“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

The advice in this article is offered by the team independent of any bank or credit card issuer. This article may contain from our partners, and terms may apply to offers linked or accessed through this page. as of posting date, but offers mentioned may have expired. Bankrate logo

At Bankrate, we have a mission to demystify the credit cards industry — regardless or where you are in your journey — and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next. Bankrate logo

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

Having a credit card can be a great convenience. It allows you to make purchases and pay for them later. However, if you fall behind on your payments, the credit card company may take steps to recover the money you owe by accessing your bank account. This raises an important question – can they legally take money from your bank account without your permission?

How Credit Card Companies Collect Debts

When you open a credit card account, you agree to repay any charges according to the terms in the cardholder agreement. If you fail to make the minimum payment, the credit card company will start their debt collection process. Here are some common steps they may take:

- Call and send letters requesting payment

- Report missed payments to credit bureaus, damaging your credit score

- Raise your interest rate for non-payment

- Cancel or reduce your credit limit

- Turn your account over to a collection agency

- Take legal action and sue you for the debt

Throughout this process, the credit card company is hoping you will pay voluntarily If you don’t, legal action may follow

Lawsuits and Judgments Against Cardholders

If repeated attempts to collect the debt fail, the credit card company may sue you. In a lawsuit they have to prove

- You entered into a contract by opening the credit card account

- You failed to hold up your end of the contract by not making payments

- They suffered financial harm as a result

If they win they will get a court judgment against you for the amount owed. This gives them significant power to go after your assets including money in your bank accounts.

How Judgments Allow Access to Your Bank Accounts

A judgment transforms an unsecured credit card debt into a legally enforceable obligation. This allows the plaintiff (the credit card company) to use the court system to collect from you. With a judgment, they can:

- Garnish your wages – Recover money directly from your payroll

- Put liens on your property – Prevent you from selling assets like your home until the debt is paid

- Levy your bank accounts – Seize money from your checking or savings account

Banks are legally required to comply with a garnishment or levy order issued by a court.

Limits on Amounts That Can Be Taken

Federal and state laws offer some protections on the amounts that can be levied from your bank account:

- Social Security, disability income, and certain other sources are exempt from garnishment. Any funds from exempt sources are off-limits.

- The bank must leave you at least some minimum amount after a levy. For example, Florida exempts $1000 in a checking account.

- Weekly garnishment of disposable earnings is capped, typically at 25%. This applies to wage garnishments, not bank levies.

While limits exist, creditors can still recover significant sums directly from your bank account after getting a judgment.

How to Prevent Your Accounts From Being Levied

Here are some tips to keep creditors away from the money in your bank accounts:

- Communicate with the credit card company. Set up a payment plan if possible. Their goal is to get paid, not levy your account.

- Pay off the account and avoid legal action. This is the only guaranteed way to protect your accounts.

- Try to settle for less than you owe. Offering a lump-sum discount payment may stop them from suing.

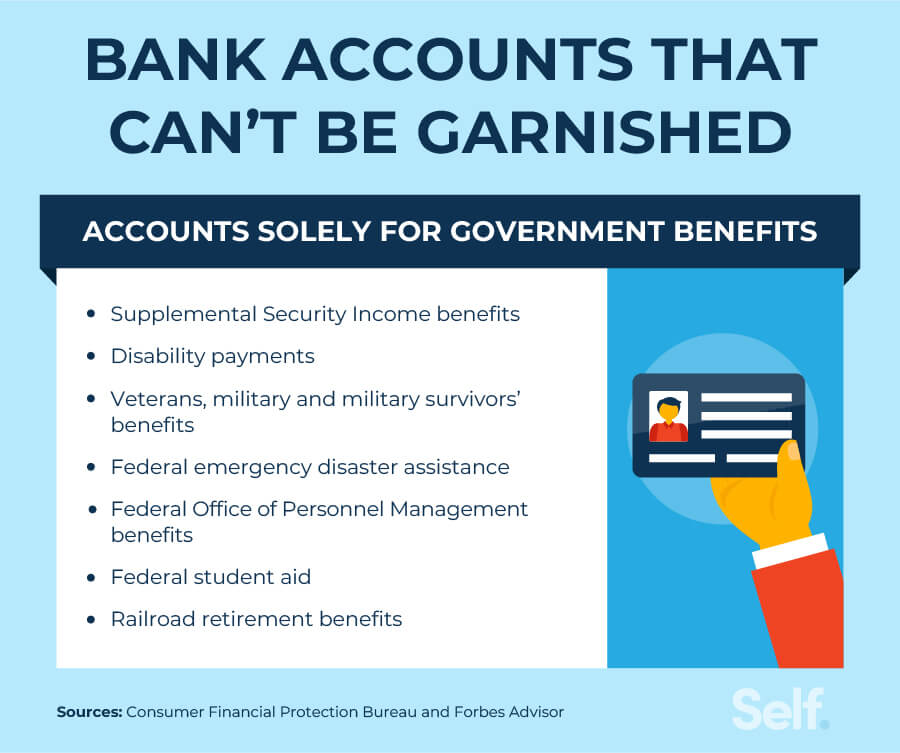

- Bank with an exempt institution. Some special credit unions and banks are exempt from garnishment orders.

- Open a separate exempt account. Certain types of accounts are protected from creditors.

- File for bankruptcy. This immediately halts all collection and lawsuits. Accounts are protected while in bankruptcy.

Acting quickly gives you the most options. Once a judgment is issued, the credit card company has the court’s permission to go after your bank accounts.

Frequently Asked Questions

Still have questions? Here are answers to some common queries about credit card companies and bank account levies:

Can they take money from my account without suing me first?

No. There must be a legal judgment in place ordering your bank to release funds.

What if I file bankruptcy after my account is frozen?

The bankruptcy halts the garnishment. The account freeze will be lifted.

What types of bank accounts are protected?

Certain retirement, education, and disability accounts cannot be levied.

Can they take my tax refunds or stimulus money?

No. Refunds and government payments are exempt.

Do I get notice before my account is frozen?

Yes, the bank must notify you of any legal orders it receives pertaining to your accounts.

The Bottom Line

While credit card companies cannot legally withdraw money from your accounts without permission, through the courts they can get orders to seize funds to pay debts you owe. This makes it critical to take action quickly if your credit card company threatens to sue you over missed payments. Seeking professional help from a credit counselor or bankruptcy attorney can go a long way in protecting your bank accounts.

Can a bank take money from your account without permission?

Credit card companies cannot take money out of your checking account without your permission, even if both accounts are from the same bank. If you have a Chase credit card and checking account and you are late on your credit card payment, for example, Chase cannot seize the funds in your checking account to cover it.

This is good news for consumers who want to maintain control over their funds. However, banks may get the authority to seize funds from a bank account based on certain legal proceedings. We’ll go over how that works in more detail below.

If you owe a bank money, can they take it from another bank account?

If you have credit card debt with a bank but you have money deposited with another institution, the same rules still apply. Your credit card issuer cannot legally seize funds from any bank account you have unless an exception (like a court order or judgment) applies.