Investing in dividend stocks may be considered as part of the goal to building long-term wealth. If you are interested in learning more about dividend stocks, this article may be helpful.

Ever wondered how those savvy investors seem to make money while they sleep? Well, they might be tapping into the power of dividends! I’ve been researching dividend investing for years, and I’m excited to share everything you need to know about getting paid from dividend stocks.

What Are Dividends Anyway?

Dividends are basically payments that companies make to their shareholders from their profits. Think of it as a “thank you” for investing in their business. When a company makes money and has extra cash that isn’t being reinvested back into the business they might decide to share some of that wealth with their investors.

As TD Direct Investing explains, “Dividend stocks are shares of companies that pay shareholders a portion of their profits in the form of dividends.”

How Do Dividends Actually Work?

Let me break down the process of how dividend payments actually happen:

- Company Earns Profits – First, a company must be profitable enough to have excess cash.

- Board Approves Dividend – The company’s board of directors decides to share some of those profits with shareholders.

- Dividend Announcement – The company announces when the dividend will be paid, how much, and the important dates.

- Payment Distribution – Finally, the company sends out the money to eligible shareholders.

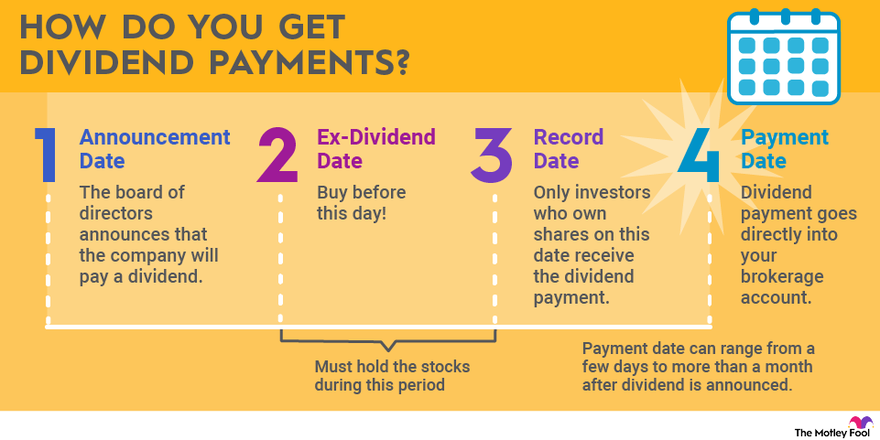

There are several important dates that you need to know if you want to receive dividends

- Declaration Date: When the company officially announces the dividend

- Ex-Dividend Date: The cutoff date to be eligible for the upcoming dividend (buy before this date!)

- Record Date: When the company checks its books to see who owns shares

- Payment Date: When the money actually hits your account

According to NerdWallet “Investors must have bought the stock at least two days before the official date of a dividend payment (the ‘date of record’) in order to receive that payment.”

Show Me the Money! How Dividend Payments Work

Now for the part you’re really interested in—how do you actually get paid?

Cash Dividends

Most commonly, dividends are paid in cash. Here’s how it works:

- The payment is calculated based on how many shares you own

- For example, if you own 100 shares and the dividend is $0.50 per share, you’ll receive $50

- Payments typically go directly into your brokerage account

- Most U.S. companies pay dividends quarterly, though some pay monthly or semi-annually

Stock Dividends

Sometimes, instead of cash, companies might pay you with additional shares of stock. This increases your ownership in the company without you having to buy more shares.

Dividend Reinvestment Programs (DRIPs)

Many investors choose to automatically reinvest their dividends to buy more shares of the same stock. This is called a DRIP, and it’s a powerful way to compound your returns over time. Some companies even offer discounts when you reinvest this way!

As TD Direct Investing points out, “Some companies may also offer a Dividend Reinvestment Plan (DRIP). Instead of receiving cash payments, dividends are paid to you in the form of additional shares.”

