Nothing in this world is certain but death and taxes, Benjamin Franklin said. But even death can’t bring relief from taxes.

Yes, death can be a tax-triggering event. And there are two you should be aware of: the estate tax and inheritance tax.

The estate tax is levied on the things the deceased owns or has certain interests in when they die. The inheritance tax is paid by the heir.

The federal government has an estate tax only, but states can have one, both, or none, which can make death taxes even more confusing.

Most people probably won’t have to pay these taxes because thresholds are high. In 2019, for example, only 6,409 federal estate tax returns were filed. Of those, only about 40% were taxable but the revenue garnered was $13.2 billion, IRS data show. However, the Congressional Budget Office expects that revenue “to increase sharply after 2025, when the amount exempt from estate tax is scheduled to drop” in half due to the expiration of the Tax Cuts and Jobs Act.

Are you worried about your family paying a hefty tax bill on your house after you’re gone? You’re not alone! I’ve spent countless hours researching this topic because, let’s face it, none of us can escape death or taxes – but we CAN be smart about minimizing those taxes on our loved ones.

As Benjamin Franklin famously said “Nothing in this world is certain but death and taxes.” But even though death is inevitable, the taxes that come with it don’t have to be so painful for your heirs.

In this article, I’ll walk you through practical strategies to protect your house from inheritance taxes. These aren’t just theoretical ideas – they’re proven methods that can potentially save your beneficiaries thousands of dollars.

Understanding Inheritance Taxes vs. Estate Taxes

Before diving into avoidance strategies, it’s super important to understand what we’re actually trying to avoid Many people mix up inheritance taxes and estate taxes, but they’re actually different beasts

Estate Tax: This is a tax on the total value of your property when you die, before assets are distributed to heirs. It’s paid by your estate, not by your beneficiaries. The federal government and some states levy this tax.

Inheritance Tax: This is a tax paid by the person who inherits your assets. The federal government doesn’t impose this tax, but six states currently do: Iowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. (Note that Iowa is phasing out its inheritance tax and will no longer apply it to deaths in 2025 or later.)

Good news! Most people won’t have to worry about federal estate taxes because the exemption threshold is quite high – $13.61 million per person in 2024 and $13.99 million in 2025. However, if you live in a state with lower exemption thresholds or inheritance taxes, your planning needs to be more careful.

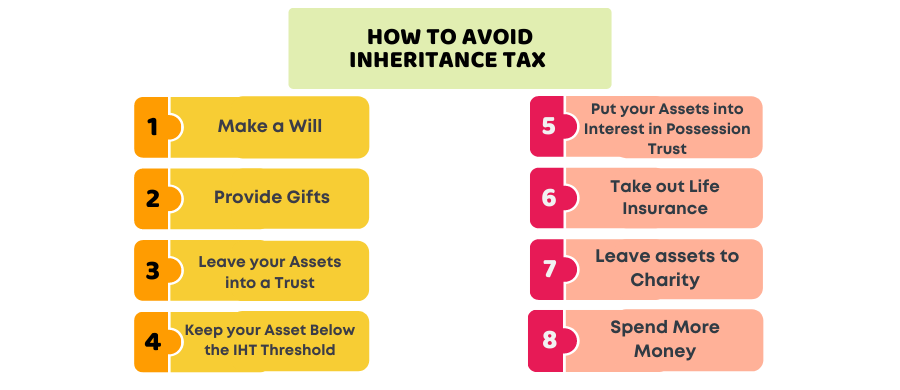

6 Effective Ways to Avoid Inheritance Tax on Your House

1. Set Up an Irrevocable Trust

This is probably the most effective strategy for protecting your house from inheritance taxes. Here’s how it works:

When you place your house in an irrevocable trust, you’re essentially transferring ownership from yourself to the trust. Because those assets don’t legally belong to you anymore, they aren’t subject to estate or inheritance taxes when you pass away.

