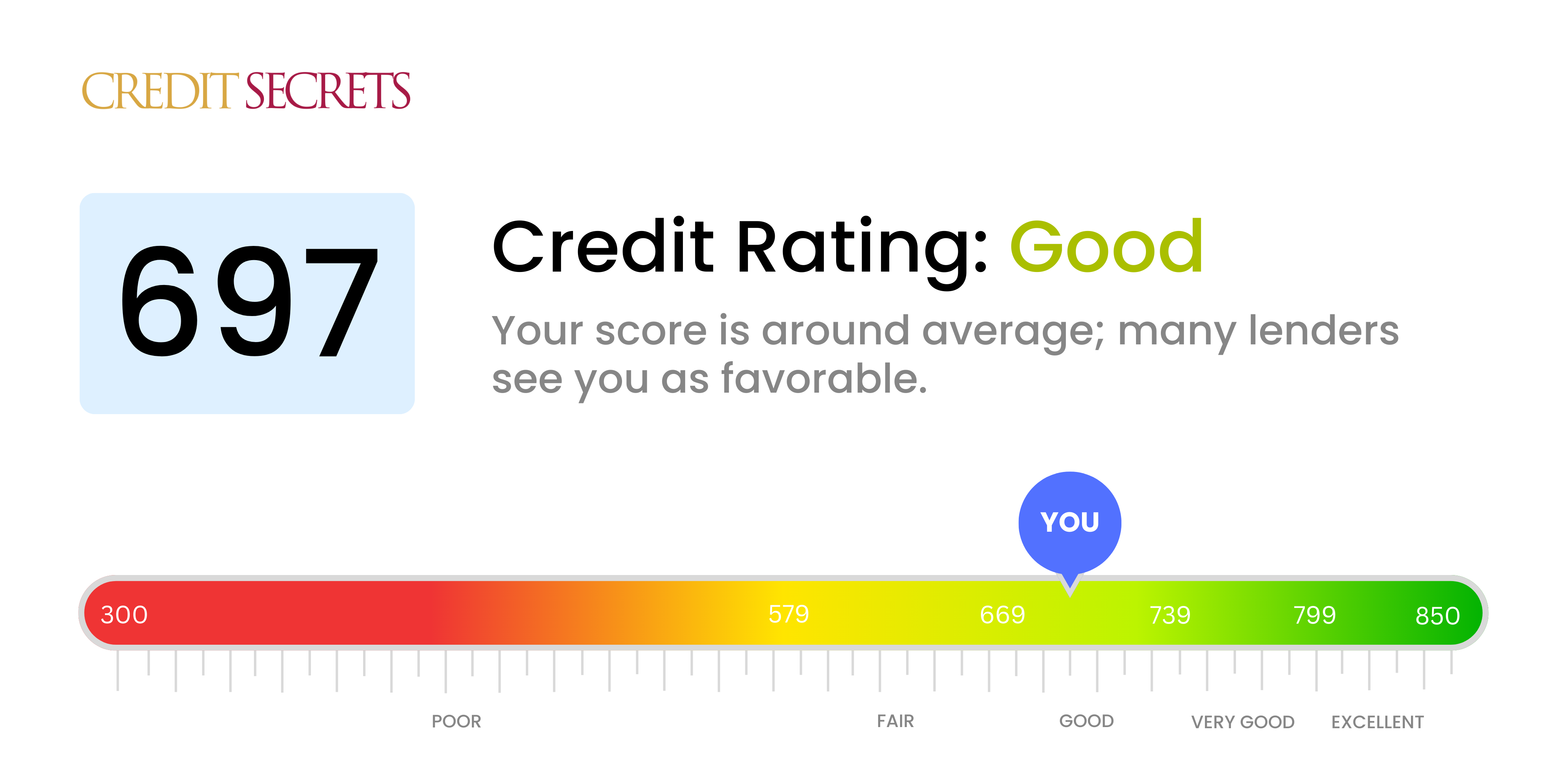

A 697 credit score is considered a “good” credit score, which means you shouldn’t have trouble qualifying for new credit, like a consumer loan or credit card. However, a 697 score falls below the top two FICO® credit tiers — “very good” and “exceptional” — so you likely won’t qualify for a lender’s best interest rates or loan terms.

With a 697 score, lenders will see you as an average risk, since your score isn’t far off from the the average consumer credit score in the U.S., which is 717. Learn more about what a 697 credit score means and what it can get you.

