Have you ever looked at your bank account and thought, “There’s no way I can become an investor with what I’ve got”? I used to think the same way. The good news is, you don’t need a huge pile of cash to start building wealth. Even just $100 a month can create amazing results over time.

But is investing $100 monthly actually worth it? Let’s dive into the numbers and see what’s possible when you harness the power of consistency and compound growth.

The Shocking Power of $100 Monthly Investments

Here’s something that might surprise you investing just $100 a month from age 25 to 65 could potentially turn into $1176,000 by retirement. That’s right – a modest monthly contribution that’s less than many people’s cable bills could potentially make you a millionaire.

The secret isn’t the amount you invest. It’s that you don’t miss a single month for 40 years. $100 can make you a millionaire when you’re steady predictable and disciplined with your investing approach.

What Impacts Your $100 Monthly Investment Returns?

When investing $100 monthly two key factors will determine your success

1. Asset Choices

The investments you select significantly impact your returns. Higher-risk assets like stocks potentially offer greater returns, while more conservative options like bonds typically provide more stability but lower growth.

2. Investment Timeline

Time is truly your greatest ally. The longer your money remains invested, the more it benefits from compound interest – where your returns begin generating their own returns.

Let me break down how these $100 monthly investments might grow in different scenarios:

Scenario 1: Investing $100 Monthly in the Stock Market

The S&P 500 has historically averaged around 10% annual returns over the long term. Let’s see how $100 monthly contributions would grow at this rate:

Long-Term Investor (25 years)

- Total contributions: $30,000 ($100 × 12 × 25)

- Estimated final value: $133,889

- Investment gains: $103,889

Those returns are nothing to sneeze at! Your money more than quadruples over this period.

Short-Term Investor (5 years)

- Total contributions: $6,000 ($100 × 12 × 5)

- Estimated final value: $8,000

- Investment gains: $2,000

Even in just five years, your money works for you and grows by about 33%. Not bad for a small monthly contribution!

Scenario 2: Investing $100 Monthly in Bonds

If you prefer less risk, bonds might be your choice. Let’s assume a more conservative 6% annual return:

Long-Term Investor (30 years)

- Total contributions: $36,000 ($100 × 12 × 30)

- Estimated final value: $97,451

- Investment gains: $61,451

Still impressive growth, though not as dramatic as stocks over the same period.

Short-Term Investor (5 years)

- Total contributions: $6,000 ($100 × 12 × 5)

- Estimated final value: $6,949

- Investment gains: $949

The returns are more modest here, but you still see growth with minimal risk.

Scenario 3: Saving $100 Monthly in a Savings Account

What if you chose to skip investing altogether and just used a savings account?

With a high-yield savings account offering 4% interest (which is actually pretty good in today’s market):

- Total contributions over 5 years: $6,000

- Estimated final value: $6,618

- Earnings: $618

While saving is better than not saving at all, the difference between investing and saving becomes enormous over longer periods.

The Magic Ingredient: Compound Interest

Albert Einstein supposedly called compound interest the “eighth wonder of the world,” and when you see the numbers, it’s easy to understand why.

Compound interest is like a snowball rolling downhill, gathering more snow as it goes. When you invest, your money earns returns, and then those returns start earning their own returns. This creates a powerful snowball effect that accelerates over time.

Here’s an example of how compound interest transforms your $100 monthly investment over 40 years (assuming 10% average return):

| Years Invested | Total Contributions | Approximate Value |

|---|---|---|

| 10 years | $12,000 | $20,655 |

| 20 years | $24,000 | $76,570 |

| 30 years | $36,000 | $227,933 |

| 40 years | $48,000 | $637,678 |

And with even stronger performance in good growth stock mutual funds, reaching that $1,176,000 figure becomes possible over 40 years.

5 Tips to Maximize Your $100 Monthly Investment

-

Start early and stay consistent

The earlier you begin, the more time your money has to compound. Missing contributions can significantly impact your long-term results. -

Automate your investments

Set up automatic transfers from your checking account to your investment account. What you don’t see, you won’t spend! -

Diversify your portfolio

Don’t put all your eggs in one basket. Spread your $100 across different types of investments based on your risk tolerance. -

Minimize fees

Look for low-cost index funds or ETFs with expense ratios under 0.2%. Over decades, saving 1% in fees can translate to tens of thousands of dollars in additional returns. -

Reinvest your dividends

Instead of taking dividend payments as cash, configure your account to automatically reinvest them to purchase additional shares.