There’s a key difference between revocable and irrevocable trusts:

- With a revocable trust, you can take assets out if necessary

- With an irrevocable trust, the assets are generally tied up until you die

Besides tax benefits, setting up a trust helps your estate avoid probate – that lengthy and often expensive court process that validates wills. This means your heirs get access to their inheritance faster and with less hassle.

The downside? You give up some control over your home when you put it in an irrevocable trust. This is why you should consult with an estate planning attorney to make sure this strategy aligns with your overall goals.

2. Gift Your Home While You’re Still Alive

Another effective strategy is to give your home to your heirs while you’re still alive. In 2024, you can gift up to $18,000 per person without triggering gift taxes or reducing your lifetime estate tax exemption.

For example, if you’re married and want to gift property to your three children, you and your spouse could together give each child up to $36,000 annually ($18,000 from each parent) without any gift tax implications.

If your house is worth considerably more, you can use part of your lifetime gift and estate tax exemption, which is $13.61 million per person in 2024. But remember, any portion you use for gifting reduces what’s available for your estate when you die.

Pro tip: If you still want to live in your house after gifting it, you’ll need to pay fair market rent to the new owners. Otherwise, the IRS might consider it an incomplete gift and include it in your estate anyway.

3. Consider the Alternate Valuation Date

If you’re the executor of an estate, here’s a strategy that might help: you can choose an alternate valuation date for the estate’s assets.

Typically, the cost basis of property in a deceased person’s estate is the fair market value on the date of death. However, the executor might choose the alternate valuation date, which is six months after the date of death.

This option is only available if it will decrease both the gross amount of the estate AND the estate tax liability. If property values have dropped during those six months, using the alternate valuation date could result in lower estate taxes.

4. Take Advantage of the Stepped-Up Basis

When someone inherits property, they receive what’s called a “stepped-up basis.” This means the tax basis of the property becomes its fair market value at the time of the owner’s death, not the original purchase price.

For example, if your parent bought a house for $50,000 decades ago, and it’s worth $350,000 when they pass away, your basis in the property would be $350,000. If you later sell it for $400,000, you’d only pay capital gains tax on the $50,000 difference.

This is why sometimes it makes more sense to inherit property rather than receiving it as a gift during the owner’s lifetime. When you receive a gift, you generally take on the giver’s original basis, which could result in higher capital gains taxes when you sell.

5. Utilize the Marital Deduction

If you’re married, you can leave unlimited assets to your spouse free of federal estate taxes thanks to the unlimited marital deduction. This essentially postpones estate taxes until the second spouse dies.

For example, if you own a $1 million house and leave it to your spouse, no federal estate taxes will be due at your death. However, when your spouse later dies, the house will be included in their estate.

To maximize this strategy, couples often combine the marital deduction with other estate planning tools like bypass trusts or portability elections to preserve both spouses’ estate tax exemptions.

6. Move to a State Without Estate or Inheritance Taxes

This might seem extreme, but if you live in a state with high estate or inheritance taxes, moving to a state without these taxes could save your heirs a significant amount of money.

Remember, while federal estate tax might not affect most people due to the high exemption amount, state estate and inheritance taxes often kick in at much lower thresholds.

States with no estate or inheritance taxes include Florida, Texas, Nevada, and Wyoming, among others. If you’re considering this option, consult with a tax professional who understands the tax implications in both your current state and your potential new state.

Who Needs to Worry About Inheritance Taxes?

Not everyone needs to stress about these taxes. Here’s a quick way to determine if you should be concerned:

-

Federal Estate Tax: If your total estate (including your house, investments, retirement accounts, etc.) is worth less than $13.61 million (in 2024), federal estate tax likely won’t affect you.

-

State Estate/Inheritance Taxes: Check if your state imposes these taxes. Currently, 12 states plus the District of Columbia have estate taxes, and six states have inheritance taxes. Maryland has both!

| States with Estate Tax | States with Inheritance Tax |

|---|---|

| Connecticut | Iowa (phasing out by 2025) |

| District of Columbia | Kentucky |

| Hawaii | Maryland |

| Illinois | Nebraska |

| Maine | New Jersey |

| Maryland | Pennsylvania |

| Massachusetts | |

| Minnesota | |

| New York | |

| Oregon | |

| Rhode Island | |

| Vermont | |

| Washington |

- Beneficiary Relationship: For inheritance taxes, the relationship between the deceased and the beneficiary matters. Spouses are typically exempt, and children often pay lower rates than distant relatives or non-relatives.

