Spoiler alert They’re actually pretty competitive!

Have you been wondering if Charles Schwab fees are high compared to other brokers? I’ve been investing for years and recently took a deep dive into Schwab’s fee structure What I found might surprise you!

As an investor, nothing irritates me more than hidden fees eating away at my returns. That’s why I’ve put together this comprehensive breakdown of Charles Schwab’s fees to help you understand exactly what you’ll pay before opening an account.

The Quick Answer: Are Schwab Fees High?

No, Charles Schwab fees are generally not high. In fact, they offer $0 online commissions for stocks and ETFs, competitive options pricing, and no account maintenance fees. Their investment management fees are also reasonably priced compared to industry standards.

Let’s break down the details…

Charles Schwab’s Basic Trading Fees (2025)

Here’s a quick overview of Schwab’s most common trading fees:

| Investment Type | Online Fee | Broker-Assisted Fee |

|---|---|---|

| Stocks & ETFs | $0 | $0 + $25 service charge |

| Options | $0 base + $0.65 per contract | $0.65 per contract + $25 service charge |

| Mutual Funds (Schwab OneSource) | $0 | $0 + $25 service charge |

| OTC Stocks | $6.95 | $6.95 + $25 service charge |

| Futures | $2.25 per contract | $2.25 per contract |

As you can see, most basic trading can be done online for free or with very reasonable fees. The $0 commission for stocks and ETFs matches what other major brokers like Fidelity, E*Trade, and TD Ameritrade offer.

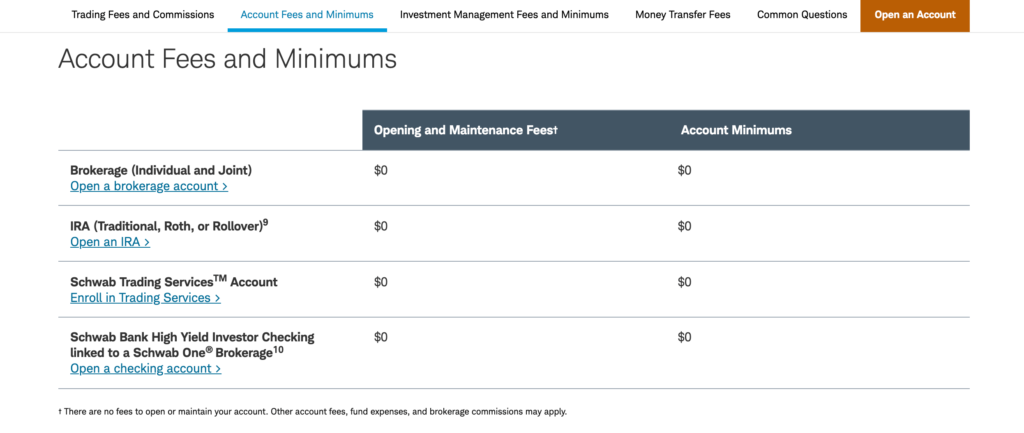

Account Fees: Another Pleasant Surprise

One thing I absolutely love about Schwab is their approach to account fees. Check this out:

- Account opening fee: $0

- Annual maintenance fee: $0

- Account minimum: $0 for most accounts

This applies to practically all their account types, including:

- Brokerage accounts (individual and joint)

- Traditional, Roth, and Rollover IRAs

- Education accounts

- Trust accounts

- Most retirement accounts

This is a big deal because some brokers still charge annual account maintenance fees or require high minimum balances. Schwab doesn’t do either for their basic accounts.

Where Schwab Might Charge More

While most basic services are competitively priced, there are a few areas where you might pay a bit more:

- Broker-assisted trades: $25 service charge (this is standard across the industry)

- Foreign stock transactions: $50 foreign transaction fee for OTC market transactions

- Wire transfers: Fees vary but can be higher than some competitors

But honestly, most investors rarely need these services. I’ve been with Schwab for years and have never paid a broker-assisted fee because their online platform works great.

Schwab’s Investment Management Fees

If you’re looking for managed accounts or advisory services, here’s what you’ll pay:

- Schwab Intelligent Portfolios: $0 advisory fee (but you’ll have cash allocation that earns less)

- Schwab Intelligent Portfolios Premium: $300 one-time planning fee + $30 monthly

- Schwab Wealth Advisory: Starts at 0.80% (rates decrease at higher asset levels)

- Schwab Managed Portfolios: Starts at 0.90% (rates decrease at higher asset levels)

The Intelligent Portfolios option is particularly interesting – no advisory fee, which is rare in the industry. However, it does require a portion of your portfolio to be held in cash, which is an indirect cost since that cash might earn less than it could elsewhere.