How to Adjust Your Strategy as Your Income Grows

Starting with $100 monthly doesn’t mean you have to stick with that amount forever. As your income increases, consider:

- Gradually increasing contributions: Each time you get a raise, bump your monthly investment by $25 or $50

- Diversifying into additional asset classes: As your portfolio grows, you might add international funds, real estate investment trusts (REITs), or sector-specific ETFs

- Periodically reviewing your portfolio: As your financial situation changes, your investment strategy should evolve too

Real-Life Example: Sarah’s $100 Monthly Investment Journey

Sarah started investing $100 monthly at age 25, using a simple index fund tracking the S&P 500. She set up automatic transfers so she’d never miss a contribution.

When she got a promotion at age 30, she increased her monthly contribution to $150. At 35, she bumped it up to $200, and by 40, she was investing $300 monthly.

By age 65, even though she started with just $100, her consistent approach and gradual increases helped her build a retirement portfolio worth over $1.5 million. That’s the power of starting small and staying consistent!

But What If I Didn’t Start at 25?

Don’t panic if you’re starting later. The best time to start was yesterday, but the next best time is today.

If you start at age 40 instead of 25, you might not reach the same total, but you’ll still be far better off than if you never started at all. A 40-year-old investing $100 monthly until age 65 (25 years) could potentially have around $133,889 at retirement (assuming that 10% average annual return).

And remember, most people can gradually increase their contributions as they advance in their careers, helping to make up for a later start.

Is $100 a Month Really Worth Investing?

Absolutely, unequivocally, YES!

Here’s why:

- It builds the investing habit: Starting small helps you develop consistency

- It can grow into significant wealth: Thanks to compound interest, even small amounts can grow substantially

- It’s accessible to almost everyone: Most people can find $100 in their monthly budget

- It provides flexibility: You can always increase your contributions as your financial situation improves

How to Get Started With Your $100 Monthly Investment

- Pay off high-interest debt first: If you have credit cards charging 18-25% interest, tackle those before investing

- Build a small emergency fund: Aim for at least $1,000 to handle minor emergencies

- Choose an investment platform: Consider brokerages like Fidelity, Vanguard, or Schwab that offer commission-free trading

- Select your investments: Index funds like VTSAX (Vanguard Total Stock Market Index) or target-date retirement funds are great for beginners

- Set up automatic contributions: Schedule $100 to transfer automatically each month

Common Questions About Investing $100 Monthly

Q: Can I really become a millionaire with just $100 a month?

A: Yes, potentially! With consistent investing, good growth investments, and enough time (40 years at 10% returns), it’s mathematically possible to reach over $1 million.

Q: What if I need to stop contributing temporarily?

A: Life happens! If you need to pause contributions during financial hardship, that’s okay. Just resume as soon as possible, and consider increasing future contributions slightly to help catch up.

Q: Is it better to save up and invest a lump sum?

A: Generally, it’s better to invest consistently over time through dollar-cost averaging (regular periodic investments), which your $100 monthly plan accomplishes.

Q: Should I invest $100 in stocks or crypto or something else?

A: For most long-term investors, a diversified approach using low-cost index funds is ideal. Cryptocurrency and individual stocks can be much riskier.

The Bottom Line: Small Investments, Big Results

I’ve learned that wealth-building isn’t about making dramatic moves or having huge sums to invest. It’s about consistency, patience, and letting time work its magic.

Starting with just $100 a month is absolutely worth it. That small amount, invested regularly over decades, can potentially grow into hundreds of thousands or even millions of dollars.

Remember this truth: $100 can make you a millionaire when you’re steady, predictable, and disciplined with your approach. The key is simply to start, stay consistent, and give your money time to grow.

So, is investing $100 a month worth it? I’d say it might be one of the smartest financial decisions you’ll ever make.

