Ever felt lost in the world of investing, wondering “what are the types of brokers” and which one might be right for you? You’re not alone! The financial landscape can be overwhelming, especially when it comes to choosing someone to help manage your investments. As someone who’s spent years navigating these waters, I’m excited to break down the different types of brokers in simple terms.

What Exactly Is a Broker?

Before diving into the types, let’s clarify what a broker actually is. Simply put, a broker is an intermediary who connects buyers and sellers in various markets. Think of them as the middlemen who make transactions possible.

In the investment world, brokers are individuals or firms that act as go-betweens for investors and securities exchanges. They’re the ones who execute your buy and sell orders, and depending on the type of broker, they might offer additional services like investment advice or market research.

The Main Types of Brokers You Should Know

1. Full-Service Brokers

These are the traditional, white-glove service providers of the brokerage world. Companies like Morgan Stanley, Goldman Sachs, and Bank of America Merrill Lynch fall into this category.

What they offer:

- Comprehensive investment advice

- Detailed market research

- Retirement planning

- Estate planning

- Tax advice

- Access to a wide range of investment products

The catch? You’ll pay premium commissions for these services. Full-service brokers typically charge higher fees because they provide personalized attention and expertise.

Who they’re best for: High-net-worth individuals who want hands-on guidance and don’t mind paying extra for personalized service.

2. Discount Brokers

The rise of technology has democratized investing, and discount brokers are at the forefront of this revolution. These brokers focus on executing trades with minimal frills.

What they offer

- Low-cost or even commission-free trading

- Basic trading platforms

- Limited investment advice

- Self-directed investing options

The advantage? Significantly lower fees compared to full-service brokers Many discount brokers nowadays offer $0 commission on standard stock trades!

Who they’re best for: Cost-conscious investors who are comfortable making their own investment decisions or don’t need extensive guidance.

3. Online Brokers

While not technically a separate category (they can be either full-service or discount), online brokers deserve special mention because they’ve transformed how we invest.

What they offer:

- 24/7 access to trading platforms

- Mobile apps for on-the-go investing

- Tools for technical analysis

- Educational resources

- Virtual trading simulators

The advantage? Convenience and accessibility. You can manage your investments anytime, anywhere.

Who they’re best for: Tech-savvy investors who prefer DIY approaches and digital interfaces.

4. Agency Brokers

These specialized brokers act solely as agents for their clients, focusing on getting the best possible trade executions.

What they offer:

- No inventory of shares (unlike many larger brokers)

- Focus on best execution for clients

- Often specialize in specific markets or securities

The advantage? Reduced conflicts of interest since they don’t trade against their clients.

Who they’re best for: Institutional investors or high-net-worth individuals making large trades where execution quality matters significantly.

5. Real Estate Brokers

Switching gears from securities, real estate brokers facilitate property transactions.

What they offer when representing sellers:

- Determining property market values

- Listing and advertising properties

- Showing properties to potential buyers

- Advising on offers and provisions

- Submitting all offers to sellers

What they offer when representing buyers:

- Locating suitable properties

- Preparing offers and purchase agreements

- Negotiating with sellers

- Managing inspections and repair negotiations

- Assisting through closing and possession

The distinction: Real estate brokers have a higher level of licensing than agents and can supervise real estate agents. They’re the bosses of the real estate world!

How Brokers Make Their Money

Understanding how brokers get paid helps you know what incentives they might have:

- Commissions: Fees charged per trade (traditional model)

- Flat fees: Fixed charges regardless of transaction size

- Asset-based fees: Percentage of assets under management (common with financial advisors)

- Payment for order flow: Compensation from exchanges for directing orders their way

- Spreads: Difference between buy and sell prices (common in forex)

The Regulatory Framework: Who Watches the Watchmen?

