Did you know that you can trade outside of regular market hours? With extended-hours trading, you can trade before markets open and after they close. If youre someone with a busy schedule, pre-market and after-hours trading may work for you.

What Are After-Hours Trading Sessions?

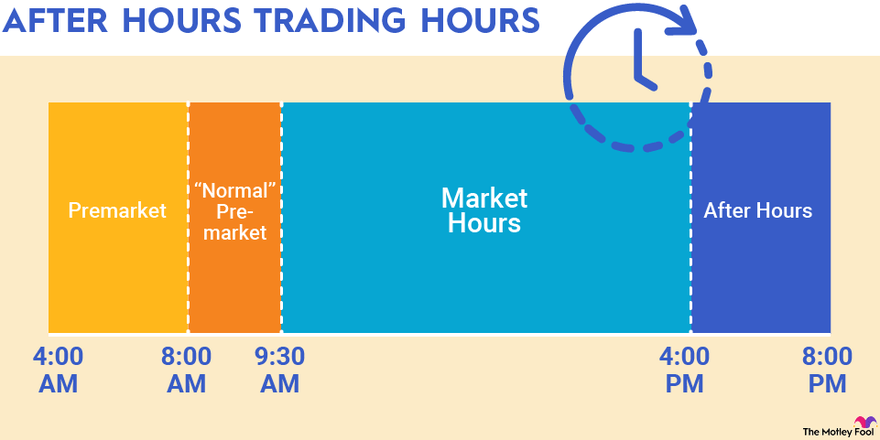

Ever been frustrated when you wanted to sell a stock at 7 PM but couldn’t? I’ve been there too! Traditional stock market hours (9:30 AM to 4:00 PM Eastern Time) can be limiting for many investors who work during the day or want to react to breaking news. But there’s good news – yes, you absolutely can sell your stocks after regular market hours through what’s called extended-hours trading.

Extended-hours trading gives investors additional time to buy and sell securities beyond the standard market hours On platforms like Robinhood, extended hours typically run from 7 00 AM to 9 30 AM ET before the market opens (pre-market) and 4 00 PM to 8 00 PM ET after the market closes (after-hours)

Some brokerages even offer overnight trading options like Robinhood’s 24 Hour Market which allows trading select stocks and ETFs 24 hours a day, 5 days a week.

Why Would You Want to Sell Stocks After Hours?

There are several good reasons why you might want to trade outside regular market hours:

-

Earnings announcements – Companies often release quarterly earnings reports after the market closes. If the news is unexpected (either good or bad) you might want to react immediately rather than waiting until the next day when prices could already have moved significantly.

-

Foreign market activity – Events in Asian or European markets can influence U.S. stock prices. Extended-hours trading lets you respond to these global market movements as they happen.

-

Breaking news – Sometimes major company or economic news breaks after regular trading hours, and you may want to adjust your portfolio accordingly.

-

Schedule conflicts – If your work or personal schedule prevents you from trading during regular market hours, extended-hours trading offers flexibility.

I personally use after-hours trading when big tech companies announce their earnings. Last quarter, I was able to sell some shares right after a disappointing report rather than facing a bigger drop the next morning!

How After-Hours Orders Work on Robinhood

When selling stocks after regular market hours on Robinhood, there are some important limitations and differences to understand:

Market Orders vs. Limit Orders

During extended hours, market orders are not supported. If you place a market order during extended hours, it’ll be queued for the next regular market session. This is really important to understand! You can’t just set a market order and expect it to execute immediately like during normal trading hours.

Instead, you’ll need to use limit orders where you specify the minimum price you’re willing to accept for your shares. A limit order will only execute if it can be filled at that price or better.

Order Timing and Expiration

When placing a limit order, you need to specify which trading session your order is valid for:

- Good-for-day (GFD) limit orders for regular market hours expire at market close (4 PM ET)

- GFD limit orders for extended hours expire at the end of the extended-hours session (8 PM ET)

- Good-til-canceled (GTC) limit orders remain active until executed or canceled (they expire after 90 calendar days)

Fractional Shares Limitations

Not all securities are eligible for fractional share trading during extended hours. If you want to sell a fractional position after hours and the security isn’t eligible, you have two options:

- Sell only whole shares

- Queue your fractional sell order for regular market hours

This is a limitation I’ve run into personally when trying to sell partial positions of smaller companies after hours.

Stop Orders and Trailing Stop Orders

It’s important to note that stop orders and trailing stop orders won’t execute during extended hours. If you place these order types during extended or overnight hours, they’ll queue for the opening of regular market hours on the next trading day.

Risks of Selling Stocks After Hours

While extended-hours trading provides flexibility, it comes with increased risks that every trader should understand:

1. Lower Liquidity

After-hours markets typically have far fewer participants than regular trading hours. This reduced liquidity means:

- Your order might not fully execute

- You might have to accept a worse price than expected

- It might take longer to find a buyer for your shares

I’ve experienced this firsthand when trying to sell shares of a mid-cap tech stock after hours – what would have been a quick transaction during market hours took nearly 20 minutes to fully execute, and at a slightly lower price than I expected.

2. Higher Volatility

Stock prices can fluctuate more dramatically during extended hours due to the lower trading volume. A single large order can move prices significantly, leading to exaggerated price swings.

