The current average mortgage rate for someone with a good credit score (700) was 7.42% as of January 3, 2025, according to Curinos data. Your credit scores can directly impact your eligibility for a mortgage and the interest rate you receive. You may need a score in the high 700s (or higher) to get the best interest rate.

The current average mortgage rate on a conventional 30-year fixed-rate mortgage for someone with a good credit score of 700 was 7.42% as of January 3, 2025, according to Curinos data. You generally need a credit score of at least 580 to qualify for a mortgage, and a score of 760 or higher to get the best interest rate.

Your credit score is one of the most important factors that mortgage lenders consider when reviewing your loan application. The higher your credit score, the better your chances are of getting approved for a mortgage with lower interest rates and more favorable loan terms.

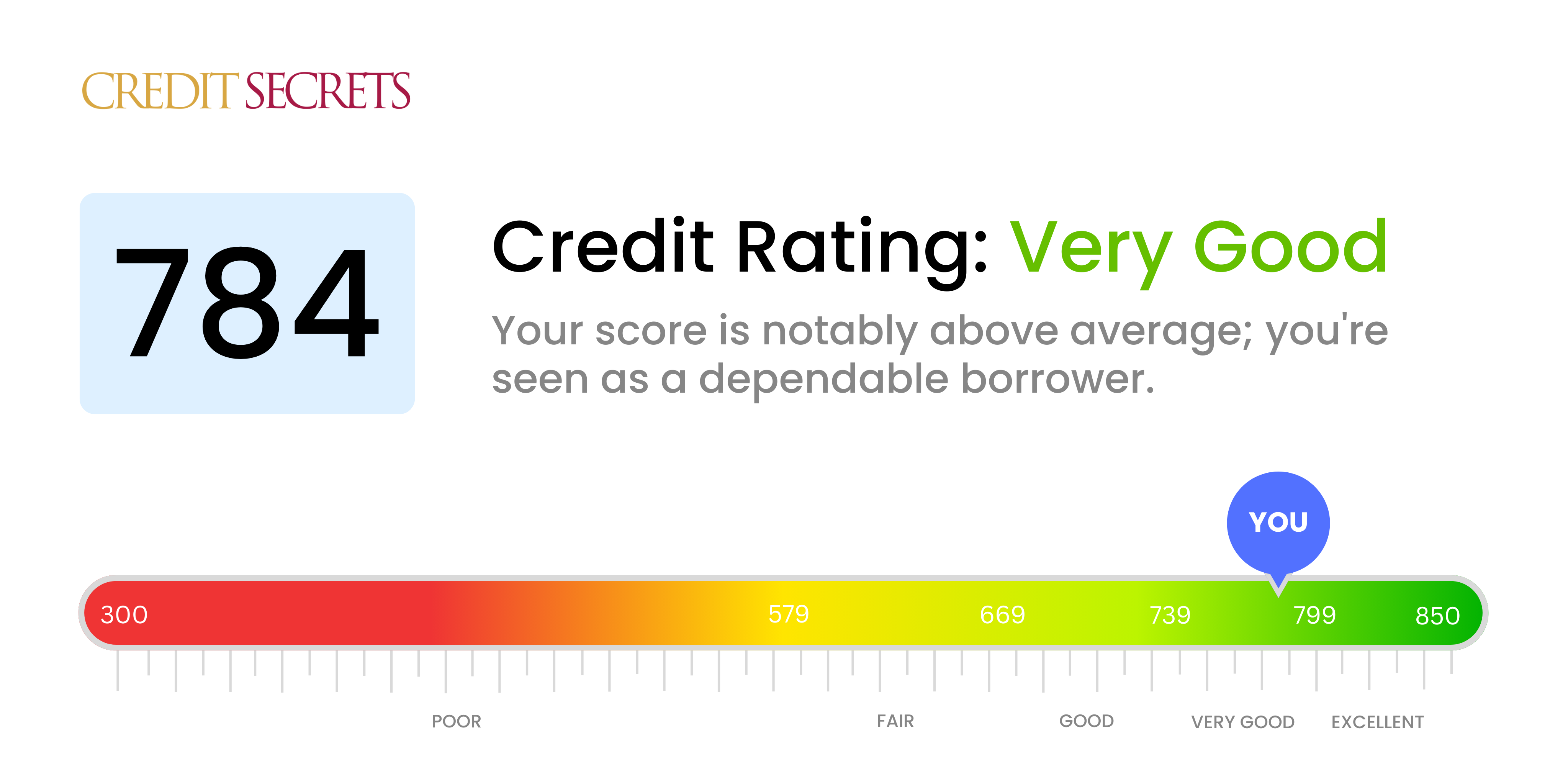

So if your credit score is 784, can you get a mortgage? The short answer is yes – a 784 credit score is considered excellent, and should qualify you for the best mortgage rates available.

What Does a 784 Credit Score Mean?

Most mortgage lenders use credit scores from the Fair Isaac Corporation (FICO) when evaluating borrowers. FICO scores range from 300 to 850, with higher scores indicating lower credit risk.

Here’s how a 784 credit score breaks down

-

It falls in the range of 740-799, which is classified as a “very good” credit score by FICO.

-

It’s well above the minimum credit score of 620 that most conventional mortgage lenders require.

-

It’s near the top of FICO’s scoring range, with only about 20% of consumers having credit scores of 784 or above.

