Have you ever thought, “Why bother investing $50 or $100? It’s not gonna make a difference anyway”? I used to think the same way. But after years of research and personal experience, I’ve learned that investing small amounts isn’t just worth it—it might be the most powerful financial habit you’ll ever develop.

Let me break down why small investments matter and how they can transform your financial future, even if you’re starting with just a few bucks.

Why Many People Don’t Start Investing (And Why They’re Wrong)

Most folks think investing is only for the rich—you know those people who can drop thousands into the market without breaking a sweat. I get it. When you’re struggling to make ends meet putting $25 a month into investments seems pointless.

But here’s the hard truth: waiting until you have “enough” money to invest is one of the biggest financial mistakes you can make.

As Robert G. Allen, author of several personal finance bestsellers perfectly said “How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.”

While keeping money in savings accounts and having an emergency fund is essential for short-term needs investing for the future is arguably just as crucial for long-term wealth building.

The Magic of Starting Small: Time Is Your Best Friend

The single greatest advantage any investor can have isn’t a huge bank account—it’s time. And this is where small investors actually have an edge.

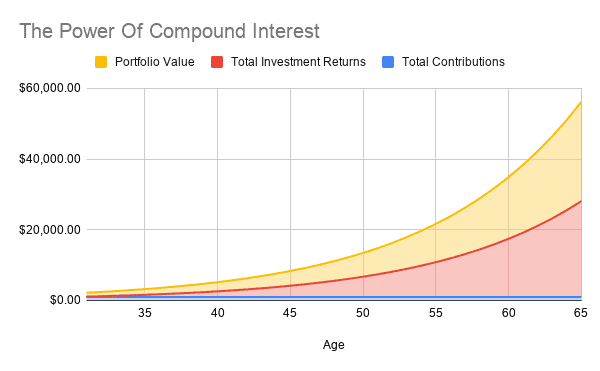

When you invest, even small amounts, compound interest becomes your secret weapon. Compound interest is basically interest on interest—your money makes money, and then that money makes more money.

Let me show you what I mean:

Corbin Blackwell, a senior financial planner at Betterment, gives this example: “Let’s say you invested just $100 today and saw a 5% annual return – thanks to the power of compound interest, if you don’t touch your investment, in 30 years you’d have $430.”

That might not sound impressive, but look what happens when you invest consistently:

If you invest $100 monthly for 30 years into an index fund with a conservative 8% return (the S&P 500’s historical average is actually around 10.7%), you’d end up with over $146,000!

The shocking part? Your total contributions would only be $36,000, which means your money would have quadrupled in value. That’s the power of compound interest and time.

The S&P 500 Example: Small Investments, Big Returns

Many financial experts recommend index funds like the S&P 500 for beginners and small investors. Some call it a “boring investment,” but the results are anything but boring.

During the COVID-19 pandemic, the S&P 500 dropped 33% between January and March 2020. But since then? It’s grown by more than 110% in value.

This demonstrates an important lesson: markets go up and down, but riding the waves over the long term typically produces the largest returns. Trying to time the market is nearly impossible, even for professionals.

How to Start Investing with Small Amounts (A Step-by-Step Guide)

1. Build a Budget That Works for You

Before investing a dime, you need to know how much you can afford to put away. As Blackwell advises, you should only invest money that you don’t need for daily expenses like food, rent, and high-interest debt payments.

Creating a budget gives you clarity on where your money goes each month and helps identify areas where you might cut back to free up investment cash. You can use:

- Budgeting apps like Empower

- Spreadsheets

- The simple pen and paper method

I personally use Empower because it lets me track expenses and monitor my investments in one place. Whatever method you choose, having a budget helps ensure you don’t cut into essential spending when investing.

2. Choose Your Investment “Bucket”

There are several account types you can use to hold your investments:

- Roth IRA: Great if you expect to be in a higher tax bracket when you retire (contributions are taxed now, but growth and withdrawals after 59½ are tax-free)

- Traditional IRA: Contributions may be tax-deductible now, but you’ll pay taxes when you withdraw

- HSA: If eligible, these offer triple tax advantages for healthcare expenses

- 529 Plans: For education expenses

- Taxable Brokerage Account: Offers flexibility but fewer tax advantages

3. Select Your Investments

This is where many beginners get stuck. With countless options from individual stocks to ETFs to crypto, it’s easy to feel overwhelmed.

For long-term investors starting with small amounts, index funds are often ideal because they:

- Have low fees

- Require little maintenance

- Provide broad market exposure

- Historically deliver stable returns

As John Bogle, founder of Vanguard, wisely put it: “Don’t look for the needle in the haystack. Just buy the haystack.”

4. Automate Your Investing

This step is crucial! Once you’ve decided how much to invest monthly, set up automatic transfers from your checking account to your investment account.

Automating investments helps overcome what psychologists call “present bias”—our tendency to value immediate gratification over future benefits. It’s much easier to spend money now than save for later, but automation removes this temptation.

By making investing passive, you’ll consistently grow your nest egg without having to make the decision month after month.

