Ever wonder why some investors get so excited about dividend stocks? I’ve been there too. When I first started investing, dividends seemed like this mysterious bonus that only savvy investors understood But trust me, they’re not complicated at all!

In this comprehensive guide I’ll break down exactly what dividends are, show you real-world examples, and explain why they might be a valuable part of your investment strategy. By the end you’ll have a clear understanding of how these regular payments work and how they can contribute to your financial goals.

Understanding Dividends: The Basics

Dividends are basically a company’s way of sharing its profits with shareholders Think of it as a “thank you” payment for investing in their business When a company earns money, they have two main choices reinvest that money back into the business or distribute some of it to shareholders in the form of dividends.

Key Points About Dividends:

- Dividends are portions of a company’s profits paid out to shareholders

- They’re typically paid on a regular schedule (quarterly, annually, or monthly)

- Not all companies pay dividends – it’s completely optional

- Dividend amounts must be approved by the company’s board of directors

As a shareholder, receiving dividends feels kinda like getting a bonus for being a part-owner of the company. It’s one of the two main ways investors make money from stocks (the other being capital appreciation when stock prices rise).

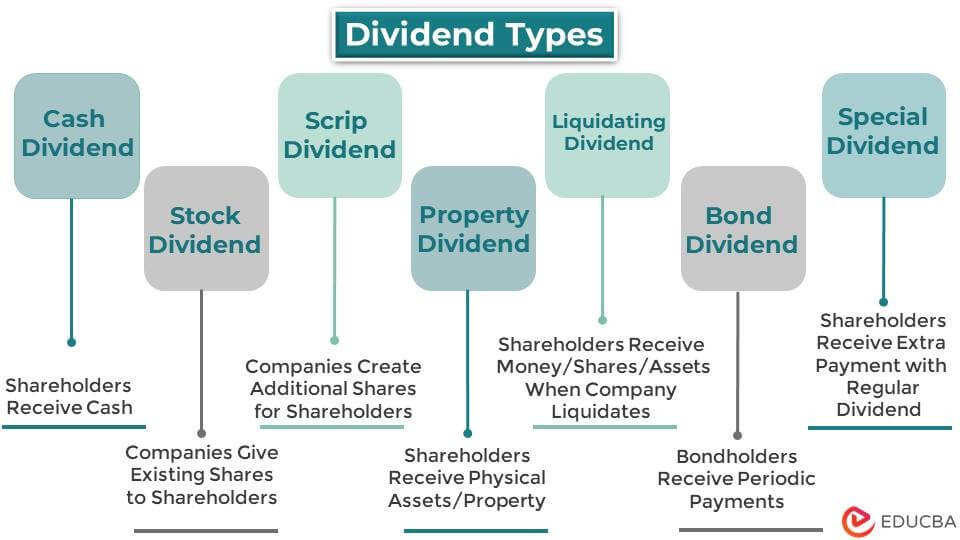

Types of Dividends You Should Know

When companies decide to pay dividends, they can do it in different ways:

Cash Dividends

The most common type! These are literal cash payments deposited directly into your brokerage account. For example, if a company declares a $2 per share dividend and you own 10 shares, you’ll receive $20 in dividend income.

Stock Dividends

Instead of cash, companies sometimes issue additional shares. This allows you to increase your ownership without buying more shares. It’s like the company saying “instead of giving you cash, we’re giving you more of us!”

Special Dividends

These are one-time payments that companies might distribute after particularly profitable periods or major business events like selling a subsidiary. They’re not regular and can’t be counted on for recurring income.

How Do Dividends Actually Work? The Process Explained

Let’s walk through the dividend process step by step:

-

Declaration: The company’s board of directors announces they’ll pay a dividend, including the amount per share and relevant dates.

-

Important Dates: Four key dates matter for dividend payments:

- Declaration Date: When the dividend is officially announced

- Ex-Dividend Date: The cutoff day for eligibility (if you buy shares on or after this date, you won’t get the upcoming dividend)

- Record Date: When the company checks its records to see who’s eligible

- Payment Date: When the money actually hits your account

-

Distribution: On the payment date, the company transfers the dividend to all eligible shareholders.

-

Reinvestment Option: Many investors choose to automatically reinvest their dividends to buy more shares, which can significantly boost returns over time through compounding.

Real-World Dividend Examples

Let’s look at some concrete examples to make this crystal clear:

Example 1: Cash Dividend from General Electric (GE)

According to GE’s 2017 financial statements, the company paid a dividend of $0.84 per share. If you owned 100 shares of GE at that time, you would’ve received $84 in dividend income that year ($0.84 × 100 shares).

Example 2: Dividend Yield Calculation

Imagine Company XYZ pays an annual dividend of $3 per share, and its stock currently trades at $60. The dividend yield would be:

Dividend Yield = Annual Dividend Per Share ÷ Current Share PriceDividend Yield = $3 ÷ $60 = 0.05 or 5%This means for every $100 invested, you’d receive approximately $5 in annual dividend income.

Example 3: Quarterly Dividend Schedule

Many companies like Coca-Cola pay dividends quarterly (every three months). If Coca-Cola declares an annual dividend of $1.76 per share, you’d receive $0.44 per share every quarter.

Why Do Companies Pay Dividends?

You might be wondering why companies give away money instead of keeping it all for growth. There are several good reasons:

-

Signal Financial Health: Regular dividend payments demonstrate that a company is profitable and financially stable.

-

Attract Investors: Many investors, especially retirees, prefer dividend-paying stocks for the reliable income stream.

-

Reward Shareholders: Dividends are a way for companies to share success with the people who’ve invested in them.

-

Mature Business Stage: Companies that have reached maturity may have fewer growth opportunities, making dividends a better use of cash.

But not every company pays dividends! Young, fast-growing companies (especially in tech and biotech) typically reinvest all their profits back into research, development, and expansion.

Which Companies Typically Pay Dividends?

Certain types of companies are more likely to pay regular dividends:

- Established “Blue Chip” Companies: Think Johnson & Johnson, Procter & Gamble, and Coca-Cola

- Utility Companies: Companies like Duke Energy or Southern Company

- Banks and Financial Institutions: JPMorgan Chase, Wells Fargo, etc.

- Real Estate Investment Trusts (REITs): Required by law to distribute 90% of taxable income

- Master Limited Partnerships (MLPs): Also required to make specified distributions

As an investor, knowing which sectors typically pay dividends can help you build a dividend-focused portfolio if that aligns with your investment goals.

The Impact of Dividends on Stock Prices

When a company pays a dividend, it affects the stock price in a predictable way. Here’s what typically happens:

-

When a dividend is announced, the stock price might increase slightly as investors buy in to receive the upcoming payment.

-

On the ex-dividend date, the stock price usually drops by approximately the amount of the dividend, since new buyers won’t receive the upcoming payment.

For example, if a stock trading at $50 declares a $2 dividend, the stock might trade at $52 just before the ex-dividend date. Then, on the ex-dividend date, it would likely open around $50 again.

Dividend Yield: A Key Metric for Dividend Investors

Dividend yield is super important for comparing the relative attractiveness of different dividend stocks. It’s calculated by dividing the annual dividend by the current stock price.

Dividend Yield = Annual Dividend Per Share ÷ Current Stock PriceFor example, if Company A pays an annual dividend of $3 on a $60 stock, its yield is 5%. If Company B pays $2 on a $50 stock, its yield is 4%. This makes Company A more attractive from a dividend perspective (though other factors matter too!).

However, beware of extremely high dividend yields (like 10%+), as they can sometimes indicate a company in trouble with a falling stock price.

How Dividends Appear in Financial Statements

When looking at a company’s financial statements, you’ll find dividend information in several places:

- Income Statement: Dividends aren’t considered expenses, so they don’t appear here

- Balance Sheet: Reflected in reduced retained earnings

- Cash Flow Statement: Found in the financing activities section

- Financial Reports: Often listed as “dividend per share” in quarterly or annual reports

For example, in GE’s quarterly statements, they clearly show the dividend per common share was $0.84 in 2017, $0.93 in 2016, and $0.92 in 2015.

Dividends vs. Share Buybacks: Alternative Ways to Return Value

Companies have two main ways to return capital to shareholders:

- Dividends: Direct cash payments to shareholders

- Share Buybacks: Using cash to repurchase shares in the open market

Buybacks reduce the number of outstanding shares, which can boost earnings per share and potentially increase the stock price. Many companies use a mix of both strategies.

Should You Focus on Dividend-Paying Stocks?

The answer depends on your personal investment goals:

Advantages of Dividend Investing:

- Regular income stream (great for retirement)

- Potential for lower volatility

- Companies are often more established and stable

- Compound growth through dividend reinvestment

Disadvantages:

- Possibly slower growth potential

- Tax implications (dividends are taxable)

- May indicate limited growth opportunities

How to Start Investing in Dividend Stocks

If you’re interested in building a dividend portfolio, here’s a simple way to get started:

-

Research Dividend-Paying Companies: Look for companies with consistent dividend payment histories and sustainable payout ratios.

-

Consider Dividend ETFs: Exchange-traded funds that focus on dividend stocks offer instant diversification.

-

Set Up a Dividend Reinvestment Plan (DRIP): Automatically reinvest your dividends to purchase additional shares.

-

Monitor Dividend Health: Watch for companies maintaining or increasing their dividends over time.

-

Track Your Dividend Income: Keep records of how much passive income your portfolio generates.

Frequently Asked Questions About Dividends

Are dividends guaranteed?

No! Companies can reduce or eliminate dividends at any time, though established dividend payers try to avoid this because it typically causes their stock price to fall.

How are dividends taxed?

Dividend income is generally taxable. Qualified dividends are taxed at lower capital gains rates, while non-qualified dividends are taxed as ordinary income. The specifics depend on your tax bracket and how long you’ve held the stock.

Can I live off dividend income?

Potentially! Many retirees build substantial dividend portfolios that generate enough income to cover living expenses. However, this usually requires a significant investment base.

Conclusion: Are Dividends Right for Your Portfolio?

Dividends can be an excellent way to generate passive income and build wealth over time. They provide tangible returns regardless of market volatility and can significantly boost total returns when reinvested.

However, they’re not the only factor to consider when investing. A balanced approach that considers growth potential, company fundamentals, and your personal financial goals is always the wisest strategy.

Whether you’re just starting your investment journey or looking to optimize an existing portfolio, understanding dividends is an important piece of the investment puzzle. They might not be flashy like the latest tech IPO, but dividend stocks have helped countless investors build substantial wealth through consistent payments and compounding returns.

Have you started investing in dividend stocks yet? What strategies have worked best for you? I’d love to hear about your experiences in the comments below!

Step 1: The Company Decides to Pay a Dividend

The first step in the dividend payment process begins with the company. When a company makes a profit, its board of directors decides whether to pay out a portion of these profits as dividends to shareholders. This decision is based on factors like the company’s financial health, future growth plans, and overall business strategy.

Once the decision is made, the company announces the dividend amount per share and the schedule for payment. This announcement informs shareholders about the expected dividend they will receive.

There are several key dates to keep in mind when it comes to dividend payments:

- Declaration Date: This is the date when the company officially announces its intention to pay a dividend. The declaration includes the dividend amount, payment date, and other relevant details.

- Ex-Dividend Date: The ex-dividend date is the cutoff day to be eligible for the dividend. If you purchase shares on or after this date, you will not receive the upcoming dividend. The ex-dividend date is usually set one or two business days before the record date.

- Record Date: The record date is when the company looks at its records to determine who the eligible shareholders are. If you own shares on this date, you will receive the dividend.

- Payment Date: This is the date when the dividend is actually paid out to shareholders. On this day, you will receive the dividend income, either in cash or additional shares, depending on the type of dividend.

How Do Dividends Work?

Understanding how dividend payments work is essential for anyone interested in investing in or analyzing dividend-paying businesses.