Common Mistakes to Avoid

When planning how to protect your house from inheritance taxes, watch out for these pitfalls:

-

Adding a child to your home’s deed without understanding the consequences: This can result in unintended gift tax consequences and remove the stepped-up basis benefit.

-

Failing to update your estate plan after major life events: Marriage, divorce, births, deaths, and significant changes in asset values should trigger a review of your estate plan.

-

DIY estate planning without professional guidance: While online resources (like this article!) are helpful, every situation is unique. Working with an estate planning attorney can help you avoid costly mistakes.

-

Waiting too long to start planning: Some strategies, like irrevocable trusts, are most effective when implemented years before they’re needed.

Final Thoughts

Protecting your house from inheritance taxes isn’t a one-size-fits-all process. The best strategy depends on your unique situation – the value of your home, your state of residence, your family dynamics, and your overall financial goals.

I always recommend working with professionals who understand the complexities of estate and inheritance taxes. A good estate planning attorney and tax advisor can help you create a comprehensive plan that minimizes taxes while achieving your legacy goals.

Remember, it’s not just about avoiding taxes – it’s about making sure your hard-earned assets go to the people and causes you care about, with minimal hassle and expense.

Have you already taken steps to protect your home from inheritance taxes? I’d love to hear about your experiences in the comments below!

FAQs About Avoiding Inheritance Tax on Your House

Q: Do I have to report my inheritance on my tax return?

A: In general, you don’t need to report an inheritance to the IRS because inheritances aren’t considered taxable income by the federal government. However, subsequent earnings from inherited assets may need to be reported.

Q: How much money can I inherit before I have to pay taxes on it?

A: For federal estate taxes, the 2024 exemption is $13.61 million per individual. State thresholds vary widely – some states like Oregon impose estate taxes on estates larger than $1 million, while others match the federal exemption.

Q: Can I just give my house to my children to avoid inheritance taxes?

A: Yes, but with caveats. You can give up to $18,000 per recipient in 2024 without filing a gift tax return. Larger gifts require using part of your lifetime gift and estate tax exemption. Also, if you continue living in the house rent-free, the IRS may still include it in your estate.

Q: What’s the difference between putting my house in a revocable vs. irrevocable trust?

A: A revocable trust doesn’t protect against estate taxes because you maintain control of the assets. An irrevocable trust removes the assets from your estate for tax purposes, but you give up control over those assets.

Q: Will my heirs have to pay income tax when they inherit my house?

A: Inheriting a house isn’t considered taxable income. However, if they sell the house, they may owe capital gains tax on any appreciation in value since your death.

Remember, planning ahead is key when it comes to protecting your assets for future generations. The sooner you start implementing these strategies, the more options you’ll have available to you!

What is the difference between inheritance tax and estate tax?

Estate tax is “a tax on your right to transfer property at your death,” the IRS says. They’re paid by the estate of the person who died before assets are distributed.

Inheritance tax is levied on someone who’s inherited money, property or other assets. It only applies when the person who dies and passes on assets lived in one of the states that has an inheritance tax. It’s not dependent on where the beneficiary lives.

Who levies an inheritance tax?

Only six states have an inheritance tax, but that will be cut to 5 next year as Iowa drops its tax.

Tax rates vary depending on the state but range between less than 1% to as high as 20% and usually apply to the amount above an exemption threshold. Rates depend on the size of your inheritance, state tax laws and your relationship with the deceased. Generally, the closer you are to the deceased, the less likely you’ll have to pay this tax. Spouses are always exempt from paying inheritance tax, and immediate family members like children, parents are often exempt, too, or pay a lower rate.

This year, these states have an inheritance tax: