Have you ever wondered who’s keeping an eye on all those big banks and financial institutions that handle your money? Well, I’ve been researching this topic extensively for my blog, and I’m excited to share what I’ve learned about the main watchdogs of our financial system

The US financial sector is monitored by several federal agencies that work together to ensure stability and protect consumers. While there are numerous regulatory bodies involved, four primary agencies stand at the forefront of financial regulation in America.

The Big Four Financial Regulators

The main financial regulators in the United States are

- The Federal Reserve System (Fed)

- Federal Deposit Insurance Corporation (FDIC)

- Securities and Exchange Commission (SEC)

- Office of the Comptroller of the Currency (OCC)

Let’s dive deeper into each one and understand their roles and responsibilities in maintaining our financial system’s integrity.

1. The Federal Reserve System (Fed)

The Federal Reserve is probably the most well-known financial regulator in the U.S. As our country’s central bank, it’s responsible for regulating the financial system and managing monetary policy.

Key Functions of the Fed:

- Controls open market operations that determine the federal funds rate

- Supervises bank holding companies (its largest oversight responsibility)

- Regulates state member banks

- Oversees savings and loan holding companies

- Monitors foreign banks operating in the United States

- Supervises some regional banks (which may also be regulated by FDIC)

The Fed plays a crucial role in maintaining economic stability through its monetary policy tools. Because it has authority over bank holding companies, it’s responsible for regulating many of the nation’s largest banks. All nationally chartered banks must be members of the Fed, although they’re primarily supervised by the OCC.

I find it interesting that in March 2023, the Federal Reserve began reviewing its oversight of large regional banks after the unexpected failures of Silicon Valley Bank and Signature Bank. This sparked concerns about the broader banking system’s stability, showing how these regulators must constantly adapt to new challenges.

2. Federal Deposit Insurance Corporation (FDIC)

The FDIC was created by the Banking Act of 1933 (the Glass-Steagall Act) during the Great Depression when widespread bank failures shook consumer confidence.

Key Functions of the FDIC:

- Provides deposit insurance guaranteeing accounts up to certain limits

- Supervises state-chartered banks that aren’t members of the Fed

- Regulates regional banks that aren’t Fed members

- Oversees state-chartered savings associations

- Acts as receiver for failed banks

The FDIC’s deposit insurance is perhaps its most visible function, covering deposits up to $250,000 per customer per covered banking institution. This protection gives consumers confidence that their money is safe even if their bank fails.

3. Securities and Exchange Commission (SEC)

The SEC is the primary regulator of U.S. securities markets, created by the Securities Exchange Act. It focuses on protecting investors and maintaining fair, orderly markets.

Key Functions of the SEC:

- Regulates securities exchanges

- Supervises securities firms

- Oversees self-regulatory organizations like FINRA

- Requires registration of most securities (except certain private offerings and government securities)

- Monitors broker-dealer firms

- Oversees the Securities Investor Protection Corporation (SIPC)

The SEC describes its mission as “protecting investors, maintaining fair, orderly, and efficient markets, and facilitating capital formation.” It’s the watchdog that ensures companies provide accurate information to investors and that market players follow the rules.

4. Office of the Comptroller of the Currency (OCC)

The OCC is among the oldest federal regulatory agencies, established in 1863 by the National Currency Act. It’s part of the Treasury Department and focuses specifically on banks.

Key Functions of the OCC:

- Regulates national banks

- Supervises federal savings associations

- Oversees operating subsidiaries of national banks and federal savings associations

The OCC’s primary mission is to ensure that national banks operate safely and comply with applicable laws. They conduct regular examinations of banks and can take enforcement actions when necessary.

Other Important Financial Regulators

While the four agencies above are the primary regulators, several other important bodies play significant roles in overseeing specific aspects of the financial sector:

Consumer Financial Protection Bureau (CFPB)

Created by the Dodd-Frank Act in 2010, the CFPB has supervisory authority over:

- Nonbank mortgage originators and servicers

- Banks, thrifts, and credit unions with assets over $10 billion

- Their affiliates regarding compliance with federal consumer financial laws

National Credit Union Administration (NCUA)

The NCUA is an independent federal agency that:

- Charters and regulates federal credit unions

- Insures deposits at federal credit unions (similar to the FDIC for banks)

State Insurance Departments

Unlike most financial sectors, insurance is primarily regulated at the state level:

- Each state has its own insurance department

- They license insurers to do business in the state

- Set capital and surplus requirements

- Review and approve/reject rate increases

- Maintain guaranty associations to cover claims if insurers become insolvent

The Regulatory Web: How These Agencies Interact

What makes U.S. financial regulation interesting (and sometimes confusing) is how these agencies overlap and interact. Many financial institutions fall under multiple regulators depending on their structure and activities.

For example:

- A national bank might be regulated by the OCC but also subject to Fed oversight as a member bank

- A bank holding company would be regulated by the Fed, while its national bank subsidiary would be supervised by the OCC

- Consumer protection aspects of banking are overseen by the CFPB for larger institutions

This complex web of regulation can be challenging to navigate, but it provides multiple layers of protection for the financial system and consumers.

Recent Changes and Challenges in Financial Regulation

The regulatory landscape is constantly evolving. After the 2008 financial crisis, the Dodd-Frank Act introduced significant changes, including:

- Creation of the CFPB

- Dissolution of the Office of Thrift Supervision (OTS)

- Enhanced regulations for “systemically important” financial institutions

More recently, regulators have been grappling with new challenges like:

- The rapid growth of fintech companies

- Cryptocurrency markets

- Cybersecurity threats

- Bank failures (as seen in 2023)

Why This Matters to You

You might be wondering why you should care about all these regulatory agencies. Well, they directly impact your financial life in several ways:

- They help ensure your bank deposits are safe

- They work to prevent financial crises that could affect your investments

- They protect you from unfair or deceptive financial practices

- They maintain stability in the financial markets where your retirement savings may be invested

For instance, without the FDIC’s deposit insurance, you’d have to worry about losing your savings if your bank failed. Without the SEC’s oversight, stock market manipulation would be more common, potentially harming your investments.

