What Exactly Is an Asset Anyway?

Have you ever wondered if those stock certificates or digital shares in your brokerage account actually count as assets? Well I’m here to clear things up for ya!

According to the U.S. Securities and Exchange Commission’s official website Investor.gov, an asset is defined as “Any tangible or intangible item that has value in an exchange.” And guess what? Stocks definitely fall into this category!

The definition specifically mentions “shares of stock” as an example of assets, alongside bank accounts and homes This means when you’re buying shares of Apple, Microsoft or any other company on the stock market, you’re acquiring assets that have real value.

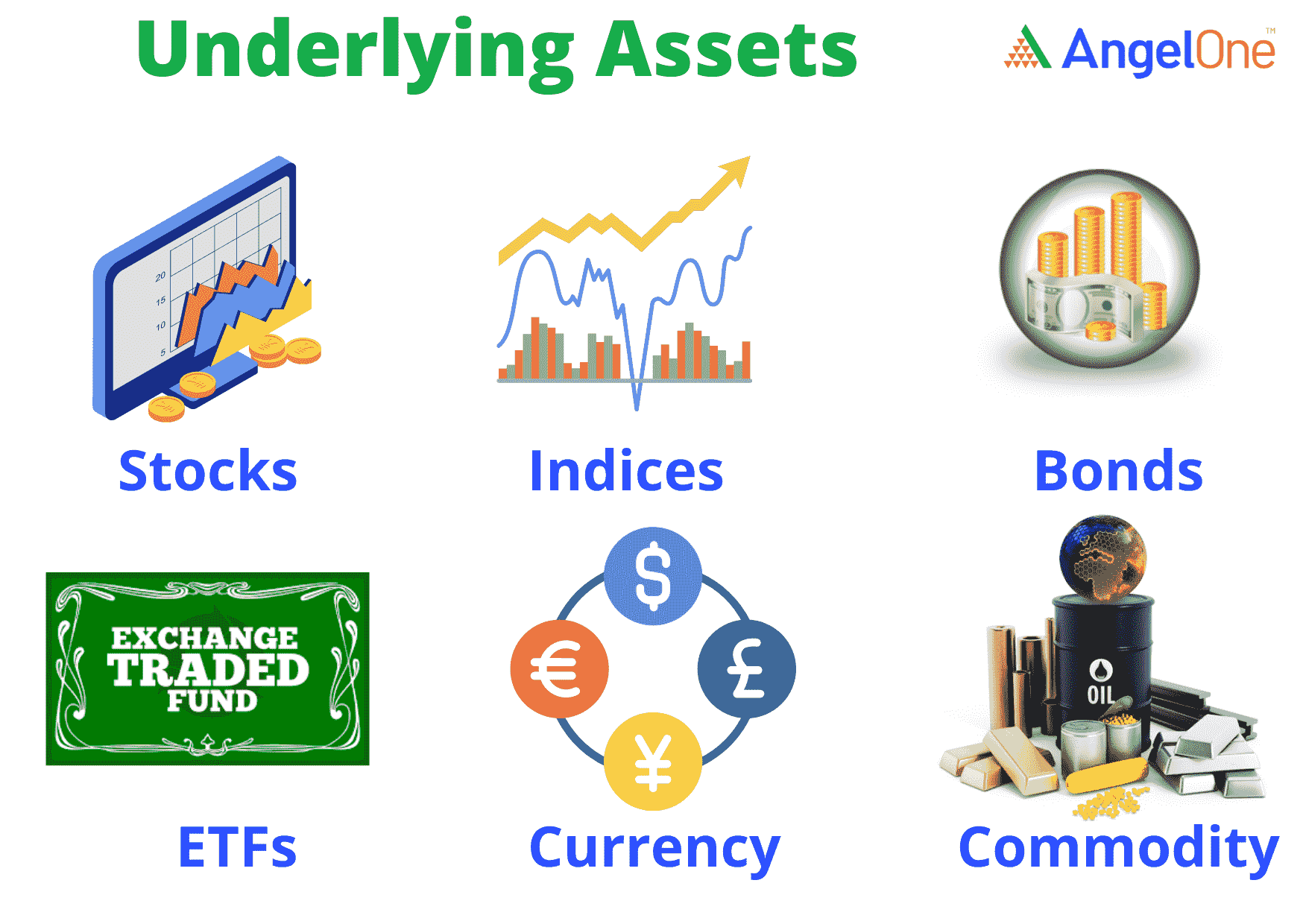

Types of Assets (And Where Stocks Fit In)

Assets come in many forms and understanding the different types can help you better manage your investment portfolio. Let me break it down for you

Tangible vs. Intangible Assets

-

Tangible Assets: These are physical items you can touch and feel

- Real estate (homes, land)

- Vehicles

- Collectibles (art, antiques)

- Cash and physical currency

-

Intangible Assets: These don’t have physical form but still hold value

- Stocks and bonds

- Bank accounts

- Digital assets

- Intellectual property

Stocks are clearly intangible assets – you can’t physically touch them (especially now that most are digital), but they definitely have value!

Why Stocks Are Valuable Assets

So what makes stocks valuable enough to be considered assets? Here’s why they matter:

- Ownership Rights – When you buy stock, you literally own a piece of that company

- Potential Income – Many stocks pay dividends, providing regular income

- Growth Potential – Stock values can increase over time, building wealth

- Liquidity – Stocks can usually be sold quickly when you need cash

I personally started investing in stocks back in 2018, and despite some ups and downs (hello, 2020 pandemic crash!), they’ve become a significant part of my asset portfolio.

How Stocks Compare to Other Common Assets

Let’s see how stocks stack up against other common assets you might include in your financial portfolio:

