These reviewers are industry leaders and professional writers who regularly contribute to reputable publications such as the Wall Street Journal and The New York Times.

Our expert reviewers review our articles and recommend changes to ensure we are upholding our high standards for accuracy and professionalism.

Our expert reviewers hold advanced degrees and certifications and have years of experience with personal finances, retirement planning and investments.

Choosing between annuities and bonds for your retirement can feel like trying to pick the perfect tool for a job you’ve never done before. I’ve spent years researching retirement options and let me tell ya – it ain’t always straightforward! Today I’m breaking down the annuities vs. bonds debate in simple terms so you can figure out which might work better for your golden years.

The Quick Answer

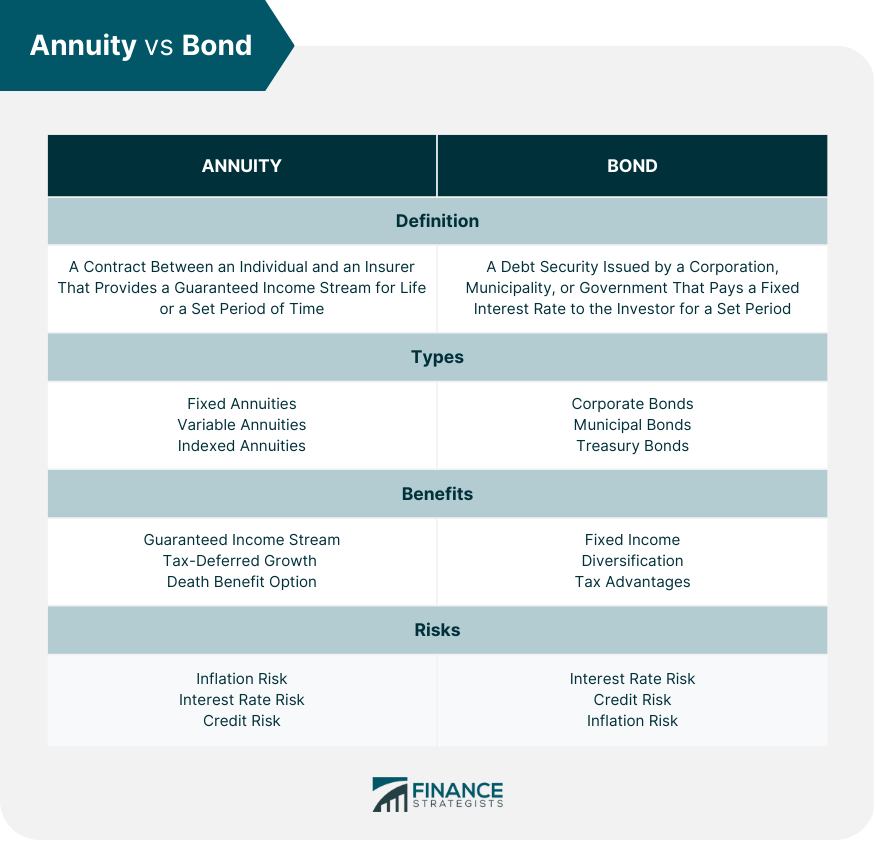

Annuities generally provide guaranteed lifetime income but with lower yields, while bonds typically offer higher yields but for a fixed period. The “better” choice depends entirely on your personal retirement goals, risk tolerance, and need for income security.

Understanding the Basics: What Are These Things Anyway?

Before we dive into which is better, let’s make sure we’re on the same page about what these financial products actually are.

Annuities Explained

An annuity is basically an insurance contract that provides regular payments You give a lump sum to an insurance company, and they promise to pay you back over time – often for the rest of your life

There are several types:

- Fixed annuities: Provide predictable, steady payments

- Variable annuities: Payments fluctuate based on investment performance

- Indexed annuities: Payments tied to a stock market index

- Immediate annuities: Payments begin right away

- Deferred annuities: Payments begin at a future date

Bonds Explained

A bond is essentially an IOU. When you buy a bond, you’re lending your money to an entity (government, corporation, municipality) for a set period. In return, they promise to pay you interest during that time and return your principal when the bond matures.

