Who holds the most Bitcoin? The answer might surprise you. The ownership of Bitcoin is as diverse as it is significant. The largest holders of bitcoin include Satoshi Nakamoto, public companies like MicroStrategy and Tesla, institutional investment products such as BlackRock, individuals known as “Bitcoin whales,” and even some governments through legal seizures and strategic purchases like the United States and El Salvador. These diverse holders collectively influence the Bitcoin market and its dynamics.

Satoshi Nakamoto is the anonymous creator of Bitcoin, but he doesn’t own the Bitcoin project. Nobody owns the Bitcoin project.

Bitcoin is software run by a decentralized network, which means no single party is in control of the set of rules in the software. These rules must be agreed upon by the network participants in order for them to transact. So if no one owns the Bitcoin protocol, who are the biggest holders of the bitcoin (BTC)? We answer this question in the video below or continue reading the rest of the article.

Are you curious about who’s hoarding the most Bitcoin in their digital wallets? The landscape of Bitcoin ownership has dramatically shifted over the years, with institutions now dominating what was once a playground for tech-savvy individuals Let’s dive into the world of Bitcoin whales and discover who really controls the largest portions of this $100+ billion market.

The Mystery Man Still Reigns Supreme: Satoshi Nakamoto

At the top of our list sits the most enigmatic figure in crypto history – Satoshi Nakamoto, Bitcoin’s anonymous creator Despite disappearing from the internet around 2011, Satoshi is believed to hold approximately 11 million bitcoins (worth over $117 billion as of October 2025).

These coins are spread across multiple addresses, with the first 50 BTC ever mined sitting in what’s called the Genesis address. Interestingly, this address occasionally receives small donations from Bitcoin enthusiasts paying homage to the creator – it’s gained an extra 54 BTC since Nakamoto’s disappearance.

What’s fascinating is that these coins have never moved. Not a single satoshi. This has led to countless theories:

- Satoshi lost the private keys

- They died without passing on access

- They’re exercising incredible restraint to avoid destabilizing the market

- It’s all part of a long-term plan we don’t yet understand

Major Institutional Holders in 2025

The crypto landscape has changed dramatically. Individual investors have been overtaken by major institutions, especially after January 2024’s watershed moment when spot Bitcoin ETFs were approved by the SEC.

1. BlackRock iShares Bitcoin Trust (IBIT)

BlackRock, the world’s largest asset manager, has accumulated a staggering 805,534 BTC as of October 2025 through its iShares Bitcoin Trust (IBIT). After receiving SEC approval in January 2024, BlackRock’s Bitcoin ETF quickly became one of the dominant forces in Bitcoin ownership.

2. Binance

The world’s largest cryptocurrency exchange by trading volume holds approximately 612,450 BTC (as of October 2025). According to their Proof-of-Reserves page, Binance maintains a bitcoin-to-client deposit ratio of 103.5%, meaning they actually hold more bitcoin than their clients have deposited. This policy helps ensure customer assets remain safe and available for withdrawal.

3. Strategy (Formerly MicroStrategy)

Led by Bitcoin evangelist Michael Saylor, Strategy has been on an aggressive Bitcoin acquisition spree. As of October 2025, the business intelligence firm holds around 640,250 bitcoins.

Saylor is perhaps the most vocal corporate advocate for Bitcoin, frequently promoting it through media appearances, Twitter posts, and conference speeches. The company has even taken on debt specifically to purchase more Bitcoin – a high-risk strategy that has so far paid off handsomely.

4. Grayscale Bitcoin Trust ETF (GBTC)

One of the original institutional Bitcoin investment vehicles, Grayscale’s Bitcoin Trust ETF holds approximately 172,108 BTC as of late October 2025. Interestingly, this represents a significant decline from its previous holdings, as many investors moved their funds to competing ETFs after the January 2024 SEC approvals.

Grayscale is owned by Digital Currency Group, a venture capital powerhouse that has investments across the crypto ecosystem, including stakes in exchanges like Blockchain and Kraken, and development companies like Polygon, Ripple, and Lightning Labs.

Government Bitcoin Holdings

While not technically “investors,” governments have accumulated significant Bitcoin holdings, primarily through seizures of illegal activities:

The United States Government

Uncle Sam is sitting on a substantial crypto fortune – approximately 326,588 bitcoins valued at around $35 billion as of October 2025. Most of these coins came from high-profile seizures like the Silk Road marketplace shutdown and various ransomware payment recoveries.

The government has occasionally auctioned off portions of these holdings, though many remain in custody as cases work through the legal system.

Wealthy Individual Investors

While their exact holdings are harder to verify than public companies and funds, several high-profile individuals are known to have substantial Bitcoin investments:

The Winklevoss Twins

Tyler and Cameron Winklevoss, famous for their dispute with Facebook’s Mark Zuckerberg, were early Bitcoin adopters. They reportedly purchased around 1% of all Bitcoin in circulation in 2013 (roughly 100,000 BTC at that time) when prices were under $10. While their current holdings aren’t publicly disclosed, they’ve likely retained a significant portion through their Gemini exchange and personal wallets.