| Asset Type | Liquidity | Growth Potential | Income Generation | Volatility |

|---|---|---|---|---|

| Stocks | High | High | Medium (dividends) | High |

| Bonds | Medium-High | Low-Medium | High (interest) | Low-Medium |

| Real Estate | Low | Medium-High | Medium (rent) | Medium |

| Cash | Very High | Very Low | Very Low (interest) | Very Low |

| Commodities | Medium | Medium | None | High |

As you can see, stocks offer a unique combination of high liquidity and growth potential, though they come with higher volatility than some other assets.

How Stocks Fit Into Your Asset Allocation

Asset allocation is super important for building a strong investment strategy. The SEC’s Investor.gov site includes a whole section dedicated to asset allocation basics, highlighting how dividing your investments among different asset categories can help manage risk.

When thinking about stocks as assets in your portfolio, consider:

- Your age – Younger investors can typically allocate more to stocks (higher risk, higher potential return)

- Risk tolerance – How comfortable are you with market fluctuations?

- Time horizon – When will you need the money? Longer horizons allow for more stock exposure

- Financial goals – What are you saving for? Retirement? House? Education?

I’ve personally found that maintaining about 70% of my portfolio in stocks works for me at my age (mid-30s), but your situation might be different!

Different Ways Stocks Function as Assets

Stocks aren’t just one-dimensional assets. They can serve multiple purposes in your financial life:

Growth Assets

Many people buy stocks primarily for appreciation – the increase in share price over time. Growth stocks specifically focus on companies expected to grow faster than average, potentially providing substantial returns.

Income-Generating Assets

Dividend stocks are specifically valued for their ability to generate regular income. Companies that consistently pay dividends can provide steady cash flow, making them attractive assets for retirees or income-focused investors.

Diversification Assets

Stocks from different sectors, industries, and geographical regions can help diversify your overall asset portfolio, potentially reducing risk.