Brokers aren’t operating in the Wild West – they’re subject to strict regulations:

- Securities brokers must register with the Financial Industry Regulatory Authority (FINRA)

- They must follow the “suitability rule” – ensuring they have reasonable grounds for recommending specific investments

- They’re bound by “know your client” (KYC) rules to understand clients’ financial situations

- Real estate brokers are licensed at the state level, with each state having its own requirements

Discount vs. Full-Service: The Great Debate

Let me break down the key differences in table form:

| Feature | Discount Brokers | Full-Service Brokers |

|---|---|---|

| Cost | Low/no commissions | Higher commissions |

| Investment Advice | Limited or none | Comprehensive |

| Research | Basic tools | Detailed analysis |

| Additional Services | Minimal | Financial planning, tax advice, etc. |

| Ideal For | Self-directed investors | Those wanting guidance |

| Compensation Model | Salary-based | Often commission-based |

The Evolution of Brokerage Services

The brokerage industry has undergone massive transformation. In the past, only wealthy individuals could afford a broker to access the stock market. Today, thanks to online brokerages, practically anyone can invest with minimal costs.

This democratization has led to an explosion of discount brokers offering self-directed platforms where investors can execute their own trades without needing personalized advice.

A Real-World Example

Imagine Amy, a high-net-worth investor who wants to purchase 10,000 shares of Tesla (TSLA). With a full-service broker, she’d call her dedicated broker who would:

- Receive her order

- Check if the brokerage has shares available

- If available, fill Amy’s order immediately

- If not, buy those shares from exchanges or other brokerages

- Potentially break the order into smaller chunks (500-1,000 shares) to optimize execution

- Deliver the shares to Amy after funds settle

This personalized service comes at a premium but provides Amy with expertise and confidence in executing her large trade.

How to Choose the Right Broker for You

Selecting the right broker depends on several factors:

- Your investment knowledge: Beginners might benefit from more guidance

- Portfolio size: Larger portfolios may justify higher fees for comprehensive service

- Trading frequency: Active traders should prioritize low commissions

- Investment goals: Long-term investors have different needs than day traders

- Desired services: Do you want just execution or comprehensive planning?

The Bottom Line

Brokers play a crucial role in connecting investors to the markets. Whether you choose a full-service broker with comprehensive guidance or a discount broker with minimal fees depends on your personal needs, experience level, and investment goals.

Remember that the right broker for you might change as your financial situation evolves. What works when you’re just starting might not be optimal as your portfolio grows and your needs become more complex.

I’ve found that many investors actually use multiple brokers – perhaps a discount broker for routine investments and a full-service broker for more complex financial planning needs. There’s no one-size-fits-all answer!

The good news? With the variety of brokers available today, you’re sure to find one that fits your unique financial journey. And now that you understand the different types, you’re well-equipped to make that choice!

FAQs About Brokers

How much do brokers make?

Brokers can be well-paid, with factors like client worth significantly impacting earnings. A typical stockbroker might earn a base salary plus commissions, with an average salary around $161,399 as of July 2024.

How do you become a broker?

Becoming a broker typically requires:

- A background in finance or economics

- Appropriate licensing (varies by broker type)

- For securities brokers, registration with FINRA

- For real estate brokers, state-level licensing

Can I invest without a broker?

For most securities markets, you’ll need some type of broker to execute trades. However, some companies offer direct stock purchase plans that allow you to bypass traditional brokers.

What’s the difference between a broker and a financial advisor?

While there’s overlap, brokers primarily execute trades and may offer investment advice, while financial advisors focus on comprehensive financial planning. Advisors registered as RIAs are held to a fiduciary standard, meaning they must act in clients’ best interests.

What is a Brokerage?

A brokerage provides intermediary services in various areas, e.g., investing, obtaining a loan, or purchasing real estate. A broker is an intermediary who connects a seller and a buyer to facilitate a transaction.

Individuals or legal entities can act as brokers. The broker performs its actions according to the client’s instructions. The broker is then compensated, receiving either a flat fee or a certain percentage of the transaction amount.

- A broker is a mediator between the buyer and the seller and who receives a payment in the form of a commission.

- The main function of a broker is to solve a client’s problem for a fee. The secondary functions include lending to clients for margin transactions, provide information support about the situation on trading platforms, etc.

- The three types of brokerage are online, discount, and full-service brokerages.

Functions of a Brokerage

The main function of a broker is to solve the client’s problems for a fee. However, there are other broker functions existing today. A brokerage can:

- Execute trades on the financial markets at the expense of the customer and on his behalf.

- Provide information support about the situation on trading platforms, sending notifications about quotes and trading mechanisms.

- Provide information about other market participants, making the correct decision for the client to conduct the transaction.

- Lending to clients for margin transactions.

- Storage and protection of customer data.

- Creating a technical base to make transactions on the exchange.

Certainly, broker companies carry out a broader activity besides mediation. Without a broker, the financial market itself would not exist.

Brokers can be one of three types:

A new form of digital investment that interacts with the customer on the internet. Online brokerages offer the main advantages speed, availability, and low commissions.

A discount broker is a stockbroker who performs buy and sell orders at a reduced commission rate.

A full-service brokerage provides a wide range of professional services to customers, such as tax tips, investment advisory, equity researching, etc.

Let’s take a closer look at the main specializations of brokers and their respective features:

A stockbroker is a professional intermediary on stock or commodity markets who sells and buys assets in the interest of the client on the most favorable terms.

Operations on the exchange market are difficult for outsiders and require a certain number of special approvals and permissions to finalize transactions. It is useful to address professional participants on a stock exchange, such as to brokers.

Credit brokers are specialists with the necessary information and professional contacts with credit institutions. They provide individual assistance to clients in selecting optimal lending options. They also assist with obtaining the needed financing, its conversion, and repayment, etc.

A leasing broker is a specialist who is similar to a credit broker but in the field of leasing equipment. A leasing brokerage’s main clients include legal entities and commercial organizations.

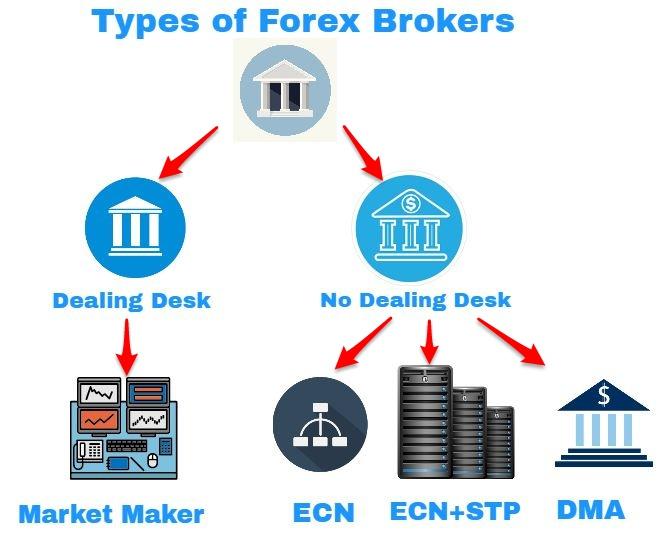

A forex broker is an intermediary who provides access to the forex currency market. Since the forex market is open only to a certain number of organizations, access to it for individuals is possible only through the mediation of forex brokers.

A real estate broker searches for buyers and sellers of real estate, e.g., warehouses, offices, retail, as well as residential properties. A real estate broker receives a certain percentage commission of the real estate transaction.

A business broker offers its services for buying and selling an existing business. They usually deal with a business valuation, take part in negotiations with potential buyers, and generally help in the sale of the business.

The main goals of contacting an insurance broker are as follows:

- Mediators draw up insurance policies at a discount.

- It saves time required to fill out an insurance contract.

- It allows searching for better offers from insurers.

Thank you for reading CFI’s guide on Brokerage. To keep learning and advancing your career, the following resources will be helpful:

- Share this article