Roughly 66% of cars financed go to borrowers with scores of 661 or higher, but those with lower scores have options.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

If youre looking to buy a car, the process could get more expensive soon. The Trump administrations tariffs could affect the auto industry, driving up prices. Knowing your credit score now can help you enter the buying process on strong footing.

A first-quarter 2025 report by credit bureau Experian found that roughly 66% of cars financed were for borrowers with credit scores of 661 or higherExperian Information Solutions . State of the Automotive Finance Market Q1 2025. Accessed Jun 9, 2025.View all sources. The report also found that on average, the credit score for a used-car loan was 684, while the average score for a new-car loan was 756.

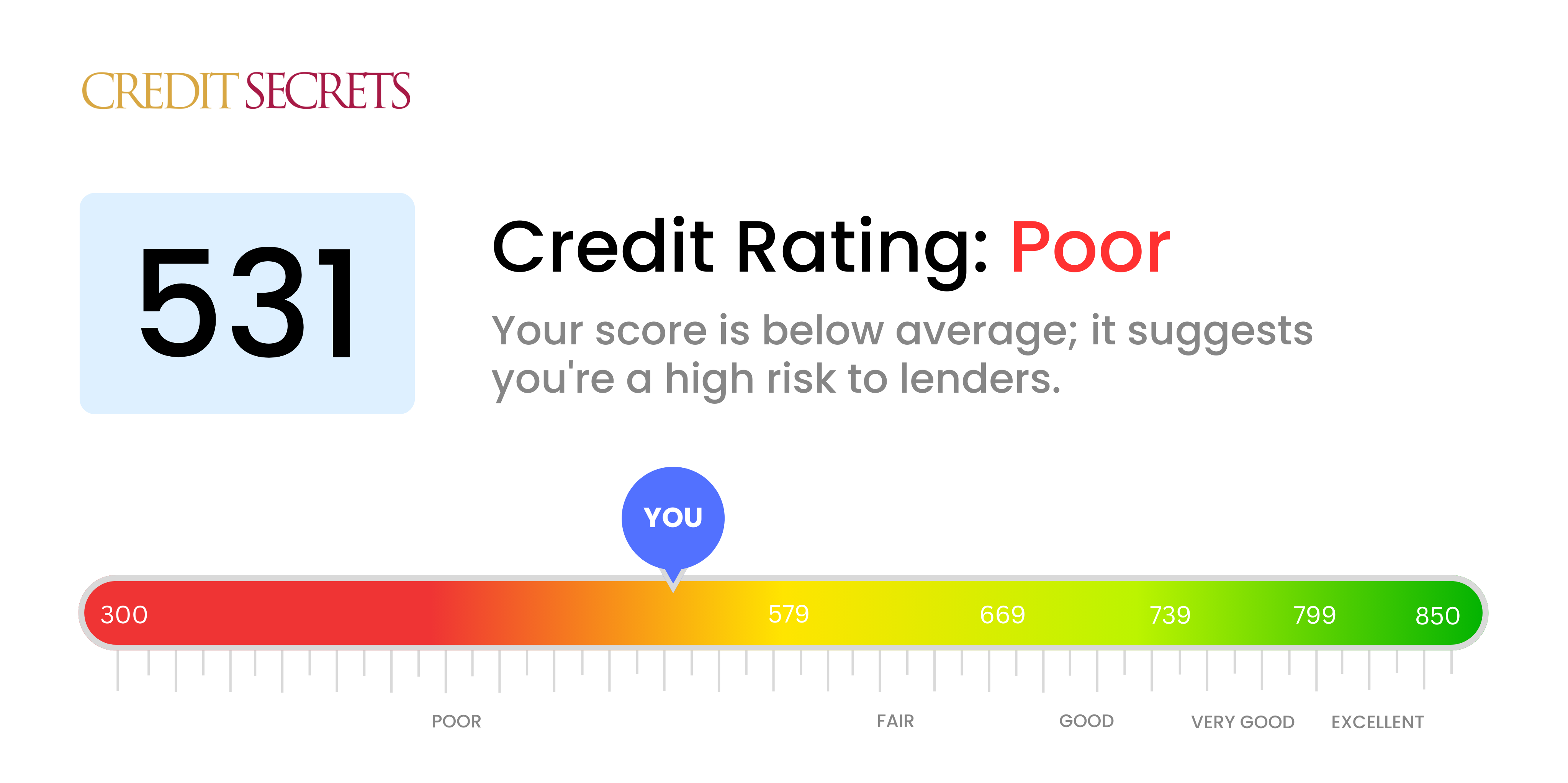

Getting approved for an auto loan with bad credit can be challenging, but it is possible in many cases A credit score of 531 is considered very poor and will make qualifying for a competitive car loan difficult. However, with the right strategy, you may still be able to finance the car you need

What Credit Score is Needed for a Car Loan?

There is no official minimum credit score requirement set by lenders. The average credit score for approved auto loans is around 700 for new cars and 650 for used cars. However, each lender has its own lending criteria.

Here are some general guidelines on the credit scores typically needed for car loan approval:

-

Prime borrowers (scores 661-780) – Will usually qualify for the best rates from most lenders, often as low as 3-5% for new cars or 4-6% for used cars.

-

Non-prime borrowers (scores 601-660) – May be approved by some lenders but will pay higher interest rates, such as 8-12% for a new car or 10-15% for a used car.

-

Subprime borrowers (scores 501-600) – Will have fewer options and pay higher rates but can still get approved, possibly with rates from 15-20%.

-

Deep subprime (scores below 500) – Very unlikely to be approved for a traditional auto loan. May need to explore buy here pay here dealers.