How Schwab Compares to Competitors

When we stack Schwab against other major brokers, here’s how they compare:

- Stock/ETF trades: Tied with Fidelity, TD Ameritrade, E*Trade at $0

- Options contracts: $0.65 per contract (same as TD Ameritrade, slightly higher than some others)

- Mutual fund access: Excellent with thousands of no-transaction-fee funds

- Account fees: Among the best with no maintenance fees or minimums

- Advisory services: Competitive, especially with Intelligent Portfolios’ $0 fee option

Hidden Fees to Watch For

While Schwab is generally transparent, there are some fees that might catch you off guard:

- Short-term redemption fee: $49.95 for redemption of funds purchased through Schwab’s Mutual Fund OneSource service and held for 90 days or less

- Industry fees: These include SEC fees, FINRA trading activity fees, and options regulatory fees that get passed on to customers

- Foreign transaction taxes: These apply to certain ADRs from countries like France, Italy, and Spain

My Personal Experience with Schwab Fees

I’ve been investing with Schwab for about 5 years now, and I can honestly say I’ve paid very little in fees. Most of my stock and ETF trades are free, and I rarely need broker assistance.

The one time I did need help with a complex options strategy, I did pay the $25 broker-assisted fee, but the guidance I received was worth it. The rep took almost 30 minutes explaining everything to me, so I felt the fee was justified.

The Schwab Satisfaction Guarantee

One thing that sets Schwab apart is their satisfaction guarantee. If you’re not satisfied with any eligible fee, Schwab will refund it upon request. This includes their Program Fees for advisory services and commissions listed in their pricing guide. Requests must be made within 90 days of the charge.

That’s pretty rare in the financial industry and gives me peace of mind.

Tips to Minimize Fees at Schwab

Here are some strategies I use to keep my fees as low as possible:

- Always trade online instead of calling a broker

- Use Schwab ETFs when possible (many have very low expense ratios)

- Choose from Schwab’s OneSource mutual funds to avoid transaction fees

- Hold mutual funds for at least 90 days to avoid early redemption fees

- Keep an eye on cash balances in managed accounts where yields might be lower

When Schwab Might Not Be the Cheapest Option

Despite all the positives, there are a few situations where Schwab might not be the most economical choice:

- Active options traders might find better per-contract rates elsewhere

- International investors might face higher fees for foreign stock transactions

- Very small investors might benefit more from fractional share programs at other brokers (though Schwab does offer Stock Slices)

Is Schwab Right for You?

Based on their fee structure, Schwab is an excellent choice for:

- Long-term investors who want low-cost stock and ETF trades

- Investors who value service quality and are willing to pay reasonable fees for it

- Those seeking managed accounts with competitive fee structures

- Retirement investors who want a wide range of no-fee IRA options

However, you might want to look elsewhere if:

- You’re an extremely active options trader

- You primarily trade international stocks

- You need extensive broker assistance regularly

Final Thoughts

When I started researching for this article, I wondered if Charles Schwab fees were high. After analyzing their entire fee structure, I can confidently say they are not. They’re actually very competitive across the board, especially for everyday investors.

What’s particularly impressive is their combination of low fees and excellent service. In my experience, their customer service is top-notch, which makes their already competitive fee structure an even better value.

Have you had experience with Schwab or other brokers? I’d love to hear your thoughts in the comments! And if you’ve found this breakdown helpful, please share it with other investors who might be wondering about Schwab’s fees.

FAQs About Charles Schwab Fees

What is the minimum investment needed for a Schwab brokerage account?

There is no minimum investment needed to open a basic brokerage account at Schwab.

How much does it cost to open an account at Schwab?

Nothing. There are no fees to open and maintain a Schwab account.

If I place a trade myself online but call with a question about the trade, do I have to pay the broker-assisted fee?

No. As long as you place the trade yourself, you don’t have to pay the broker-assisted fee even if you call with questions.

Does Schwab charge annual maintenance fees for IRAs?

No, Schwab does not charge annual maintenance fees for IRAs.

Are there any hidden fees with Schwab’s Intelligent Portfolios?

While there’s no advisory fee, you will pay the operating expenses on the ETFs in your portfolio. Also, a portion of your portfolio is placed in an FDIC-insured deposit at Schwab Bank, which may earn less than other cash alternatives outside the program.

Remember, the investment landscape changes frequently, so always check Schwab’s current pricing guide at schwab.com/pricing for the most up-to-date information!