Let me tell you something important – hitting 55 isn’t just about celebrating another birthday with a cake that has too many candles. It’s a critical time to get serious about your investment strategy as retirement looms closer. Whether retirement feels like it’s just around the corner or you’re planning to work for another decade, now is the perfect time to optimize your investment approach.

As someone who’s spent years advising folks in this age bracket, I’ve seen the good, the bad, and the downright scary when it comes to pre-retirement investing. Let’s dive into what a 55-year-old should actually be investing in right now.

Understanding Your Investment Timeline at 55

When you’re 55, you’re in a unique position. You’re likely

- Approaching your peak earning years

- Only about 10-15 years away from traditional retirement age

- Needing to balance growth with increasing security

- Possibly supporting children and aging parents simultaneously

This creates a specific investment window that requires careful planning You don’t want to play it too safe (and miss out on growth) or too aggressive (and risk losses you can’t recover from)

Top Investment Vehicles for 55-Year-Olds

1. Max Out Retirement Accounts

This should be your absolute priority. If you haven’t been maxing these out, now’s the time to get serious:

- 401(k) or 403(b) Plans: For 2025, you can contribute up to $23,500, plus an additional $7,500 as a catch-up contribution if you’re 50 or older. That’s a total of $31,000 you can sock away!

- Traditional and Roth IRAs: You can contribute $7,000 in 2025, plus a $1,000 catch-up contribution (total: $8,000)

Here’s the really cool part – those catch-up contributions can make a HUGE difference. For example, that extra $1,000 per year in an IRA from ages 50 to 65 could add nearly $26,000 to your retirement savings (assuming a 6% annual return).

The even better news? If you max out your 401(k) with the additional $7,500 catch-up contribution you might end up with about $193000 more by retirement than if you hadn’t made those extra contributions. That’s not pocket change!

2. Maintain a Balanced Stock Portfolio

Despite what some might tell ya, 55 is NOT the time to abandon stocks. You still have potentially decades ahead, and inflation is a real threat to your savings.

A good allocation might include:

- Large, mid, and small-cap companies

- Established international markets

- Some emerging market exposure

- Real estate investment trusts (REITs)

The exact percentage in stocks will depend on your risk tolerance and timeline, but many financial advisors suggest having 50-60% in equities at this age.

3. Add Fixed-Income Investments

While stocks remain important, gradually increasing your bond allocation makes sense:

- U.S. Treasury bonds: These are super safe and backed by the government

- Municipal bonds: These can offer tax advantages (especially if you’re in a high tax bracket)

- Corporate bonds: Higher yields but more risk than government bonds

- International bonds: For further diversification

Consider a ladder approach with bonds of different maturities to manage interest rate risk.

4. Look at Guaranteed Income Sources

As you get closer to retirement, having some guaranteed income becomes more important:

- Annuities: These can provide steady income streams in retirement

- Cash-value life insurance: Some policies build value you can access

- Dividend-focused investments: Companies with strong dividend histories can provide regular income

5. Consider a Roth Conversion Strategy

Many 55-year-olds should seriously look at converting some traditional IRA money to Roth IRAs. This creates tax diversification, giving you more flexibility in retirement.

Having both traditional and Roth accounts lets you control your taxable income in retirement by choosing which account to withdraw from. Plus, Roth IRAs have no required minimum distributions during your lifetime.

Investment Management Strategies at 55

Diversification is Key

This isn’t the time to have all your eggs in one basket. Proper diversification across:

- Asset classes (stocks, bonds, real estate, etc.)

- Sectors (healthcare, technology, consumer goods, etc.)

- Geographic regions (U.S., developed international, emerging markets)

- Investment vehicles (individual stocks, mutual funds, ETFs)

This approach helps protect your portfolio from any single market downturn.

Consider Working with a Financial Advisor

At 55, your financial situation is likely more complex than ever. A good financial advisor can help with:

- Creating a retirement income plan

- Tax-efficient investment strategies

- Estate planning considerations

- Long-term care planning

The cost (typically around 1% of assets annually) can be worth it for personalized guidance.

Target Date Funds: A Simple Option

If managing multiple investments feels overwhelming, target-date funds automatically adjust your asset allocation as you age. Just pick a fund with a date close to your planned retirement year.