Why you should start investing today

Investing can be an intimidating word and concept for many reasons. There are a large amount of terms, tax implications, planning and investments to understand — along with knowing there will be market fluctuations making your net worth go up and down. But by understanding the mere basics, you can begin to grow your wealth quickly.

Corbin Blackwell CFP, senior financial planner at wealth management app Betterment, told Select that, “Investing is one of the best ways to grow your long-term wealth and reach major goals for things like retirement, buying a home and college funds.”

She also said that beginning the investing journey is often the most difficult part, as growth will be limited at first. He added that, “Tools available today, like digital investment advisors, make it easier than ever to get started.”

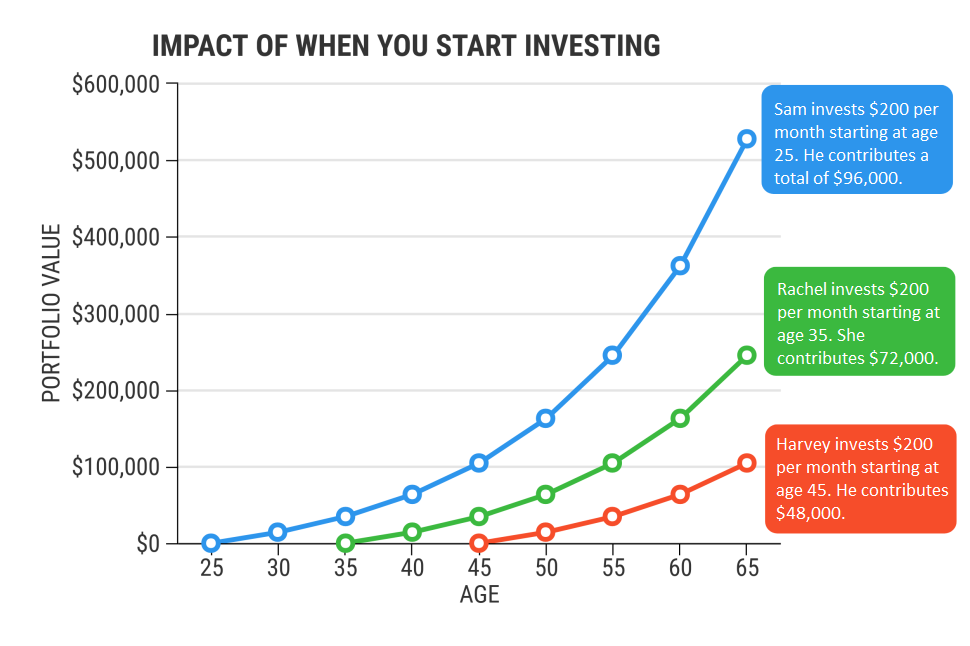

And by getting started today, you have the best asset that any investor can have on their side: time.

By letting your money sit in the market longer, you allow for compound interest to take over — which is when your interest and gains stack on top of one another. Blackwell gives an excellent example of the power of compound interest:

“Lets say you invested just $100 today and saw a 5% annual return – thanks to the power of compound interest, if you dont touch your investment, in 30 years youd have $430.”

Thats an ok return, but imagine if you invested $100 monthly for 30 years into a common index fund. An index fund is a fund that has a group of companies within it, and tracks the performance of the entire group. These groups can range in focus including the size of each company, the respective industries, location of the companies, type of investment and more. One of the most popular indices, the S&P 500, consists of the 500 largest companies in the United States, making it a relatively safe investment because of its exposure to hundreds of companies and dozens of industries.

Many consider this a boring investment, but the results the index has produced are nothing to balk at.

The average yearly return of the S&P 500 over the last 30 years is 10.7%, but even at a conservative return of 8%, you would have over $146,000 if you invest $100 a month for 30 years. The impressive part is that your total contributions would be $36,000, which means your money would have quadrupled in value in 30 years (note that past performance does not guarantee future success).

In short, the more money and more time you have in the market, the more likely you are to grow your investment funds.

How to begin investing

If growing your net worth is your goal, you can get started in just a few minutes. Here are a few things to consider: