The Quick Answer

Yes, Vanguard VOO is generally considered an excellent investment for most investors. As one of the most popular index ETFs tracking the S&P 500 it offers broad market exposure incredibly low fees (just 0.03%), and a solid track record of performance. It’s a cornerstone investment for both beginners and sophisticated investors looking for a simple way to own a piece of America’s 500 largest companies.

But let’s dig deeper to see if it’s the right fit for YOUR investment goals.

What is Vanguard VOO?

VOO (full name: Vanguard S&P 500 ETF) is an exchange-traded fund that tracks the performance of the S&P 500 index. This means when you buy VOO, you’re essentially investing in 500 of the largest U.S. companies all at once.

According to Morningstar VOO “offers a well-diversified market-cap-weighted portfolio of 500 of the largest US stocks. This exchange-traded fund accurately represents the large-cap opportunity set while charging rock-bottom fees, a recipe for success over the long run.”

Some key facts about VOO:

- Inception date: September 2010

- Expense ratio: 0.03% (incredibly low!)

- Asset class: Large-cap U.S. stocks

- Structure: Exchange-traded fund (trades like a stock)

- Minimum investment: Price of 1 share (around $200-500 depending on market conditions)

Why Investors Love VOO

1. Exceptional Diversification

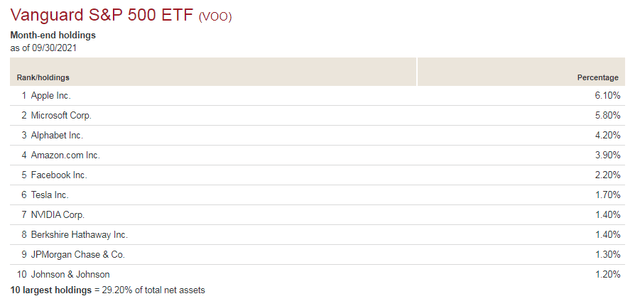

When you buy a single share of VOO, you instantly own a tiny slice of 500 of America’s largest businesses across various industries This includes tech giants like Apple and Microsoft, healthcare companies like Johnson & Johnson, financial institutions like JPMorgan, and consumer brands like Coca-Cola

This diversification helps smooth out your returns – when one sector struggles, others might thrive.

2. Rock-Bottom Fees

VOO’s expense ratio of just 0.03% is one of its biggest selling points. This means for every $10,000 invested, you pay just $3 per year in fees!

Let me put this in perspective:

- VOO: 0.03% expense ratio

- Average actively managed fund: 0.60-1.00% expense ratio

- Many financial advisor-recommended funds: 0.50-1.25% expense ratio

Over decades, this fee difference can save you tens of thousands of dollars.

3. Simplicity

VOO removes the guesswork from investing. You don’t need to analyze individual stocks, time the market, or worry about rebalancing your portfolio. VOO automatically adjusts as companies enter and exit the S&P 500 index.

4. Historical Performance

While past performance doesn’t guarantee future results, the S&P 500 has delivered remarkable returns over the long run:

- Average annual return over last 30 years: approximately 10%

- Includes multiple market cycles, recessions, and bull markets

As noted in the recent Yahoo Finance article, even investors who bought VOO at “the absolute worst moment before the 2022 inflation crisis set in” would still be up 42% today—or 50% if they reinvested their dividends.

The Current Market Situation (November 2025)

According to recent market data from Yahoo Finance, VOO has gained 19.9% over the past 52 weeks and is up 40.4% from the tariff-inspired “liberation day” crash in early April.

However, there are some market concerns to be aware of:

- The Shiller P/E ratio recently hit 41.0, approaching dot-com bubble levels

- Geopolitical tensions remain elevated

- Federal Reserve continues to assess inflation

- The government shutdown situation remains unresolved

As the article notes: “The market has been climbing like a caffeinated squirrel up a redwood tree lately.”

Who Should Invest in VOO?

VOO is well-suited for:

- Long-term investors with time horizons of 5+ years

- Beginners looking for a simple, low-cost entry into stock investing

- Retirement savers building a core portfolio position

- Passive investors who prefer a “set it and forget it” approach

- Fee-conscious investors who understand how expenses eat into returns

However, VOO may not be ideal for:

- Short-term traders looking for quick gains

- Investors needing current income (though VOO does pay dividends)

- Those seeking exposure to international markets

- Investors who need small-cap exposure

How to Invest in VOO

Investing in VOO is straightforward:

- Open a brokerage account (Vanguard, Fidelity, Charles Schwab, Robinhood, etc.)

