The Dividend History page provides a single page to review all of the aggregated Dividend payment information. Historical information is not adjusted for stock splits. Visit our Dividend Calendar: Please note that the dividend history for Nasdaq stocks may also be combined the regular with the special dividend. Our partner, Quotemedia, provides the upcoming ex-dividend dates for the next month (Other OTC & OTCBB stocks are not included in coverage for Dividend History). Please note that the dividend history might include the company’s preferred securities as well. Price/Earnings Ratio is a widely used stock evaluation measure. For a security, the Price/Earnings Ratio is given by dividing the Last Sale Price by the Actual EPS (Earnings Per Share).

Data provided by Nasdaq Data Link, a premier source for financial, economic and alternative datasets. Data Links cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs. Register for your free account today at data.nasdaq.com.

Nasdaq Dividend History provides straightforward stock’s historical dividends data. Dividend payout record can be used to gauge the companys long-term performance when analyzing individual stocks.

These symbols will be available throughout the site during your session. Data is currently not available

These instruments will be available throughout the site during your session. Data is currently not available

The Current State of Disney Dividends in 2025

Yes! Disney does pay dividends to its shareholders. If you’re wondering whether to invest in Disney for dividend income, you’ll be happy to know that after a period of suspension, Disney has resumed its dividend payments and even increased them over time.

On December 4 2024 The Walt Disney Company’s Board of Directors declared a cash dividend of $1.00 per share. This represents a significant 33% increase over the $0.75 per share paid to shareholders during fiscal year 2024. The dividend will be paid in two installments of $0.50 per share.

As a Disney investor myself, I find their current dividend strategy to be well-balanced between rewarding shareholders and funding future growth. Let’s dive deeper into everything you need to know about Disney’s dividend payments.

Disney’s Dividend Payment Schedule

Unlike many companies that pay quarterly dividends, Disney pays semi-annual dividends (twice a year). The most recent dividend payment schedule is:

| Record Dates | Payable Dates |

|---|---|

| December 16, 2024 | January 16, 2025 |

| June 24, 2025 | July 23, 2025 |

If you owned 100 shares of Disney stock, you would receive a $50 dividend payment for each installment, totaling $100 annually.

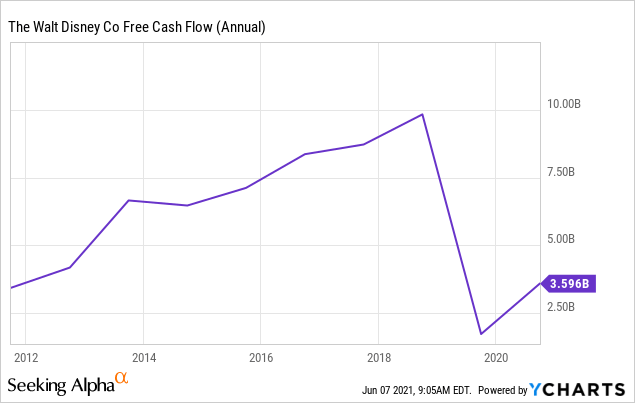

Disney’s Dividend History: A Rollercoaster Ride

Disney’s dividend history has been kinda interesting over the past few years:

-

Pre-COVID Era: Before the pandemic, Disney was paying healthy dividends. The last semi-annual dividend paid prior to the pandemic was $0.88 per share in January 2020.

-

COVID-19 Suspension: Disney suspended its dividend in 2020 in response to the COVID-19 pandemic. This suspension lasted for four years as the company focused on recovering from pandemic-related impacts and investing in its streaming platforms.

-

January 2024: Disney resumed dividend payments with a $0.30 per share payment.

-

July 2024: The dividend was increased to $0.45 per share, representing a 50% increase from the January payment.

-

December 2024: Disney announced a further increase to $1.00 per share (paid in two $0.50 installments), marking a 33% increase over the total $0.75 paid during fiscal year 2024.

It’s worth noting that even with these increases, the current dividend is still about 49% lower than the pre-pandemic level. However, the trend of consistent increases suggests Disney’s commitment to returning value to shareholders.

Why Did Disney Suspend Dividends?

The decision to suspend dividends wasn’t made lightly. The COVID-19 pandemic hit Disney particularly hard, with theme parks closed, cruise ships docked, and movie theaters shut down. The company needed to preserve cash during this uncertain period.

Additionally, Disney was heavily investing in its Disney+ streaming platform, which required significant capital. By suspending the dividend, Disney could redirect those funds to strategic initiatives and maintain financial flexibility during the crisis.

How to Receive Disney Dividends

To receive Disney dividends, you must be a shareholder of record by the specified record date. Here’s how dividends are typically paid:

- Direct Deposit: If you’ve enrolled in direct deposit, the dividend will be automatically deposited into your bank account.

- Check: If you haven’t enrolled in direct deposit, you’ll receive a check in the mail.

- Dividend Reinvestment: If you’re enrolled in The Walt Disney Company Investment Plan, your dividends will be automatically reinvested to purchase additional shares.

The Walt Disney Company Investment Plan

Disney offers a direct stock purchase plan called “The Walt Disney Company Investment Plan.” This plan allows investors to:

- Buy shares directly from Disney with an initial investment of at least $250 or by authorizing monthly deductions of at least $50 for five consecutive transactions

- Reinvest all cash dividends automatically in additional shares

- Make additional investments of $50 or more by check or through automatic deductions

- Sell shares through the plan

This can be a great option for long-term investors who want to gradually build their position in Disney stock while automatically reinvesting dividends.

