The Dividend History page provides a single page to review all of the aggregated Dividend payment information. Historical information is not adjusted for stock splits. Visit our Dividend Calendar: Please note that the dividend history for Nasdaq stocks may also be combined the regular with the special dividend. Our partner, Quotemedia, provides the upcoming ex-dividend dates for the next month (Other OTC & OTCBB stocks are not included in coverage for Dividend History). Please note that the dividend history might include the company’s preferred securities as well. Price/Earnings Ratio is a widely used stock evaluation measure. For a security, the Price/Earnings Ratio is given by dividing the Last Sale Price by the Actual EPS (Earnings Per Share).

Data provided by Nasdaq Data Link, a premier source for financial, economic and alternative datasets. Data Links cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs. Register for your free account today at data.nasdaq.com.

Nasdaq Dividend History provides straightforward stock’s historical dividends data. Dividend payout record can be used to gauge the companys long-term performance when analyzing individual stocks.

These symbols will be available throughout the site during your session. Data is currently not available

These instruments will be available throughout the site during your session. Data is currently not available

Yes, Ford is Currently Paying Dividends – Here’s What You Need to Know

If you’re wondering whether Ford Motor Company (NYSE: F) is currently paying dividends, the answer is a resounding yes. As of November 2025, Ford continues its dividend program with quarterly payments that have made it an attractive option for income-focused investors.

I’ve been following Ford’s dividend history for years, and I’m excited to share the latest information about their current dividend program, payment schedule, and what you might expect as an investor in Ford stock.

Ford’s Current Dividend Details (Updated November 2025)

Before diving into the analysis, let’s look at the key facts about Ford’s current dividend:

- Current Annual Dividend: $0.75 per share

- Dividend Yield: 5.68%

- Dividend Frequency: Quarterly ($0.15 per quarter)

- Next Ex-Dividend Date: November 7, 2025

- Next Payment Date: December 1, 2025

- Payout Ratio: 63.47%

- Consecutive Years of Growth: 1 year

These numbers tell us that Ford is not just paying dividends—it’s offering a relatively attractive yield compared to many other stocks in the market.

How Ford’s Dividend Stacks Up Against Others

Ford’s current dividend yield of 5.68% is quite impressive when compared to other companies According to data from Koyfin

- Ford’s dividend yield is higher than 88% of companies in its sector

- It’s higher than 82% of companies in the United States

- And it’s higher than 86% of companies worldwide

This puts Ford in the upper echelon of dividend-paying stocks globally, which is significant for income investors looking for reliable quarterly payouts

Ford’s Dividend Payment Schedule

Ford pays dividends on a quarterly schedule. Based on the most recent information, here’s what to expect

- The company declares a dividend amount

- Sets an ex-dividend date (most recently November 7, 2025)

- Then makes payments to shareholders (next payment December 1, 2025)

If you’re planning to invest in Ford specifically for the dividend, you’ll need to purchase shares before the ex-dividend date to receive the upcoming payment. Anyone who buys Ford stock on or after the ex-dividend date will have to wait for the following quarter’s payment.

Is Ford’s Dividend Safe and Sustainable?

When evaluating dividend stocks, one of the most important considerations is whether the company can maintain its payments over time. Let’s examine Ford’s dividend sustainability:

Payout Ratio Analysis

Ford’s current payout ratio stands at 63.47%. This means the company is paying out about 63.47% of its earnings as dividends, leaving around 36.53% to reinvest in the business or handle unexpected expenses.

A payout ratio of 63.47% is moderate-to-high but not immediately concerning. However, it does leave less room for retained earnings that could be used for growth initiatives, debt reduction, or navigating through economic downturns.

Many dividend investors prefer companies with payout ratios below 60%, as this suggests more financial flexibility. Ford is slightly above this threshold, which means investors should keep an eye on the company’s earnings to ensure the dividend remains sustainable.

