Have you ever dreamt of becoming a crorepati? I certainly have! The good news is that with disciplined investing and proper financial planning, becoming a crorepati in 15 years isn’t just a fantasy—it’s actually achievable for many of us.

In this article, I’ll share practical strategies that can help you reach that magical 7-figure number, based on solid investment principles and the power of compounding Let’s dive into the roadmap that could potentially transform your financial future!

Understanding What It Takes to Become a Crorepati

Before we jump into strategies, let’s understand what we’re really talking about. A crorepati means having wealth worth Rs. 1 crore (10 million rupees). While this amount might not have the same purchasing power it had decades ago (thanks, inflation!), it’s still a significant financial milestone for most Indians.

The journey to becoming a crorepati requires:

- Consistent savings habits

- Smart investment choices

- The magic of compounding

- Time and patience

How Much Do You Need to Invest Monthly to Become a Crorepati?

The amount you need to invest monthly depends on several factors

- Your current age

- Your existing savings

- Expected rate of return on investments

- The effects of inflation

For example, if you’re 30 years old with no current savings and want to become a crorepati by age 45 (in 15 years), assuming an average annual return of 12%, you’d need to invest approximately Rs. 26,000 per month.

But wait—that’s without accounting for inflation! If we factor in an inflation rate of 5%, the actual value you’ll need after 15 years would be around Rs. 2.08 crore to have the same purchasing power as 1 crore today. This would require a monthly SIP of about Rs. 54,000.

Investment Vehicles to Help You Reach Crorepati Status

1. Mutual Fund SIPs (Systematic Investment Plans)

SIPs are one of the most powerful tools for wealth creation By investing a fixed amount regularly in equity mutual funds, you

- Benefit from rupee-cost averaging (buying more units when prices are low)

- Avoid timing the market

- Enforce disciplined investing

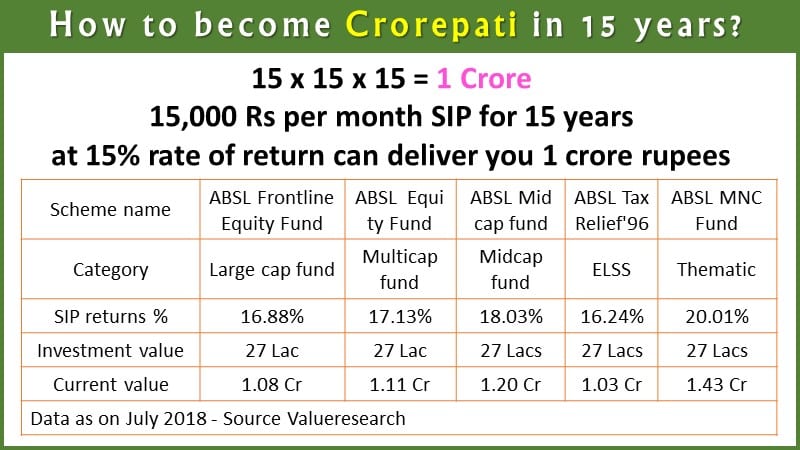

Top-performing equity funds have historically delivered returns of 12-15% over long periods. Looking at historical data, many investors who started SIPs of Rs. 25,000-30,000 fifteen years ago in good equity funds have already reached or are close to the crorepati mark.

2. Equity Investments

Direct stock investments can potentially yield higher returns than mutual funds, but they come with higher risks and require more knowledge. If you have the expertise or are willing to learn, allocating a portion of your investments to quality stocks can accelerate your crorepati journey.

Some investors have achieved crorepati status in even less than 15 years through smart stock picking, but remember—this path requires significant research and risk tolerance.

3. Real Estate

While real estate isn’t as liquid as financial investments, it has created substantial wealth for many. Strategic real estate investments in growing areas can appreciate significantly over 15 years.

Property investments typically require larger initial capital but can deliver through:

- Capital appreciation

- Rental income

- Tax benefits

4. Public Provident Fund (PPF) and Other Fixed-Income Options

These alone probably won’t make you a crorepati in 15 years, but they should be part of your diversified portfolio:

- PPF (current interest rate around 7.1%)

- Corporate bonds

- Fixed deposits

- Government securities

The Power of Compounding: Your Best Friend

Einstein allegedly called compounding the “eighth wonder of the world,” and for good reason! It’s what makes becoming a crorepati possible for ordinary people.

Let’s look at a simple example:

If you invest Rs. 30,000 monthly for 15 years at 12% annual returns:

- Total amount invested: Rs. 54 lakhs

- Final corpus: Approximately Rs. 1.34 crore!

The difference of Rs. 80 lakhs is what compounding has earned for you!

My Recommended Wealth-Building Strategy for 15 Years

If I were personally trying to reach crorepati status in 15 years, here’s the approach I’d take:

-

Determine my target amount: Factoring in inflation, I’d aim for around Rs. 2 crore rather than just 1 crore.

-

Maximize my savings rate: I’d try to save and invest at least 40-50% of my income.

-

Create an asset allocation strategy:

- 65-70% in equity mutual funds and stocks

- 20% in real estate or REITs

- 10-15% in fixed-income instruments

-

Start with a monthly SIP of at least Rs. 40,000-50,000: Using tools like the Crorepati Calculator on Advisorkhoj can help determine the exact amount based on your situation.

-

Increase my investments annually: I’d increase my SIP amount by at least 10% every year as my income grows.

-

Reinvest all gains: No withdrawals until reaching my goal.

-

Regularly review and rebalance my portfolio: I’d check every 6 months to ensure my investments are performing as expected.

Common Mistakes to Avoid on Your Crorepati Journey

-

Starting too late: Every year delayed requires a significantly higher monthly investment.

