The average new car loan interest rate for a buyer with an excellent credit score was 5.08% in Q3 2024. That average rises to 15.43% for borrowers with poor credit scores. Learn how your credit score affects your auto loan interest rate.

Your credit score is a critical factor in determining your eligibility for an auto loan and your potential interest rate and other loan terms. The average car loan interest rate for new cars is 6.73%, while the average interest rate for used cars is 11.87%; your actual rate will vary based on your credit score and other factors.

On average, a new car buyer with an excellent credit score can secure an average interest rate of 5.18%, but that average jumps to 15.81% for borrowers with poor credit scores. For used car buyers, those averages range from 6.82% to 21.58%, depending on the borrowers credit history.

If youre thinking about buying a car in the near future, understanding the relationship between credit scores and interest rates can help you assess your options and determine the best way to move forward with your decision.

A credit score of 722 is considered excellent by FICO and will qualify you for the best auto loan rates available. With a score in this range, you should have no problem getting approved for a car loan and securing a low interest rate.

What Credit Score is Needed to Buy a Car?

There is no official minimum credit score required to qualify for a car loan However, your credit score plays a major role in determining your auto loan eligibility and interest rate

Here’s a breakdown of average auto loan rates by credit score range

- Super Prime (781-850): 5.18% for new cars, 6.82% for used cars

- Prime (661-780): 6.70% for new cars, 9.06% for used cars

- Non-Prime (601-660): 9.83% for new cars, 13.74% for used cars

- Subprime (501-600): 13.22% for new cars, 18.99% for used cars

- Deep Subprime (300-500): 15.81% for new cars, 21.58% for used cars

As you can see, buyers with higher credit scores in the prime and super prime ranges get the most competitive rates on auto loans. A score of 722 puts you safely in the prime credit range.

Why a 722 Credit Score is Considered Excellent

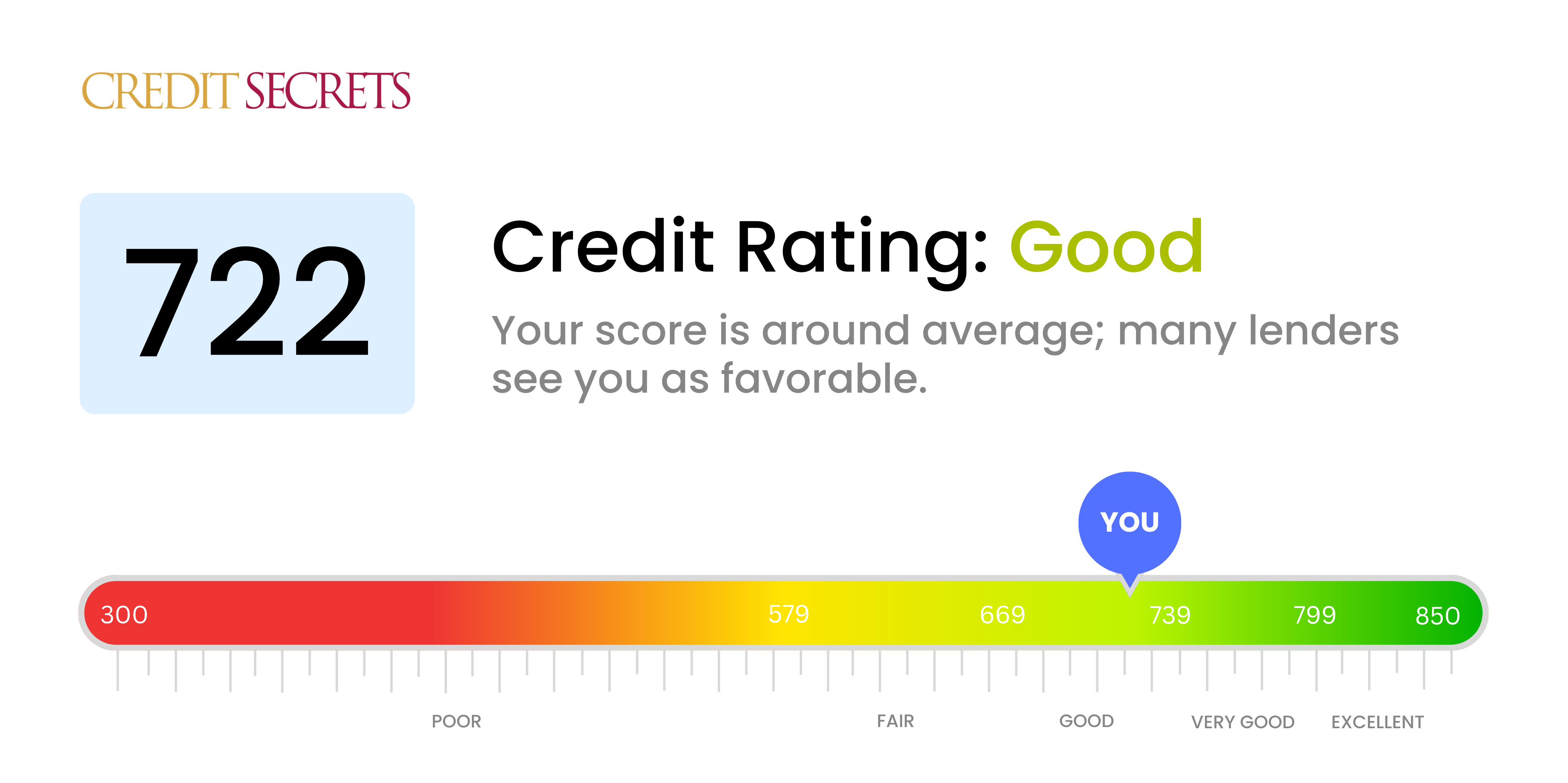

The most commonly used credit scoring model is the FICO score, which ranges from 300 to 850. According to FICO, a credit score of 722 falls in the “very good” category

Here’s how FICO categorizes credit scores:

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Poor

So with a 722 FICO score, you have very good credit. In fact, a score of 722 is better than 70% of Americans. This means banks and lenders will view you as a low-risk borrower who is very likely to repay debts on time.