Common types include:

- Government bonds: Issued by federal governments

- Corporate bonds: Issued by companies

- Municipal bonds: Issued by local governments

- Agency bonds: Issued by government agencies

The Big Showdown: Annuities vs. Bonds

Now let’s compare these two retirement vehicles across several key factors.

1. Income Guarantee

Annuities: The big selling point! Many annuities can provide guaranteed income for life, no matter how long you live. This addresses the “outliving your money” fear many retirees have.

Bonds: Provide regular interest payments but only until the bond matures. Once that happens, you get your principal back but the income stops unless you reinvest.

Winner for lifetime income security: Annuities

2. Yield and Returns

Annuities: Generally offer lower yields compared to bonds. Fixed annuities provide stable returns, while variable annuities could potentially deliver higher returns (with higher risk).

Bonds: Bonds generally earn higher yields than annuities. Currently, 10-year treasury bonds yield around 4.5%, while fixed annuities offer yields above 5.5% (as of late 2025).

Winner for potential returns: Usually bonds, but check current rates!

3. Tax Advantages

Annuities: Offer tax-deferred growth, meaning you don’t pay taxes on the earnings until you withdraw them. Non-qualified annuity payments are partially taxable.

Bonds: Interest income is fully taxable (except for municipal bonds, which may be tax-exempt).

Winner for tax efficiency: Usually annuities, especially for long-term growth

4. Liquidity and Flexibility

Annuities: Typically less liquid. Early withdrawals may incur surrender charges and tax penalties.

Bonds: Can be bought and sold fairly easily, offering better liquidity. However, if you sell before maturity, you might get more or less than you paid, depending on interest rate changes.

Winner for flexibility: Bonds

5. Risk and Safety

Annuities: Fixed annuities offer stability against market fluctuations. The main risk is the financial strength of the insurance company issuing the annuity.

Bonds: Risk varies by type. Government bonds are generally safer than corporate bonds. All bonds face interest rate risk – when rates rise, existing bond values fall.

Winner for stability: It depends on the specific products, but fixed annuities often have less market volatility

Real Talk: Who Should Choose What?

You Might Prefer Annuities If:

- You’re worried about outliving your savings

- You want guaranteed income you can’t outlive

- You’re a conservative investor who prioritizes stability over higher potential returns

- You want tax-deferred growth

- You don’t need immediate access to all your money

You Might Prefer Bonds If:

- You want potentially higher yields

- You value flexibility and liquidity

- You’re comfortable managing reinvestment when bonds mature

- You’re willing to accept some market fluctuations

- You want more control over your investments

Smart Strategies: Why Not Both?

Here’s a secret many financial experts recommend: use both! This approach, sometimes called a “bucketing strategy,” gives you the best of both worlds.

Combination Strategies:

-

Bond Laddering: Purchase bonds with staggered maturity dates to provide regular income and manage interest rate risk.

-

Annuity Laddering: Buy multiple annuities at different times to create a staggered income stream while taking advantage of changing interest rates.

-

Core and Explore: Use annuities as your “core” guaranteed income (along with Social Security) and bonds as your “explore” portion for potentially higher returns.

A Quick Comparison Table

| Feature | Annuities | Bonds |

|---|---|---|

| Duration | Often lifetime | Fixed maturity date |

| Typical Yields | Lower but guaranteed | Higher but not guaranteed for life |

| Liquidity | Limited, may have surrender charges | Can be sold, but value fluctuates |

| Tax Treatment | Tax-deferred growth | Interest typically fully taxable |

| Risk | Insurance company strength | Issuer default risk, interest rate risk |

| Best For | Guaranteed lifetime income | Higher yield, flexibility |

My Personal Take

I’ve talked with hundreds of retirees, and I’ve noticed something interesting – those who sleep the best at night often have some form of guaranteed income (like annuities) covering their essential expenses, with bonds and other investments providing additional income for discretionary spending.

The “annuities are better than bonds” or “bonds are better than annuities” debate misses the point. They’re different tools for different jobs in your retirement toolkit!