5. Consider Using a Robo-Advisor

If choosing investments feels intimidating, robo-advisors like Betterment or Wealthfront can be great for beginners. These platforms:

- Ask questions about your financial situation and goals

- Create a diversified portfolio based on your answers

- Automatically rebalance your investments

- Often charge lower fees than human advisors

Best Brokerages for Small Investors

To start investing, you’ll need an account with a brokerage that serves as the middleman between you and the market. When choosing a brokerage, consider:

- Fees: Look for no or low-fee options without minimum deposits

- Ease of use: Choose platforms with interfaces you find intuitive

- Promotions: Some brokerages offer sign-up bonuses (I recently got $100 from Fidelity after depositing just $50)

Here are some top options for small investors:

Fidelity Investments

- No minimum to open accounts

- Zero commission fees for stock, ETF, and options trades

- No transaction fees for over 3,400 mutual funds

- Offers fractional shares (meaning you can buy portions of expensive stocks)

TD Ameritrade

- No account minimum

- Zero commission fees for stock, ETF, and options trades

- Zero transaction fees for hundreds of mutual funds

- Excellent educational resources for beginners

Vanguard

- Known for having some of the lowest-cost index funds

- $0 commissions on stocks and ETFs

- Large selection of no-transaction-fee mutual funds

- Excellent for long-term investors

Real Talk: The Challenges of Investing Small Amounts

Let’s be honest—there are some downsides to starting small:

-

Growth feels slow at first: When you’re only investing $50 a month, seeing your balance grow by a few dollars can feel discouraging.

-

Diversification can be harder: With limited funds, it’s more difficult to spread your investments across many different assets.

-

Fees can eat a larger percentage: Even small fees can take a bigger bite out of small portfolios.

However, these challenges shouldn’t stop you from starting. Many brokerages now offer fractional shares and fee-free investing options specifically designed for small investors.

My Personal Experience: Small Steps to Big Results

When I first started investing, I could only afford to put away $25 per paycheck. It felt almost pointless—watching that tiny balance fluctuate by cents some days. After six months, I had less than $300 invested, and I almost gave up.

But I stuck with it, gradually increasing my contributions as my income grew. Seven years later, that initial habit has grown into a significant portfolio that’s weathered market ups and downs.

The most valuable thing wasn’t the initial money—it was developing the investing habit early. By starting small, I learned how markets work without the pressure of having large sums at risk.

Common Questions About Investing Small Amounts

Is it better to save money until I have a larger amount to invest?

No! Time in the market beats timing the market. Starting with small, regular investments typically outperforms waiting to invest a lump sum later.

What’s the minimum amount I should invest?

There’s no magic number. Even $5-10 per week consistently invested can grow significantly over time. The important thing is starting the habit.

Should I invest small amounts or pay off debt first?

Generally, prioritize paying off high-interest debt (like credit cards) before investing. However, low-interest debt (like mortgages) shouldn’t necessarily prevent you from starting to invest.

How long will it take to see significant growth?

This depends on your investment amount, frequency, and market performance. The first few years may show modest growth, but compound interest accelerates dramatically over longer periods.

Bottom Line: Small Investments Today, Big Results Tomorrow

Before investing, make sure you have:

- A fully funded emergency fund (3-6 months of expenses)

- Paid off high-interest debt

- A clear budget that allows for consistent investing

Once those foundations are in place, even small investments can help achieve your short and long-term financial goals.

Remember, few if any investors start with large sums of money. Growing wealth happens gradually through consistent habits over time. The most important step is simply getting started—no matter how small the amount.

As the Chinese proverb says, “The best time to plant a tree was 20 years ago. The second best time is now.” The same is true for investing. Your future self will thank you for every dollar you invest today, no matter how small it seems.

What small amount could you start investing today? Even if it’s just $10 or $20, that first step might be the beginning of your wealth-building journey.

Why you should start investing today

Investing can be an intimidating word and concept for many reasons. There are a large amount of terms, tax implications, planning and investments to understand — along with knowing there will be market fluctuations making your net worth go up and down. But by understanding the mere basics, you can begin to grow your wealth quickly.

Corbin Blackwell CFP, senior financial planner at wealth management app Betterment, told Select that, “Investing is one of the best ways to grow your long-term wealth and reach major goals for things like retirement, buying a home and college funds.”

She also said that beginning the investing journey is often the most difficult part, as growth will be limited at first. He added that, “Tools available today, like digital investment advisors, make it easier than ever to get started.”

And by getting started today, you have the best asset that any investor can have on their side: time.

By letting your money sit in the market longer, you allow for compound interest to take over — which is when your interest and gains stack on top of one another. Blackwell gives an excellent example of the power of compound interest:

“Lets say you invested just $100 today and saw a 5% annual return – thanks to the power of compound interest, if you dont touch your investment, in 30 years youd have $430.”

Thats an ok return, but imagine if you invested $100 monthly for 30 years into a common index fund. An index fund is a fund that has a group of companies within it, and tracks the performance of the entire group. These groups can range in focus including the size of each company, the respective industries, location of the companies, type of investment and more. One of the most popular indices, the S&P 500, consists of the 500 largest companies in the United States, making it a relatively safe investment because of its exposure to hundreds of companies and dozens of industries.

Many consider this a boring investment, but the results the index has produced are nothing to balk at.

The average yearly return of the S&P 500 over the last 30 years is 10.7%, but even at a conservative return of 8%, you would have over $146,000 if you invest $100 a month for 30 years. The impressive part is that your total contributions would be $36,000, which means your money would have quadrupled in value in 30 years (note that past performance does not guarantee future success).

In short, the more money and more time you have in the market, the more likely you are to grow your investment funds.

How to begin investing

If growing your net worth is your goal, you can get started in just a few minutes. Here are a few things to consider: