makes Sense

Despite the risks, there are legitimate reasons why investors might consider short selling:

-

Portfolio hedging: Short selling specific stocks can help hedge against downside risk in other parts of your portfolio.

-

Market bubbles: During periods of extreme overvaluation, short selling can provide profits during market corrections.

-

Specific company issues: If you identify serious problems with a company’s business model, accounting, or management, short selling might be appropriate.

Final Thoughts: Is Short Selling Right for You?

For most beginner investors, short selling probably isn’t the best strategy. The unlimited risk potential and complexity make it more suitable for experienced traders who thoroughly understand market dynamics.

If you’re still a beginner, I’d recommend mastering the basics of long-term investing first. Learn how to analyze companies, diversify your portfolio, and manage risk before venturing into advanced strategies like short selling.

But if you’re determined to try it, start small. Maybe allocate just a tiny portion of your portfolio to short positions while you learn the ropes.

Remember: Even professional short sellers get it wrong sometimes, and the consequences can be devastating when they do.

Bottom Line

So can you sell stock before buying it? Yes, through short selling. Is it a good idea for beginners? Probably not.

Whatever you decide, make sure to do your homework, understand the risks, and never short sell with money you can’t afford to lose – and potentially lose more than your initial investment.

Got any questions about short selling or other investing strategies? Drop them in the comments below, and I’ll do my best to help!

Happy (and careful) investing!

How do you sell stock?

You sell stock by placing an order with your broker. You fill out an order form that will ask what stock you want to sell, if you want to sell in shares or dollars, how much you want to sell, and if you want to sell via a market or limit order. Ideally, youll be selling the stock after it has grown in value from when you bought it, locking in a profit. The stock-selling order form will look something like this:

This is what an order form for selling stock looks like on Fidelity. Most brokerages will have a similar process.

3 steps to selling stocks

When you sell depends on your investing strategy, your investing timeline, and your tolerance for risk.

Sometimes though, loss aversion and fear get in the way. There are good reasons and bad reasons to sell stocks. Check your emotions when youre ready to pull the trigger.Advertisement

Charles Schwab |

Public |

Coinbase |

|---|---|---|

| NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.8 /5 |

NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.6 /5 |

NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.6 /5 |

|

Fees $0 per online equity trade |

Fees $0 |

Fees 0% – 4% varies by type of transaction; other fees may apply |

|

Account minimum $0 |

Account minimum $0 |

Account minimum $0 |

|

Promotion None no promotion available at this time |

Promotion Earn a 1% uncapped match when you transfer your investment portfolio to Public. |

Promotion None no promotion available at this time |

| Learn More | Learn More | Learn More |

Ongoing poor performance relative to the competition, irresponsible leadership and management decisions you don’t support may all make the list of good reasons. Maybe you’ve decided your money would do better elsewhere, or you’re harvesting losses to offset gains for which you’ll owe income taxes.

Bad reasons typically involve a knee-jerk reaction to short-term stock market fluctuations or one-off company news. Bailing when things get rocky only locks in your losses, which is the opposite of what you want. (You know the saying: Buy low, sell high.) Before you sell, think about why you bought the stock in the first place. Did you consider what news or circumstances would make you sell it? Go over your reasoning to ensure you’re not giving in to an emotional response you might later regret.

» Prone to emotional investing? Check out robo-advisors

How To Sell Stocks: When To Take Profits | Learn How To Invest: IBD

FAQ

How long before I can buy a stock after selling it?

More specifically, the wash-sale rule states that the tax loss will be disallowed if you buy the same security, a contract or option to buy the security, or a “substantially identical” security, within 30 days before or after the date you sold the loss-generating investment.

Why did Warren Buffett sell his stocks?

Do I get taxed if I sell a stock then reinvest it?

But with stocks, reinvesting your gains does not reduce the federal income taxes you may owe. When you reinvest the proceeds from selling a stock that has risen in value, you may have a higher cost basis for federal income tax purposes.

What is the 7% sell rule?