If youre just starting your investment journey, understanding the basics of stocks and bonds is crucial. Both are widely used by investors to build wealth, but they have distinct characteristics, risks and benefits. In this guide, we break down each type of investment, explore their roles in building a portfolio and show how you can balance them for long-term success.

When you purchase a stock, you buy a small share of a company. Stockholders become partial owners of the company, entitled to a portion of the companys profits and, in some cases, voting rights on key business decisions.

In exchange for this ownership, stockholders take on the risk that the companys stock price may rise or fall, depending on its performance and broader market conditions.

Are you constantly worrying about where to put your money? You’re definitely not alone. As I was reviewing my own investment portfolio last month, I kept asking myself that age-old question are bonds safer than stocks? The answer isn’t quite as straightforward as many financial advisors make it seem

In this comprehensive guide, I’m going to break down everything you need to know about the safety of bonds versus stocks, how they compare, and which might be right for your financial situation in today’s market. By the time you finish reading, you’ll have a much clearer picture of how to balance risk and reward in your investment strategy.

The Short Answer: Yes, But It’s Complicated

Before diving into the details, let’s address the headline question directly:

Yes, bonds are generally safer than stocks – but that doesn’t automatically make them better investments for everyone in every situation.

According to the data from NerdWallet, U.S. Treasury bonds are considered more stable than stocks in the short term. This lower risk typically translates to lower returns, with the bond market historically returning around 6% compared to the stock market’s average annual return of about 10% (not accounting for inflation).

But safety isn’t the only factor to consider when investing. Let’s explore the key differences between these two investment types

Stocks vs. Bonds: Understanding the Fundamental Differences

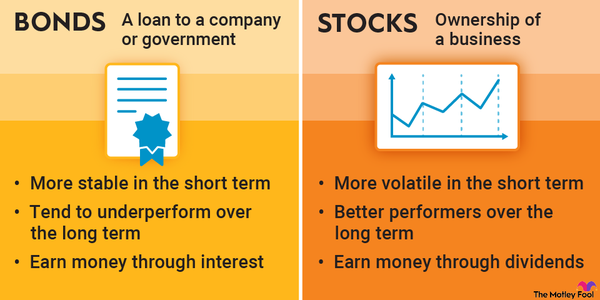

To really understand which is safer, we first need to clarify what stocks and bonds actually are

What Are Stocks?

Stocks represent partial ownership (equity) in a company. When you buy stock, you’re purchasing a tiny slice of that business – one or more “shares.” The more shares you buy, the more of the company you own.

For example, if a company has a stock price of $50 per share and you invest $2,500, you would own 50 shares. If the company performs well and the stock price rises to $75, your investment would grow to $3,750 – a 50% increase!

Of course, the reverse is also true. Poor company performance could cause your shares to lose value.

What Are Bonds?

Bonds, on the other hand, are loans from you to a company or government. When you buy a bond, the issuer is in debt to you and will pay you interest on that loan for a set period, after which they’ll pay back the total amount you initially invested.

Let’s say you buy a $2,500 bond with a 2% annual interest rate for 10 years. You’d receive approximately $50 in interest payments each year. After 10 years, you would have earned $500 in interest plus received your original $2,500 back.

4 Key Differences Between Stocks and Bonds

Now that we understand the basics, let’s explore the major differences that impact their relative safety:

1. Equity vs. Debt

- Stocks = Equity (ownership)

- Bonds = Debt (loans)

This fundamental difference explains much about their risk profiles. As an owner (stockholder), you’re last in line to get paid if a company goes bankrupt. As a lender (bondholder), you’re higher up in the payment priority list if things go south.

2. Capital Gains vs. Fixed Income

- Stocks make money through capital gains (selling shares at higher prices than you paid)

- Bonds generate cash through regular, predictable interest payments

This is why bonds are considered more reliable for income-focused investors. You generally know exactly how much you’ll receive and when.

3. Inverse Performance Relationship

Here’s something fascinating: stocks and bonds often have an inverse relationship in terms of price. When stock prices rise, bond prices frequently fall (and vice versa).

This happens because when stock markets are booming, investors tend to move money from bonds to stocks to capitalize on growth. Conversely, when stocks are tanking, investors often flee to the relative safety of bonds, driving bond prices up.

John Hancock notes that “Bonds and stocks react differently to adverse events, meaning a blend of both investment vehicles can add increased stability to your portfolio.”

4. Tax Treatment

- Bonds payments are typically subject to income tax

- Stock profits are subject to capital gains tax (which may be lower than income tax rates for some investors)

Some bonds offer special tax advantages:

- Municipal bond payments are exempt from federal income tax

- Treasury bond payments are generally exempt from state income tax

Risk vs. Reward: What the Numbers Tell Us

Let’s look at the historical performance data:

| Investment Type | Average Historical Return | Risk Level |

|---|---|---|

| Stocks (S&P 500) | ~10% | Higher |

| Bonds (U.S. Aggregate) | ~5-6% | Lower |

According to CNN Money (cited by John Hancock), “large stocks on average have returned 10% per year since 1926 vs. a 5-6% return for long-term government bonds.”

This higher return for stocks comes with a price: volatility. A portfolio of 100% stocks is almost twice as likely to end the year with a loss than a portfolio of 100% bonds.

The Different Types of Bonds and Their Risk Levels

Not all bonds are created equal when it comes to safety:

U.S. Treasury Bonds

These are considered virtually risk-free, as they’re backed by the U.S. government. However, they typically offer the lowest yields.

Corporate Bonds

These vary widely in risk and return potential:

- Investment-grade bonds: Higher credit rating, lower risk, lower returns

- High-yield (junk) bonds: Lower credit rating, higher risk, higher returns

As Brett Koeppel, a certified financial planner quoted by NerdWallet, states: “The primary role of fixed income in a portfolio is to diversify from stocks and preserve capital, not to achieve the highest returns possible.”