The Future of Financial Regulation

Looking ahead, I believe we’ll see continued evolution in financial regulation as new technologies and financial products emerge. Regulators will need to balance innovation with consumer protection and financial stability.

Some areas likely to receive increased regulatory attention include:

- Digital assets and cryptocurrencies

- AI and algorithmic decision-making in finance

- Climate-related financial risks

- Cybersecurity and data privacy

The U.S. financial system is regulated by a complex network of agencies, with the Federal Reserve, FDIC, SEC, and OCC serving as the four main pillars. These agencies work together to ensure financial stability, protect consumers, and maintain the integrity of our markets.

Understanding who regulates what in the financial sector isn’t just academic knowledge—it helps you know where to turn if you face problems with financial institutions and gives you confidence that multiple layers of protection exist for your money.

What’s your experience with financial regulations? Have you ever had to deal with any of these regulatory agencies? I’d love to hear your thoughts in the comments!

Becoming a Financial Regulator

There are various reasons why you would want to become a financial regulator. You may have a passion for finance and economics or a true yearning to grow a career in the financial industry. Having a career in financial regulation can be intellectually challenging and financially rewarding.

What is the Primary Purpose of Regulatory Agencies?

Financial regulatory agencies are government agencies or independent organizations responsible for enforcing laws and regulations, overseeing market activities, and protecting consumers and investors.

There are several regulatory agencies that oversee the activities of banks, credit unions, and savings & loan associations. Various regulators oversee the mortgage industry, the insurance industry, and the stock markets.

By overseeing and regulating financial markets and institutions, these financial regulators serve to uphold the integrity of the financial markets, ensuring stability, transparency, and fairness.

Financial regulatory structure

FAQ

Who are the regulators of the financial sector?

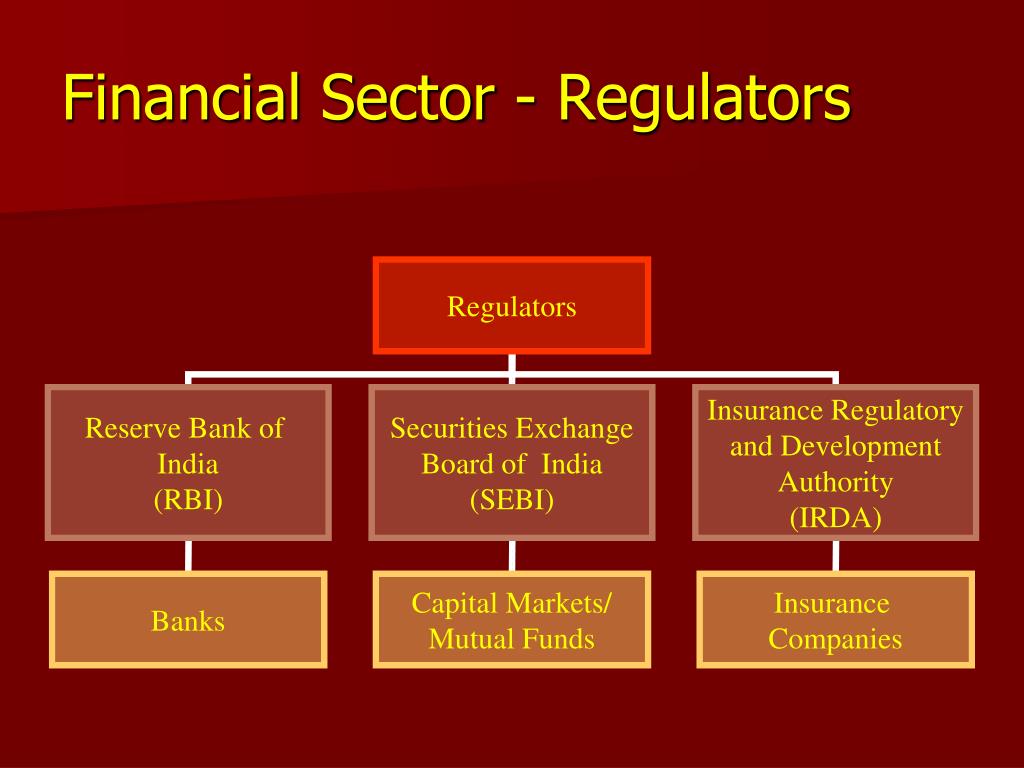

India’s financial regulators

Securities and Exchange Board of India (SEBI) – the securities market regulator. Reserve Bank of India (RBI) – the banking regulator and also the banker’s bank. Insurance Regulatory and Development Authority of India (IRDAI) – the insurance regulator.

What are the 4 pillars of the financial industry?

A term used to describe the main types of financial institutions: banking, trust, insurance and securities.

What are the 4 types of financial institutions?

The four main types of financial institutions are commercial banks, credit unions, insurance companies, and investment firms. Commercial banks offer a wide range of services like checking and savings accounts, while credit unions are member-owned cooperatives. Insurance companies provide protection against financial loss, and investment firms help individuals and businesses buy and sell securities.

What are US financial regulators?

The Securities and Exchange Commission (SEC) is the main U.S. stock market regulator, created by the Securities Exchange Act. It oversees the securities exchanges and securities firms as well as self-regulatory organizations such as the Financial Industry Regulatory Authority (FINRA).