Types of Dividends You Can Receive

There are several different kinds of dividend payments you might encounter:

- Cash Dividends – The most common type, paid directly into your brokerage account

- Stock Dividends – Additional shares instead of cash

- Dividend Reinvestment Programs (DRIPs) – Automatically reinvest your dividends

- Special Dividends – One-time payments that don’t recur regularly

- Preferred Dividends – Payments to owners of preferred stock (which is more like a bond)

- Dividend Funds – Payments from ETFs or mutual funds that hold dividend stocks

How to Evaluate Dividend Stocks

Not all dividend stocks are created equal! Here’s how I evaluate them:

Dividend Yield

This is the annual dividend amount divided by the stock price, expressed as a percentage.

For example:

- If a $100 stock pays $4 in annual dividends, the yield is 4%

- If a $10 stock pays $0.40 in annual dividends, the yield is also 4%

A higher yield might seem better, but be careful—sometimes a very high yield can be a warning sign!

Dividend Payout Ratio

This shows what percentage of a company’s earnings are being paid out as dividends.

- Low payout ratio (10-30%): Company is reinvesting most profits for growth

- Medium payout ratio (30-55%): Balanced approach

- High payout ratio (55-75%+): Could be unsustainable

As NerdWallet warns, “If a company pays out 100% or more of its income, the dividend could be in trouble.”

Dividend Growth Rate

The best dividend companies increase their payouts over time. Some elite companies, called “dividend aristocrats,” have increased their dividends every year for at least 25 years!

As Fidelity research cited by NerdWallet found, “During periods of inflation, stocks that increased their dividends the most outperformed the broad market, on average.”

Dividend Coverage Ratio

This ratio shows how well a company’s cash flow supports its dividend payments. It’s calculated by dividing operating cash flow by total dividends paid.

Debt-to-Equity Ratio

While not directly related to dividends, a company’s debt level affects its ability to maintain dividend payments. Simply divide the company’s total debt by its total assets.

Companies That Typically Pay Dividends

The most reliable dividend payers tend to be well-established companies with stable cash flows that don’t need to reinvest all their profits for growth. Some examples include:

- Exxon Mobil (XOM)

- Target

- IBM

- Sherwin-Williams Co.

- Johnson & Johnson

- Verizon (VZ)

By contrast, high-growth companies like tech startups rarely pay dividends because they’re reinvesting profits to fuel expansion.

Pros and Cons of Dividend Investing

Let’s be honest about the good and bad of dividend investing:

Pros

- Steady income stream – Regular payments can supplement your income

- Tax efficiency – Qualified dividends are taxed at lower rates than regular income

- Lower volatility – Dividend stocks tend to be more stable

- Compounding potential – Reinvesting dividends can supercharge your returns

- Hedge against inflation – Companies that grow their dividends can help protect your purchasing power

Cons

- Limited growth potential – Dividend stocks typically grow more slowly

- Not guaranteed – Companies can cut dividends during tough times

- Dividend yield traps – Sometimes high yields signal trouble

- Tax implications – You’ll pay taxes on dividends even if you reinvest them

How to Start Investing for Dividends

Ready to get started? Here’s how:

- Open a brokerage account – You’ll need an account with a broker like TD Direct Investing, Charles Schwab, or another online broker

- Choose your investment approach:

- Individual stocks – Research and pick specific dividend-paying companies

- Dividend ETFs/funds – Buy funds that hold many dividend stocks

- Dividend aristocrats – Focus on companies with long track records of dividend increases

- Consider tax implications – Hold dividend stocks in tax-advantaged accounts when possible

- Set up dividend reinvestment – Many brokerages offer automatic dividend reinvestment programs

- Monitor your investments – Keep an eye on the companies’ financial health

Are Dividends Taxed?

Unfortunately, yes. Dividends are taxable, but how they’re taxed depends on whether they’re “qualified” or “ordinary” dividends:

- Qualified dividends: Taxed at preferential capital gains tax rates (0%, 15%, or 20% depending on your income)

- Ordinary dividends: Taxed at your normal income tax rate

To qualify for the lower tax rate, you must have owned the stock for at least 60 days during the 121-day period beginning 60 days before the ex-dividend date.

Dividend Investing Strategies

Here are some popular strategies for dividend investing:

Dividend Growth Investing

Focus on companies that consistently increase their dividends year after year, even if the current yield is modest. This approach prioritizes long-term income growth.

High-Yield Investing

Target stocks with above-average dividend yields for maximum current income. But be careful of yield traps!

Dividend Aristocrats

Invest in companies that have increased their dividends annually for at least 25 consecutive years. These tend to be blue-chip companies with stable businesses.

Dividend ETFs

For diversification, consider ETFs that focus on dividend stocks. These provide exposure to many dividend payers in a single investment.

Common Mistakes to Avoid

I’ve seen many new dividend investors make these mistakes:

- Chasing the highest yields without considering sustainability

- Ignoring dividend growth in favor of current yield

- Neglecting diversification across sectors and companies

- Failing to consider tax implications of dividend investments

- Overlooking total return (dividends plus stock price appreciation)

Frequently Asked Questions

Do ETFs pay dividends?

Yes! If the stocks held within an ETF pay dividends, those dividends are passed on to the ETF investors. There are also specialized dividend ETFs that specifically target dividend-paying companies.

What are stock dividends?

Stock dividends are paid in the form of additional shares rather than cash. Companies might do this when they want to reward shareholders but preserve cash.

Does it matter when I buy a dividend stock?

Absolutely! You must own the stock before the ex-dividend date to receive the next dividend payment. If you buy on or after that date, you’ll miss that payment (though the stock price will typically reflect this).

Can dividends be cut or eliminated?

Yes. Companies have no legal obligation to pay dividends, and they can reduce or eliminate them at any time—especially during economic downturns or financial difficulty.

How often are dividends typically paid?

Most U.S. companies pay dividends quarterly (every three months), but some pay monthly, semi-annually, or annually.

Final Thoughts

Dividend investing can be a fantastic way to generate passive income and build wealth over time. The regular cash payments provide not only income but also the opportunity to compound your returns through reinvestment.

Remember, the best dividend investments aren’t necessarily those with the highest current yields, but rather companies with strong financials, reasonable payout ratios, and histories of dividend growth.

Whether you’re just starting out or looking to enhance your existing portfolio, dividend stocks can be a valuable component of a well-rounded investment strategy. Just make sure to do your research, diversify appropriately, and consider the tax implications of your dividend investments.

Happy investing!

What are stock dividends?

Stock dividends are dividends paid to shareholders in the form of shares instead of cash. Companies often choose to pay stock dividends to shareholders when they have limited liquid cash available.

How do dividends work?

If a dividend is announced, qualified shareholders are notified through a press release, which usually includes the following information:

- The Declaration Date, which is the date the dividend is declared by the board. The announcement will include the dividend amount, the Ex-Dividend Date, the Record Date, and the Payment Date.

- The Ex-Dividend Date, which is the date the stock no longer trades with the dividend. If you purchase shares on or after the Ex-Dividend Date you are not entitled to the upcoming dividend payment. Typically, the Ex-Dividend Date is set to one business day before the record date.

- The Record Date, which is when companies review the list of shareholders to determine who is eligible to receive the upcoming dividend payment. To be on the companys books by the Record Date, an investor must purchase the stock at least one business day before the Record Date, due to the T+1 settlement rule in most Canadian and US markets (where stocks trade are settled one business day after the trade is made).

- The Payment Date, which is the day shareholders will receive the dividend payment

Dividends are often paid quarterly, but can be paid out on other frequencies (or even as a one-time payment, for special dividends). The amount received depends on the number of shares you own in that company.

For example, if you own 100 shares and are paid out $0.50 for every share, you may get $12.50 every quarter – or $50 annually.

To qualify for a dividend payout, you must be a “Shareholder of Record”. That means you must already be listed as one of the company’s shareholders on the Record Date.

Dividend payouts are usually in relation to the overall financial health of the company, as well as the price at which their stocks/shares are trading.

When there is a high-value dividend, it may indicate that the company is financially healthy and pulling a good profit.

However, high-value dividends may also point to signs that the company has no future projects planned and is using this cash to pay shareholders (rather than reinvesting it).

For companies with an established history of dividend payments, any significant reductions to the dividend amounts, or the elimination of dividends altogether, may be a warning about the company’s financial health. On the other hand, it might be a signal that management has a plan to reinvest that money into the growth of the company. That is why it is important to research the companies you’re considering investing in.