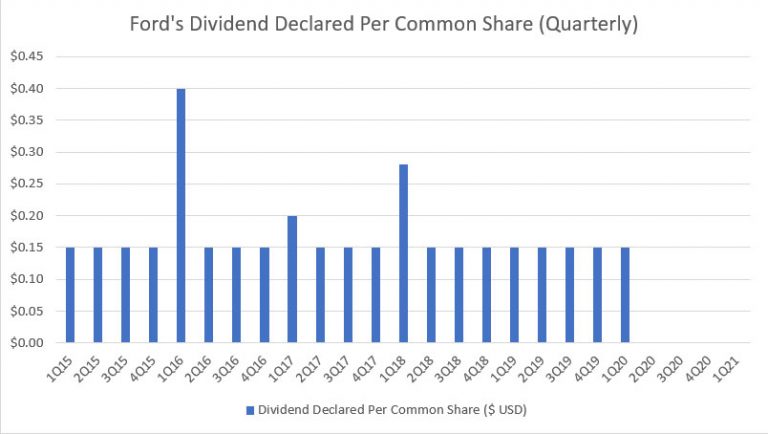

Dividend Growth History

Ford has increased its dividend for 1 consecutive year. While this isn’t a long track record compared to some “Dividend Aristocrats” that have increased dividends for 25+ years, it does show a recent commitment to rewarding shareholders.

Looking at longer-term growth rates:

- 1-year dividend growth: 0.00% (no increase in the past year)

- 3-year dividend growth: 10.06% (average annual increase)

- 5-year dividend growth: 14.87% (average annual increase)

- 10-year dividend growth: 0.43% (average annual increase)

These numbers reveal a somewhat inconsistent dividend growth history, which reflects Ford’s business cycles and strategic decisions over the years.

Ford’s Dividend History: The Full Picture

Ford’s dividend history hasn’t always been smooth. The company has a track record of maintaining dividends during strong economic periods but has suspended them during significant downturns.

Most notably, Ford suspended its dividend during the 2008-2009 global financial crisis, and more recently during the COVID-19 pandemic in 2020. The company reinstated the dividend in Q4 2021 and has maintained payments since then.

This pattern suggests that while Ford prioritizes dividends when possible, the company is willing to cut the dividend to preserve capital during severe economic challenges. This approach has helped Ford survive major industry downturns, but it also means the dividend isn’t as reliable as some other blue-chip dividend stocks with decades of uninterrupted payments.

Ford vs. General Motors: Dividend Comparison

When discussing Ford’s dividend, it’s natural to compare it with its domestic rival, General Motors (GM). Both are major American automakers facing similar industry challenges and opportunities.

While a detailed comparison would require current GM data that isn’t provided in our sources, historically these two companies have taken different approaches to capital allocation and shareholder returns, with Ford typically being more generous with dividends while GM has often focused more on share repurchases and reinvestment.

Factors That Could Impact Ford’s Future Dividends

Several factors could influence Ford’s ability to maintain or grow its dividend in coming years:

1. Electric Vehicle Transition

Ford is investing heavily in its transition to electric vehicles through its “Ford+” strategy. The company plans to spend billions on EV development, which could potentially pressure its ability to maintain dividend payments if these investments don’t generate expected returns quickly enough.

2. Economic Conditions

The automotive industry is cyclical and sensitive to economic conditions. Any significant economic slowdown could impact vehicle sales and Ford’s profitability, potentially putting pressure on the dividend.

3. Supply Chain Challenges

Ongoing global supply chain issues, particularly semiconductor shortages, have impacted Ford’s production capacity and profitability. Resolution or worsening of these issues will impact Ford’s financial performance.

4. Debt Levels

Ford carries significant debt, and interest payments on this debt can compete with dividend payments for the company’s cash flow. Management’s success in managing debt levels will influence dividend sustainability.

Should You Invest in Ford for Its Dividend?

Whether Ford makes a good dividend investment depends on your investment goals and risk tolerance. Here are some considerations:

Pros of Ford as a Dividend Investment:

- Attractive Yield: At 5.68%, Ford offers a dividend yield substantially higher than the S&P 500 average.

- Established Business: Despite industry changes, Ford remains a major global automaker with strong brand recognition.

- Potential Growth: If Ford’s transition to EVs succeeds, it could support long-term dividend growth.