Getting a Car Loan with a 722 Credit Score

A 722 credit score makes you an ideal car loan borrower in the eyes of lenders. Here are some benefits you can expect with this score:

Low Interest Rates

The higher your credit score, the lower interest rate you can qualify for on an auto loan. With a 722 FICO, you’ll likely get offered rates of 6-8% on a new car loan and 8-10% on a used vehicle. This beats the current average rates of 6.73% for new and 11.87% for used cars.

Bigger Loan Amounts

Good credit means lenders will trust you with larger loan amounts. While lenders generally limit subprime borrowers to loans of $15,000 – $30,000, you may be approved for loans up to $60,000 with a score around 720.

Lower Chance of Getting Denied

A credit score of 722 indicates to lenders that you manage credit responsibly. Very few lenders will turn down applicants with scores in this range. Pre-approvals can ensure you won’t get denied when it’s time to finalize financing.

Less Money Down

With very good credit, you won’t need to put as much money down compared to borrowers with lower scores. While subprime buyers may need to put down 20% or more, you can likely qualify for a loan with less than 10% down.

Quicker Approvals

When you apply for an auto loan with a 722 credit score, the lender can approve you more quickly compared to applicants with poor credit. Pre-approvals are especially fast, taking just a soft credit check.

How to Get the Best Car Loan with a Credit Score of 722

While a 722 credit score makes you eligible for top rates, you can take additional steps to maximize savings on your next auto loan:

-

Compare lender rates – Rates vary between lenders, so compare offers from banks, credit unions and online lenders. Applying with multiple lenders won’t hurt your score.

-

Ask about discounts – Many lenders offer auto loan discounts for current customers, military members, good students, etc.

-

Opt for shorter terms – Loan terms of 36 months or less often have lower rates. Just make sure you can afford the higher monthly payment.

-

Make a sizable down payment – Putting 20% down or more can help you qualify for even better rates.

-

Have a co-signer – Adding a co-signer with great credit may help you get bumped up to a better rate tier.

-

Get pre-qualified – Being pre-qualified shows sellers you’re serious and gets financing out of the way early.

So while a credit score of 722 already qualifies you for prime loan rates, taking these extra steps can potentially save you hundreds more over the life of your loan.

What to Do if Denied for an Auto Loan

It’s highly unlikely you’ll get denied for a car loan with a very good 722 credit score. But in the rare case that you do get turned down, here are some options:

-

Ask the lender why – Find out if there are errors on your report or if you’re lacking certain qualifications.

-

Improve your credit – Pay down balances, dispute errors to boost your score. Wait a few months and reapply.

-

Find a subprime lender – Specialty lenders offer financing to borrowers with credit challenges. Rates are higher but it’s possible to get approved.

-

Save up and reapply – Come back with a larger down payment, lower debt-to-income ratio or added qualifications.

-

Add a co-signer – A co-signer with great credit can improve your chances of approval substantially.

-

Shop for a cheaper car – Lenders may approve you for a smaller loan amount on an older used car versus a new luxury vehicle.

While it would be uncommon to get denied with a great 722 credit score, addressing any issues that led to the denial and adjusting your application can help you get approved down the road.

The Bottom Line

A credit score of 722 will qualify you for excellent auto loan rates from most lenders. With very good credit, you can expect quick approvals, low rates, high loan amounts and great terms. Taking steps to improve your rate further can potentially save you hundreds over the life of the loan. A score in this range makes auto loan financing easy and affordable.

Manage all of your vehicles in one place

Make vehicle ownership, maintenance and management easy with our free account.

Enter information about your vehicles and weâll find you potential auto savings.

Monitor your vehicle history reports, open recalls, car value history and market trends.

Average Car Loan Interest Rates

According to Experians State of the Automotive Finance Market report, the average interest rate for a new car loan was 6.73% in the first quarter (Q1) of 2025, and the average monthly payment on a new car was $745. In contrast, used car buyers are netting an average rate of 11.87% nearly double the new car average, with a monthly payment of $521.

While an auto loans annual percentage rate (APR) is a product of multiple factors, your credit score is a significant one. Heres what the averages look like for different credit score ranges:

| Credit Score Range | New Car APR | New Car Monthly Payment | Used Car APR | Used Car Monthly Payment |

|---|---|---|---|---|

| Super prime (781 or above) | 5.18% | $727 | 6.82% | $523 |

| Prime (661 – 780) | 6.70% | $753 | 9.06% | $510 |

| Near prime (601 – 660) | 9.83% | $784 | 13.74% | $527 |

| Subprime (501 – 600) | 13.22% | $762 | 18.99% | $533 |

| Deep subprime (300 – 500) | 15.81% | $736 | 21.58% | $532 |

Source: Experian data as of Q1 2025; VantageScore® 4.0 used

What Credit Score Do Car Dealerships Use? (Which Credit Bureau Is Most Used for Auto Loans?)

FAQ

Is 722 a good credit score to buy a car?

What credit score is needed for a $30,000 car loan?

What can a 722 credit score get you?

What credit score is needed for a $20,000 car loan?

There is no minimum credit score required to buy a car, but most lenders have minimum requirements for financing. Most borrowers need a FICO score of at least 661 to get a competitive rate on an auto loan.