Tim Draper

Venture capitalist Tim Draper purchased nearly 30,000 bitcoins at a U.S. Marshals Service auction in 2014. At today’s prices, that investment would be worth billions if he’s held onto most of it.

Michael Saylor (Personally)

Beyond his company’s holdings, Michael Saylor has personal Bitcoin investments, though the exact amount isn’t publicly disclosed.

How Bitcoin Ownership Has Evolved

The Bitcoin ownership landscape has undergone several distinct phases:

2009-2013: The Early Adopters

In Bitcoin’s infancy, ownership was concentrated among a small group of cypherpunks, computer scientists, and cryptography enthusiasts. Mining was accessible with basic computer hardware, allowing individuals to accumulate thousands of coins with minimal investment.

2014-2020: Early Institutional Interest

As Bitcoin gained mainstream attention, we saw the first wave of institutional adoption. Companies like MicroStrategy (now Strategy) began adding Bitcoin to their balance sheets, and investment vehicles like Grayscale’s Bitcoin Trust emerged to provide exposure to traditional investors.

2021-Present: ETF Revolution and Institutional Dominance

The approval of spot Bitcoin ETFs in January 2024 marked a turning point. Large financial institutions now control significant portions of the Bitcoin supply, with BlackRock quickly becoming one of the largest holders.

The Impact of Concentrated Ownership

The concentration of Bitcoin in fewer hands raises some important questions:

1. Volatility Concerns

When large amounts of Bitcoin are controlled by a handful of entities, their trading decisions can significantly impact market prices. If Satoshi were to suddenly sell their holdings, or if a major institution decided to liquidate, it could trigger a substantial market correction.

2. Decentralization Questions

Bitcoin was created with the ethos of decentralization – distributing financial power away from central authorities. The increasing concentration of ownership in institutional hands seems to run counter to this founding principle.

3. Market Maturation

On the positive side, institutional involvement has brought increased liquidity, reduced volatility compared to earlier eras, and more sophisticated market infrastructure. These developments may ultimately strengthen Bitcoin’s position as a legitimate asset class.

How to Join the Bitcoin Ownership Club

While you might not reach Satoshi or BlackRock levels, there are several ways to own Bitcoin:

Direct Ownership

- Cryptocurrency exchanges like Coinbase, Binance, and Kraken

- Bitcoin ATMs (though these often charge high fees)

- Peer-to-peer marketplaces

Indirect Ownership

- Bitcoin ETFs like BlackRock’s IBIT or Grayscale’s GBTC

- Companies with Bitcoin exposure (like Strategy)

- Cryptocurrency-focused mutual funds and index products

Things to Consider Before Investing

- Volatility: Bitcoin prices can fluctuate dramatically in short periods

- Security: Self-custody requires careful management of private keys

- Regulatory uncertainty: Government policies toward crypto continue to evolve

- Investment horizon: Bitcoin has historically rewarded long-term investors despite short-term volatility

The Future of Bitcoin Ownership

Where is Bitcoin ownership heading in the coming years? Several trends seem likely:

-

Continued institutional adoption: More corporations will likely add Bitcoin to their balance sheets as inflation hedges and portfolio diversifiers

-

Retail accessibility improvements: User-friendly custody solutions will make it easier for average people to securely hold their own Bitcoin

-

Inheritance planning emergence: As early adopters age, specialized services for crypto estate planning will become more common

-

Geographical diversification: While North American and European entities currently dominate institutional holdings, we’ll likely see increased ownership from Asian, African, and Latin American institutions

The days when individuals dominated Bitcoin ownership are largely behind us. Today’s Bitcoin landscape is increasingly dominated by major financial institutions, public companies, and large exchanges. Satoshi Nakamoto remains the single largest individual holder, though the mystery creator’s coins remain untouched after all these years.

As Bitcoin continues its journey from fringe technology to mainstream asset class, the concentration of ownership will remain a key factor in its development. Whether this institutional dominance strengthens or weakens Bitcoin’s long-term position is still being determined, but one thing’s certain – the game of “who owns the most Bitcoin” has become a high-stakes contest among some of the world’s most powerful financial players.

What do you think about this concentration of Bitcoin wealth? Is it a positive development for the ecosystem or a concerning trend? I’d love to hear your thoughts in the comments below!