Minimum Credit Scores by Loan Type

While a 784 credit score exceeds minimum requirements for most mortgages, it’s still helpful to understand typical credit score thresholds for different loan types:

- Conventional loans: 620 minimum credit score

- FHA loans: 500 minimum credit score (with 10% down), 580 (with 3.5% down)

- VA loans: No minimum, but lenders often require at least 620

- USDA loans: No official minimum, but 640+ recommended

- Jumbo loans: Requirements vary, but often 700+

As you can see, a 784 credit score surpasses even the strictest minimums set by mortgage lenders.

Mortgage Rates You Can Expect with a 784 Credit Score

In addition to making you eligible for just about any mortgage, a 784 credit score should qualify you for the lowest interest rates available from lenders.

Based on recent averages, here are example rates you can expect with a 784 credit score:

- 30-year fixed: Around 6.5%

- 15-year fixed: Around 5.5-6%

- 5/1 ARM: Around 5-6%

Of course, your actual mortgage rate will depend on current market rates, the specific lender, and other factors like your down payment amount and debt-to-income ratio. But with a score as high as 784, you can feel confident you’ll be getting the very best rates for which you qualify.

Getting a Mortgage Preapproval with a 784 Credit Score

Before you start seriously looking at homes and making offers, it’s a good idea to get preapproved for a mortgage. Preapproval involves completing a full mortgage application so the lender can verify your credit, income, assets, and eligibility for financing.

The preapproval process is a great way to confirm you can get a mortgage with a 784 credit score, and find out the maximum loan amount, rates, and terms for which you’ll qualify. Along with a credit check, you’ll need to submit documents like W-2s, pay stubs, bank statements, and your mortgage down payment funds.

Once approved, you’ll receive a preapproval letter stating the loan amount and terms. This shows sellers you’re a serious buyer who has already been vetted by a lender. Your high 784 score will make the preapproval process quick and smooth.

Tips for Maintaining Your Excellent Credit

While a score of 784 qualifies you for the best mortgage rates already, you’ll want to continue building and maintaining your credit to ensure you stay in top shape for the loan process. Here are some tips:

- Keep credit card balances low. Shoot for a credit utilization rate under 30%.

- Never miss credit card or loan payments. Set up autopay if needed.

- Don’t open or close any accounts before applying for a mortgage.

- Check your credit reports and dispute any errors with the credit bureaus.

- Sign up for credit monitoring to catch any suspicious activity.

- Don’t take on new debts like car loans unless absolutely necessary.

Sticking to these credit best practices will help guarantee your high score stays put. Let your 784 score work for you to get approved for a great mortgage with ease.

The Bottom Line

A credit score of 784 is considered excellent by lenders, and will qualify you for the lowest mortgage rates and best loan terms available. Minimum credit requirements won’t be a concern at all with this high of a credit score.

Be sure to get preapproved by a lender to confirm you can get a mortgage with a 784 credit score, and exactly what rates and terms you are eligible for. Then you can confidently start your home search knowing that financing will not be an obstacle.

Mortgage Lenders Generally Use Older Credit Scores

Many mortgage lenders use classic FICO® Scores when reviewing mortgage applications. There are three classic scores, one for each credit bureau:

- FICO® Score 2, or Experian/Fair Isaac Risk Model v2

- FICO® Score 5, or Equifax Beacon 5

- FICO® Score 4, or TransUnion FICO Risk Score 04

In October 2022, the Federal Housing Finance Agency (FHFA) announced that mortgage lenders will be required to deliver newer FICO 10 T and VantageScore 4.0 credit scores when selling mortgages to Fannie Mae or Freddie Macâa common arrangement. There was an estimated implementation timeline for late 2025. But in early 2025, that was revised to a “to-be-determined” date.

How Credit Scores Affect Mortgage Rates

Your credit score can directly impact your eligibility for different types of mortgages and the interest rate you receive. Generally, a higher credit score can help you qualify for more types of mortgages, a larger loan, a lower down payment and a lower interest rate.

However, unlike when you apply for most loans or credit cards, mortgage lenders tend to request credit scores based on all three of your credit reports and use specific credit scoring models.

Heres a closer look at credit scores and how they can affect your options and rates when you apply for a mortgage.

A credit score is a number that creditors can use to assess the risk that a consumer will miss a payment by at least 90 days. There are many types of credit scores available, and credit scoring companies like FICO and VantageScore® regularly release new versions and types.

Most credit scores analyze your credit report from one of the major credit bureausâExperian, TransUnion or Equifaxâto determine a score. Many credit scores, including the scores commonly used for mortgages, range from 300 to 850. A higher score is better because it indicates the person is less likely to miss a payment.

Most scores consider similar factors, such as your payment history and credit utilization ratio, but the specific factors and weighting depend on the type of credit score.

How Do I Get A Mortgage with a Zero Credit Score?

FAQ

Is 784 a good credit score for a mortgage?

A score of 740 or above is generally considered very good, but you don’t need that score or above to buy a home.

What is the lowest credit score to get a mortgage?

The lowest credit score to buy a house typically starts at 500 for FHA loans with a higher down payment, while conventional loans often require a minimum score of 620. Knowing the lowest credit score to buy a house can help you assess your options and take steps to improve your financial standing.

What credit score is needed to buy a $300K house?

What can I get with a credit score of 784?

| Loan Type | Chances of Approval with 784 CIBIL Score |

|---|---|

| Pre-Approved Loans | 95% likelihood; quick approval with minimal scrutiny. |

| Personal Loan | 90% likelihood; low interest rates and higher loan amounts. |

| Home Loan | Very High (95% likelihood; competitive rates and higher limits). |