If you’re looking to invest $500,000 and double it within three years to make $1 million, one asset class you should consider is real estate. Continue reading to learn the strategy from an expert investor.

Given how volatile the stock market has been lately, and how anemic bond yields have been, many investors are looking for alternate asset classes in which to invest their money. If you’re looking to invest $500,000 and double it within three years to make $1 million, one asset class you should consider is real estate.

Side Note: Although we wrote this article specifically for investors with $500k, the strategies outlined here can really apply to any amount of money. Whether you have $100k, 200k or 250k, this article will show you how to double your money within three years.

Ever stare at your $500,000 savings and wonder how to make it work harder for you? I’ve been there. The stock market’s been like a rollercoaster lately, and bonds are paying pennies. It’s enough to make anyone feel stuck.

But what if I told you there’s a strategy that could double your money in just 2-3 years? And no, this isn’t some get-rich-quick scheme or crypto gamble. I’m talking about something solid, tangible, and historically reliable: real estate investing.

In this article I’ll break down exactly how to invest $500K to make $1 million using proven real estate strategies. Whether you’ve got inheritance money, retirement savings or you’ve been squirreling away cash for years, this approach could be your path to seven figures.

Why Real Estate Beats Stocks for Doubling Your Money

Let me start with a simple truth when it comes to doubling $500K quickly (within 2-3 years) real estate offers advantages that stocks simply can’t match.

Here’s why

The Power of Leverage

The secret weapon in real estate investing is leverage. With stocks, your $500K buys you exactly $500K worth of assets. But with real estate, that same $500K can control $2.5 million worth of property.

Think about it: if you use your $500K as 20% down payments across multiple properties, you’re controlling 5 times more assets than you could with stocks. This multiplies your growth potential dramatically.

Consider these numbers:

- To double $500K in stocks within 3 years, you’d need 26% annual returns

- To double $500K in leveraged real estate, you only need 7% annual appreciation

Which seems more realistic to you? Finding stocks that consistently return 26% year after year, or finding properties that appreciate at 7% annually? For most investors, the real estate path is not only more achievable but also more predictable.

The Building Block: One House at a Time

Let’s start small to understand the concept. Instead of jumping straight to $500K, imagine you have $50K to invest.

With that $50K as a 20% down payment, you could purchase a $250K property (like a nice single-family home in central Florida). Your tenant’s rent covers your mortgage, taxes, insurance, and property management. You might not see much cash flow initially, but that’s not the primary goal.

The magic happens with appreciation. In markets like central Florida, where appreciation has been hitting double digits, your property value could grow 10% per year. After just two years of 10% growth (which compounds), your property would appreciate by 21%.

That 21% appreciation on a $250K property equals $52,500—slightly more than your initial $50K investment. You’ve essentially doubled your money in two years!

Even if appreciation slowed to 7% annually, you’d still double your investment in three years.

Scaling Up: How to Turn $500K into $1 Million

Now let’s apply this model to your full $500K investment. Here’s the strategy:

- Use your $500K as 20% down payments on multiple properties

- With $500K, you can control approximately $2.5 million worth of real estate

- This would be roughly 10 properties valued at $250K each

- Leverage Fannie Mae/Freddie Mac loans (you can have up to 10 investment property loans)

If these properties appreciate at 10% annually, your $500K investment would grow to $1 million in just two years. Even at a more conservative 7% appreciation rate, you’d reach $1 million in three years.

This isn’t theoretical—many investors are using this exact approach right now.

Why Florida? The Perfect Market for This Strategy

If you’re wondering where to invest your $500K to see this kind of growth, Florida stands out for several compelling reasons:

Booming Job Growth

Florida is extremely business-friendly, attracting companies from higher-tax states. The Florida Chamber of Commerce projects the state will grow by 4 million people by 2030 and create 2 million new jobs. More jobs mean more housing demand.

Massive Population Growth

Florida is experiencing population growth from two powerful sources:

- Workers: Following job opportunities

- Retirees: Florida is the #1 retirement destination in the U.S.

With 10,000 baby boomers retiring daily, many head to Florida for its:

- Homestead exemption (protecting primary residences from creditors)

- No state income tax

- Pleasant year-round climate

Central Florida’s The Villages—the largest retirement community in America with 138,000 affluent retirees—has permits to build another 60,000 homes over the next 20 years.

What’s great about retirees as a demographic driver? They’re recession-proof! Retirees don’t need jobs; instead, they create jobs (healthcare workers, service industry, etc.), making for stable economic growth.

Housing Supply Shortage

Florida homebuilders simply can’t keep up with demand. This supply-demand imbalance creates upward pressure on home prices, fueling appreciation.

The Step-by-Step Plan to Turn $500K into $1 Million

Ready to implement this strategy? Here’s your roadmap:

1. Start With One Property

Even if you have the full $500K, consider starting with just one property to test the waters. This allows you to:

- Learn the ropes of being a landlord

- Build a relationship with a property manager

- Understand the market dynamics before scaling up

2. Choose the Right Markets

Besides Florida, consider these markets with similar supply-demand characteristics:

- Dallas

- Austin

- Atlanta

- Charlotte

- Huntsville

Diversification is key—spread your investments across at least 2 different markets.