Common Misconceptions About Stocks as Assets

Let me clear up a few things people often get wrong:

❌ Misconception: Stocks aren’t real assets because they’re just “pieces of paper”

✅ Reality: Stocks represent actual ownership in real companies with real value

❌ Misconception: All assets should be tangible to have value

✅ Reality: Intangible assets like stocks can be extremely valuable and are recognized as legitimate assets by financial institutions

❌ Misconception: Stocks are too risky to be considered “true” assets

✅ Reality: All assets carry some level of risk – stocks are simply on the higher end of the risk spectrum

How to Start Building Your Stock Assets

If you’re looking to add stocks to your asset portfolio, here’s a simple process to get started:

- Assess your financial situation – Make sure you have emergency savings before investing

- Set clear goals – What are you investing for?

- Determine your risk tolerance – Be honest about how much volatility you can handle

- Open a brokerage account – Choose a reputable broker with reasonable fees

- Start with broad market exposure – Index funds or ETFs can provide diversification

- Consider dollar-cost averaging – Invest regularly regardless of market conditions

- Monitor and rebalance – Review your stock assets periodically

We started our stock investing journey with just $100 a month in an S&P 500 index fund. It wasn’t much, but it got us in the habit and helped us learn about how stocks work as assets.

Important Considerations for Stock Assets

Before diving into stock investing, keep these considerations in mind:

Taxation Matters

Unlike some other assets, stocks have specific tax implications:

- Capital gains taxes when you sell for a profit

- Dividend taxes on income received

- Different tax treatments for long-term vs. short-term holdings

Volatility Reality Check

Stocks can fluctuate significantly in value – sometimes by 50% or more during major market corrections. This doesn’t mean they’re not assets, just that they’re volatile ones.

Not All Stocks Are Created Equal

Some stocks represent stable, profitable companies with decades of consistent performance. Others might be speculative companies with no earnings. Both are assets, but with very different risk profiles.

How to Protect Your Stock Assets

Protecting your stock assets is crucial for long-term investment success:

- Diversify across industries – Don’t put all your eggs in one basket

- Consider index funds – These provide instant diversification

- Use tax-advantaged accounts – IRAs, 401(k)s, etc. can provide tax benefits

- Stay informed – Monitor company and economic news

- Be wary of fraud – The SEC warns about investment scams on Investor.gov

- Add a trusted contact – The SEC recommends adding a trusted contact to your account for additional protection

The Role of Stocks in Long-Term Wealth Building

Historically, stocks have been one of the most effective asset classes for building wealth over long periods. Despite short-term volatility, the overall trend of stock markets has been upward over time.

According to financial research, stocks have outperformed most other asset classes over periods of 20+ years. This makes them particularly valuable assets for long-term goals like retirement.

I’ve personally seen this play out in my own portfolio. Even with the crazy market swings we’ve all experienced, my stock assets have grown substantially over time.

Final Thoughts: Yes, Stocks Are Definitely Assets!

To wrap things up – yes, stocks absolutely are assets according to the official definition from the SEC. They represent ownership, have exchange value, and can be a crucial part of your overall wealth-building strategy.

Whether you’re just starting your investment journey or you’re a seasoned investor, understanding that stocks are legitimate, valuable assets can help frame your approach to building and managing your portfolio.

Remember what Investor.gov says: assets include “any tangible or intangible item that has value in an exchange” – and stocks definitely fit this description!

So next time someone asks you “are stocks an asset?” you can confidently answer: “Absolutely!”

Do you have stocks in your asset portfolio? What percentage of your assets do you allocate to stocks? I’d love to hear your thoughts in the comments below!

What are Stocks? And How do They Work?

FAQ

Are stocks an asset or liability?

Does stock count as an asset?

Is a stock an asset or expense?

Short-term investments: Stocks you expect to sell within a year go under Current Assets. Long-term investments: Stocks held for over a year are considered Other Assets.

Are stocks considered income or assets?

How are stocks and bonds taxed? When you sell an asset like a stock or bond for a gain, your potential federal income tax liability depends on two factors: How long you’ve owned the asset and where you hold it.