Have you ever wondered if your company is carrying too much debt? Or maybe not enough? I’ve been there too, trying to figure out the magic number that would make banks happy while still allowing my business to grow The truth is, there’s no one-size-fits-all answer when it comes to a “good” debt ratio

In this article I’m gonna break down everything you need to know about debt ratios – what they mean, how to calculate them, and most importantly what range is considered healthy for different industries. Let’s dive in!

Understanding Debt Ratios: The Basics

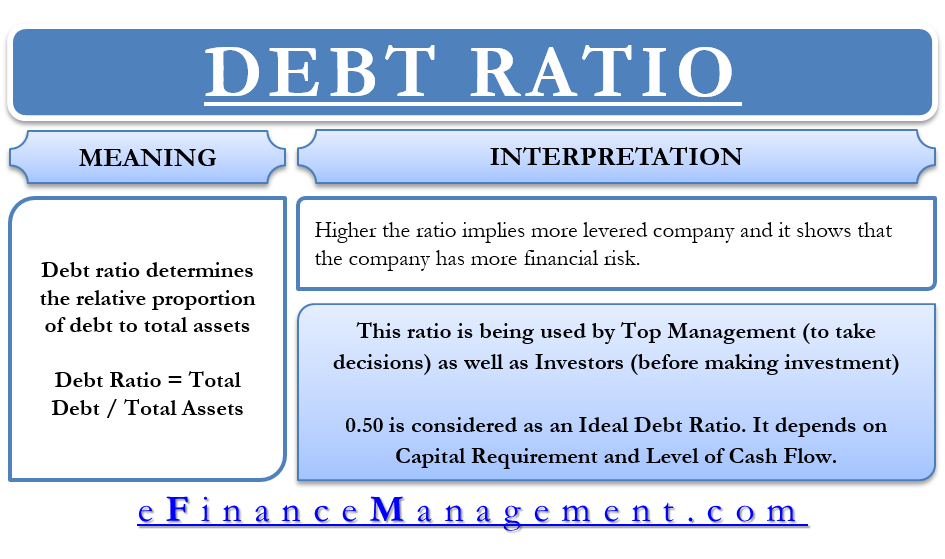

A debt ratio, sometimes called a “debt-to-income (DTI) ratio,” is a financial metric that compares a company’s total liabilities to its total assets. It’s calculated by dividing total liabilities by total assets, and it tells you how leveraged a company is – in other words, how much of its assets are financed by debt rather than equity.

The formula looks like this

Debt Ratio = Total Liabilities ÷ Total Assets

So if a company has $60,000 in liabilities and $100,000 in assets, its debt ratio would be 0.6 or 60%.

But what does this number actually mean? Is 60% good or bad? Well, that’s where things get a bit complicated.

What’s Considered a Good Debt Ratio?

Most investors typically look for companies with debt ratios between 0.3 (30%) and 0.6 (60%). But the truth is, whether a debt ratio is “good” depends on several factors:

- Industry standards: Capital-intensive industries like manufacturing or utilities can handle higher debt ratios

- Company size and maturity: Larger, established companies with steady cash flows can manage more debt

- Interest rate environment: During high interest periods, lower debt ratios are preferred

- Company’s growth stage: Growing companies might need more debt to fund expansion

From a risk perspective, debt ratios of 0.4 (40%) or lower are generally considered better. When a company’s debt ratio exceeds 0.6 (60%), it might struggle to borrow additional money, as lenders often have debt ratio limits.

The Dangers of Too Much Debt

Having a high debt ratio (above 60%) comes with several risks:

- Interest payments must be made regardless of profitability

- Less flexibility during economic downturns

- Difficulty securing additional financing

- Potential need to sell assets or declare bankruptcy if cash flow problems arise

- Higher interest rates on new loans

I remember consulting with a manufacturing client who pushed their debt ratio to nearly 70% to fund a major expansion. When a recession hit, they couldn’t maintain their debt payments and were forced to sell valuable equipment at a loss – a painful lesson about the dangers of excessive leverage.

The Surprising Risk of Too Little Debt

While having too much debt is obviously problematic, you might be surprised to learn that having too little debt can also be risky. A company with a 0% debt ratio means it never borrows to finance operations or growth – and that can actually limit returns to shareholders.

Why? Because debt financing is usually cheaper than equity financing (selling additional shares). Used wisely, debt can help a company:

- Fund growth opportunities

- Invest in new technology or equipment

- Expand into new markets

- Take advantage of tax benefits (interest payments are often tax-deductible)

Different Types of Debt Ratios

Beyond the basic debt ratio, there are several variations that provide different insights:

For Businesses:

- Debt-to-Equity Ratio: Compares total liabilities to shareholders’ equity

- Interest Coverage Ratio: Shows how easily a company can pay interest on outstanding debt

- Debt Service Coverage Ratio: Measures ability to meet all debt obligations

For Individuals:

-

Non-mortgage debt-to-income ratio: Should be 20% or less of net income

- 15% or lower is considered healthy

- Above 20% is a warning sign

-

Housing debt-to-income ratio: Should be 28% or less of gross income

- Includes mortgage payments, property taxes, and insurance

-

Total debt-to-income ratio: Should be 36% or less of gross income

- Some lenders accept up to 43%

- Includes all recurring debt payments

Industry Comparisons: What’s Normal?