3. Build Your Team

To execute this strategy successfully, you’ll need:

- A reliable property manager

- A trustworthy real estate agent who understands investment properties

- A mortgage broker experienced with investment loans

- An accountant familiar with real estate tax strategies

4. Scale Strategically

Once you’ve successfully managed one property for 6-12 months:

- Acquire additional properties using the same principles

- Aim to purchase 1-2 properties per quarter

- Focus on newer construction to minimize maintenance costs

5. Monitor and Adjust

Track the performance of each property and be prepared to:

- Sell underperforming assets

- Refinance to access equity for additional purchases

- Adjust your strategy based on market conditions

Pros and Cons of This Strategy

As with any investment approach, there are advantages and drawbacks to consider:

Advantages

- Not correlated to stock market: Provides true diversification

- Inflation hedge: Real estate typically performs well during inflationary periods

- Leverage magnifier: Multiplies your returns compared to other investments

- Passive income potential: As properties appreciate and mortgages pay down, cash flow improves

Drawbacks

- Illiquid investment: Can’t quickly convert to cash without significant transaction costs

- Time commitment: Even with property managers, you’ll need to devote some attention

- Geographic concentration risk: Mitigate by investing in multiple markets

- Financing challenges: Loan terms may become less favorable after you reach 4-6 properties

Is This Real Estate Strategy Right for You?

This approach isn’t for everyone. You should consider this strategy if:

- You have $500K (or a significant portion of it) available to invest

- You’re comfortable with a medium-term (2-3 year) investment horizon

- You don’t need immediate access to the funds

- You’re willing to learn about real estate investing

- You can handle some degree of active management

You might want to look elsewhere if:

- You need immediate liquidity

- You prefer completely passive investments

- You’re extremely risk-averse

- You don’t have the time or interest to oversee property managers

My Personal Experience

I’ve personally used a similar strategy to grow my wealth. When I started, I was nervous about putting all that money into real estate. What if the tenants destroyed the property? What if the market crashed?

But after buying my first property and seeing how a good property manager handled the day-to-day headaches, I gained confidence. Within three years, I had acquired 6 properties, and the appreciation was even better than I’d projected.

The best part? I was only spending about 1-2 hours per month on my entire portfolio. The key was finding the right markets and building a reliable team.

Frequently Asked Questions

Q: Can I really double my money in just 2-3 years?

A: While there are no guarantees in investing, this strategy has worked for many investors during periods of strong real estate appreciation. The key is market selection and proper execution.

Q: What if property values don’t appreciate as expected?

A: Real estate investing has multiple profit centers. Even with lower appreciation, you benefit from mortgage paydown, potential tax benefits, and eventual cash flow as rents increase over time.

Q: How much time will I need to dedicate to managing these properties?

A: With good property managers, expect to spend about 1 hour per month per property on average, with more time required during tenant turnovers.

Q: Can I do this with less than $500K?

A: Absolutely! The same principles apply whether you’re starting with $50K, $100K, or $250K. You’ll just control fewer properties initially.

Q: What about cash flow? Won’t I be losing money monthly?

A: In high-appreciation markets, properties often start at break-even or slightly negative cash flow. However, as rents increase and you pay down the mortgage, cash flow improves over time. The main profit comes from appreciation in this strategy.

Conclusion: Your Path to $1 Million

Turning $500K into $1 million is an achievable goal with the right real estate strategy. By leveraging your investment across multiple properties in growth markets like Florida, you can potentially double your money in just 2-3 years.

The magic lies in the power of leverage, careful market selection, and proper execution. While no investment is without risk, real estate has historically provided more predictable returns than stocks, especially when you’re aiming for significant growth in a relatively short timeframe.

Remember to start small, learn as you go, diversify across markets, and build a reliable team. With patience and discipline, your $500K could be working much harder for you than it is sitting in a bank account or volatile stock portfolio.

Ready to take the next step? Begin by researching high-growth markets, connecting with experienced real estate investors, and consulting with a financial advisor about how this strategy fits into your overall wealth-building plan. Your journey to $1 million starts today!