- Fund your account with money you won’t need in the near future

- Search for the ticker “VOO” and place your order

- Consider dollar-cost averaging by investing regular amounts over time

- Reinvest dividends to maximize compound growth

- Hold for the long term to ride out market volatility

VOO vs. Other S&P 500 ETFs

VOO isn’t the only S&P 500 ETF available. Here’s how it compares to its main competitors:

| ETF | Ticker | Expense Ratio | Provider | Assets Under Management |

|---|---|---|---|---|

| Vanguard S&P 500 ETF | VOO | 0.03% | Vanguard | $300+ billion |

| SPDR S&P 500 ETF | SPY | 0.09% | State Street | $400+ billion |

| iShares Core S&P 500 ETF | IVV | 0.03% | BlackRock | $300+ billion |

While these funds track the same index, VOO and IVV have the edge in terms of expenses. SPY has greater trading volume, which can be important for institutional investors or active traders, but is less relevant for most individual investors.

VOO vs. Vanguard Total Stock Market ETF (VTI)

Another common comparison is between VOO and VTI, which tracks a broader index:

- VOO: Tracks the S&P 500 (500 large U.S. companies)

- VTI: Tracks the CRSP U.S. Total Market Index (4,000+ U.S. companies of all sizes)

Both have the same 0.03% expense ratio, but VTI provides exposure to mid-cap and small-cap stocks in addition to the large caps in VOO.

For many investors, either is an excellent choice. VTI offers slightly broader diversification, while VOO focuses on the largest, most established companies.

Potential Drawbacks of Investing in VOO

No investment is perfect. Here are some considerations:

- Limited to U.S. large-cap stocks – No international exposure or small/mid-cap representation

- Concentrated in largest companies – Top 10 holdings often make up 25-30% of the fund

- Subject to market volatility – Will decline during market corrections and bear markets

- No downside protection – Unlike actively managed funds that might hold cash or defensive positions

- Tech-heavy – Technology sector currently represents a substantial portion of the S&P 500

My Personal Experience with VOO

I’ve been investing in VOO since 2017, and it’s been one of my most reliable holdings. During the 2020 COVID crash, it plummeted like everything else, but then rebounded much faster than I expected.

What I like most is the simplicity – I don’t have to worry about which companies to buy or sell. I just keep adding money regularly through both market ups and downs. Some of my friends got burned trying to pick individual stocks, while my boring VOO investment just keeps growing.

One thing I’ve learned: don’t check the price every day! VOO is a long-term investment, and daily price movements are just noise.

Expert Opinions on VOO

Financial experts generally hold VOO in high regard. As noted in the Motley Fool article on Yahoo Finance:

“The bottom line? The Vanguard S&P 500 ETF is almost always a buy if you’re thinking in decades rather than days. Start now, add more later, and let compounding do its beautiful, boring work.”

The article emphasizes a key investing principle: “Time in the market beats timing the market.” This means that rather than trying to find the perfect moment to buy VOO, it’s better to invest consistently over time.

Is Now a Good Time to Buy VOO?

This is the million-dollar question that everyone wants answered. Based on the recent Yahoo Finance article:

“I can’t tell you whether the market will drop 20% next month or surge another 20% during the next year. Warren Buffett, with his decades of experience and billions in wealth, freely admits he can’t time the market either.”

The author suggests a balanced approach:

- Buy some VOO now (even if it’s not the perfect entry point)

- Keep some cash ready in case a market correction provides better buying opportunities

- Focus on decades, not days or months

As they colorfully put it: “Waiting for the ‘perfect’ entry point is like waiting for the perfect romantic partner while refusing to go on any dates.”

Smart Strategies When Investing in VOO

To maximize your success with VOO:

1. Dollar-Cost Averaging

Invest a fixed amount regularly (weekly, monthly, or quarterly) regardless of share price. This removes the pressure of timing the market and can reduce overall risk.

2. Hold for the Long Term

The longer your investment horizon, the more likely you are to experience positive returns. Historically, the S&P 500 has been positive in about 75% of individual years but over 95% of 10-year periods.

3. Reinvest Dividends

Allow your dividends to buy additional shares automatically. This harnesses the power of compounding.

