Ever stared at your compensation package and wondered if those stock options are actually worth anything? You’re not alone As someone who’s navigated the complex world of equity compensation, I’ve seen both massive wins and disappointing losses when it comes to stock options

In this guide, I’ll break down everything you need to know about employee stock options – what they are how they work and most importantly, whether they’re worth your time and consideration. Let’s dive in!

What Are Employee Stock Options Anyway?

Employee stock options are a type of equity compensation that gives you the opportunity to purchase shares in your company at a predetermined price (called the exercise price or strike price) at some point in the future. Unlike RSUs or other equity awards that directly grant you actual shares, stock options just give you the right to buy shares.

In the US, companies typically set the exercise price equal to the fair market value (FMV) of the stock on the date the option is granted. This is important because it establishes the baseline from which any potential profit will be measured.

When the current market value of the stock exceeds your exercise price, your options are considered “in the money” – that’s when they have real value! Conversely, if the market value drops below your exercise price, they’re “underwater” – not a great situation to be in.

The Two Main Types of Stock Options

There are two primary flavors of stock options you might receive:

Incentive Stock Options (ISOs)

- Can only be given to employees

- Offer more favorable tax treatment if held long enough

- Subject to Alternative Minimum Tax (AMT)

- Come with restrictions like a $100,000 grant limit

Nonqualified Stock Options (NSOs)

- Can be granted to non-employees (contractors, directors, vendors)

- Have fewer restrictions than ISOs

- Simpler tax structure (but no special tax benefits)

- More flexibility overall

The Life Cycle of Stock Options

No matter which type you receive, stock options generally follow a four-stage life cycle:

- Grant: You receive the options with a specific exercise price

- Vesting: You wait through a predetermined period to earn the right to exercise

- Exercise: You purchase the shares at your exercise price

- Sale: You sell the shares (hopefully at a profit!)

The Potential Upsides of Stock Options

For Employees

-

Potentially Huge Financial Rewards

Unlike cash bonuses that have a fixed value, stock options can multiply in value if your company performs well. This explains why some lucky employees at companies like Amazon, Google, and Apple became millionaires through their stock options. -

Tax Advantages

Especially with ISOs, you may qualify for favorable long-term capital gains tax rates if you hold the shares long enough after exercise. -

Skin in the Game

Having stock options gives you a real stake in the company’s success – your financial interests align with the company’s growth.

For Employers

-

Encourages an Ownership Mindset

When employees have options, they tend to think and act more like owners. -

Improves Motivation

The better the company performs, the more valuable those options become – creating a powerful incentive for employees to contribute to growth. -

Increases Retention

Since options typically vest over several years, they create “golden handcuffs” that encourage employees to stay longer. Leaving early means potentially walking away from significant value.

The Downsides and Risks You Should Know

Before you get too excited, let’s talk about the less sunny side of stock options:

-

They Could Become Worthless

If your company’s stock value doesn’t grow or actually declines, your options might never be worth exercising. Unlike salary or cash bonuses, there’s no guaranteed value. -

Dilution Concerns

When option-holders exercise their stock options, it can dilute existing shareholders’ equity. -

Complex Tax Implications

Particularly with ISOs, you might face Alternative Minimum Tax issues that can be confusing and potentially costly. -

Administrative Burden

For companies, managing stock option plans creates significant administrative work – tracking ownership changes, updating policies, ensuring compliance, etc.

Real Talk: Are Stock Options Actually Worth It?

I’ve seen people make life-changing money with stock options… and I’ve seen others end up with essentially worthless paper. Here’s my honest take on when they’re worth it:

When Stock Options Are Probably Worth It

-

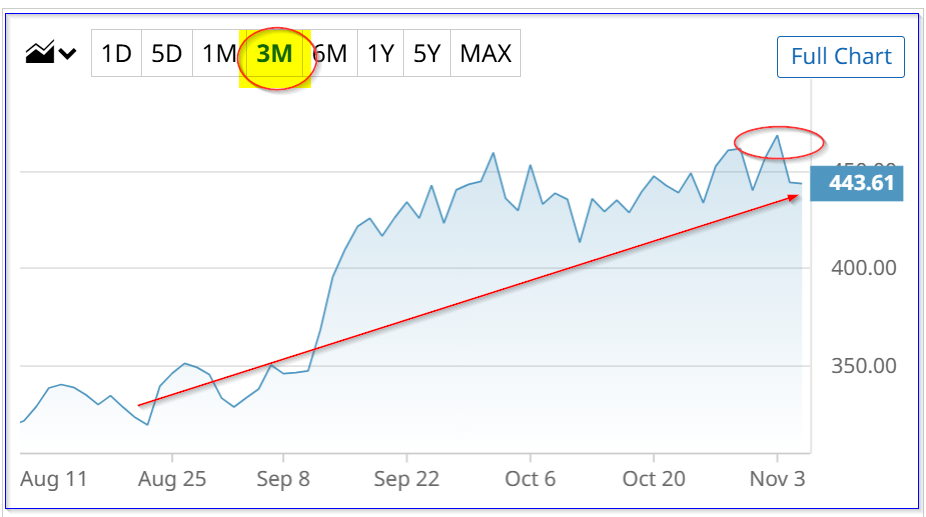

You’re joining a fast-growing company with strong fundamentals

If the company is on a clear upward trajectory, those options could multiply in value significantly. -

The exercise price is reasonable compared to current valuation

The lower your exercise price relative to current value, the better your potential upside. -

You can afford the financial risk

If exercising the options won’t create financial hardship, and you can afford to take the risk of losing that investment. -

You believe in the company’s long-term vision

Your insider knowledge gives you unique insight into the company’s potential.