Cons of Ford as a Dividend Investment:

- Dividend Volatility: Ford has cut its dividend during past downturns, making it less reliable for income-dependent investors.

- Industry Challenges: The automotive industry faces significant disruption from electrification and autonomous driving technology.

- Moderate Payout Ratio: At 63.47%, Ford’s payout ratio doesn’t leave excessive room for dividend increases without corresponding earnings growth.

How to Receive Ford Dividends

If you’ve decided to invest in Ford for its dividend, here’s how to ensure you receive payments:

- Purchase Ford stock through your brokerage account before the ex-dividend date (next one is November 7, 2025)

- Hold the shares through the record date

- Receive the dividend payment automatically in your brokerage account on the payment date (next one is December 1, 2025)

Most brokerages allow you to set up automatic dividend reinvestment plans (DRIPs) if you’d prefer to reinvest your dividends into additional shares rather than receiving cash.

Tax Considerations for Ford Dividends

Remember that Ford’s dividends are likely considered “qualified dividends” for most U.S. investors, which means they’re taxed at the lower long-term capital gains rate rather than as ordinary income. However, you should consult with a tax professional regarding your specific situation.

Final Thoughts: Is Ford’s Dividend Right for Your Portfolio?

Ford’s current dividend program offers an attractive yield that stands out in today’s market. The 5.68% yield places it above most of its peers and represents a meaningful income stream for shareholders.

However, potential investors should weigh this attractive current yield against Ford’s history of dividend cuts during economic downturns and the significant transitions occurring in the automotive industry.

For investors seeking high current income and willing to accept some risk to the dividend’s consistency, Ford presents an interesting opportunity. For those requiring maximum dividend reliability, other companies with longer histories of uninterrupted payments might be more suitable.

I believe Ford represents a reasonable balance of current income and potential growth as the company navigates the transition to electric vehicles. Just don’t put all your investment eggs in this one automotive basket!

Do you currently hold Ford in your dividend portfolio? I’d love to hear about your experience with their dividend program in the comments below!

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

We are actively working to enhance your experience by translating more content. However, please be aware that the page you are about to visit has not yet been translated.

We appreciate your undertanding and patience as we continue to imporove our services.

- F

- Dividend History

The Dividend History page provides a single page to review all of the aggregated Dividend payment information. Historical information is not adjusted for stock splits. Visit our Dividend Calendar: Please note that the dividend history for Nasdaq stocks may also be combined the regular with the special dividend. Our partner, Quotemedia, provides the upcoming ex-dividend dates for the next month (Other OTC & OTCBB stocks are not included in coverage for Dividend History). Please note that the dividend history might include the company’s preferred securities as well. Price/Earnings Ratio is a widely used stock evaluation measure. For a security, the Price/Earnings Ratio is given by dividing the Last Sale Price by the Actual EPS (Earnings Per Share).

- Real-time Data is provided using Nasdaq Last Sale Data

Data provided by Nasdaq Data Link, a premier source for financial, economic and alternative datasets. Data Links cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs. Register for your free account today at data.nasdaq.com.

Nasdaq Dividend History provides straightforward stock’s historical dividends data. Dividend payout record can be used to gauge the companys long-term performance when analyzing individual stocks.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session. Data is currently not available

To add instruments:

- Type a instrument or company name. When the instrument you want to add appears, add it to My European Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple instruments separated by spaces.

These instruments will be available throughout the site during your session. Data is currently not available

Does Ford Motor Company Stock Pay A Dividend? – Car Performance Pros

FAQ

What is Ford’s next dividend?

Is Ford giving a special dividend?

Ford intends to return between 40% and 50% of its free cash flows to shareholders, and the company has been paying special dividends to help reach its distribution targets. This year, Ford paid a supplemental dividend of $0.15 to mark the company’s third consecutive special dividend, after dishing out $0.18 last year.

Did Ford cut its dividend?

How much dividend will I get from Ford?

Ford Motor Company’s ( F ) dividend yield is 5.72%, which means that for every $100 invested in the company’s stock, investors would receive $5.72 in dividends per year. Ford Motor Company’s payout ratio is 63.47% which means that 63.47% of the company’s earnings are paid out as dividends.