When the Lines Blur: Exceptions to the Rule

Interestingly, some investment vehicles blur the line between stocks and bonds:

Dividend Stocks

Large, stable companies often issue dividend stocks that provide regular income similar to bonds. These can offer a middle ground between growth and income.

Preferred Stock

This investment resembles bonds even more and is generally less risky than common stock but riskier than bonds. Preferred stocks often pay higher dividends than both common stocks and bond interest.

How to Decide: Is Your Portfolio Too Conservative or Too Aggressive?

So how do you decide the right mix for your situation? One traditional rule of thumb suggests that the percentage of stocks in your portfolio should equal 100 minus your age. For example:

- If you’re 30: 70% stocks, 30% bonds

- If you’re 60: 40% stocks, 60% bonds

But many financial experts now suggest this approach is too conservative given our longer lifespans today. Some recommend using 110 or even 120 minus your age instead.

Ultimately, your stock/bond allocation depends on several factors:

- Your age and time horizon

- Your risk tolerance

- Your income needs

- Your financial goals

5 Signs Bonds Might Be Right for You

You might want to favor bonds if:

- You’re approaching retirement and need to preserve capital

- You need predictable income from your investments

- You have a low tolerance for market volatility

- You’re saving for a medium-term goal (3-5 years)

- You want to diversify an otherwise stock-heavy portfolio

5 Signs Stocks Might Be Better for You

You might want to favor stocks if:

- You have a long investment timeframe (10+ years)

- You’re comfortable with short-term volatility

- You’re seeking maximum growth potential

- You don’t need current income from your investments

- You’re young and have time to recover from market downturns

The Power of Diversification: Why the Answer is Usually “Both”

For most investors, the smartest approach isn’t choosing between stocks OR bonds – it’s finding the right balance of both.

As John Hancock puts it: “There is no one right answer when it comes to investing. Bonds and stocks react differently to adverse events, meaning a blend of both investment vehicles can add increased stability to your portfolio.”

This approach, known as diversification, helps manage risk while still providing growth potential.

My Personal Take on the Stocks vs. Bonds Question

I’ve been investing for over a decade now, and I’ve learned that the “safety” of any investment depends largely on your time horizon. For money I need in the next 1-3 years, bonds are definitely safer. For money I won’t need for 20+ years, stocks have historically been the safer choice despite their short-term volatility.

Currently, my own portfolio is roughly 75% stocks and 25% bonds, which reflects my relatively long time horizon and comfort with some market fluctuations. But I adjust this balance periodically based on market conditions and my changing financial needs.

The Bottom Line: Safety is Relative

So, are bonds safer than stocks? In the short term, absolutely. But over very long periods, stocks have consistently outperformed bonds, which means bonds might actually be “riskier” if your goal is to maximize long-term growth and outpace inflation.

The wisest approach is usually to include both in your portfolio, adjusting the balance based on your personal situation, goals, and timeline.

Remember what DQYDJ (cited by John Hancock) suggests: “over a long enough time period…there would have to be a major change in equity market behavior for you to come out worse on the back end” with stocks.

Final Thoughts: Start Early, Regardless of Your Choice

Whether you decide to focus more on stocks or bonds, what truly matters is starting early. As John Hancock emphasizes, “Let the magic of compounding do the heavy lifting, and you’ll be saving money and building your wealth in no time.”

I’d love to hear your thoughts on the stocks vs. bonds debate! Do you favor one over the other in your portfolio? Share your experience in the comments below.

Stocks vs. Bonds: Risk and Return Comparison

- Stocks carry higher risk but also higher potential returns. A well-chosen stock may increase dramatically in value over time, providing strong growth. However, stocks are susceptible to price swings driven by market conditions and company performance.

- Bonds are generally considered lower risk. The risk of losing principal is minimal unless the bond issuer defaults. Bonds tend to offer fixed returns (interest), which are often lower than stock returns. While this provides stability, the lower returns can be less attractive for those seeking high growth.

Example: In 2020, the stock market saw significant fluctuations due to the pandemic. The S&P 500 dropped by 34% in March but rebounded by 70% as of December. Meanwhile, bonds generally maintained their value, providing more stability and steady income for those who were risk-averse during uncertain times.

READ MORE: Investing in a Bear Market

How To Buy Bonds

Bonds can be purchased directly through brokers or bond funds, which pool together various bonds. Direct purchases may be more cumbersome for small investors, so many choose bond funds for more liquidity and diversification.

Dave Explains Why He Doesn’t Recommend Bonds

FAQ

Are bonds safe if the market crashes?

Is it better to invest in bonds or stocks?

Bonds are generally safer and offer more stability, but stocks usually provide higher returns over time. If you’re looking for compounding, stocks may be the better choice for long-term growth!

What is the safest form of investment?

The concept of the “safest investment” can vary depending on individual perspectives and economic contexts. But generally, cash and government bonds—particularly U.S. Treasury securities—are often considered among the safest investment options available. This is because there is minimal risk of loss.

What is the 7% rule in stocks?

The “7% rule” for stocks is a risk management strategy that dictates selling a stock when it drops 7% below the purchase price to limit losses and preserve capital. This rule, popularized by investors like William O’Neil, is based on the observation that even strong stocks typically don’t fall more than 7-8% below their ideal buy point. It can be implemented by setting a stop-loss order with your broker or through manual monitoring. Another related, but distinct, “7% rule” is a retirement planning concept where you assume a 7% annual withdrawal rate from your investments to determine how much you need to save for retirement, as explained in this YouTube video.