So while a 531 credit score is on the low end, it doesn’t necessarily mean you won’t qualify if you apply with subprime lenders. However, expect to pay a much higher interest rate and potentially a larger down payment.

Auto Loan Interest Rates for a 531 Credit Score

The interest rate you are offered will depend on your specific credit profile, income, debts, and the lender. But on average, a borrower with a 531 FICO score can expect rates around:

- New car: 15-20%

- Used car: 18-24%

This compares to average rates of:

- 4-6% for prime borrowers (700+ score)

- 8-12% for non-prime borrowers (600-699 score)

So while approval is possible, that high interest on a 531 score auto loan can really add up over the life of the loan. Even a few extra percentage points can mean paying thousands more in interest costs.

Strategies to Get a Car Loan with Bad Credit

If your credit score is 531 and you need a car, here are some tips that may help you get approved and find a reasonable rate:

-

Apply with subprime lenders – Specialty lenders like Capital One, RoadLoans, and AutoCreditExpress work with bad credit applicants.

-

Provide a large down payment – A 20-30% down payment shows the lender you are committed to paying back the loan.

-

Use an auto loan cosigner – Adding a cosigner with good credit may help you qualify and get a lower rate.

-

Consider a secured car loan – These require collateral like a savings account to help offset the risk.

-

Look for buy here pay here dealers – They offer in-house financing but charge very high rates.

-

Improve your credit first – Paying down debts or adding positive information could help boost your score.

Shopping around with multiple lenders and comparing pre-approval offers is also important to find the best possible rate for your situation. Expanding your search nationwide can increase your options.

What is the Minimum Down Payment for a 531 Credit Score?

Most lenders don’t publish specific down payment requirements because they are customized for each applicant based on credit, income, and debts. However, you can expect to put down a larger down payment with a low 531 credit score.

Here are some general guidelines on minimum down payments:

-

Prime borrowers (700+ score) – Often 0-10% down

-

Non-prime borrowers (600-699) – Typically 10-15% down

-

Subprime borrowers (500-599) – Around 15-20% down or higher

To improve your chances of approval and demonstrate your commitment, aim for at least a 20% down payment if possible. The more you can put down, the better.

Will I Get Approved for an Auto Loan with a 531 Score?

Every lender has its own approval criteria, but a 531 credit score will make getting approved challenging. According to Experian data, only around 5% of new car loans and 20% of used car loans go to borrowers with scores under 600.

Some tips that may help increase your odds include:

-

Applying with subprime lenders that work with bad credit

-

Having a co-signer with a good credit score

-

Putting down a large down payment

-

Providing proof of sufficient income

-

Keeping your requested loan amount low

Even with poor credit, approval is still possible if you find the right lender and meet their requirements. But interest rates will likely be much higher than average.

How Can I Improve My Chances of Getting a Car Loan?

Here are some tips to improve your chances of qualifying for an auto loan if your credit score is very low:

-

Pay down credit card balances to lower your debt-to-income ratio

-

Become an authorized user on someone else’s credit card to add positive history

-

Open a new credit card or secured card to mix up your credit history

-

Pay down collections accounts and try to get them removed from your credit reports

-

Wait to apply for new credit since too many inquiries can hurt your approval odds

-

Ask creditors to remove late payments if they were over 7 years ago

-

Explain any past credit issues with a letter from your lender application

Even marginal improvements can bump your credit scores enough to open up more options. Building your credit for 6-12 months before applying may offer the best approval odds and interest rates.

Final Thoughts

Obtaining auto loan approval with very poor credit such as a 531 score will be challenging and result in higher than average interest rates. But with the right strategy, including applying with subprime lenders, having a large down payment, and potentially using a cosigner, you may still be able to qualify and finance the vehicle you need. Taking some time to improve your credit can also increase your chances and save you money on interest in the long run.

Bring a bigger down payment

A big down payment can help offset a bad credit score by lowering your monthly payments. It might even help you get a lower interest rate. For some lenders, a big down payment might make you appear less risky, despite a lower credit score.

What is a good FICO Auto Score?

It’s smart to have some idea what dealers will see when they check your credit profile by checking your credit score. Chances are, however, that your dealer might use a FICO automotive score instead of a traditional FICO score or VantageScore.

Your FICO Auto Score is a specialty score ranging from 250 to 900. Just like with traditional credit scores, higher scores get better terms.

To calculate this score, FICO weighs past car-loan payments more heavily than the traditional score does. It also gives more weight to any repossessions or auto-loan bankruptcies you might have filed. To check your automotive score, you can buy a full set of FICO scores through myFICO.com.

Buying A Car with Bad Credit – Exposing Dealership – secrets to buying a car

FAQ

Can you buy a car with a 531 credit score?

In general, you’ll need a FICO credit score of at least 600 to qualify for a traditional auto loan, although there are lenders that offer bad credit auto loans.Mar 7, 2025

Is 531 a good credit score for a loan?

What does an 531 credit score mean? As mentioned, an 531 credit score is generally considered to be a poor credit rating.

What credit score is needed for a $20,000 car loan?

There’s no minimum credit score required to get an auto loan. However, a credit score of 661 or above—considered a prime VantageScore® credit score—will generally improve your chances of getting approved with favorable terms. For the FICO® Score Θ , a good credit score is 670 or higher.

What credit score do you need to buy a $30,000 car?

To qualify for a $30,000 car loan, most lenders prefer to see a credit score of at least 660 to 700. That being said, your credit score is only one part of the equation. Lenders will also consider: Your debt-to-income ratio (how much you owe compared to how much you earn)