Have you ever wondered if your investments count as assets? It’s a common question that many folks struggle with when trying to manage their finances. The simple answer is yes investments are definitely assets – but there’s more to it than just that. In this article, I’ll break down the relationship between investments and assets help you understand the key differences, and explain why knowing this matters for your financial planning.

The Relationship: All Investments Are Assets, But Not All Assets Are Investments

Let’s start with the most important point: all investments are assets, but not all assets are investments.

This distinction might seem minor at first but it’s crucial for understanding how to categorize your possessions and financial holdings properly.

According to EquityZen, there’s a clear difference between the two concepts

- Assets are things that have value and are “acquired” and owned

- Investments are “made” and owned with a specific intention

The key difference lies in the intent and purpose behind owning something. When you make an investment, you’re specifically looking for that asset to grow in value or generate returns over time.

What Exactly Is an Asset?

To understand this relationship better, let’s first define what an asset actually is.

An asset is simply anything that has value. As Forbes contributor David John Marotta explains, “An asset is something that has value. When we say ‘value,’ we don’t mean intrinsic value. Instead, the value of an asset is whatever people are willing to pay for it now.”

Assets can be literally anything from:

- Physical items (homes, cars, jewelry)

- Financial instruments (stocks, bonds)

- Digital assets (cryptocurrencies)

- Collectibles (comic books, trading cards)

- Intellectual property (patents, copyrights)

The important thing is that an asset holds some kind of value that could theoretically be converted to cash.

What Makes Something an Investment?

An investment is a specific type of asset that you acquire with the intention of generating future income or appreciation.

According to Forbes, “An investment is when you use your money to buy something with the hope of making more money in the future. This can be things like stocks, bonds, or even a small business. The goal is to have your money grow over time through dividends, interest, or capital appreciation.”

The critical differentiator is that investments are specifically acquired with the intention of:

- Generating income (like dividend stocks or rental properties)

- Appreciating in value over time (like growth stocks or real estate)

- Providing financial returns in the future

Types of Assets: Liquid vs. Illiquid

When considering assets (including investments), it’s helpful to understand the difference between liquid and illiquid assets:

Liquid Assets:

- Easily converted into cash

- Have market makers always willing to buy/sell

- Examples: stocks, bonds, ETFs, mutual funds, precious metals

- Transaction can happen quickly with minimal value loss

Illiquid Assets:

- Cannot be easily converted to cash

- No standing market for these assets

- Examples: real estate, collectibles, private business interests

- May take time to find a buyer, and value may fluctuate significantly

Most investments will fall into one of these categories, and understanding the liquidity of your investments is important when planning your financial strategy.

Common Examples of Assets That Are Also Investments

Let’s look at some common examples of assets that are also considered investments:

- Stocks – Ownership shares in companies that can appreciate and pay dividends

- Bonds – Debt instruments that provide interest payments

- Real Estate – Property that can generate rental income and appreciate

- Mutual Funds/ETFs – Baskets of securities that offer diversification

- Retirement Accounts (401k, IRA) – Tax-advantaged investment vehicles

- Business Ownership – Stakes in companies that can grow in value

- Commodities – Raw materials like gold, silver, or oil that can appreciate

Examples of Assets That Are Not Typically Investments

Not all assets are investments. Here are some examples of assets that don’t typically qualify as investments:

- Personal Vehicle – Cars usually depreciate in value (except rare collectibles)

- Electronics and Appliances – These items lose value quickly

- Clothing and Personal Items – These typically have little resale value

- Vacation Homes (in some cases) – If used purely for personal enjoyment rather than income

- Boats, RVs, and other luxury items – These often depreciate and require ongoing expenses

As Robert T. Kiyosaki famously said, “Rich people acquire assets. The poor and middle class acquire liabilities that they think are assets.” This distinction is important because some assets, like boats or second homes, might actually function more like liabilities if they require constant payments without generating income or appreciating in value.

The SEC’s Perspective on Investments vs. Assets

The distinction between investments and assets isn’t just academic – it has real regulatory implications. According to EquityZen, the Securities and Exchange Commission (SEC) makes distinctions between owning investments versus owning assets in parts of the accredited investor definition.