The Building Block: One House

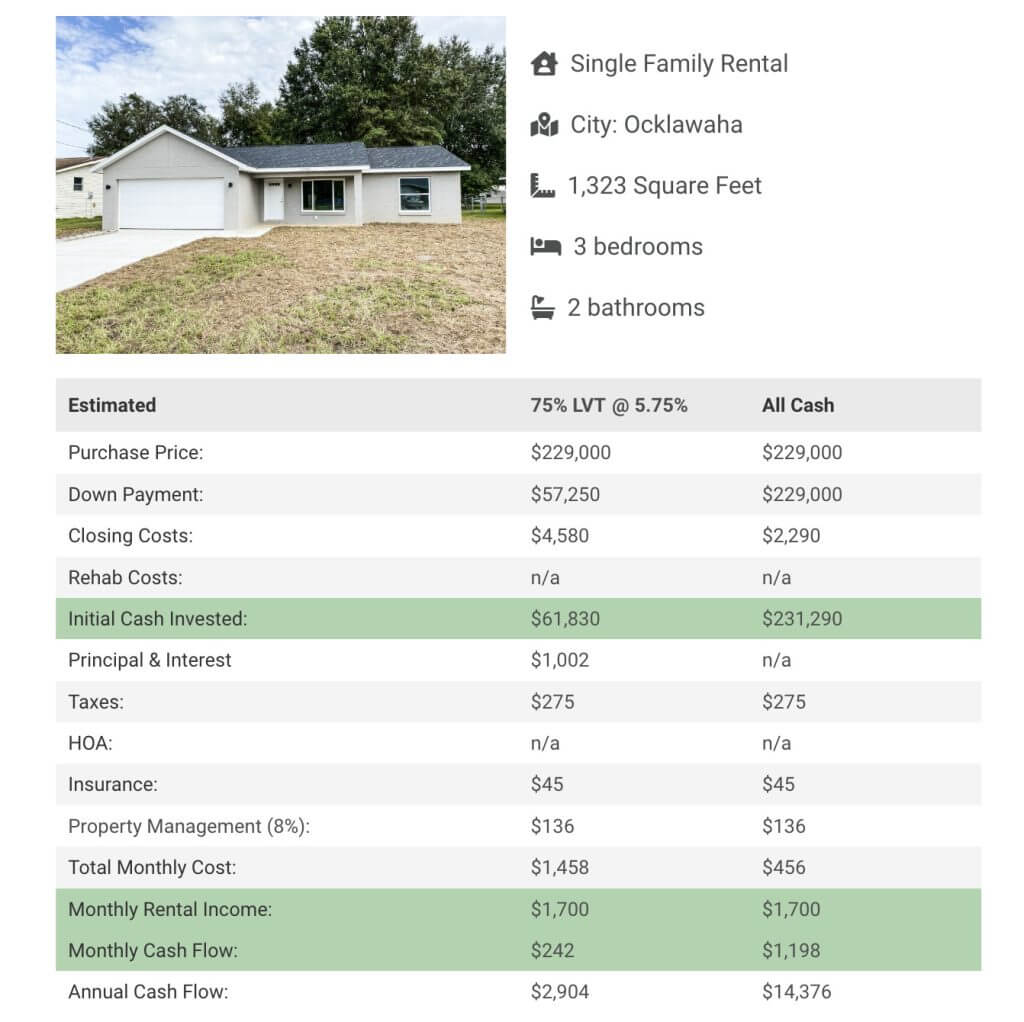

If you’re reading this article, you likely want to know how to invest $500,000. I’ll answer this question in detail later in this article. But to keep it simple for now, let’s assume you have $50,000 to invest instead of $500,000. With 20% down, that $50,000 will buy you a brand-new construction $250,000 investment property in central Florida, like this one:

The rent your tenant pays will cover the principal, interest, taxes, insurance, and property management, but there won’t be much cash flow left over- it will essentially breakeven. The primary goal though, is capital appreciation. Central Florida real estate, for example, has been appreciating well into the double-digits each year and that’s expected to continue even as interest rates are rising. (To understand why, see the section about Florida below.)

If the property appreciates 10% per year, then after the second year it’s appreciated 21% (compounded) which means you’ve doubled your original investment of 20% down. Even if appreciation were to slow to 7% per year, you would still double your original 20% down payment in three years. (This means if you were to invest $500k instead of $50k you could double it in just three years. More on that below.)

Where To Invest $500k Today To Double Your Investment

If you’re looking to invest $500k to make $1 million within two or three years, one of the best real estate markets today is Florida. Economics 101 taught us that prices are set by supply and demand, and the supply/demand dynamics in Florida are bullish for continued home price appreciation for the foreseeable future.

Florida is very pro-business and companies are moving and expanding there. According to the Florida Chamber of Commerce, Florida’s population will grow by 4 million by 2030 and will create 2 million more jobs. (1)

Increasing population means increased demand for housing, so rents go up and property values go up.

Aside from the influx of workers from all the new jobs being created, Florida also gets lots of retirees.

10,000 baby boomers retire every day and Florida is the #1 retirement destination. The state’s homestead exemption (your primary residence is exempt from liens from creditors) (2), lack of state income tax and pleasant climate make it a desirable place for retirees.

Central Florida in particular is home to The Villages, the largest retirement community in the US, with over 138,000 largely affluent retirees. (3) The Villages has received permits to build another 60,000 houses over the next 20 years, ensuring future growth. (4)

Retirees are also recession-proof: They don’t need or want jobs. In fact, retirees bring jobs. For every thousand retirees, the area will need more health care workers, more restaurant workers, more groundskeepers for the golf courses, etc. This makes for a growing and stable place to invest in real estate.

Homebuilders in Florida are unable to keep up with the demand. (4)

Other markets with similar supply/demand characteristics include Dallas, Austin, Atlanta, Charlotte and Huntsville.