Hey there, fam! If you’re sittin’ there wonderin’, “Can I get a car loan with a 697 credit score?” then you’ve come to the right spot. I’m here to lay it out straight—no fluff, just the real deal. Quick answer? Heck yeah, you can likely get a car loan with a 697 score. It ain’t the golden ticket to the lowest rates, but it’s solid enough to get you behind the wheel. Stick with me, and we’ll dive deep into what this score means, what kinda loan terms you might expect, and how to boost your chances of drivin’ off with a sweet deal.

What’s a 697 Credit Score Anyway? Fair or Fabulous?

First things first, let’s chat about where a 697 credit score lands ya. In the credit world, scores usually range from 300 to 850, and they’re like a report card for how well you handle money. A 697 sits in what most folks call the “fair” or just-barely “good” category. It’s in the prime range of 661 to 780, which means you’re not in the danger zone, but you ain’t exactly in the VIP lounge either.

Here’s the breakdown of credit score vibes

- Superprime (781-850): Top-tier, best rates, lenders lovin’ ya.

- Prime (661-780): Decent spot, good rates, you’re in the game.

- Nonprime (601-660): Meh, higher rates, gotta work harder.

- Subprime (501-600): Tough spot, pricey loans if you get ‘em.

- Deep Subprime (300-500): Real struggle, options are slim.

So, at 697, you’re in the prime range, sittin’ pretty toward the lower end of it. Lenders see ya as an okay bet—not risky, but not their dream borrower neither. It’s like bein’ a B-student; you pass, but you ain’t gettin’ the scholarship just yet.

Can You Actually Get That Car Loan with 697?

Alright let’s get to the meat of it—can you score a car loan with this number? I’m tellin’ ya, it’s totally doable. Most lenders don’t have a hard-and-fast minimum score for auto loans but from what I’ve seen, a lotta folks with scores around 661 and up are gettin’ approved. In fact, over half the cars financed go to peeps with scores in this range or higher. You’re above the line where most used car loans get approved, which often starts around 675 or so, and way above the bare minimum for new cars, sometimes as low as 600.

But, and this is a big ol’ but, your score ain’t the only thing lenders eyeball. They’re also peekin’ at:

- Your Income: Can ya afford the monthly payments without breakin’ a sweat?

- Debt-to-Income Ratio (DTI): How much of your cash is already tied up in other debts? Lower is better.

- Down Payment: Got some cash to put down upfront? That sweetens the deal.

- Loan Term: Short terms mean higher payments but less interest; long terms are easier monthly but cost more overall.

- Car Choice: Fancy ride or budget wheels? Lenders care about the value and type.

- Who’s Lendin’: Different banks, credit unions, or dealerships got their own rules.

With a 697, you’re in a spot where approval is likely, but the terms might not be the cheapest You’re not gettin’ turned away at the door, though, which is a win in my book!

What Kinda Rates Are We Talkin’ with a 697 Score?

Now, let’s talk dollars and cents ‘cause that’s where it stings if your score ain’t top-notch. Interest rates on car loans are tied tight to your credit score—higher score, lower rate, and vice versa. For a 697, you’re lookin’ at rates that are decent but not gonna make ya jump for joy.

Here’s a lil’ table to show what I mean for new and used cars (based on general trends I’ve come across):

| Credit Range | New Car APR (Approx.) | Used Car APR (Approx.) |

|---|---|---|

| Superprime (781-850) | 5.2% | 6.8% |

| Prime (661-780) | 6.7% | 9.1% |

| Nonprime (601-660) | 9.8% | 13.7% |

| Subprime (501-600) | 13.2% | 19.0% |

At 697, you’re in the prime range, so expect somethin’ around 6.7% for a new car and maybe 9.1% for a used one. Compare that to someone with a score in the low 500s payin’ nearly double—ouch! For a $20,000 used car loan over five years, that’s about $415 a month for you, versus over $500 for someone with worse credit. Interest over the whole loan? You’re payin’ around $5,000, while they’re shellin’ out closer to $11,000. Big diff, right?

But here’s the kicker: these rates ain’t set in stone. Make a fat down payment or pick a shorter loan term, and you might nudge that rate down a smidge. Shop around too—don’t just take the first offer a dealer throws at ya. We’ve all been there, thinkin’ we gotta sign right away, but nah, take your time!

How to Boost Your Odds of Snaggin’ That Loan

Even with a 697, you might wanna stack the deck in your favor. Lenders can be picky, and a few smart moves can make ya look like a better bet. Here’s what I’d do if I was in your shoes:

- Check Your Credit Report for Goofs: Pull your report and scan for errors. Wrong late payment listed? Dispute it! A cleaner report can bump your score a bit.

- Pay Down Some Debt: If you’ve got credit card balances or other loans eatin’ up your income, chip away at ‘em. A lower debt-to-income ratio makes lenders smile.