3. Wider Bid-Ask Spreads

The spread between what buyers are willing to pay and what sellers are asking for is typically much wider during extended hours. This can mean selling at a less favorable price than you might get during regular hours.

4. Unlinked Markets

During extended hours, different trading systems might show different prices for the same security. This fragmentation can lead to price discrepancies and potentially inferior execution prices.

5. Exaggerated Reaction to News

News announcements during extended hours can cause outsized price movements due to the lower liquidity, potentially resulting in prices that don’t reflect the actual impact of the news.

Is Selling Stocks After Hours Worth It?

Whether selling stocks after hours makes sense depends on your specific situation:

It might be worth it if:

- You need to react immediately to breaking news or earnings

- You have a precise price target in mind (using limit orders)

- You’re trading highly liquid, major stocks where finding buyers is easier

- You understand the risks involved

It might NOT be worth it if:

- You’re trading illiquid stocks with few after-hours participants

- You’re hoping to get the best possible execution price

- You’re new to trading and uncomfortable with the additional risks

- You’re using complex order types like stop orders

How to Sell Stocks After Hours on Robinhood

Here’s a simple step-by-step guide to selling stocks during extended hours on Robinhood:

- Log into your Robinhood account during extended hours (7-9:30 AM ET or 4-8 PM ET)

- Navigate to the stock you want to sell

- Tap “Trade” and then “Sell”

- Enter the number of shares you want to sell (remember fractional shares have limitations)

- Important: Select “Limit Order” (not Market Order)

- Set your limit price (the minimum price you’ll accept)

- Under “Expiration,” choose between extended hours options

- Review and submit your order

Remember that the price shown on Robinhood during extended hours represents the stock’s last trade price on a Nasdaq exchange, which might differ from the current best available price.

Common Questions About Selling Stocks After Hours

Can I use any order type to sell stocks after hours?

No, you can only use limit orders during extended hours on Robinhood. Market orders, stop orders, and trailing stop orders won’t execute and will be queued for regular market hours.

Are all stocks available for extended-hours trading?

While most stocks are available, trading volumes vary significantly. Major stocks and ETFs typically have more after-hours activity. Additionally, Robinhood’s 24 Hour Market only includes select stocks and ETFs.

Will I get the same price as during regular hours?

Probably not. Due to lower liquidity and wider spreads, execution prices during extended hours are often less favorable than during regular market hours.

How do I know if my after-hours sell order executed?

Robinhood will notify you when your order executes. You can also check your order status in the app or website.

Can I cancel an extended-hours order?

Yes, you can cancel a pending limit order during extended hours just like you would during regular market hours.

Final Thoughts

Extended-hours trading gives you more flexibility to manage your investments on your own schedule and react to important news as it happens. However, it’s not without risks – lower liquidity, higher volatility, and wider spreads can all impact your trading results.

Before selling stocks after hours, I’d recommend:

- Using limit orders with realistic price expectations

- Being prepared for partial executions

- Focusing on more liquid securities

- Starting with smaller trades until you’re comfortable with the process

I’ve personally found after-hours trading to be a valuable tool in my investment strategy, particularly for adjusting positions following earnings announcements. But I’m also careful to weigh the convenience against the potential for less favorable pricing.

What’s your experience with extended-hours trading? Have you found it valuable or do you prefer to stick with regular market hours? Either way, knowing your options gives you more control over your investment decisions!

Remember, all investing involves risk, but being informed about how extended-hours trading works can help you decide if and when selling stocks after hours makes sense for your situation.

What is pre-market and after-hours trading?

As an investor, its helpful to know that most stock exchanges in North America are typically open for 5-7 hours on weekdays. The Toronto Stock Exchange (TSX), New York Stock Exchange (NYSE), and Nasdaq (NASDAQ) all share the same regular trading hours – between 9:30 a.m. and 4 p.m. ET, Monday to Friday, except stock market holidays.

The economy, however, is not bound by these hours and important market shifts can occur at any time. This factor and advancements in electronic trading have encouraged markets to enable trading beyond regular hours.

Trading outside regular hours is called extended hours trading. It consists of two sessions:

Pre-market trading usually takes place between 8 a.m. and 9:20 a.m. ET on weekdays (U.S. only).

After-hours trading hours can vary depending upon the brokerage. Typically, it starts at 4 p.m. and runs as late as 8 p.m. ET on weekdays (U.S. only). However, some brokerages may allow clients to execute trades only till 7p.m. ET or even later than 8 p.m. ET.

The relative shortness of regular trading hours can lead to more efficient markets and less volatility – shorter trading periods give investors more time to analyze business news and information before markets open, which can help prevent rushed trading decisions. However, as trading activity is compressed into a smaller period of time, it can lead to increased liquidity and smaller spreads.

Pre-market trading and after-hours trading generally have less volume – and depending on where you are, they may have different trading rules. Besides low volume, there is also limited liquidity during extended hours, which can lead to increased volatility, larger spreads, and greater price uncertainty. Plus, earning reports are typically announced after regular trading hours which can lead to major price swings.

What are the pre-market trading hours?

Any trading activity that occurs before markets open is known as pre-market. While the TSX does not offer pre-market trading, the NYSE and NASDAQ do. It usually takes place between 8 a.m. and 9:30 a.m. ET on weekdays, but many discount brokers facilitate access to NYSE and NASDAQ pre-market trading as early as 4 a.m. ET.