4. Use Tax-Advantaged Accounts

When possible, hold VOO in 401(k)s, IRAs, or Roth accounts to minimize tax impact.

5. Maintain Proper Asset Allocation

VOO should typically be part of a broader portfolio that might include bonds, international stocks, and other asset classes based on your age and risk tolerance.

Final Thoughts: Is VOO Right for You?

VOO represents one of the simplest, most cost-effective ways to invest in the U.S. stock market. Its combination of broad diversification, ultra-low fees, and strong long-term performance makes it appropriate for most investors.

As the Yahoo Finance article concludes: “The Vanguard S&P 500 ETF is almost always a buy if you’re thinking in decades rather than days.”

For most investors, the question isn’t whether to own VOO, but rather what percentage of your portfolio it should represent. This depends on your:

- Age

- Risk tolerance

- Other investments

- Financial goals

- Time horizon

Remember that all investments carry risk, and VOO will decline during market downturns. However, for patient investors with long time horizons, these temporary declines have historically been followed by new highs.

My advice? Start with a position in VOO that lets you sleep at night, add to it regularly, and resist the urge to sell when markets get turbulent. Your future self will likely thank you.

Meet the S&P 500

The S&P 500 is an index of about 500 of the biggest stocks in America. Together, they make up about 80% of the value of the entire U.S. stock market. Thats why the S&P 500 is often used as a proxy for the total U.S. stock market.

Here are the indexs top 10 components, by weight, as of mid-September, which together make up about 38% of the ETFs value:

|

Stock |

Percent of ETF |

|---|---|

|

Nvidia |

7% |

|

Microsoft |

6.37% |

|

Apple |

5.98% |

|

Amazon |

4.16% |

|

Meta Platforms |

3.28% |

|

Broadcom |

2.76% |

|

Alphabet Class A |

2.63% |

|

Alphabet Class C |

2.46% |

|

Tesla |

2.31% |

|

Berkshire Hathaway Class B |

1.78% |

Note that the weightings are as they are because the S&P 500 index is market-cap weighted, meaning that bigger companies will move the needle more than smaller ones. Thus, while Nvidia and Dominos Pizza are both in the index, Nvidia, with its recent market value of $4.1 trillion, will wield much more influence on the index than Dominos, with its recent market value of about $15 billion. Dominos was recently ranked 427th in the S&P 500, with a weighting of 0.03%.

If you dont love this kind of weighting (which is fairly common in index funds), you might want to look at the Invesco S&P 500 Equal Weight ETF, which — as the name says — is equal weighted, meaning that it holds each of its 500 or so components in roughly equal proportion. The Invesco equal-weight ETFs top-10 holdings would, therefore, make up only about 2% of the overall ETF value.

Vanguard S&P 500 ETF

Its hard to beat a low-fee, broad-market index fund for long-term growth.

Is the Vanguard S&P 500 ETF (VOO +0.10%) a buy now? I think it is. Lets take a closer look at the S&P 500 index and the Vanguard exchange-traded fund (ETF) that tracks it.

Even Warren Buffett is a fan of the Vanguard S&P 500 ETF, writing in his 2013 letter to shareholders:

The Complete Guide to VOO (Vanguard S&P 500 Index ETF)

FAQ

Is VOO worth investing in?

It’s hard to go wrong with VOO in the long run — even investors who bought VOO at the worst possible time before the 2022 inflation crisis are up 42% today (50% with reinvested dividends).

What is the 10 year return on VOO?

| 1-yr | 10-yr | |

|---|---|---|

| VOO (Market price) | 21.48% | 290.54% |

| VOO (NAV) | 21.41% | 290.61% |

| Benchmark 2 Benchmark S&P 500 Index | 21.45% | 291.96% |

What is Vanguard’s best performing ETF?

The best-performing Vanguard ETF from the past year is Vanguard Information Technology ETF (VGT), which is up 34.78%, but the fund with the lowest expense ratio is Vanguard Emerging Markets Ex-China ETF (VEXC). Source: Finviz. Data current as of November 4, 2025.

Does Warren Buffett invest in VOO?

One piece of Buffett advice he has consistently echoed is that the average investor’s best route is to simply invest consistently in an S&P 500 exchange-traded fund (ETF). For a while, Berkshire held shares of the Vanguard S&P 500 ETF (NYSEMKT: VOO). Yet, in the fourth quarter of 2024, it sold all of its shares.