- Save for a Bigger Down Payment: The more cash you put down, the less you borrow. It shows you’re serious and cuts your monthly payments. Even an extra grand can help.

- Shop Around for Rates: Don’t settle for the dealership’s financing right off the bat. Hit up banks, credit unions, even online lenders. Compare offers like you’re pickin’ the best pizza joint.

- Consider a Co-Signer: Got a buddy or family member with stellar credit? Ask ‘em to co-sign. It’s a big ask, I know, but it could land ya a better rate. Just don’t miss payments—ya don’t wanna mess up their credit too!

- Pick a Cheaper Ride: If the loan terms look rough, maybe go for a less pricey car. Lenders are happier with smaller loans on affordable wheels.

I remember when I was huntin’ for my first car, my score wasn’t much better than yours. I saved up a chunk for the down payment, and it made the whole process smoother. Felt like I had some control, ya know?

What If the Loan Terms Ain’t Great?

So, let’s say you get approved, but the interest rate is higher than you hoped. Don’t sweat it too much—there’s ways to play this smart. First, take the loan if you need the car now, but keep an eye on your credit. Make every payment on time, and in 6 to 12 months, you might be able to refinance for a lower rate once your score creeps up.

Or, if you can wait, hold off on buyin’ the car and focus on boostin’ that score. Here’s a few tricks I’ve used to get my credit lookin’ prettier:

- Pay Bills on Time, Every Time: Late payments are a killer. Set reminders or autopay—don’t let a $20 bill tank your score.

- Keep Credit Card Balances Low: Try not to use more than 30% of your limit. Got a $1,000 limit? Keep the balance under $300 if ya can.

- Don’t Apply for New Credit Right Now: Every new app dings your score a lil’. Chill on new cards or loans for a few months before the car loan app.

- Keep Old Accounts Open: Even if you don’t use that dusty credit card, keep it active. Closing it shortens your credit history, which ain’t good.

Building credit takes time, no lie. But even a few months of good habits can push ya into a better range for lower rates. I’ve been there—felt like forever, but it paid off when I got a better deal later.

Why Does a 697 Score Matter for More Than Just Cars?

While we’re on the topic, let’s zoom out a sec. A 697 credit score don’t just affect car loans—it’s a snapshot of your financial vibe for all kinda stuff. Wanna personal loan for a vacay? Or a credit card with sweet rewards? This score puts ya in a “maybe” zone. You’ll prob get approved for some things, but the terms might sting a bit with higher fees or rates.

For car loans specifically, it’s a big deal ‘cause cars ain’t cheap, and lenders wanna know you’re good for the money over a few years. Plus, in most places, your credit can even jack up your car insurance costs. Crazy, right? So keepin’ that score in check—or pushin’ it higher—saves ya cash all around.

Real Talk: My Take on Buyin’ a Car with This Score

Look, I ain’t gonna sugarcoat it—697 is a workable score, but it ain’t gonna get ya the red carpet treatment. You’re likely to get a loan, no prob, especially if your income’s steady and you’ve got a down payment ready. But expect to pay a bit more in interest than someone with a score over 750. That’s just how the game works.

When I was lookin’ for a ride a while back, I had a score in this ballpark. I got the loan, but man, those monthly payments with that interest rate felt like a punch sometimes. I made it work by throwin’ extra cash at the loan when I could, cuttin’ down the interest over time. You can do the same—just gotta be strategic.

If you’re feelin’ nervous ‘bout applyin’, don’t be. Worst case, ya get a “no” from one lender, but there’s plenty more out there. Plus, applyin’ to a few places in a short window—like within 14 days—usually counts as just one hit to your credit, so shop smart without hurtin’ your score.

Other Things to Chew On Before You Sign

Before ya head to the dealership or bank, let’s cover a few more tidbits to keep in mind. First, think ‘bout the whole cost of ownin’ a car—not just the loan. Gas, maintenance, insurance—it adds up quick. Make sure your budget’s ready for all that, not just the monthly payment.

Also, decide if ya want new or used. New cars got lower rates usually, but they cost more upfront. Used cars might have higher rates (like that 9.1% I mentioned), but the sticker price is friendlier. I went used for my first whip ‘cause it fit my wallet better—somethin’ to ponder.

And hey, don’t forget ‘bout negotiatin’. Even with a 697 score, you’ve got some power at the table. Haggle on the car price, not just the loan terms. Sometimes droppin’ the car cost by a few hundred saves ya more than a slightly better rate.

Wrappin’ It Up: You’ve Got This!