Debt ratios vary significantly across industries. Here’s a quick comparison:

| Industry | Typical Debt Ratio Range |

|---|---|

| Technology | 30-40% |

| Healthcare | 40-50% |

| Manufacturing | 50-60% |

| Utilities | 55-65% |

| Retail | 40-55% |

These are just guidelines – even within industries, there’s considerable variation. For example, a mature software company might have a lower debt ratio than a tech startup needing capital for rapid growth.

How to Calculate Your Company’s Debt Ratio

Calculating your debt ratio is straightforward. You’ll need your balance sheet, which should show:

- Total liabilities (all debt and obligations)

- Total assets (everything the company owns)

Then simply divide:

Debt Ratio = Total Liabilities ÷ Total Assets

For example:

- Total Liabilities: $450,000

- Total Assets: $750,000

- Debt Ratio: $450,000 ÷ $750,000 = 0.6 or 60%

Improving Your Debt Ratio

If your company’s debt ratio is higher than you’d like, here are some strategies to improve it:

- Cut costs and increase revenue to boost profitability

- Refinance debt at lower interest rates

- Improve cash flows through better inventory or accounts receivable management

- Increase equity financing instead of taking on more debt

- Restructure debt to extend payment terms

- Sell underperforming assets to pay down debt

One client of mine successfully reduced their debt ratio from 75% to 45% over two years by implementing a strict cash management system and temporarily diverting all excess profits to debt repayment. It required sacrifice, but ultimately made the company much more financially stable.

Real-World Examples

Let’s look at some real examples to illustrate good and bad debt ratios:

Example 1: Healthy Debt Management

A manufacturing company with:

- Debt ratio of 45%

- Strong cash flow that easily covers interest payments

- Strategic use of debt to fund equipment upgrades

- Clear plan for debt reduction

This company is in a good position despite having significant debt because they’re managing it effectively and using it for productive purposes.

Example 2: Overleveraged Company

A retail chain with:

- Debt ratio of 75%

- Struggling to make interest payments

- Debt used primarily to cover operating losses

- No clear path to profitability

This company is in a dangerous position, with debt being used to stay afloat rather than create growth.

The Impact of Economic Conditions

Your ideal debt ratio also depends on broader economic conditions:

- During economic growth: Companies can usually manage higher debt ratios

- During recessions: Lower debt ratios provide more safety

- In high interest environments: Lower debt is preferred due to higher servicing costs

- In low interest environments: Higher debt might be acceptable if used strategically

We saw this play out dramatically during the COVID-19 pandemic, when companies with low debt ratios were able to weather the storm much better than their highly leveraged competitors.

Finding Your Company’s Sweet Spot

So how do you determine the ideal debt ratio for your business? Consider these factors:

- Industry benchmarks: Research typical ratios in your sector

- Growth plans: Will you need financing for expansion soon?

- Cash flow stability: How predictable is your revenue?

- Interest rate environment: Current and projected rates

- Risk tolerance: Both yours and that of your investors

I typically recommend that small to medium businesses aim for a debt ratio between 30-50%, with adjustments based on the factors above.

Warning Signs to Watch For

Regardless of your industry, these red flags suggest your debt level might be problematic:

- Struggling to make interest payments

- Regularly borrowing to cover operating expenses

- Declining credit score or increasing interest rates

- Lenders rejecting additional financing requests

- Cash flow problems despite reasonable sales

In the end, a “good” debt ratio isn’t about hitting some magic number – it’s about finding the right balance for your specific business situation. Too much debt creates risk and limits flexibility, while too little might mean missed growth opportunities.

Most healthy companies maintain debt ratios between 30% and 60%, but the right number for your business depends on your industry, growth stage, cash flow stability, and economic conditions.

My advice? Monitor your debt ratio regularly, compare it to industry peers, and be strategic about when and why you take on debt. Remember, debt isn’t inherently good or bad – it’s a tool that, when used wisely, can help your business grow and thrive.

Have you checked your company’s debt ratio lately? I’d love to hear where you stand and what challenges you’re facing with managing your debt levels. Drop me a comment below!

What Is A Good Debt Ratio Percentage? – CreditGuide360.com

FAQ

What debt ratio is too high?

Key takeaways

Debt-to-income ratio is your monthly debt obligations compared to your gross monthly income (before taxes), expressed as a percentage. A good debt-to-income ratio is less than or equal to 36%. Any debt-to-income ratio above 43% is considered to be too much debt.

Is 0.5 a good debt ratio?

Yes, a D/E ratio of 50% or 0.5 is very good. This means it is a low-debt business and the company’s equity is twice as high as its debts.

Is a 7% debt-to-income ratio good?

A DTI ratio of 35% or less shows you’re managing your debt well. This range may increase your chances of getting loans with competitive rates. It also means you likely have money left over for saving and unexpected expenses. If your DTI ratio falls between 36% and 41%, you may still be in good shape.

Is a debt ratio of 75% good?

A debt ratio of 75% means that 75% of a company’s assets are financed by debt. Whether this is “good” varies based on industry benchmarks and the company’s specific circumstances. But generally a debt ratio of 0.4 or below is considered to be favorable and as it suggests a lower reliance on debt.