However, be aware that:

- They may have higher fees than individual index funds

- The one-size-fits-all approach might not match your specific needs

- You’ll have less control over exact allocations

Real-World Example: Mary’s Investment Strategy at 55

Let me share a quick case study of how one of my clients approached investing at 55:

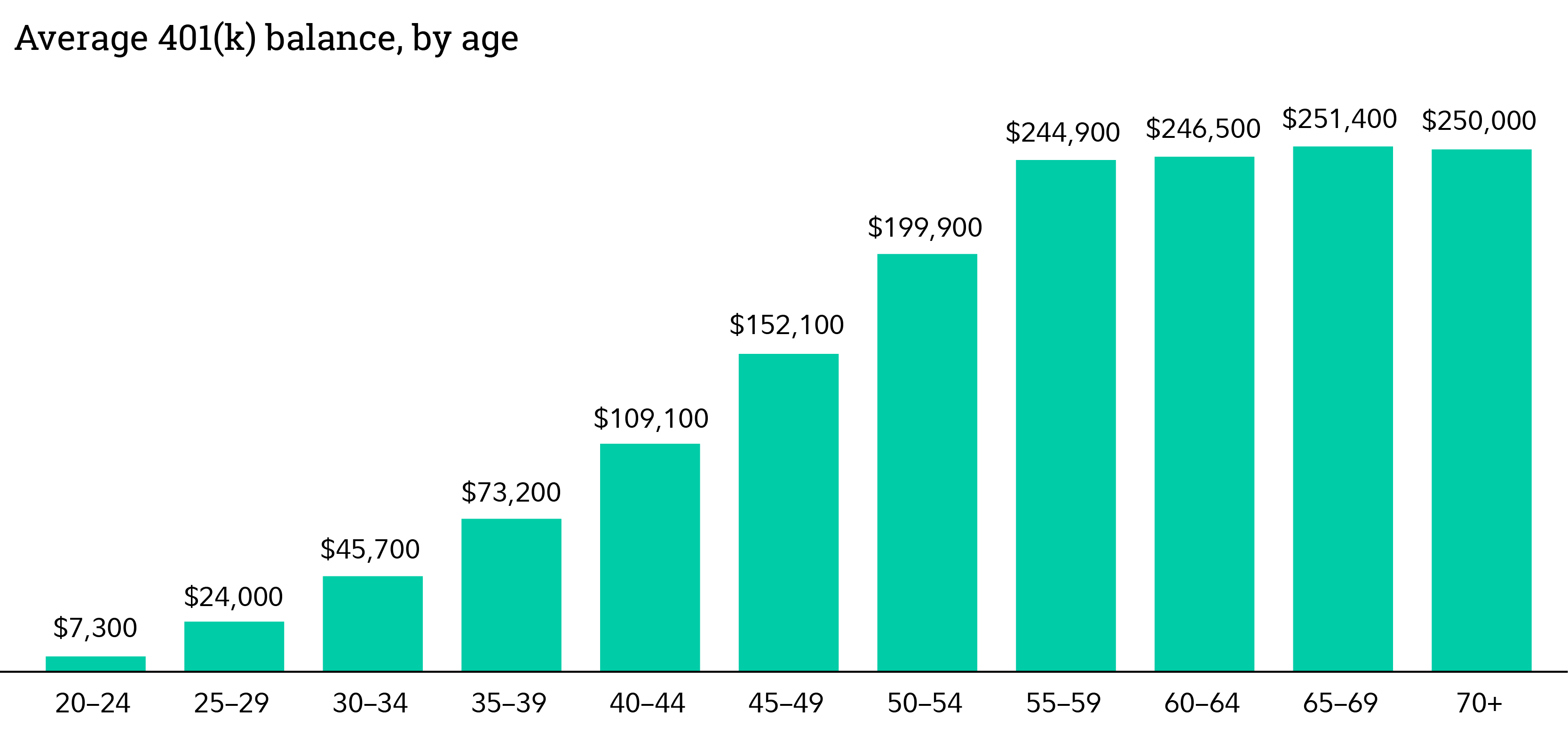

Mary was making $90,000 annually and had about $350,000 saved for retirement – which was a bit below the recommended 4x annual salary benchmark.

Her strategy:

- Maxed out her 401(k) with the full catch-up contribution ($31,000/year)

- Added $8,000 to her Roth IRA (using the catch-up provision)

- Allocated her investments as:

- 55% stocks (30% large-cap, 10% mid/small-cap, 15% international)

- 35% bonds (mix of treasuries, municipal, and high-quality corporate)

- 10% alternatives (REITs and a small gold position)

- Began exploring long-term care insurance options

- Created a plan to work until 67 to maximize Social Security benefits

Don’t Forget These Important Considerations

Health and Long-Term Care Planning

At 55, it’s crucial to think about potential healthcare costs:

- Long-term care insurance: The mid-50s to mid-60s is the optimal time to purchase this

- Health Savings Accounts (HSAs): If eligible, these offer triple tax advantages

- Medicare planning: Understanding future options and costs

Emergency Fund Needs

Even at 55, maintaining a proper emergency fund is essential – perhaps even more so as job loss at this age can be more challenging to recover from. Aim for 6-12 months of expenses in liquid savings.

