Unless you plan on purchasing a vehicle in all cash, your credit score is one of the most important factors in securing financing on a new or used car. Your credit score provides lenders with the likelihood that you’ll repay your debts on time.

A solid understanding of your credit score before you head to the dealership can help steer negotiations in your favor when trying to secure an affordable monthly payment. Better credit generally means lower costs. If you’re in good credit standing, you’ll probably get a favorable deal, which means you’ll pay significantly less throughout the loan duration than someone with less than stellar credit.

Auto credit scores differ from those used for mortgage approval and other significant purchases. Keep reading to find out why that’s the case as we explore how auto lenders view credit reports, what’s a good credit score to buy a car and much more.

Getting a new car is an exciting experience. But before you start shopping around it’s important to know where your credit score stands. Your credit score plays a big role in determining whether you can get approved for an auto loan and the interest rate you’ll pay. So can you buy a car with a 736 credit score? Let’s take a closer look.

What is Considered a Good Credit Score?

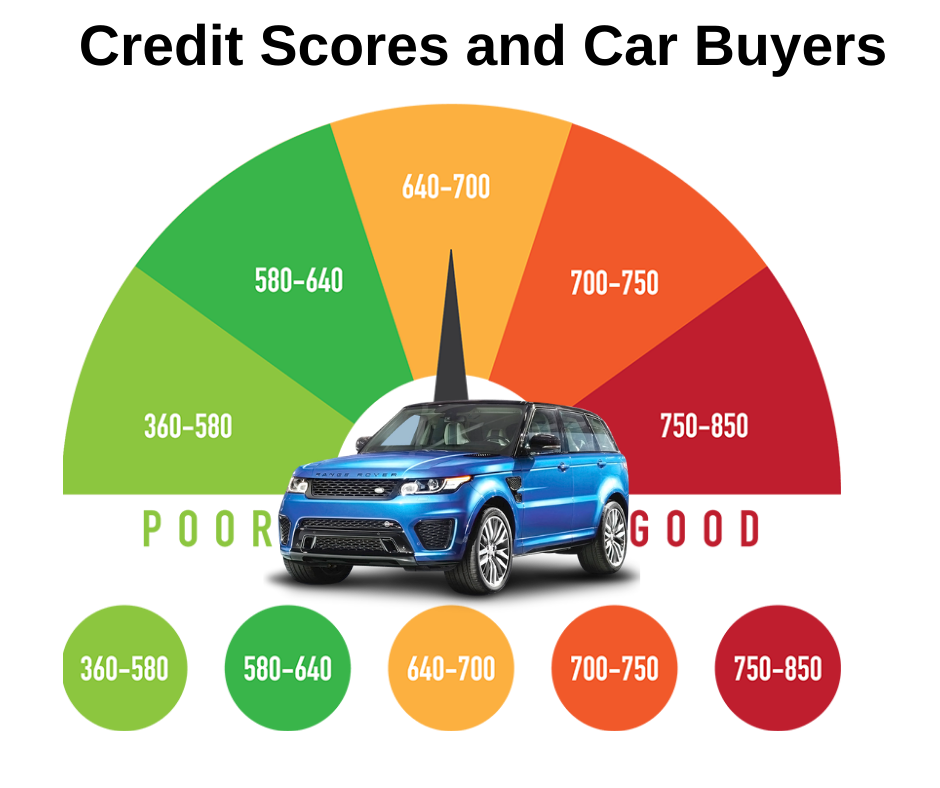

Credit scores range from 300 to 850. In general, scores above 700 are considered good, and anything above 760 is considered excellent.

Here’s how the credit score ranges typically break down

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Poor

So with a score of 736, your credit is on the higher end of the “good” range. While not exceptional, a 736 credit score is still respectable. Most lenders see borrowers with scores in this range as relatively low risk.

Can You Get Approved for an Auto Loan with a 736 Credit Score?

The short answer is yes A 736 FICO score is high enough to qualify for an auto loan from most lenders,

According to Experian data, the average credit score for approved auto loans in Q1 2025 was:

- New car loans: 756

- Used car loans: 684

So your 736 score is well above the average for used car loans, and slightly below the average for new. But that doesn’t mean you won’t qualify for a new car loan.

As long as the rest of your finances check out, a 736 credit score should be sufficient to get approved for an auto loan from most lenders. However, expect a higher interest rate than borrowers with excellent credit.

What Interest Rate Can You Expect with a 736 Credit Score?

While a 736 credit score meets the approval criteria for most lenders, it will impact the interest rate you pay. The higher your score, the lower your interest rate will generally be.

Here are the average interest rates for auto loans by credit score range, according to Experian data:

- Scores 781-850 (Exceptional): New car – 5.18%, Used car – 6.82%

- Scores 741-780 (Very Good): New car – 6.18%, Used car – 8.27%

- Scores 661-740 (Good): New car – 6.70%, Used car – 9.06%

- Scores 601-660 (Fair): New car – 9.83%, Used car – 13.74%

- Scores 501-600 (Poor): New car – 13.22%, Used car – 18.99%

With a 736 credit score, you can expect interest rates somewhere around 6.70% for a new car, and 9.06% for a used model. While not the lowest rates, these are still relatively competitive for an “good” credit score.

