As a trader who’s faced the rollercoaster of stock market swings for years, I’ve often encountered situations where a stock jumps in price while trading volume remains unusually low. This scenario confuses many investors—is it a bullish sign or a red flag? Let’s dive deep into this market phenomenon that often leaves both novice and seasoned investors scratching their heads.

Understanding Low Volume Price Increases

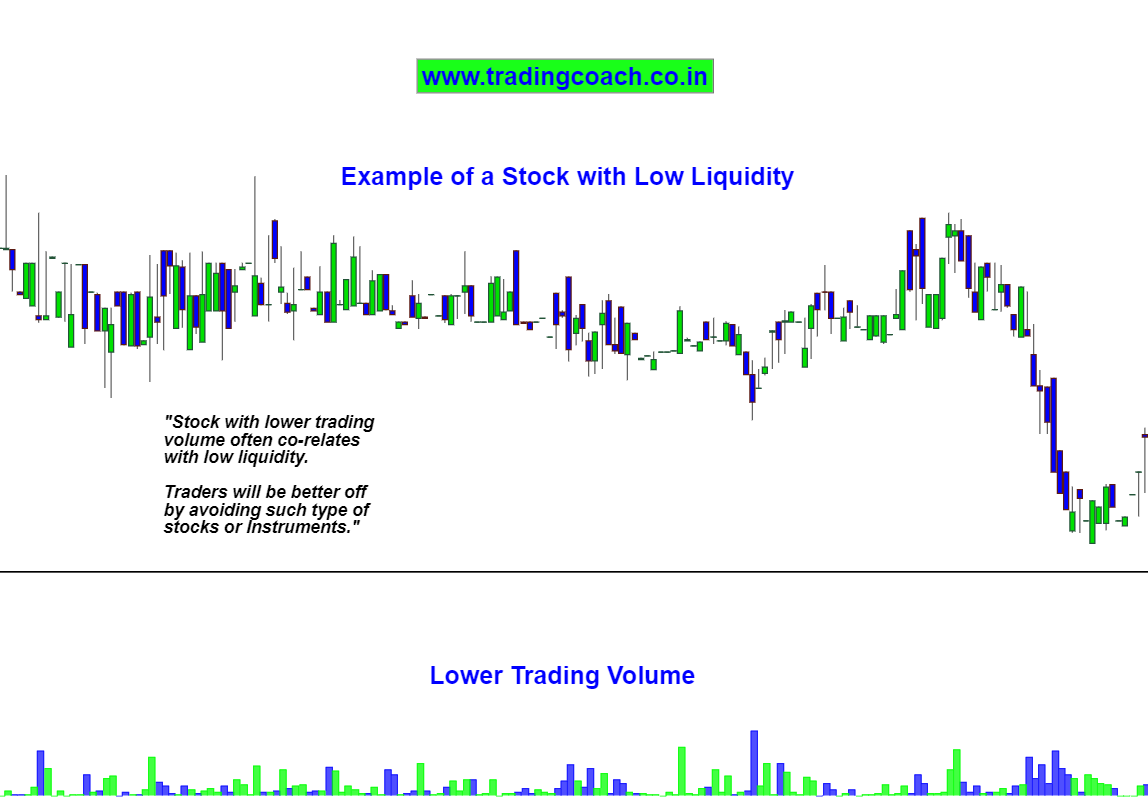

When a stock price increases on low volume, it essentially means the stock’s value is rising without many shares changing hands. Typically, a healthy price movement is accompanied by strong trading volume that confirms investor interest. But when prices climb on minimal volume, it’s like hearing applause from just a few people in a large theater—something doesn’t quite add up.

Low volume is generally defined as when a stock trades with a daily average of 1,000 shares or fewer. These stocks often fly under the radar of mainstream investors and lack general trading interest.

The Key Signals Behind Low Volume Rallies

1. Limited Participation

When a stock rises on low volume, it signals that very few market participants are driving the price movement. This limited participation means:

- The price movement might not be sustainable

- There’s potential for quick reversals when more participants enter

- The stock might be vulnerable to manipulation

2. Lack of Conviction

Volume represents conviction in a market move, When volume is low

- Investors aren’t rushing to buy the stock despite its rising price

- The upward move might be driven by technical factors rather than fundamental strength

- There’s less “smart money” validating the price increase

3. Potential for Price Manipulation

Low-volume stocks are easier to manipulate because:

- It takes less capital to move the price

- Fewer participants are involved to counter manipulative activities

- Price can be artificially inflated by a small number of traders

Is It a Trap or an Opportunity?

Warning Signs (When to Be Cautious)

When a stock rises on low volume it could be a warning sign if

- The move contradicts broader market trends – If the overall market is declining but a low-volume stock is rising, be especially wary

- The company hasn’t released positive news – Price increases should normally be justified by fundamental developments

- The stock has a history of volatility – Previous patterns of pump-and-dump might be repeating

- The bid-ask spread is unusually wide – Indicating poor liquidity and potential difficulties exiting positions

Potential Opportunities (When It Might Be Bullish)

Sometimes, low volume price increases can represent opportunities:

- Early stages of trend reversal – Smart money sometimes begins accumulating positions quietly before the broader market notices

- Lack of selling pressure – If holders aren’t willing to sell despite rising prices, it could indicate strong conviction among existing shareholders

- Seasonal factors – During holiday periods or summer months when volume naturally declines, low volume moves may be less concerning

Real-World Scenarios Where Low Volume Matters

Temporary Events and Market Phases

Uncertainty around major events like political elections or extreme weather can create opportunities. For example, during India’s 2004 general election, there was a major drop in stock prices when a coalition backed by Communist parties appeared to be the only option for government formation. Investors who bought stocks during this panic saw their purchases triple in less than four years—with some little-known, low-volume stocks seeing up to 15-fold returns!