Will Disney’s Dividend Continue to Grow?

While we don’t have a crystal ball to predict future dividend growth, there are promising signs:

-

Improved Financial Performance: Disney reported annual revenue of $91.4 billion in its Fiscal Year 2024, indicating a strong financial position.

-

Management Commitment: Disney CEO Robert A. Iger has stated, “With the company operating from a renewed position of strength, we are pleased to increase the dividend for shareholders while continuing to invest for the future and drive sustained growth through Disney’s world-class portfolio of assets.”

-

Strategic Initiatives: Disney has been focusing on improving quality, innovation, efficiency, and value creation across its business segments.

-

Historical Pattern: Prior to the pandemic, Disney had a history of dividend increases, raising its payout four times between 2015 and 2020.

However, Disney’s dividend yield remains relatively modest compared to many other dividend-paying stocks. Based on current share prices, the annual dividend of $1.00 per share represents a yield of just over 1%.

Comparing Disney’s Dividend to Other Entertainment Companies

When evaluating Disney’s dividend, it’s helpful to compare it to other entertainment and media companies. While Disney’s current yield of around 1% is lower than some traditional dividend stocks, it’s important to remember that Disney is also focused on growth initiatives and share buybacks as ways to return value to shareholders.

Dividend Taxation and Reporting

If you received a dividend of $10.00 or more from Disney, you’ll receive IRS Form 1099-DIV, which will be mailed by The Walt Disney Company on or before January 31, 2025. This will be reportable when you file your 2024 tax return in calendar year 2025.

For non-U.S. shareholders, Form 1042-S for dividends paid in 2024 will be mailed on or before March 15, 2025.

How to Keep Track of Your Disney Dividends

If you’re enrolled in The Walt Disney Company Investment Plan, you’ll receive account statements reflecting the payment and reinvestment of dividends on an annual basis if dividends were declared in the prior calendar year.

You can also review account transactions, including dividend reinvestment transactions, by accessing your shareholder account online at www.disneyshareholder.com.

Should You Buy Disney Stock for the Dividend?

While Disney does pay dividends, it’s probably not the best choice if dividend income is your primary investment objective. There are many other stocks with higher dividend yields and longer histories of dividend growth.

However, if you’re interested in a company with:

- Strong global brand recognition

- Diversified revenue streams (Entertainment, Sports, and Experiences)

- Growth potential through streaming services

- A dividend that could potentially grow over time

…then Disney might be a compelling investment opportunity that offers both growth potential and some dividend income.

Final Thoughts on Disney’s Dividend

Disney’s dividend story reflects the company’s evolution and priorities. After suspending dividends during the pandemic, Disney has returned to its dividend-paying tradition with a clear commitment to increasing shareholder returns while continuing to invest in future growth.

For investors, the resumption and growth of Disney’s dividend is a positive sign of the company’s financial health and confidence in its future prospects. While the current yield may not attract pure income investors, the combination of potential share price appreciation and growing dividends could make Disney an attractive component of a diversified investment portfolio.

As with any investment decision, it’s important to consider your own financial goals and consult with a financial advisor before making significant investment choices. The magic of Disney might extend beyond its parks and entertainment offerings to its potential as a long-term investment for your portfolio.

Remember, if you’re considering becoming a Disney shareholder for the dividends, you’re not just investing in a company—you’re investing in one of the most recognized entertainment brands in the world with a history dating back nearly a century.

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

We are actively working to enhance your experience by translating more content. However, please be aware that the page you are about to visit has not yet been translated.

We appreciate your undertanding and patience as we continue to imporove our services.

- DIS

- Dividend History

The Dividend History page provides a single page to review all of the aggregated Dividend payment information. Historical information is not adjusted for stock splits. Visit our Dividend Calendar: Please note that the dividend history for Nasdaq stocks may also be combined the regular with the special dividend. Our partner, Quotemedia, provides the upcoming ex-dividend dates for the next month (Other OTC & OTCBB stocks are not included in coverage for Dividend History). Please note that the dividend history might include the company’s preferred securities as well. Price/Earnings Ratio is a widely used stock evaluation measure. For a security, the Price/Earnings Ratio is given by dividing the Last Sale Price by the Actual EPS (Earnings Per Share).

- Real-time Data is provided using Nasdaq Last Sale Data

Data provided by Nasdaq Data Link, a premier source for financial, economic and alternative datasets. Data Links cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs. Register for your free account today at data.nasdaq.com.

Nasdaq Dividend History provides straightforward stock’s historical dividends data. Dividend payout record can be used to gauge the companys long-term performance when analyzing individual stocks.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session. Data is currently not available

To add instruments:

- Type a instrument or company name. When the instrument you want to add appears, add it to My European Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple instruments separated by spaces.

These instruments will be available throughout the site during your session. Data is currently not available

Disney raises dividend by 33%

FAQ

How often does Disney pay dividends?

Is Disney a good dividend stock?

)

and it has a history of dividend cuts, although it has recently begun to increase the dividend again after a suspension.Does Amazon stock pay dividends?

On April 27, 1998, Amazon announced a 2-for-1 split of common shares, effective on June 2, 1998, for stockholders of record on May 20, 1998. Does Amazon distribute dividends? We have never declared or paid cash dividends on our common stock.

Will Disney start paying dividends again?