Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Are you diving into the fast-paced world of day trading? While the thrill of quick profits might be your focus there’s something equally important you need to understand – the taxes you’ll pay on those day trading gains.

I’ve helped many new traders navigate this confusing territory, and let me tell ya, the tax implications of day trading can significantly impact your bottom line if you’re not careful.

In this comprehensive guide, I’ll break down exactly what taxes you’ll pay as a day trader, how they’re calculated, and some legitimate strategies to potentially reduce your tax burden.

The Basic Tax Framework for Day Traders

First things first – day trading profits are taxable, and they’re generally taxed as short-term capital gains Here’s what that means for you

Short-Term vs. Long-Term Capital Gains

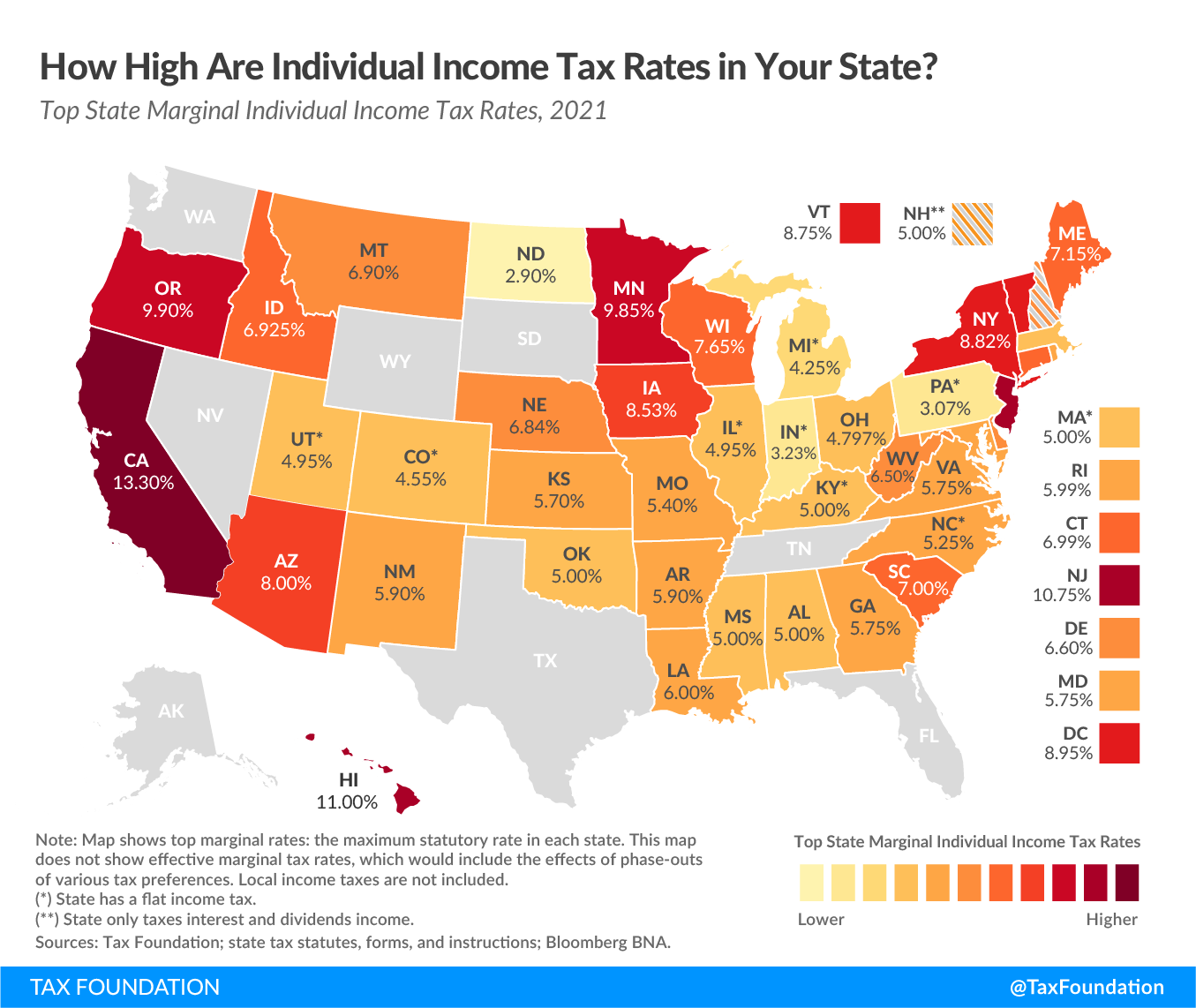

When you buy and sell investments within the same day (or hold them for less than a year), any profits are considered short-term capital gains. These gains are taxed at your ordinary income tax rate, which can range from 10% to 37% depending on your total income.