Social Security Strategy

While you can’t claim until 62 at the earliest, now’s the time to understand your benefits:

- Create an account at ssa.gov to see your estimated benefits

- Consider whether claiming early, at full retirement age, or delaying until 70 makes the most sense for your situation

- If married, coordinate claiming strategies with your spouse

What to Avoid When Investing at 55

Some common mistakes I see people making at this age:

- Taking on too much risk: Trying to make up for lost time with aggressive investments

- Being too conservative: Moving everything to cash and bonds prematurely

- Raiding retirement accounts: Early withdrawals are costly in taxes and lost growth

- Failing to plan for inflation: This can erode purchasing power over a 30+ year retirement

- Not considering tax efficiency: Where you hold investments matters for tax purposes

Final Thoughts: Balancing Growth and Protection

At 55, successful investing is about finding the right balance. You still need growth to fund what could be a 30+ year retirement, but you also need to protect what you’ve already accumulated.

Remember, your investment strategy should be personalized to your specific situation. Your health, family longevity, pension availability, inheritance expectations, and risk tolerance all factor into the optimal approach.

I always tell my clients that 55 is not the time to panic about retirement – it’s the time to get strategic. With potentially another decade of solid earning and investing years ahead, you have plenty of time to strengthen your financial position.

The key is to be intentional, consistent, and to take advantage of all the catch-up provisions available to you. And don’t forget – sometimes the best investment you can make is in working with a qualified financial advisor who can help you navigate these crucial years.

What’s your biggest concern about investing at age 55? Drop a comment below, and I’ll try to address it in a future post!

2: Consider supplementing savings with a taxable account

In addition to setting money aside in your retirement accounts, consider saving in a taxable account. Setting aside money in a taxable account can provide you with flexibility for different goals and improve the tax diversification of your retirement savings. If you are already on track in your retirement accounts, maybe your next dollar should not go to a tax-deferred account.

1: Start saving now

T. Rowe Price analysis shows that, in many cases, you should have 11 times your ending salary saved by the time you retire. Setting aside 15% of your annual income (including any workplace plan company match) can help you reach that goal, but if that’s too difficult right now, start saving what you can and work to increase that amount over time. (See “Saving enough for retirement.”) Keep in mind that many employer-sponsored plans allow you to automate contribution increases.

Big changes to your budget, such as paying off your student loans or getting married, may provide opportunities to accelerate your savings. Coming together to form a new household means realigning your goals and finances with your partner. You may now have two incomes that can contribute to your retirement savings.

Work to achieve a 15% savings target as soon as possible to help reach your retirement savings goals.

Examples beginning at age 25 assume a beginning salary of $40,000 escalated 5% a year to age 45, then 3% a year to age 65. Examples beginning at age 30 assume a beginning salary of $50,000 escalated 5% a year to age 45, then 3% a year to age 65. Example beginning at age 40 assumes a beginning salary of $80,000 escalated 5% a year to age 45, then 3% a year to age 65. Annual rate of return is 7%. All savings are assumed to be tax‑deferred. Multiple of ending salary saved divides final ending portfolio balance by ending salary at age 65. This example is for illustrative purposes only and is not meant to represent the performance of any specific investment option. The assumptions used may not reflect actual market conditions or your specific circumstances and do not account for plan or IRS limits. Please be sure to take all of your assets, income, and investments into consideration in assessing your retirement savings adequacy.

Millionaire EXPLAINS: How To Invest In Your 50’s (For Beginners)

FAQ

How can I build my wealth after 55?

- Leverage All of Your Savings Options. While a 401(k) (or another employer-sponsored plan) is a good first stop for retirement savings, it’s not the only way to build your nest egg. …

- Be Strategic About Paying Down Debt. …

- Manage Risk Carefully.

Is it too late to start investing at 55?

It is never too late to start putting money into a retirement account. The earlier you start the more growth you would have, but with 25 years for your investments to grow you can build up a substantial retirement account.

What is the best investment for a 55 year old?

- High-yield savings accounts.

- Certificates of deposit (CDs).

- U.S. Treasury securities.

- Dividend-paying stocks.

- Treasury inflation-protected securities (TIPS).

- Fixed annuities.

- Stable value funds.

What if I invest $1000 a month for 5 years?

If you would have invested ₹1,000 per month for 5 years at a conservative 10% p.a. return, you could have accumulated around ₹77,437 today. If you would have consistently invested ₹1,000 per month for 10 years, you could have accumulated a corpus of around ₹2,04,845 today (assumed returns of 10% p.a.).