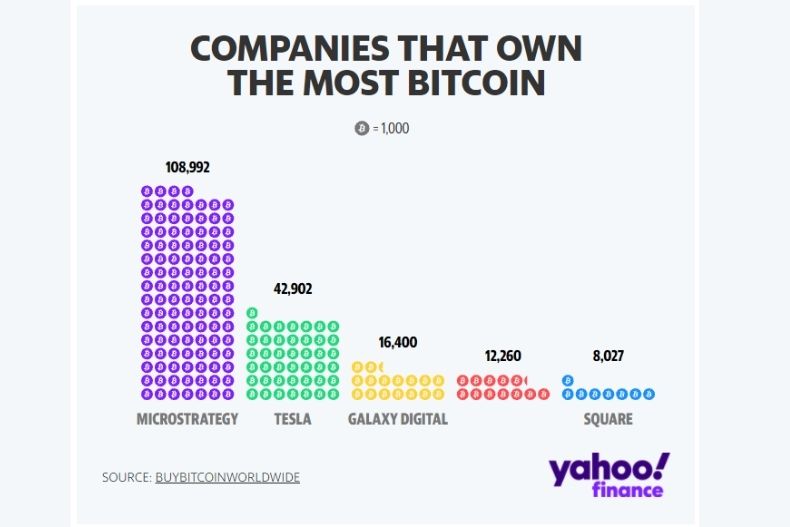

Public Companies Holding the Most Bitcoin

Collectively, public companies own more than 1 million BTC, equal to 5% of the total supply. We have covered this in depth in our report on Business Bitcoin adoption.

MicroStrategy was already covered above, holding 640,240 bitcoin.

Marathon Digital Holdings, the Bitcoin Mining mega-company, owns 53,250 BTC.

Two other bitcoin treasury companies, Twenty One Capital and Metaplanet, own 43,514 and 30,823, respectively.

How Much Bitcoin Does MicroStrategy Own?

MicroStrategy has acquired 640,250 BTC, which represents roughly 3% of the total supply.

MicroStrategy under the leadership of Michael Saylor has employed a unique strategy in which they raise debt capital and use it to purchase bitcoin. The theory behind this strategy is that the company can repay the fiat debt by selling less bitcoin in the future. Other firms, known as Bitcoin Treasury Companies, are beginning to mimic this strategy.

Tyler and Cameron Winklevoss

Following their 2008 settlement with Mark Zuckerberg for $65 million worth of Facebook shares and cash, the pair started an angel investment company. A few years later they would announce they had bought approximately $11 million worth of bitcoin at an average cost basis of $10 per coin. Itâs estimated that the Winklevoss twins own ~70,000 BTC.

Tim Draper

The VC titan has been interested in Bitcoin for a while; so much so that he made one initial purchase of 40,000 BTC at the Mt Gox exchange.

Unfortunately, all 40,000 coins were lost in the hack and subsequent bankruptcy. However, in 2014, Mr. Draper purchased 29,656 BTC for $18.7 million at a cost basis of approximately $632 per coin.

Michael Saylor

The founder and chairman of MicroStrategy revealed in an October 2020 tweet that he personally held 17,732 BTC. It is reasonable to assume that he has since acquired moreâbeing such a public Bitcoin Bullâbut this is the only mention of his personal stash.

Over time, Bitcoin ownership has been grouped into different levels based on how much Bitcoin is held at a particular address. These levels, or “strata,” categorize addresses by the total amount of Bitcoin they contain.

The amount of bitcoin that each stratum of addresses owns in relation to the entire bitcoin supply fluctuates over time.

Today, four bitcoin addresses contain 100,000 to 1,000,000 BTC for a total of 639,536 BTC. The next 82 largest owners, who range from 10,000 – 100,000 BTC, own a total of 2,161,039 BTC.

These wealthiest addresses account for about 14% of the total supply. Bitcoin addresses with 10,000 or more bitcoin are sometimes referred to as whales.

At least 12% of the supply is held by exchanges on behalf of clients.

Biggest Bitcoin Holders 2024

FAQ

Who is the largest owner of Bitcoin?

- Satoshi Nakamoto: 1.1 million BTC.

- Tim Draper: 29,656 BTC.

- Michael Saylor: 17,732 BTC.

- Strategy: 638,460 BTC.

- The United States: 198,021 BTC.

- Ukraine: 46,351 BTC.

- El Salvador: 6,320 BTC.

What if you invested $1000 in Bitcoin 10 years ago?

10 years ago: If you invested $1,000 in Bitcoin in 2015, your investment would be worth $496,927. 15 years ago: If you invested $1,000 in Bitcoin in 2010, your investment would be worth about $1.62 billion.

How many bitcoins does Elon Musk own?

This is in line with his May 2020 tweet in which he said he “only own[ed] 0.25 Bitcoins” (Musk, 2020)—which, of course, no longer had to be valid at the time of the talk.

Who is the top 1 of Bitcoin holders?

- Satoshi Nakamoto (~1.1 million BTC)

- The Winklevoss twins (70,000 BTC)

- Tim Draper (29,500 BTC)

- Michael Saylor (17,732 BTC)

- Dive into blockchain explorers.

- Keenly follow publicly known wallets.

- Use wallet tracking sites and alert tools.

- They can rock the market.