The debt and mental health evidence form (DMHEF) helps your creditors understand any mental health issues you are going through.

It gives your consent for them to get information from your doctor or health professional.

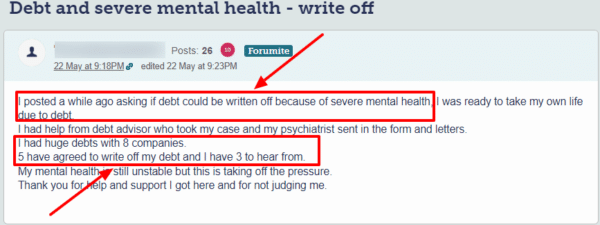

Managing finances can be stressful for anyone. But for those with mental health conditions, debt obligations and financial burdens can significantly worsen symptoms and make recovery more difficult. This raises an important question – can debt be written off due to mental illness?

While creditors are often reluctant to forgive debts solely based on mental health issues, there are legal frameworks and programs in place to provide support. This article provides a comprehensive guide on the relationship between debt and mental health, available relief options, and how tools like the Debt and Mental Health Evidence Form (DMHEF) can help facilitate debt forgiveness.

The Intertwined Relationship Between Debt and Mental Health

Research clearly shows a correlation between debt and mental health – financial struggles can trigger or exacerbate conditions like anxiety, depression and obsessive compulsive disorders. A 2018 study by the Money and Mental Health Policy Institute found that:

-

Nearly half (46%) of all people in debt also have a mental health problem

-

8 in 10 people with mental health problems say their financial situation has made their condition worse.

-

Nearly 1 in 2 people with problem debt consider taking their own life

This two-way relationship demonstrates how poor mental health can make managing finances more difficult, while debt and financial stress in turn negatively impact mental wellbeing.

Breaking out of this vicious cycle requires a multifaceted approach – managing mental health alongside proactive debt relief steps.

Can Mental Illness Lead to Debt Forgiveness?

The short answer is – not automatically in most cases. However, individuals struggling with mental illness do have options to seek relief. Some key legal frameworks and debt programs include:

Mental Health Crisis Breathing Space

This provides a temporary stop to enforcement action, fees and interest for those undergoing mental health crisis treatment. It does not directly write off debts, but offers breathing room.

Debt Management Programs

These consolidate debts into one monthly payment and negotiate reduced interest rates and waived fees. It helps manage debts more affordably.

Individual Voluntary Arrangements (IVAs)

IVAs allow repaying only a portion of total debts over an extended time period. The remainder is written off at the end.

Debt Relief Orders (DROs)

DROs write off eligible debts for those with limited disposable income and assets. Conditions apply.

While total debt forgiveness is difficult, these programs offer a path to recovery. Seeking professional debt advice is key to navigating the options.

The Debt and Mental Health Evidence Form (DMHEF)

A crucial tool for those with mental illness is the DMHEF. This standardized form is completed by a healthcare provider outlining:

- Diagnosis of a mental health condition

- How it impacts ability to manage money/repayments

- Other relevant details on severity, treatment etc.

Sharing the DMHEF with creditors can help demonstrate hardship, potentially leading to more flexibility and breathers. While not guaranteeing write-offs, it facilitates important dialog.

Overcoming Debt and Mental Health Challenges

-

Reach out for help – Debt charities, non-profits, credit counselling agencies and mental health professionals can all provide guidance tailored to your unique situation. Don’t struggle alone.

-

Prioritize treatment – Work on managing mental health issues first with counselling, medication, lifestyle changes etc. Financial recovery is easier with improved mental health.

-

Create a budget – Review income, expenses and debt repayments. Look for areas to save and reallocate towards debts.

-

Communicate with creditors – Explain your situation respectfully and explore hardship options. Provide evidence like DMHEF if required.

-

Consider debt programs – Debt management plans, IVAs etc. can make repayments more affordable. Seek professional advice on suitability.

-

Accept setbacks – Recovery is a journey with ups and downs. Don’t lose hope. Progress may be slow but perseverance pays off.

Final Thoughts

Mental illness can significantly exacerbate financial struggles, making debt obligations feel impossible to handle. While automatic write-offs are uncommon, legal frameworks do exist to ease repayment pressures. Seeking both mental health support and debt relief advice is key to breaking out of vicious cycles. Tools like DMHEF can demonstrate hardship and facilitate goodwill from creditors. With compassion, perseverance and a proactive approach, the climb to financial stability is surmountable, step by step.

All the questions on the form must be completed

Question 4 is particularly important:

- Q4. Does the person have a mental health problem that affects their ability to manage their money?

- This question should be answered ‘yes’

- There should be details of how your condition makes it harder to manage money

Do I have to pay for a DMHEF?

In England

No. This would go against a GPs contract with the NHS trust.

In Scotland, Wales, and Northern Ireland

A GP can ask for payment. But this is rare.

Can You Get Debt Written Off Due to Mental Health?

FAQ

Can you get out of debt due to mental health?

The individual creditors may decide to waive the debt if they think there’s no chance of recovering it because you are unable to work for the foreseeable future, but you may have assets that they could go after to pay off the debt, just being mentally ill doesn’t discharge you from your debt.

Can mental illness excuse debt?

Banks and credit card companies: Most major financial institutions don’t have specific policies for writing off debt due to mental illness. However, they may offer hardship programs or payment plans for individuals facing financial difficulties, regardless of the cause.

What is debt and mental health evidence for?

Debt and Mental Health Evidence Form (DMHEF)

The DMHEF is a standard form that is used to ask health and social-care professionals for evidence of your circumstances. It was designed to make it easier to collect this information for you and your creditors.

What can I do to get out of debt?

List your debts from highest interest rate to lowest interest rate. Make minimum payments on each debt, except the one with the highest interest rate. Use all extra money to pay off the debt with the highest interest rate. Repeat process after paying off each debt with the highest interest rate.