Roughly 66% of cars financed go to borrowers with scores of 661 or higher, but those with lower scores have options.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

If youre looking to buy a car, the process could get more expensive soon. The Trump administrations tariffs could affect the auto industry, driving up prices. Knowing your credit score now can help you enter the buying process on strong footing.

A first-quarter 2025 report by credit bureau Experian found that roughly 66% of cars financed were for borrowers with credit scores of 661 or higherExperian Information Solutions . State of the Automotive Finance Market Q1 2025. Accessed Jun 9, 2025.View all sources. The report also found that on average, the credit score for a used-car loan was 684, while the average score for a new-car loan was 756.

Getting a car loan when you have less than stellar credit can feel daunting. You may worry about getting denied or only qualifying for a loan with outrageous interest rates. But having a credit score of 608 doesn’t necessarily mean you can’t finance a car purchase. While lenders prefer scores of 620 or higher, you still have options to get approved.

What Credit Score Do Lenders Want for Auto Loans?

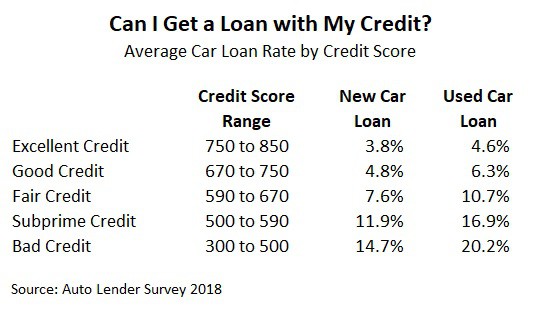

Auto lenders generally prefer borrowers with credit scores of 620 or higher. The higher your score, the lower your interest rate will likely be. Here’s a breakdown of typical required scores:

- 720+: Excellent credit. Qualifies for the best rates.

- 690-719: Good credit. Still qualifies for competitive rates.

- 620-689: Fair credit. May pay slightly higher rates but can still get approved.

- 580-619: Poor credit. Will pay higher interest rates and may need a down payment.

- 579 or less: Bad credit. Loan approval will be challenging and rates will be high.

So while a credit score of 608 isn’t ideal for an auto loan, it falls within the fair credit range You can likely get approved but should expect to pay higher interest rates

What Interest Rate Can I Get with a 608 Credit Score?

Your interest rate on a car loan depends on your credit score along with other factors like your income, loan amount, and loan term. Here are the average used car loan rates by credit score range:

- Excellent credit (781-850): 5.07%

- Good credit (671-780): 7.21%

- Fair credit (601-670): 11.14%

- Poor credit (501-600): 18.58%

- Bad credit (300-500): 20.96%

With a 608 credit score, you would likely pay somewhere around 10-12% interest on a used car loan That’s significantly higher than what borrowers with good credit can get

For example, on a $15,000 5-year loan:

- At 7% interest, your monthly payment would be $303 with $2,317 in total interest paid.

- At 12% interest, your monthly payment jumps to $341 with $4,092 in interest.

As you can see, the higher rate really increases your total costs. But 12% is still manageable, so approval is possible if you have decent income and limited debt.

Tips for Getting a Car Loan with a 608 Credit Score

Getting approved for a car loan with fair credit takes some extra effort. Here are some tips:

-

Shop around: Compare rates from multiple lenders to find the best deal. Local banks and credit unions may offer more competitive rates than large banks.

-

Put down a larger down payment: A 20-30% down payment shows lenders you’re committed to repaying the loan.

-

Consider a co-signer: Adding a co-signer with good credit can help you qualify and get a lower rate. Make sure they understand the responsibility they’re taking on.

-

Look at shorter loan terms: Opting for a 3-year loan instead of 5- or 6-years reduces the lender’s risk, which may help your approval chances.

-

Clean up your credit report: Correct any errors on your credit report and pay down balances to help boost your score before applying.

-

Improve your credit: If you can wait 6-12 months, paying bills on time and limiting credit applications can improve your score and open up better loan options.

The Bottom Line

A credit score of 608 makes getting a car loan more challenging but not necessarily impossible. While you’ll pay higher interest rates, you can likely still get approved, especially if you put down a sizeable down payment, have sufficient income, and shop around for the best lender. Improving your credit score before applying will open up better loan offers. But even with fair credit, a car purchase can be feasible if you take the right steps.

Bring a bigger down payment

A big down payment can help offset a bad credit score by lowering your monthly payments. It might even help you get a lower interest rate. For some lenders, a big down payment might make you appear less risky, despite a lower credit score.

How to buy a car with bad credit

If you have a credit score below 700 and are worried about getting approved, figure out what you can bring to the negotiating table.

Can You Get a Car With a 600 Credit Score

FAQ

Can I buy a car with a 608 credit score?

Read our editorial guidelines here. Most approved borrowers have credit scores of 661 or higher, but there is no set score to get an auto loan.Mar 18, 2025

What is the minimum credit score for a car loan?

There’s no minimum credit score required to get an auto loan. However, a credit score of 661 or above—considered a prime VantageScore® credit score—will generally improve your chances of getting approved with favorable terms. For the FICO® Score Θ , a good credit score is 670 or higher.

Can I get a $40,000 car with a 600 credit score?

In general, you’ll need a FICO credit score of at least 661 to qualify for a traditional auto loan, although there are lenders that offer bad credit auto loans. Because interest rates remain high, securing a subprime auto loan may be more difficult — and while it is possible, expect to pay a premium.

What can a 608 credit score get you?

| Type of Credit | Do You Qualify? |

|---|---|

| Unsecured Credit Card | YES |

| Home Loan | YES (FHA Loan) |

| Personal Loan | MAYBE |

| Auto Loan | MAYBE |