So, can ya get a car loan with a 697 credit score? Bet your boots you can! It’s a fair-to-good score that puts ya in a solid spot for approval, though the interest rates might not be the cheapest. You’re lookin’ at somethin’ like 6.7% for a new car or 9.1% for a used one, dependin’ on a buncha factors. But with a good down payment, steady income, and some shoppin’ around, you can make it work.

If the terms ain’t ideal, don’t fret—focus on makin’ payments on time and maybe refinance down the road. Or take a beat to build that credit up with some simple habits like payin’ bills early and keepin’ debt low. I’ve been in your spot, wonderin’ if I’d ever get the keys to my own ride, and I’m tellin’ ya, a little hustle goes a long way.

Got questions or wanna share your story? Drop a comment below—I’m all ears. Let’s get you rollin’ down the road in no time, fam!

Can I Get a Credit Card With a 697 Credit Score?

Whether you’re looking for a new cash back credit card, travel rewards card, or retail credit card, a 697 FICO score can help you qualify. You might even qualify for a 0% interest credit card.

Despite having a “good” credit rating, however, you might not qualify for a credit card issuer’s lowest annual percentage rate (APR). The best rates are typically reserved for applicants who have exceptional credit. Similarly, a 697 credit score might not be enough to qualify for the most premium rewards cards on the market.

Your credit score isn’t the only factor that card issuers evaluate, however. Other application details, like your employment status and income, can determine whether you can get a particular credit card.

What Does a 697 Credit Score Mean?

Your credit score tells lenders how much risk you pose as a borrower. Generally ranging from 300 to 850, credit scores are calculated using information from your credit reports. Although many people think they have only one credit score, we actually have several. The reason is that credit scores can be calculated using different credit reports and different scoring models, such as FICO, VantageScore®, or a lender’s proprietary algorithm. Each scoring model has its own standard for what qualifies as “good.”

In the FICO scoring model, which is the one most commonly used, a 697 score means you’re right in the middle — not the best, but not the worst. Here’s the breakdown:

• Exceptional: 800-850

• Very Good: 740-799

• Good: 670-739

• Fair: 580-669

• Poor: 300-579

A 697 credit score is also considered “good” in the VantageScore model:

• Excellent: 781-850

• Good: 661-780

• Fair: 601-660

• Poor: 500-600

• Very Poor: 300-499

A 697 score tells a lender that you generally pay your bills on time and manage your credit responsibly. You may have a “good” rather than “very good” or “excellent” credit rating either because you’re new to credit or because you’ve made a few missteps, such as late payments, in the past.

How a Car Loan Affects Credit Score | Best Car Loan For Bad Credit | Best Car Loans

FAQ

Is 697 a good credit score to buy a car?

What credit score is needed for a $30,000 car loan?

What is the interest rate for a 697 credit score auto loan?

Car Loan Interest Rates for Prime Credit Scores (661 – 780)

A score in this range indicates that you’re financially responsible when it comes to managing your credit. Average APR rates for someone with a credit score of 661-780 are 5.82% for a new car, or 7.83% if you’re buying a used car.

What can I do with a 697 credit score?

With a 697 credit score, which is generally considered “good”, you can access a variety of financial products and services, including mortgages, auto loans, personal loans, and credit cards.

Is 697 a good credit score?

An 697 credit score falls within the range that is typically considered to be good credit. Lenders will often consider a score in this range for loan approval. However, it isn’t in the “very good” or “exceptional” credit tiers, and generally won’t qualify for a lender’s best interest rates or loan terms.

Is a 697 FICO ® score good?

A 697 FICO ® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

Which credit score is best for a car loan?

People with Super Prime credit scores are likely to be offered the lowest interest rates on a car loan, as lenders will see them as very financially responsible. This means if your score falls within this range, you’ll pay less overall than someone with a lower credit score.

Do you need a good credit score to get a car loan?

Typically, a lower credit score will lead to a higher annual percentage rate (APR), and a higher APR will increase the cost of your car by hundreds of dollars. You don’t need a perfect credit score to get a reasonable rate, though. You can save on your loan by shopping around for the best auto loan rates and improving your credit score.

What credit score do you need to buy a car?

The report also found that on average, the credit score for a used-car loan was 684, while the average score for a new-car loan was 756. What minimum credit score is needed to buy a car? There isn’t one specific score that’s required to buy a car because lenders have different standards.

Does your credit score affect your car loan interest rate?

While your credit score plays a large part in determining your interest rate, there are other factors to consider. The two most common credit scores used when underwriting car loans are the FICO score and VantageScore, although some lenders may use an auto industry-specific scoring system instead.