The SEC’s logic is that requiring ownership of investments rather than just assets can better demonstrate that an investor has experience in investing and therefore likely possesses financial sophistication similar to institutional investors.

This is important because:

- Certain investment opportunities are only available to accredited investors

- The SEC wants to ensure investors understand the risks involved

- Having investments (not just assets) suggests financial experience

Why the Distinction Matters for Your Financial Planning

Understanding the difference between assets and investments matters for several reasons:

-

Financial Goal Setting – Knowing which of your possessions are true investments helps you assess your progress toward financial goals

-

Risk Management – Investments typically carry different types of risk compared to other assets

-

Tax Planning – Investments are often taxed differently than other types of assets

-

Estate Planning – Different types of assets may be handled differently in your estate plan

-

Financial Analysis – When evaluating your net worth, distinguishing between investments and other assets gives you a clearer picture of your financial health

The Relationship with Liabilities

We can’t talk about assets and investments without mentioning liabilities. According to Forbes, “A liability is a financial obligation or debt where you or your business must repay funds to someone else.”

Understanding the relationship between your assets, investments, and liabilities is crucial for financial health. Some key points:

- Some debt can be used to increase financial solvency

- Leveraging assets through reasonable debt can amplify returns

- However, excessive liabilities can erode the value of your assets and investments

How to Think About Your Own Assets and Investments

When evaluating your own financial situation, here’s a simple framework:

-

Identify all your assets – Make a list of everything you own that has value

-

Categorize which assets are investments – These are the assets you expect to generate income or appreciate in value

-

Assess the performance of your investments – Are they meeting your goals for growth or income?

-

Consider converting non-productive assets to investments – Could you sell assets that aren’t working for you and redirect that capital to investments?

-

Review regularly – As market conditions and your financial goals change, reassess your portfolio

Final Thoughts: Strategic Asset Allocation

The most successful investors understand that not all assets are created equal. By strategically allocating your resources toward true investments rather than assets that don’t generate returns, you can build wealth more effectively.

Remember that investments are a subset of assets – they’re the assets that work for you to create more wealth. By focusing on growing your investment portfolio within your broader asset base, you position yourself for long-term financial success.

So, are investments assets? Absolutely! But they’re a special category of assets with the potential to grow your wealth over time. Understanding this distinction is one of the first steps toward financial literacy and successful wealth building.

What assets do you currently own, and which ones would you classify as investments? Taking inventory might reveal opportunities to optimize your financial position and put more of your assets to work generating returns.

Investing Tips for Beginners

FAQ

Do investments count as assets?

Are investment assets or liabilities?

How is investment an asset?

An investment is an asset or property acquired to generate income or gain appreciation. Appreciation is the increase in the value of an asset over time.

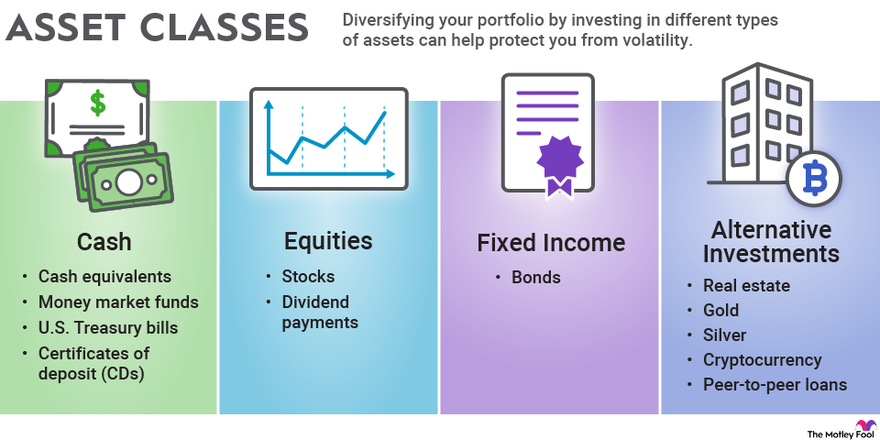

What are the four types of assets?

The four main types of assets are current assets, fixed assets, financial assets, and intangible assets. Current assets are short-term, like cash and inventory, while fixed assets are long-term, such as property and equipment. Financial assets include stocks and bonds, and intangible assets are non-physical, like patents and trademarks.