Important Considerations Before Deciding

Before you rush to buy either, keep these things in mind:

- Current Interest Rates: These significantly impact both annuity payout rates and bond yields

- Your Age: The older you are, the higher the annuity payout rates typically are

- Your Health: If longevity runs in your family, lifetime annuities may provide more value

- Your Other Income Sources: Consider Social Security, pensions, and other retirement accounts

- Fees and Expenses: Annuities, particularly variable ones, can have high fees that eat into returns

The Bottom Line

So are annuities better than bonds? The honest answer is: it depends on your specific situation and goals.

Annuities shine when it comes to providing guaranteed lifetime income and peace of mind. Bonds typically offer higher yields, more liquidity, and greater control.

For many retirees, the sweet spot is a combination approach – using annuities to create a guaranteed income floor that covers essential expenses, while using bonds and other investments to provide additional income and growth potential.

Remember, there’s no one-size-fits-all answer. Your retirement strategy should be as unique as you are!

Next Steps

If you’re seriously considering either of these options:

- Talk to a fiduciary financial advisor who specializes in retirement income planning

- Shop around for the best rates if considering an annuity

- Consider your entire financial picture, not just one element of it

- Start small if you’re uncertain – you don’t have to commit all your funds at once

What’s your experience with annuities or bonds? Have you found one works better for your retirement needs? I’d love to hear your thoughts in the comments!

How Fixed Annuities and Bonds Are Alike

Fixed annuities are the type of annuity that’s most similar to a typical corporate, municipal or government bond.

Both products are popular among conservative retirement investors for their principal protection and guaranteed growth. For fixed annuities and bonds, the security of the guarantee depends on the creditworthiness of the issuer. In every case, you need to decide how comfortable you are with the credit risk before you purchase.

Other similarities between fixed annuities and bonds include:

- Both are purchased with a lump-sum payment

- Both offer guaranteed payments for a specified period

- Both include a stated payment rate

- Both are considered safe investments with guaranteed returns of premium

- The main risk associated with both products is the risk of the issuer not being able to fulfill its obligations

Fixed Annuities and Zero Coupon Bonds

You might compare fixed annuities to zero-coupon bonds, also called zeros. Zero-coupon bonds do not pay interest at regular intervals as coupon bonds do. Instead, investors purchase zeros at a steep discount and receive the bond’s face value at maturity.

Zero-coupon bonds have a longer maturity period than other types of bonds, sometimes fifteen years or longer. Because of this, zero-coupon bonds are better suited to saving for long-term goals like retirement. Similarly, fixed annuities have a long accumulation period because they are designed for retirement savings.

Because fixed annuities and zero coupon bonds do not pay out regular interest payments, both products have no reinvestment risk. Reinvestment risk refers to how you might reinvest the interest received from a coupon bond. The risk is essentially that rates will have fallen by the time you can reinvest the interest.

Zero-coupon bonds and annuities do not carry this risk. Because the zero is holding onto the interest it accumulates, that interest compounds at the same rate. The process is similar to how fixed annuities accumulate growth: compounding annually until the annuity’s term elapses.

Annuities vs Bonds for Retirement: Which is Best?

FAQ

What is the biggest disadvantage of an annuity?

- High expenses and commissions. Cost is one of the biggest drawbacks of annuities. …

- Difficult to exit. While it may be possible to get out of an annuity contract, doing so comes at a cost. …

- Possibility of an insurer defaulting. …

- Highly complex.

Why are annuities better than bonds?

The main benefit of an annuity over buying bonds yourself is that an annuity allows the pool of insured people to share longevity risk. Those who live longer than expected are not at risk of their money running out; they’re subsidized by those who die sooner than expected.

How much does a $100000 annuity pay per month?

A $100,000 annuity can generate $580 to $859 per month, depending on your age, gender, and whether you choose single or joint lifetime income. Older buyers receive higher payments because insurers expect to pay for fewer years, and joint annuities pay less because they cover two lives.

Why is Suze Orman against annuities?

Reality: Orman explains that a variable annuity will only save you on taxes in the short run. Though you do not pay taxes when you buy or sell a mutual fund within the annuity and you do not pay taxes on year-end distributions, there are other tax disadvantages.