This is a crucial distinction because long-term investments (held for more than a year) qualify for preferential tax rates of 0%, 15%, or 20% depending on your income bracket. Unfortunately, the nature of day trading means you’ll rarely, if ever, qualify for these lower rates.

Your Day Trading Tax Rate

Here’s a quick breakdown of what you might pay on your day trading profits:

| Income Tax Bracket | Short-Term Capital Gains Rate |

|---|---|

| 10% | 10% |

| 12% | 12% |

| 22% | 22% |

| 24% | 24% |

| 32% | 32% |

| 35% | 35% |

| 37% | 37% |

As you can see, your day trading profits could be taxed as high as 37% if you’re in the highest income bracket. This is why tax planning is super important for day traders!

Are You a “Trader” or an “Investor”? The IRS Distinction Matters

The IRS makes an important distinction between “traders” and “investors,” and this classification can have significant tax implications:

Investor Status (Most Common)

Most people who buy and sell stocks, even somewhat actively, are classified as “investors” by the IRS. As an investor:

- You can deduct only up to $3,000 in capital losses against your ordinary income per year

- Investment expenses fall under “miscellaneous itemized deductions” which are only deductible if they exceed 2% of your adjusted gross income

- You’re subject to the “wash-sale rule” (more on this later)

Trader Status (Hard to Qualify For)

If you qualify as a “trader” in the eyes of the IRS, you get some valuable tax breaks:

- You can write off all your trading-related expenses as business expenses

- With a Section 475 “mark to market” election, you can use all your losses to reduce taxable income

- You can avoid the wash-sale rule with the proper election

How to Qualify as a Trader for Tax Purposes

Qualifying as a trader isn’t easy. The IRS doesn’t have a specific bright-line test, but based on tax court cases, here are some guidelines that might help you qualify:

- Trading Volume: Are you making at least 4 trades per day, 4 days per week?

- Holding Period: Is your average holding period less than 31 days?

- Time Commitment: Are you spending about 4 hours per day working as a trader (including research)?

- Business Setup: Are you treating day trading as a business with the necessary equipment, software, and research tools?

Even some large hedge funds don’t qualify as traders, so don’t assume you’ll automatically get this status just because you trade frequently.

The Real Costs That Affect Your Day Trading Tax Bill

Beyond the basic tax rates, several other factors can affect your day trading tax situation:

1. Trading Platform Fees and Costs

While many brokerages now offer commission-free trades, there are often other fees involved:

- Regulatory fees

- Data and research subscription costs

- Platform fees for advanced trading tools

- Interest on margin accounts

All these costs add up and can significantly reduce your profits. The good news is that if you qualify as a trader for tax purposes, these expenses are fully deductible as business expenses.

2. The Wash-Sale Rule Challenge

This rule is a huge headache for day traders. The wash-sale rule prohibits you from claiming a loss on a stock if you bought a “substantially identical” stock either 30 days before or 30 days after the loss sale.

For day traders who frequently trade the same stocks, this rule can prevent you from deducting losses. The only way around this is to qualify as a trader and make the Section 475 “mark to market” election with the IRS.

Important Tax Breaks for Day Traders

If you do qualify as a trader, here are the three most valuable tax breaks available to you:

1. Trading Expense Write-offs

As a trader, you can deduct all your trading-related expenses as business expenses, including:

- Home office expenses

- Computer equipment and software

- Internet and phone bills

- Educational materials

- Subscriptions to financial publications

2. Loss Deductions

With a Section 475 “mark to market” election, you can use all your losses to offset your income – not just the $3,000 maximum that applies to investors.

3. Wash-Sale Rule Exemption

As mentioned earlier, qualifying traders who make the Section 475 election don’t have to worry about the wash-sale rule, which is a significant advantage for those who frequently trade the same securities.

Tax Planning Strategies for Day Traders

Even if you don’t qualify as a trader, there are still strategies you can use to manage your tax situation:

Consider Tax-Advantaged Accounts

One of the best ways to minimize the tax impact of your trading is to use tax-advantaged accounts when possible:

- IRAs and 401(k)s: Trading within these retirement accounts lets you defer taxes until withdrawal (or avoid them entirely with Roth accounts)

- Health Savings Accounts (HSAs): These triple-tax-advantaged accounts can also be used for certain investments

Tax-Loss Harvesting

This strategy involves selling investments at a loss to offset capital gains. Just remember:

- You can use capital losses to offset capital gains without limit

- You can use up to $3,000 of excess capital losses to offset ordinary income

- Any remaining losses can be carried forward to future tax years

Keep Detailed Records

Maintain thorough records of all your trades, including:

- Date and time of each trade

- Purchase and sale prices

- Fees and commissions paid

- Research and analysis that led to the trade

Good recordkeeping will help you accurately report your taxes and provide documentation in case of an audit.