-

Investing too conservatively: While fixed deposits seem safe, they rarely beat inflation. You need growth assets to become a crorepati.

-

Withdrawing investments prematurely: This disrupts the compounding process.

-

Trying to time the market: Consistent investing beats market timing for most people.

-

Ignoring tax planning: Smart tax strategies can save lakhs over your investment journey.

Real-Life Success Stories

I recently spoke with Rajesh, a 45-year-old IT professional who started investing Rs. 15,000 monthly when he was 30. He increased his investments by 10% each year, and despite market ups and downs, he crossed the crorepati mark in just 13 years!

Another friend, Priya, combined her mutual fund SIPs with a small rental property she purchased with her savings. The combination of rental income, property appreciation, and her SIPs helped her reach the crorepati milestone in 14 years, starting from almost nothing at age 28.

Adjusting for Your Current Situation

Not everyone can start with Rs. 40,000+ monthly investments. Here’s what you can do based on your current situation:

If you can only invest Rs. 10,000 monthly:

- Start anyway! You’ll still build substantial wealth

- Look for opportunities to increase your income

- Consider extending your timeline to 20-25 years instead of 15

If you’re already 40+ years old:

- You’ll need to invest more monthly to reach the same goal

- Consider more aggressive (but still diversified) investments

- Look at delaying your crorepati goal by a few years

If you have existing savings:

- You have a head start! Your existing corpus will compound

- Use the Advisorkhoj Crorepati Calculator to factor in your current savings

- You might need less monthly investment than someone starting from zero

Tools to Help Plan Your Crorepati Journey

One of the most helpful resources I’ve found is the Crorepati Calculator on Advisorkhoj website. This calculator helps you determine:

- How much you need to save monthly to become a crorepati

- The impact of inflation on your target amount

- How your existing savings will grow

- The effects of different rates of return

Using this calculator, you can adjust variables like:

- Your current age

- The age by which you want to become a crorepati

- Expected inflation rate

- Expected investment returns

- Your current savings

The Mental Game: Staying Committed for 15 Years

Let’s be honest—consistency over 15 years isn’t easy. Here’s how I stay motivated:

-

Automate investments: Set up auto-debits so you never miss investing.

-

Visualize your goal: Keep a physical or digital reminder of what being a crorepati means to you.

-

Track progress annually: Seeing your wealth grow reinforces your commitment.

-

Find an accountability partner: Share your journey with a trusted friend with similar goals.

-

Educate yourself continuously: The more you understand investing, the more confident you’ll feel during market fluctuations.

Final Thoughts: Yes, You Can Become a Crorepati!

Becoming a crorepati in 15 years is absolutely achievable with disciplined investing, the right investment vehicles, and the power of compounding. The key is to start NOW, stay consistent, and let time work its magic.

Remember, wealth creation isn’t about making a few big, brilliant moves—it’s about making sensible decisions consistently over time. Even if market conditions change or your personal situation evolves, the principles of saving, investing, and compounding remain powerful constants.

Are you ready to start your crorepati journey today? I’d love to hear your thoughts and strategies in the comments below!

FAQs About Becoming a Crorepati in 15 Years

Q: Is it better to invest lump sum or monthly to become a crorepati?

A: For most people, monthly investing through SIPs is better as it enforces discipline and takes advantage of rupee-cost averaging. However, if you have a large lump sum available, a combination approach might work best.

Q: What if the market crashes during my 15-year journey?

A: Market crashes are actually opportunities when you’re investing regularly. Your SIPs will buy more units at lower prices, potentially increasing your returns when the market recovers.

Q: Should I focus on tax saving or returns when trying to become a crorepati?

A: While tax efficiency is important, focus primarily on after-tax returns. Sometimes, a non-tax saving investment with higher returns is better than a tax-saving one with lower returns.

Q: Is real estate or mutual funds better for becoming a crorepati?

A: Both have their place. Mutual funds offer liquidity and lower entry points, while real estate can provide rental income and leverage. A combination often works well, depending on your expertise and preferences.

Q: What if I can’t save enough monthly to become a crorepati in 15 years?

A: Either extend your timeline or look for ways to increase your income. Remember, partial success is still success—even if you reach 70-80 lakhs instead of 1 crore, you’ll still be in a strong financial position!

Know more about our Best-Selling Wealth Creation Plan – Tata AIA Fortune Pro to Grow your Wealth

In this policy, the investment risk in investment portfolio is borne by the policyholder.

Key Benefits:

- Investment growth with market-linked returns~ & loyalty additions^

- Get life Insurance cover and safeguard against uncertainties in life

- 21.95% Returns+ for Multi Cap Fund (Benchmark: 11.94%)

- Get income tax# benefits as per applicable tax laws

Unit Linked Individual Life Insurance Savings Plan (UIN:110L112V04)

Why Should You Use a Crorepati Calculator Online?

A Crorepati calculator is a perfectly safe and legal way to plan your finances while making tax# payments and filing returns, through which you can explore investments to create wealth. Even though it may take about 10-15 years for you to become a Crorepati, the Crorepati calculator sets you on the right track by offering accurate estimates of how much you need to save. Moreover, you can use a combination of different investment instruments as well as life insurance products to plan your finances and earn a financial corpus in crores. This will not only secure the financial aspect of your investment for your future needs but will also secure your family in case of an untoward emergency or occurrence.

Once you are aware of the amount that needs to be invested each month or year, you can choose suitable investment plans or savings plans to accumulate a financial corpus in crores. This can also help you plan your taxes by choosing tax-saving investments. In addition, you can use a Crorepati calculator to plan your future financial goals over the long term easily.