Macroeconomic Factors

Low-volume trading can result from local or global economic conditions like:

- Recessions

- Higher interest rates

- Inflation periods

During these times, overall stock trading activity decreases, and stocks that were already thinly traded perform even worse. But experienced investors know these conditions eventually improve, and they use excess capital to invest in carefully selected stocks that are likely to perform well long-term when economic conditions recover.

Corporate Actions Impact

Some stocks have low trading volume because of their extraordinarily high share prices. For example, Berkshire Hathaway’s Class A stocks (BRK-A) traded at an astounding $693,880 per share as of October 2024, with an average daily volume of only 1,017 shares. Similarly, Seaboard (SEB) traded at $2,984.77 per share with a mere 921 shares average daily volume.

A corporate action like a stock split can dramatically change this dynamic leading to

- Lower prices

- Higher trading volumes

- Increased liquidity

- Greater market participation

The challenge is predicting when such corporate actions might occur.

How to Trade Stocks Rising on Low Volume

Strategies for Short-Term Traders

If you’re looking to capitalize on short-term opportunities:

- Set tight stop-losses – These stocks can reverse quickly

- Look for volume confirmation – Wait for volume to increase, confirming the move

- Monitor news closely – Be ready to exit if no fundamental reasons emerge for the rise

- Consider taking profits quickly – Low volume rallies often don’t sustain long-term

Strategies for Long-Term Investors

If you’re considering low-volume stocks for long-term investment:

- Do deep fundamental research – Understand the company’s business thoroughly before investing

- Consider the “market maker” approach – Some traders successfully assume this role with thinly traded stocks by offering to both buy and sell them, quoting bid and ask prices and pocketing the difference from wide spreads

- Look for “multibagger” potential – Remember that Microsoft and Infosys were once low-volume stocks before becoming giants

- Use only excess capital – Never invest money you might need in the short term

The Liquidity Challenge of Low-Volume Stocks

One of the biggest risks of low-volume stocks is the liquidity trap. When you want to sell your position, you might find few buyers, forcing you to:

- Accept a much lower price

- Sell in small chunks over time

- Hold longer than desired

This lack of liquidity means that even if the stock price looks good on paper, your actual realized returns might be significantly different when you try to exit.

Examples of Low Volume Success Stories

While risky, some investors have made fortunes in low-volume stocks:

- Small biotech companies – Before major drug approvals, some investors accumulate positions while volume is low

- Tech startups pre-IPO – Early investors in companies like Amazon faced periods of low trading volume

- Regional banks before acquisition – Small local banks often trade at low volumes before being acquired at premiums

Exchange-Driven Changes That Affect Low-Volume Stocks

Stock exchanges sometimes implement initiatives that can dramatically impact low-volume stocks. For instance, Bats Global Market (one of the largest U.S. stock exchanges) previously proposed concentrating low-volume stocks on fewer exchanges to increase their liquidity.

Such exchange-driven changes can potentially increase returns for investors who positioned themselves in these stocks before the changes took effect.

The Bottom Line: Proceed with Caution

Trading low-volume stocks is definitely a risky game. The potential benefits depend on many factors outside an investor’s control. In my experience, the best approach is taking a long-term perspective:

- Invest only with excess money you won’t need soon

- Select stocks with genuine business potential

- Understand that many small companies listing on OTC exchanges fail

- Be prepared for significant volatility

Low volume price increases should always trigger additional scrutiny rather than immediate action. While they can sometimes signal early opportunities, they more frequently represent warning signs that demand careful investigation.

FAQs About Low Volume Stock Movements

What is considered “low volume” for a stock?

Generally, stocks with an average daily trading volume of 1,000 shares or fewer are considered low volume. However, this definition can vary depending on the stock’s price and market cap.

Can low volume stocks be traded on major exchanges?

Yes, while many low-volume stocks trade over-the-counter (OTC), some are listed on major exchanges like NYSE or NASDAQ. Even some large companies can experience periods of low trading volume.

What causes a stock to have consistently low trading volume?

Common causes include:

- Small market capitalization

- Limited public float (available shares)

- Low institutional ownership

- Limited analyst coverage

- Niche business areas with limited investor interest

How do I check a stock’s volume?

Most trading platforms and financial websites display volume information alongside price data. You can also compare current volume to average daily volume to determine if today’s volume is unusually low.

What’s the difference between low float and low volume?

Low float refers to a limited number of shares available for public trading, while low volume refers to the actual number of shares being traded. A stock can have a large float but low trading volume, or vice versa.

When investing in stocks that rise on low volume, I always remind myself of an old Wall Street saying: “Volume is the fuel that drives price movement.” Without adequate fuel, price movements rarely go far. Keep this in mind next time you spot a stock climbing on mysteriously low volume—it might save you from a costly mistake or alert you to an opportunity others haven’t yet noticed.

Bearish signals from trading volume

An uptrend with decreasing volume