While credit score requirements vary based on loan type, lenders generally require a credit score of at least 620 to buy a house with a conventional mortgage.

The minimum credit score needed to buy a house can range from 500 to 700, but will ultimately depend on the type of mortgage loan youre applying for and your lender. While its possible to get a mortgage with bad credit, you typically need good or exceptional credit to qualify for the best terms.

Read on to learn what credit score youll need to buy a house and how to improve your credit leading up to a mortgage application.

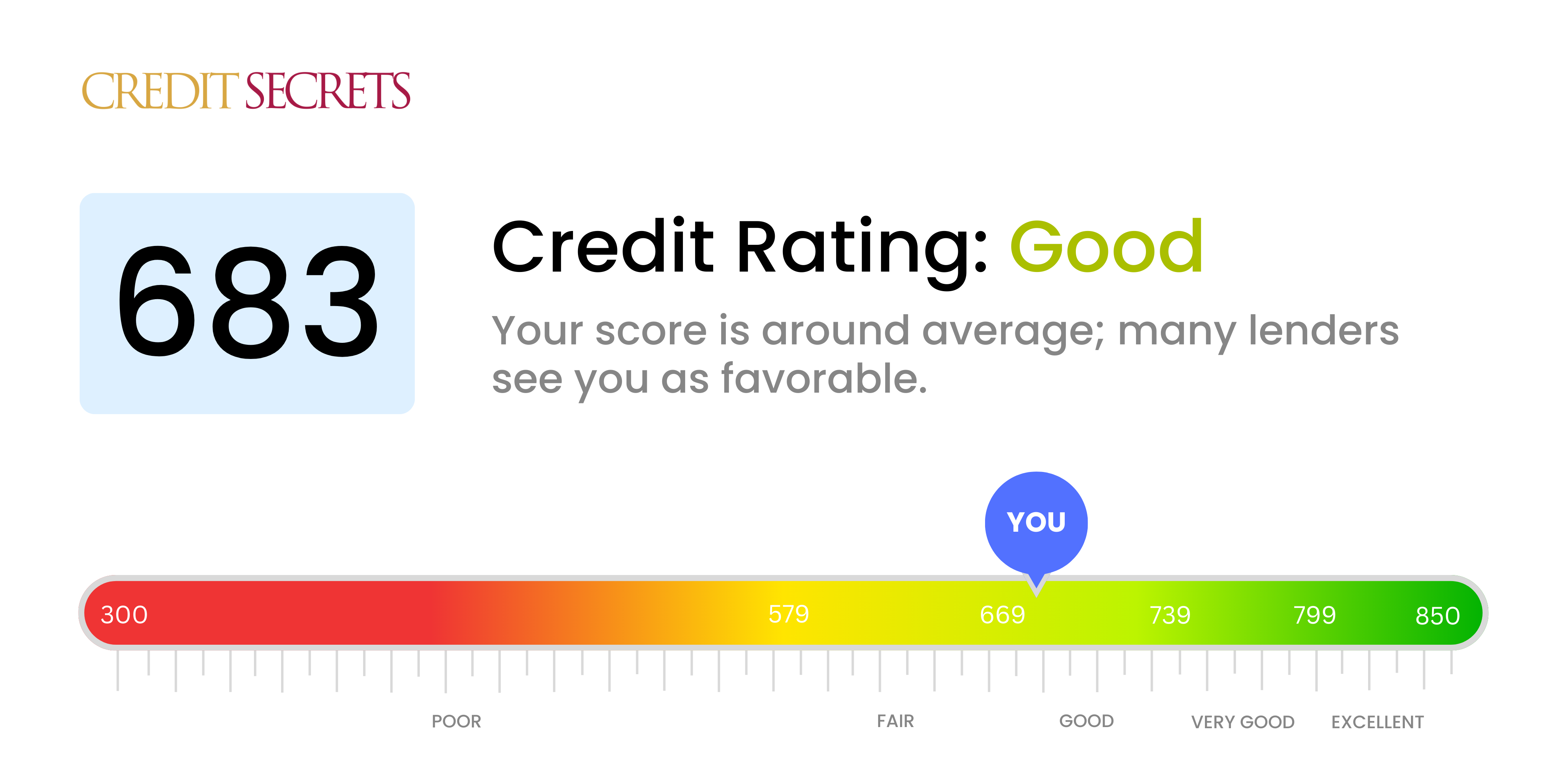

A 683 credit score falls in the good credit range, but is buying a house possible with this score? The short answer is yes, you may be able to buy a house with a 683 credit score, but it can be more challenging compared to buyers with higher scores. Read on to better understand what a 683 credit score means for your homebuying options.

What is Considered a Good Credit Score?

First, it helps to know where a 683 credit score falls in terms of the credit ranges. The main credit scoring models used are FICO® and VantageScore®, and they have slightly different score ranges:

FICO® Ranges:

- Exceptional: 800+

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 579 and below

VantageScore® Ranges:

- Excellent: 781-850

- Good: 661-780

- Fair: 601-660

- Poor: 500-600

- Very Poor: 300-499

So in both models, a 683 credit score is in the good credit range. A good credit score is better than having fair, poor or very poor credit. But it is still short of reaching the very good or excellent credit categories.

Can I Get a Mortgage With a 683 Credit Score?

The short answer is yes, you may be able to qualify for a mortgage with a 683 credit score However, there are a few factors to keep in mind

-

You may need a larger down payment: Lenders view borrowers with lower credit scores as higher risk. To compensate, they may require a down payment of 20% or more of the home’s price.

-

You may pay higher interest rates The higher your credit score, the lower your interest rate tends to be. With a 683 score, you will likely pay a higher rate compared to buyers with scores in the very good or excellent ranges

-

You may have fewer loan options Many lenders prefer borrowers with very good or excellent credit So you may not qualify for certain loan programs if your score is 683. Conventional loans that require at least a 680 score could be out of reach

-

You have decent, but not ideal, approval odds: Studies show borrowers with credit scores in the fair range (580-669 on the FICO® model) have a 70% chance of approval. For good credit, it’s 90%. So your 683 score puts you on the higher end for approval odds in the good credit tier.

Tips for Improving Your Chances

If your heart is set on buying a home now, there are steps you can take to boost your mortgage approval odds with a 683 credit score:

-

Shop around for lenders: Every lender has different standards and risk tolerances. Cast a wide net to find ones willing to work with your score.

-

Offer a larger down payment: Putting down 20-25% or more shows you are financially committed. This can make lenders more comfortable approving your loan.

-

Bring on a co-signer: Adding a co-signer with very good or excellent credit means they take on responsibility for the loan if you can’t pay. This gives the lender another layer of assurance.

-

Explain past credit issues: If you have any negative marks on your report, write a letter explaining the circumstances. Knowing the backstory can reassure lenders.

-

Pay down debts: Reducing credit card balances and other debts boosts your score and shows lenders you actively manage credit.

While possible to buy a home with a 683 credit score, taking steps to boost your score first can really improve your chances and loan terms. But diligent shopping, offering a sizable down payment, and bringing on a co-signer are key if buying right away. Make sure to compare multiple lenders to find one able to approve your loan.

How to Improve Your Credit Score Before Buying

Bringing your 683 credit score up to the very good or excellent ranges before applying for a mortgage can make a huge difference. Here are some tips:

-

Review your credit reports for errors: Dispute and remove any inaccuracies holding down your scores.

-

**Pay down credit card balances:**Aim for a balance 30% or less of your limit on each card.

-

Pay all bills on time: Payment history is a major factor in your scores. Stay on top of due dates.

-

Limit new credit applications: Too many new accounts can lower your score temporarily. Only apply for what you need.

-

Monitor your credit: Keep tabs on your score using a site like Credit JourneySM to see if your efforts are paying off.

-

Consider credit counseling: Reputable non-profit credit counseling provides advice on improving your credit.

With diligence and patience, you can improve your credit score over time. It’s ideal to give yourself at least 6 months to boost your score if you plan on applying for a mortgage. The higher your score, the better your chances of getting approved and securing favorable interest rates.

The Takeaway

A 683 credit score is on the lower end of the good credit range. While it may be possible to get approved for a mortgage with this score, you will have fewer options, may need a larger down payment, and will likely pay higher interest rates compared to buyers with very good or excellent scores. Improving your score before applying for a home loan can really expand your opportunities. But if buying right away, be prepared to shop around, offer a higher down payment, and bring on a co-signer to boost your chances with a 683 score. Monitor your credit and make efforts over time to reach higher score tiers before applying.

Jumbo Loans Minimum Credit Score: 700

A jumbo loan is a type of conventional loan that doesnt meet the requirements to be a conforming loan, particularly due to a higher loan amount. In general, lenders require a credit score of 700 or higher for jumbo loans.

Pay All Bills on Time

Your debt payment history is the most important factor of your FICO® Score, and even one late payment can do serious damage to your score. If youve had trouble paying on time in the past, try putting your bills on autopay so you never miss a payment. Just be sure you have enough money in your bank account to cover your bills.

Learn more: How to Improve Your Credit Score Fast

What credit score do you need to buy a house?

FAQ

Is 683 a good credit score to buy a house?

About 70% of all mortgages are conventional loans, which typically require a FICO score of 620 or better. If your score is 760 or higher, you should qualify for the best interest rates.

Is a 680 credit score good enough to buy a house?

With a credit score of 680, you’re in the “good” credit range, giving you access to many great mortgage options. This score puts you in a strong position to secure competitive terms. As a Senior Mortgage Advisor with over 20 years of experience, I’ve helped many clients with similar scores find excellent deals.

What credit score is needed for a $250000 house?

For a $250,000 home, you’ll likely need a fair to good credit score: 740+: Best rates and terms. 680-739: Good rates, still very good affordability. 620-679: Higher rates, may require larger down payment or FHA loan.

What can I get with a 683 credit score?