Are you worried about what will happen to your hard-earned retirement savings after you’re gone? You’re not alone. Many people invest diligently in IRAs throughout their working years but neglect to consider how these accounts will be handled after death. Let’s dive into the sometimes confusing world of IRAs and estates.

Understanding How an IRA is Handled in an Estate

Individual Retirement Accounts (IRAs) don’t automatically follow the instructions in your will This surprises many folks! The way your IRA gets distributed depends largely on one critical document your beneficiary designation form

When someone passes away, their IRA typically follows one of two paths:

- Direct transfer to named beneficiaries – bypassing the estate entirely

- Flowing into the estate – when no beneficiary is named or the estate is specifically designated

The difference between these two paths is HUGE and can dramatically affect how quickly your heirs receive the money, how much they’ll pay in taxes, and how complicated the process becomes

What Happens When Your IRA Goes to Named Beneficiaries?

When you’ve properly named beneficiaries on your IRA, good things happen:

- The account transfers directly to your beneficiaries without going through probate

- Your beneficiaries gain access to the funds more quickly

- They typically have more flexibility in how they withdraw the money

- The account remains protected from creditors in many cases

- The tax implications can be more favorable

Your beneficiaries will have different options depending on their relationship to you. Spouses generally have the most flexibility, including the ability to roll the inherited IRA into their own account.

What Happens When Your IRA Goes to Your Estate?

Now here’s where things can get messy. If your IRA becomes part of your estate (either by designation or default), several disadvantages kick in:

- The IRA must go through probate court (time-consuming and public)

- Distribution timelines are accelerated (generally 5 years instead of 10)

- Higher taxes are likely due to compressed withdrawal schedules

- Estate creditors may be able to access the funds

- Additional costs like probate fees eat away at the balance

As the article from SmartAsset points out, “When someone names their estate as the beneficiary of their IRA, the account does not pass directly to heirs but instead becomes part of the probate process. In practice, this can result in less flexibility, an accelerated distribution timeline and potentially higher taxes.”

The SECURE Act and Its Impact on Inherited IRAs

The SECURE Act of 2019 significantly changed the rules for inherited IRAs. Most non-spouse beneficiaries now must empty the account within 10 years of the original owner’s death (the so-called “10-year rule”).

However, if the IRA goes through the estate, things get even more restrictive. In most cases, the entire account must be emptied within just 5 years! This means larger withdrawals and potentially much higher tax bills for your heirs.

Why Would Anyone Name Their Estate as IRA Beneficiary?

Despite the disadvantages, there are a few reasons someone might choose to name their estate as the beneficiary of their IRA:

- Simplicity: Some people find it easier to let their will dictate the distribution of all assets

- Indecision: If you can’t decide who should receive your IRA, letting it pass to your estate might seem like a way to avoid making a choice

- Limited options: People without close relatives might prefer estate distribution

- Special circumstances: In rare cases involving minor children or special needs beneficiaries, estate planning attorneys might recommend this approach

But honestly, in most situations, naming specific beneficiaries directly on your IRA is way better than letting it pass through your estate.

Real-World Example: The Cost of Poor IRA Planning

Let’s imagine Tom has a $500,000 IRA but never updated his beneficiary form after his divorce. When Tom dies, his IRA defaults to his estate. Here’s what happens:

- The IRA gets tied up in probate for 8 months

- The account must be emptied within 5 years instead of 10

- Tom’s adult children must take larger annual distributions, pushing them into higher tax brackets

- They pay approximately $25,000 more in taxes than they would have if named directly

- Probate fees and estate administration costs eat up another $15,000

In total, poor planning cost Tom’s family about $40,000 – money that could have stayed in their pockets if Tom had simply updated his beneficiary form.

How to Properly Designate IRA Beneficiaries

To avoid these pitfalls, follow these steps:

- Contact your IRA administrator to confirm current beneficiaries

- Update your beneficiary form if needed (marriage, divorce, birth, death, etc.)

- Consider both primary and contingent beneficiaries

- Be specific about percentages if naming multiple beneficiaries

- Review your designations periodically (at least every 3-5 years)

- Consider consulting with a financial advisor or estate attorney for complex situations

Remember: Your beneficiary designation form overrides your will when it comes to your IRA!

Special Considerations for Different Types of Beneficiaries

Spouse Beneficiaries

- Can roll the inherited IRA into their own IRA

- Can take required minimum distributions based on their own life expectancy

- Generally have the most flexibility

Non-Spouse Individual Beneficiaries

- Must typically empty the account within 10 years (SECURE Act rules)

- Can take distributions in any amount during that period

- No longer allowed to stretch distributions over their lifetime (with some exceptions)

Trust Beneficiaries

- Rules depend on whether the trust qualifies as a “see-through” trust

- Complex rules apply – consult with an estate planning attorney

- Can provide protection and control but with potential tax trade-offs

Charity Beneficiaries

- Charities don’t pay income tax, so they receive the full amount

- Can be a tax-efficient way to make charitable gifts

- Consider naming charities for traditional IRAs while leaving Roth IRAs to family

When Naming Your Estate Might Make Sense

While generally not ideal, naming your estate as IRA beneficiary might occasionally make sense:

- When you want to create a trust for a minor through your will

- When you have substantial debts that need to be paid from all available assets

- When you have very complex family situations that require court oversight

- When your estate is small enough that probate costs aren’t significant

But even in these cases, there are usually better alternatives, such as establishing a trust and naming it as the beneficiary rather than your estate.

Common Mistakes to Avoid

People make these mistakes all the time with their IRAs:

- Forgetting to name any beneficiary – resulting in default to the estate

- Not updating beneficiaries after life changes – like marriage, divorce, or births

- Naming only one beneficiary with no contingents

- Naming minors directly without considering guardianship issues

- Assuming your will controls your IRA – it doesn’t!

- Naming your estate to avoid making choices – creates more problems than it solves

Bottom Line: Take Action Now

Your IRA represents years of diligent saving and investing. Don’t let poor planning diminish what you’re able to leave to your loved ones.

If you haven’t reviewed your IRA beneficiary designations recently, do it NOW. It takes just a few minutes to check and update them if needed. This small action could save your heirs thousands in taxes and months of headaches.

And if your situation is complex, consider working with a financial advisor who specializes in estate planning. They can help ensure your retirement assets pass to your loved ones as efficiently as possible.

Remember, your family will thank you for taking care of these details in advance. It’s one of the most loving things you can do for them!

FAQ About IRAs and Estates

Q: Does my IRA automatically go to my spouse when I die?

A: Only if you’ve named your spouse as the beneficiary. If you haven’t named anyone, it typically goes to your estate.

Q: Can I name my estate as beneficiary and then control distribution through my will?

A: Yes, but this subjects the IRA to probate, accelerated distribution timelines, and potentially higher taxes.

Q: What happens if my named beneficiary dies before me?

A: If you’ve named contingent beneficiaries, the assets go to them. If not, the IRA typically defaults to your estate.

Q: Can creditors access my IRA after I die?

A: If your IRA passes directly to named beneficiaries, it’s generally protected from your creditors. If it goes through your estate, creditors may have access to it.

Q: Do beneficiaries pay taxes on an inherited IRA?

A: Yes, beneficiaries generally pay income tax on distributions from traditional IRAs. Roth IRA distributions are typically tax-free if the account met the 5-year holding requirement.

Remember, planning ahead for your IRA can save your heirs significant money and stress. Don’t put this off – check your beneficiary designations today!

Rules Surrounding Inherited IRAs

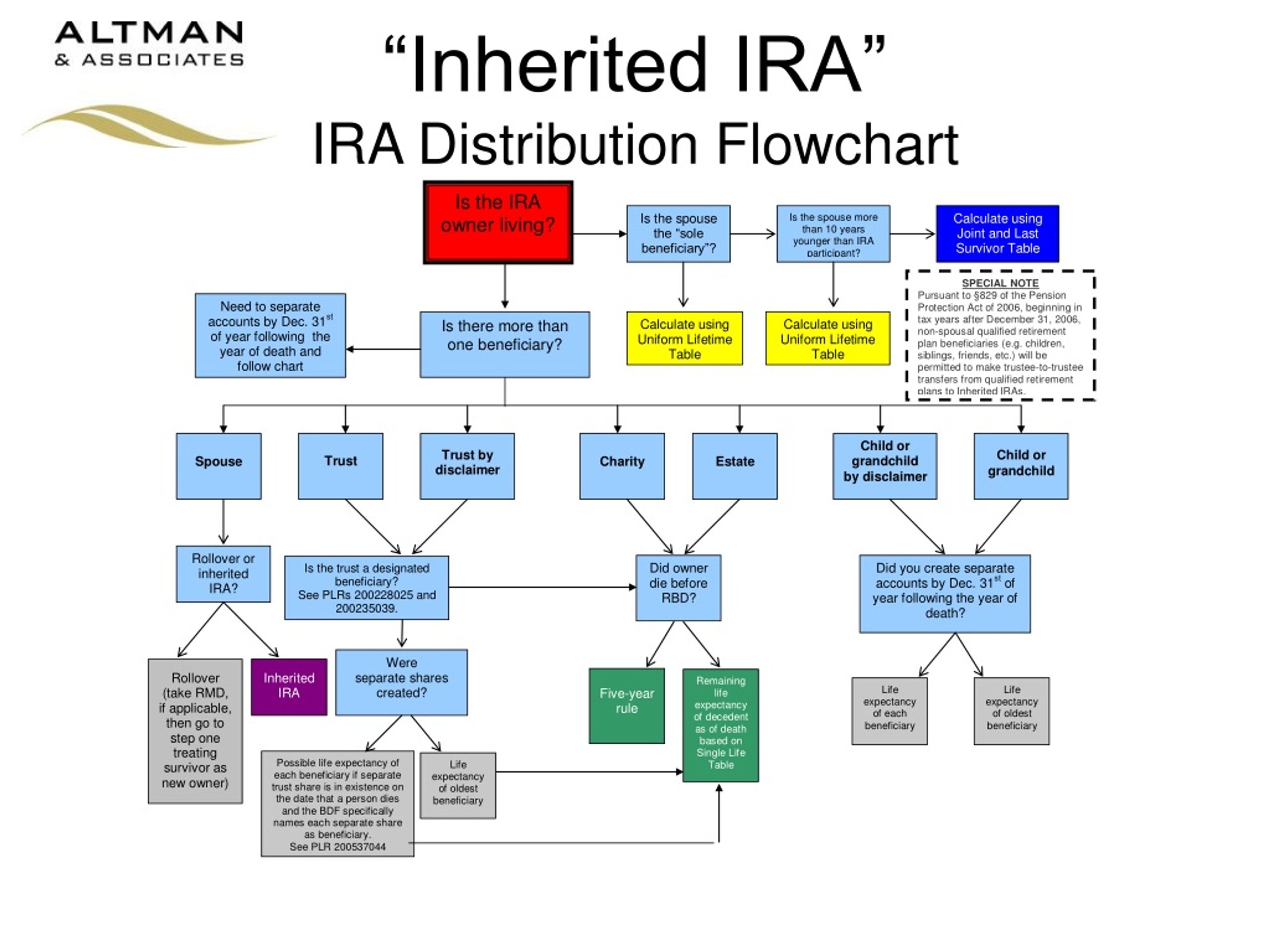

How the inherited IRA is handled depends on your relationship to the deceased person, as well as your age.

For example, rules governing an inherited IRA from a spouse are different from the rules for a non-spouse beneficiary. The age of the beneficiary at time of inheriting the IRA is another factor.

Who Can Be a Beneficiary of an Inherited IRA?

The IRS defines three categories of beneficiary:

- Eligible Designated Beneficiary

- Designated Beneficiary

- Non-Designated Beneficiary

This category includes a

- Surviving spouse

- Disabled person

- Chronically ill person

- Minor child

- Person who is not more than 10 years younger than the account owner

Eligible designated beneficiaries may also include trusts created to benefit disabled or chronically ill beneficiaries. Except for minor children, these beneficiaries may take distributions over their own life expectancy. Minor children beneficiaries are required to take all distributions within 10 years of reaching the age of majority.

A designated beneficiary is a non-spouse who doesn’t fall under one of the eligible designated beneficiary categories. This could be, for example, an adult son or daughter, or certain types of trusts. Designated beneficiaries must use all of the funds in an inherited IRA within 10 years of the original IRA owner’s death.

This includes charitable organizations, estates, and nonqualified trusts. These types of beneficiaries must withdraw the entire inherited IRA funds within five years of the IRA owner’s death (if distributions had not already begun before the person’s death, in the case of traditional IRAs). Read more details on IRA distributions for beneficiaries.