Debt can be a useful way to start your business, but without proper financial management and care, things can turn ugly quickly.

Starting a small business can take a lot of time and money, which is why many entrepreneurs leverage debt in the beginning. Debt can be a useful tool to get your business off the ground, but you must make sure your debt is working for you, not against you.

If your debt and expenses begin to outpace your revenue, this can lead to significant financial problems. This article will explain how much business debt is too much and what steps you can take to improve your business’s financial standing.

Running a business without any debt is like trying to build a house with just your bare hands—possible, but incredibly inefficient At the same time, drowning in too much debt can sink even the most promising companies So where’s that sweet spot? Let’s dive into the world of corporate debt and figure out when enough becomes too much.

The Debt Dilemma: A Balancing Act

When I talk to small business owners there’s always this nervous look they get when discussing debt. And I get it! Taking on debt feels risky. But here’s the thing—debt isn’t inherently bad. Actually it can be a powerful tool when used strategically.

As Harvard Business Review points out in their article “How Much Debt Is Right for Your Company,” many CFOs have faced challenges with balancing financing needs and maintaining healthy balance sheets. During the 1970s, many companies leveraged every new dollar of equity with approximately 3½ dollars of debt, which led to significantly higher interest payments relative to pre-tax profits.

The real question isn’t whether you should have debt—it’s how much debt is appropriate for your specific business situation.

Good Debt vs. Bad Debt: Know the Difference

Not all debt is created equal. Understanding the distinction between good debt and bad debt is crucial for any business owner.

Good Debt: The Growth Engine

Good debt is essentially an investment in your company’s future. It’s money borrowed to acquire assets that will generate positive returns over time. Think of it as using someone else’s money to help your business make more profit.

Examples of good debt include:

- Loans for purchasing essential equipment

- Financing to expand business operations

- Investment in research and development

- Capital for purchasing property that will appreciate

Bad Debt: The Profit Drain

On the flip side, bad debt carries high interest rates and offers little to no long-term value or Return on Investment (ROI). This type of debt can strain your cash flow and prevent strategic growth.

Examples of bad debt include:

- Credit card debt for non-essential expenses

- Short-term loans with excessive fees

- Unsecured personal loans used for covering routine business expenses

Warning Signs: When Debt Becomes Dangerous

There’s no magic number that works for every business, but there are definite red flags that suggest you’ve taken on too much debt:

- You’re constantly juggling payments to different creditors

- Past-due bills are piling up on your desk

- Cash flow is so tight you run out of money before month-end

- You’re considering new debt just to cover existing debt payments (yikes!)

- Overdraft notices have become a regular occurrence

- Interest payments are eating up a substantial portion of your profits

If you’re nodding your head reading this list, it might be time to rethink your debt strategy.

The Debt-to-Income Ratio: Your Financial Health Meter

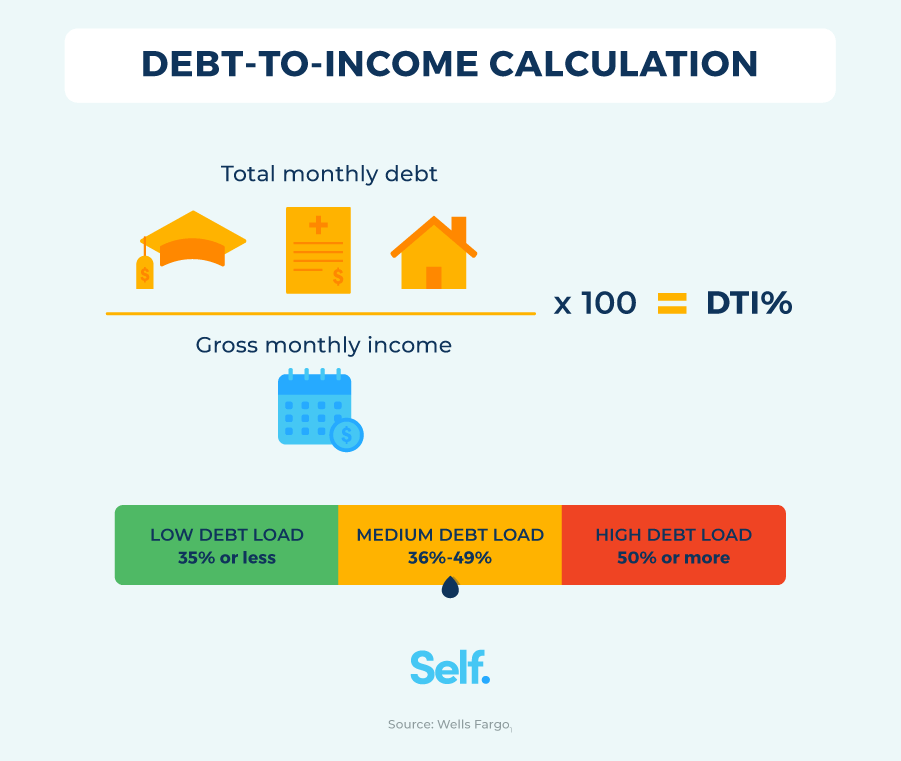

One of the most useful metrics for evaluating debt levels is the debt-to-income ratio (DTI). This ratio compares your total debt obligations to your business’s income.

To calculate your business DTI:

- Add up all monthly debt payments

- Divide by monthly income

- Multiply by 100 to get a percentage

For example, if your monthly debts total around $2,000, and your monthly income is $8,000, your DTI would be 25%.

While there’s no universal threshold that works for all businesses, a healthy DTI generally falls around 30-40%. Once you start approaching or exceeding 50%, it’s time to be concerned.

Industry Matters: Context Is Everything

What’s considered “too much debt” varies dramatically by industry. Capital-intensive industries like manufacturing or real estate typically operate with higher debt levels than service-based businesses.

Here’s a simple breakdown of typical debt tolerance by industry type:

| Industry Type | Typical Acceptable Debt-to-Income Ratio |

|---|---|

| Service-based | 15-30% |

| Retail | 20-40% |

| Manufacturing | 30-50% |

| Real Estate | 40-60% |

| Tech Startups | Varies widely (often higher during growth) |

Your business stage also matters. A startup might justifiably carry more debt during its growth phase, while a mature business should aim for greater stability.

The Hidden Costs of Excessive Debt

Too much debt doesn’t just show up as numbers on a balance sheet—it has real operational consequences:

- Limited flexibility: High debt payments restrict your ability to respond to market opportunities or threats

- Higher risk premium: Lenders and investors demand greater returns when they perceive higher risk

- Management distraction: When you’re focused on meeting debt obligations, you’re not focusing on growing your business

- Damaged relationships: Late payments to vendors can harm important business relationships

- Personal stress: The weight of excessive debt takes a toll on business owners’ wellbeing

Strategies for Climbing Out of Debt

If you’ve recognized you’re carrying too much debt, don’t panic. There are practical steps you can take:

Prioritize and Plan

Start by organizing your debts based on interest rates and urgency. Many financial experts recommend the “debt avalanche” method—focusing on the highest-interest debt first while making minimum payments on the rest. This approach saves money on interest over time.

Refinance for Relief

Explore refinancing options to secure lower interest rates and better terms. Refinancing can provide immediate relief by reducing monthly payments and improving cash flow. I recently helped a client refinance a business loan from 12% interest to 7%, saving them over $15,000 annually.

Boost Your Sales

Increasing revenue is another effective way to reduce financial strain. Focus on enhancing your sales efforts, exploring new markets, or diversifying your product or service offerings to generate additional income.

Cut Unnecessary Expenses

Take a hard look at your expenses and identify areas where you can reduce spending without compromising the quality of your products or services. Sometimes even small cuts across multiple areas can add up to significant savings.

Negotiate with Creditors

Don’t be afraid to reach out to your creditors to discuss your situation. Many are willing to work with businesses facing temporary financial challenges by offering extended payment terms or even reducing the principal amount owed.

The Role of Financial Advisors

Navigating debt management can be overwhelming for business owners who are already juggling multiple responsibilities. This is where financial advisors come in. They provide expertise in:

- Analyzing your current debt structure

- Developing sustainable debt management strategies

- Identifying refinancing opportunities

- Creating cash flow projections

- Negotiating with creditors on your behalf

Many business owners hesitate to hire financial advisors due to cost concerns, but the insights and strategies they provide often save far more than their fees.

Case Study: Finding Balance

Let me share a quick story. One of my clients, a small manufacturing company, was struggling with debt that had accumulated during a rapid expansion phase. Their DTI had crept up to nearly 55%, and they were beginning to miss payments to suppliers.

We implemented a three-pronged strategy:

- Refinanced their equipment loans to extend the term and lower monthly payments

- Negotiated with their largest supplier for extended payment terms

- Implemented a new pricing strategy that increased margins by 3%

Within 18 months, they brought their DTI down to 38% and restored positive relationships with suppliers. The business is now in a position to consider strategic growth opportunities again.

When Debt Makes Sense: Strategic Leverage

Despite the risks, there are times when taking on additional debt makes perfect sense:

- When ROI exceeds interest costs: If a project will generate returns higher than the cost of financing it, debt can be a smart move

- To take advantage of time-sensitive opportunities: Sometimes market opportunities won’t wait for you to save up the cash

- For tax advantages: In many jurisdictions, interest payments are tax-deductible, reducing the effective cost of borrowing

- To preserve equity: Debt financing allows you to grow without diluting ownership

The Takeaway: Balance is Key

So, how much debt is too much for your company? The answer depends on your industry, business stage, cash flow stability, and growth plans. But regardless of your specific situation, here are some universal principles:

- Monitor your DTI regularly and aim to keep it below 40% in most cases

- Distinguish between good and bad debt when making financing decisions

- Consider the total cost of debt, not just the monthly payment

- Maintain some borrowing capacity for unexpected opportunities or challenges

- Review and adjust your debt strategy as your business evolves

At the end of the day, debt is just a tool—and like any tool, its value depends entirely on how you use it. Used wisely, debt can help your company grow and thrive. Used poorly, it can become a burden that limits your potential.

We’ve all made financing mistakes in our businesses (I know I have!), but with careful planning and regular monitoring, you can make sure debt remains your servant, not your master.

Need help figuring out your optimal debt strategy? Consider reaching out to a financial advisor who specializes in business finances. They can provide personalized guidance based on your specific situation and goals.

Remember, the goal isn’t necessarily to eliminate all debt—it’s to ensure that every dollar you borrow is working hard to build your company’s future.

Refinancing helps grow your business.

You can increase cash flow by refinancing your short-term debt into a long-term loan. Then you’ll have more capital available every month and you can concentrate on the expenses that matter most.

Refinancing makes life simpler.

If you’re tired of juggling multiple due dates, bills and interest rates, refinancing can make your life easier. Refinancing will provide you with a single loan, so you’ll have one debt payment to keep track of instead of several.

“If your business is making multiple monthly payments on business credit cards, equipment financing and working capital loans, your life as a business owner could be simplified by consolidating those into one financing option and one debt payment,” said Ben Johnston, chief operating officer of Kapitus.

How Much Debt Is Too Much Debt | CNBC

FAQ

How much debt is too much for a company?

While every business is different, it is generally recommended to maintain a debt ratio of less than 1 to prevent instability and maintain financial control …

What is an acceptable level of debt for a company?

What is considered bad debt for a company?

Bad debt owed to your business is debt that technically cannot be recovered, such as your customer becoming insolvent. Writing off bad debt from a customer can have a significant impact on cash flow, leading you not to be able to service your debts.

How to tell if a company has too much debt?

- You are struggling to cover short-term expenses such as payroll, inventory and bills.

- Your business is losing profitability.

- You can’t secure more financing or lenders are demanding that you meet stricter requirements such as personal guarantees.