How Day Trading Impacts Your Taxes in Practice

Let’s look at a practical example:

Example Scenario:

Mike made $50,000 from his regular job and $15,000 from day trading in 2024. He’s single and takes the standard deduction.

Tax Calculation:

- Regular income: $50,000

- Day trading profits: $15,000

- Total income: $65,000

- Standard deduction: $14,600 (2025 estimated)

- Taxable income: $50,400

Mike’s day trading profits push him into a higher tax bracket for part of his income, resulting in a higher overall tax bill than if he had just earned his regular salary.

Common Day Trading Tax Mistakes to Avoid

Many new day traders make these costly mistakes:

- Not setting aside money for taxes: Unlike a job with tax withholding, you’ll need to save for taxes yourself or make quarterly estimated tax payments

- Ignoring the wash-sale rule: This can invalidate your loss deductions if you’re not careful

- Missing the Section 475 election deadline: This must be made by the tax filing deadline (usually April 15) of the previous year

- Failing to keep adequate records: Poor record-keeping can lead to missed deductions and problems during an audit

The Long-Term Investment Alternative

It’s worth noting that many financial experts suggest long-term investing over day trading, particularly from a tax perspective:

- Long-term investors qualify for lower capital gains tax rates (0%, 15%, or 20%)

- There’s less stress about timing the market perfectly

- Trading costs and tax complications are reduced significantly

- Historically, diversified long-term portfolios have performed well for most investors

Final Thoughts: Balancing Trading and Tax Planning

The reality is that day trading comes with significant tax implications that can eat into your profits. While the potential for quick gains might be appealing, make sure you understand the tax consequences before diving in.

I always recommend consulting with a tax professional who specializes in investment taxation if you’re serious about day trading. The rules are complex, and the strategies for optimizing your tax situation require expertise.

Remember, it’s not just about how much you make – it’s about how much you keep after taxes!

FAQs About Day Trading Taxes

Q: Do I need to pay taxes on day trading if I lost money overall?

A: If you had a net loss for the year, you can deduct up to $3,000 against your ordinary income. Any excess losses can be carried forward to future years.

Q: How do I report my day trading income on my tax return?

A: Day trading gains and losses are typically reported on Schedule D of your tax return, along with Form 8949 for the details of each transaction.

Q: Should I make quarterly estimated tax payments on my day trading profits?

A: Yes, if you expect to owe more than $1,000 in taxes from your trading activities, you should make quarterly estimated tax payments to avoid penalties.

Q: Can I deduct my home internet bill if I use it for day trading?

A: If you qualify as a trader, you can deduct the portion used for trading. If you’re classified as an investor, these expenses are subject to the 2% AGI limitation for miscellaneous itemized deductions.

Q: What happens if I day trade in my IRA?

A: While you can day trade in an IRA, excessive trading might be flagged by your broker or the IRS. Also, losses in an IRA cannot be deducted against other income.

Day trading can be exciting, but understanding the tax implications is crucial for your long-term financial success. By planning ahead and implementing smart tax strategies, you can potentially keep more of your trading profits and avoid unwelcome surprises when tax season rolls around.

Are you a day trader for tax purposes?

- Are you making at least four trades per day, four days per week?

- Is your average holding period must be less than 31 days?

- Do you spend about four hours per day working as a trader, including research and administration?

- Are you treating day trading as a business, with the necessary equipment, software and research tools?

Short-term capital gains tax rates

- Trading expense write-offs. Expenses related to trading are deductible as business expenses. This is potentially a much more valuable set of deductions than what ordinary investors can claim. For example, you can claim a home office for your business. Investors can deduct only investment expenses that exceed 2% of their adjusted gross income (investment expenses fall under “miscellaneous itemized deductions”) IRS. Publication 529 (12/2020), Miscellaneous Deductions. Accessed Feb 19, 2025. View all sources .

- Deductions from losses. As a trader, each year you can use all of your losses to reduce your taxable income, assuming you made a Section 475 “mark to market” election with the IRS. You must make this election by the filing deadline for your previous year’s return U.S. Internal Revenue Service. Topic No. 429, Traders in Securities (Information for Form 1040 or 1040-SR Filers). Accessed Feb 19, 2025. View all sources . Investors can reduce their taxable income by a maximum of $3,000 worth of capital losses per year.

- Wash-sale rule exemption. The wash-sale rule is a tough one for ordinary investors, who are prohibited from claiming a loss on a stock if they bought a “substantially identical” stock either 30 days before or 30 days after the loss sale. But active traders dont have to worry about that rule, as long as they made the Section 475 election.