When Stock Options Might Not Be Worth It

-

The company’s growth prospects are uncertain

If you have serious doubts about the company’s future, those options might never pay off. -

The exercise price is high relative to current value

If you’re starting underwater or barely above water, your upside potential is limited. -

The vesting schedule is extremely long or restrictive

If you have to wait many years to realize any value, opportunity cost becomes a factor. -

You can’t afford the tax consequences

Particularly with ISOs, the AMT implications can create significant tax bills even before you sell the shares.

Practical Considerations Before Accepting Stock Options

If you’re evaluating a job offer with stock options, or considering whether to exercise options you already have, here are key things to consider:

Understanding Your Grant

- Number of options: How many options are you receiving? This determines your total potential value.

- Exercise price: What’s the price at which you can purchase shares? Lower is better!

- Vesting schedule: How long before you can exercise? A common schedule is 4 years with a 1-year cliff.

- Expiration date: Most options expire 10 years after grant if not exercised.

- Post-termination exercise window: If you leave the company, how long do you have to exercise (typically 90 days)?

Financial Planning

- Calculate potential value: What would your options be worth at different company valuations?

- Understand tax implications: Particularly with ISOs, consult a tax professional.

- Consider your exercise strategy: Will you exercise as you vest? Wait until an exit event? Exercise and hold?

- Evaluate opportunity cost: What else could you do with the money you’d use to exercise?

Real-Life Stock Option Scenarios

The Startup Success Story

Sarah joined a healthcare tech startup as an early engineer and received 50,000 stock options with a $0.50 exercise price. Five years later, the company went public at $30 per share. After exercising her options and selling her shares, she netted over $1.4 million after taxes.

The Disappointing Outcome

Michael accepted a lower salary at a fintech startup in exchange for 30,000 stock options with a $2 exercise price. After three years, the company was acquired, but at only $1.75 per share. His options were underwater and ultimately worthless.

The Long-Term Play

Priya joined a mid-stage tech company and received 10,000 options at an $8 exercise price. She exercised and held her shares as they vested, paying $80,000 over four years. Seven years after joining, the company went public at $75 per share. By holding long enough for favorable tax treatment, she netted approximately $550,000 after taxes.

My Personal Take

In my experience, stock options are absolutely worth it if you’re joining a company with strong growth potential and you can financially manage the risk. However, they should never be the sole reason you take a job, and you should always value them conservatively in your compensation calculations.

I’ve personally seen stock options create life-changing wealth for colleagues who joined the right companies at the right time. But I’ve also watched friends exercise options in companies that ultimately failed, losing their entire investment.

The key is to treat stock options as the lottery tickets they essentially are – potentially valuable, but never guaranteed. Focus on companies you genuinely believe in, and consider the stock options a potential bonus rather than guaranteed compensation.

Practical Tips for Maximizing Stock Option Value

- Do your due diligence – Research the company thoroughly before joining or exercising

- Negotiate for more options rather than focusing solely on exercise price

- Consider early exercise if your company allows it and you can afford it

- Consult tax professionals before making major decisions

- Create a personal exercise strategy that aligns with your financial goals

- Diversify once possible – don’t keep all your wealth tied to one company

- Stay informed about company developments and market conditions

Final Thoughts

Stock options can be an incredible wealth-creation tool under the right circumstances. They can also be complex, risky, and sometimes worthless. The key is to approach them with realistic expectations, a solid understanding of how they work, and a clear-eyed view of your company’s prospects.

Remember: the ultimate value of your stock options depends primarily on your company’s success. The best thing you can do is contribute to that success while maintaining a balanced perspective on the potential outcomes.

Have you had experiences with stock options – good or bad? I’d love to hear your stories in the comments below!

Are Stock Options Worth It?

FAQ

Is it a good idea to buy stock options?

So, the answer is YES. Options allow investors to gain better control over the risks and rewards depending on their forecast for the stock. No matter if your forecast is bullish, bearish or neutral there’s an option strategy that can be profitable if your outlook is correct.

What are the downsides of stock options?

The Downside Risk. If pay is truly to be linked to performance, it’s not enough to deliver rewards when results are good. You also have to impose penalties for weak performance. The critics claim options have unlimited upside but no downside.

What is the 7% rule in stocks?

The “7% rule” for stocks is a risk management strategy that dictates selling a stock when it drops 7% below the purchase price to limit losses and preserve capital. This rule, popularized by investors like William O’Neil, is based on the observation that even strong stocks typically don’t fall more than 7-8% below their ideal buy point. It can be implemented by setting a stop-loss order with your broker or through manual monitoring. Another related, but distinct, “7% rule” is a retirement planning concept where you assume a 7% annual withdrawal rate from your investments to determine how much you need to save for retirement, as explained in this YouTube video.

How much do I need to invest in stocks to make $1000 a month?

You’ll need a portfolio worth about $300,000 generating a 4% dividend yield to earn $1,000 in monthly passive income. Building a diversified collection of 20 to 30 dividend stocks across different sectors helps protect your income.