Just keep in mind, your interest rate will depend on many factors beyond just your credit score. Your debt-to-income ratio, income, loan term, and the lender you apply with will all impact the rate as well. So shop around to multiple lenders to make sure you’re getting the best possible deal.

Tips for Buying a Car With a 736 Credit Score

Here are some tips to make sure your 736 credit score gets you the best auto loan financing:

-

Get pre-approved: Having a pre-approval letter in hand shows dealers you’re a serious buyer and can give you leverage to negotiate the purchase price.

-

Know your full credit report: Make sure there are no errors negatively impacting your score. Dispute any inaccuracies with the credit bureaus.

-

Pay down existing debts: This can help improve your debt-to-income ratio. Pay off credit cards and other loans if possible.

-

Make a sizable down payment: A 20% down payment or higher looks attractive to lenders and can help you qualify for better rates.

-

Consider bringing a co-signer: Adding a co-signer with excellent credit can help boost your chances of getting approved and lower your interest rate.

-

Shop around: Compare rate offers from multiple lenders, including banks, credit unions, and online auto loan providers. Spread out applications within a 14 day period to minimize credit score impact.

The Bottom Line

A credit score of 736 is considered “good” by most lenders standards. While you may not qualify for rock bottom interest rates, a 736 FICO should be sufficient to get approved for an auto loan from most lenders. Just make sure to shop around for the best rates, and take steps to boost your credit profile. With some work, you can potentially improve your score and be eligible for even better loan terms in the future.

.png)

How Auto Lenders View Credit Reports?

Before you try to find financing for a vehicle, it’s important to have a good idea of your credit standing. However, when an auto lender pulls your credit report, you may notice a discrepancy between the number you saw on a platform like Credit Karma and the number they pulled. That’s because auto lenders use a specialty reporting system called FICO® Auto Score to determine the creditworthiness of a potential borrower.

Similar to your traditional credit score, three main credit bureaus submit information to your FICO Auto Score—Equifax, Experian and TransUnion.

There are a couple of major differences between your regular credit score and your FICO Auto Score. The first being the FICO Auto Score range is generally expanded. The traditional credit score ranges from 300 to 850, while the FICO Auto Score ranges from 250 to 900. That’s because the FICO Auto Score places more weight on your payment history on auto loans and leases rather than missed payment on a credit card or student loans, for example. Additionally, the specialty auto credit report will show any repossessions or auto-loan bankruptcies that may have been previously reported.

Since your credit score can significantly affect your auto loan rates, it’s recommended that you check your credit score regularly for potential inaccuracies. If you’re concerned about the discrepancy between your regular credit score and your auto score, FICO allows you to purchase a complete set of your FICO scores for a monthly fee.

What Is A Good Credit Score To Buy A Car?

The ideal credit score to purchase a car may vary depending on the type of vehicle financing you choose. However, a 2022 report by Experian found that nearly 65% of cars financed in the United States were from borrowers with a credit score of 661 or higher. The report also found that borrowers with a score between 501 and 600 accounted for approximately 15%, while only 2% of borrowers had scores below 500.

Those numbers include financing on new and used vehicles. If we extrapolate the two, the ideal credit score will adjust slightly. According to Experian data, the average credit score for a new-car loan or lease was 736. The average credit score for a used car loan or lease dropped slightly to 669.

While other factors aside from credit scores are considered, your target credit score to finance a vehicle should be no less than 661.

Let’s examine that further. Here is a chart showing credit standings and the potential annual percentage rate (APR) for new and used vehicles.

| Credit Standing & Ranges | Average APR for a New Car | Average APR for a Used Car |

|---|---|---|

| Poor: 300-579 | 14.76% | 20.99% |

| Fair: 580-669 | 10.87% | 17.29% |

| Good: 670-739 | 6.70% | 10.48% |

| Very good: 740-799 | 3.56% | 5.58% |

| Excellent: 800-850 | 2.40% | 3.71% |

Check out Arizona Central Credit Union’s Auto Loan Rates page for the most up-to-date vehicle APRs. Also, play around with our car loan calculator to see how much you can afford to pay for a vehicle.

How to buy a car with Bad Credit. Car buying Tips

FAQ

Can I get a car loan with a 736 credit score?

For new auto loans, most borrowers have scores of around 730. The minimum credit score needed for a new car may be around 600, but those with excellent credit often get lower rates and lower monthly payments.”

What credit score do you need to buy a $30,000 car?

To qualify for a $30,000 car loan, most lenders prefer to see a credit score of at least 660 to 700. That being said, your credit score is only one part of the equation. Lenders will also consider: Your debt-to-income ratio (how much you owe compared to how much you earn)

What can I do with a 736 credit score?

A FICO® Score of 736 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

What credit score is needed for a $20,000 car loan?

There’s no minimum credit score required to get an auto loan. However, a credit score of 661 or above—considered a prime VantageScore® credit score—will generally improve your chances of getting approved with favorable terms. For the FICO® Score Θ , a good credit score is 670 or higher.