Overtrading is a common issue many traders encounter, often leading to significant losses and financial strain. Understanding overtrading is essential for anyone involved in the stock market to ensure they make informed and strategic decisions.

Here, we will delve into the overtrading meaning, the problems it can cause, the underlying causes, and strategies to avoid it. Additionally, we’ll compare overtrading with understanding to understand trading behaviours comprehensively.

Overtrading refers to the excessive buying and selling of financial instruments, often driven by emotional and impulsive decisions rather than strategic analysis. This behaviour is characterised by frequent trades, high transaction volumes, and misusing a trading account.

Traders who overtrade typically do so in an attempt to capitalise on short-term market movements, but this approach often backfires, leading to substantial financial losses.

Have you ever found yourself checking your trading app multiple times a day making trade after trade, only to realize your portfolio is actually performing worse? You’re not alone! Excessive trading or overtrading as it’s commonly known in financial circles, is a widespread issue that affects many investors, from beginners to seasoned professionals.

At Trader’s Corner, we’ve seen this pattern repeatedly with our clients Today, I’m diving deep into the psychology and factors that cause excessive trading, and more importantly, how you can avoid this costly mistake

What Exactly is Overtrading?

Overtrading refers to the excessive buying and selling of financial instruments without proper strategic analysis. Instead of making calculated decisions, traders caught in this cycle make impulsive moves driven by emotions rather than logic

The definition is pretty straightforward, but the consequences can be devastating to your financial health. When you overtrade, you’re essentially turning potential investments into gambling activities.

The 7 Major Causes of Excessive Trading

1. Lack of a Clear Trading Plan

Many traders jump into the market without a well-defined strategy. This is like setting sail without a compass – you’ll likely end up lost at sea!

A proper trading plan should outline:

- Your financial goals

- Risk tolerance levels

- Entry and exit points

- Position sizing rules

- Specific market conditions for trading

Without these guidelines, traders often make random decisions based on whims or market noise, leading to excessive trading.

2. Emotional Trading: The Fear and Greed Cycle

Emotions are probably the biggest culprits behind overtrading. Two powerful emotions dominate:

Fear – manifests as:

- Fear of missing out (FOMO) on potential profits

- Fear of losing money already invested

- Fear of being wrong about a market prediction

Greed – appears when:

- Markets are rising quickly

- You’ve had a string of successful trades

- You see others making substantial profits

These emotions create a vicious cycle. You might chase gains when the market is climbing (greed) or panic-sell during downturns (fear). Either way, you end up trading excessively without proper analysis.

3. Overconfidence Bias

After a few successful trades, it’s easy to develop an inflated sense of your trading abilities. You might start believing you can consistently predict market movements, which leads to taking more trades with less thought.

I remember when I first started trading. After three profitable weeks, I thought I had “cracked the code.” My trade frequency tripled… and so did my losses! Overconfidence had me trading excessively, and the market quickly humbled me.

4. The Desire for Quick Profits

We live in an instant gratification culture. Many traders want to get rich quickly rather than building wealth steadily over time.

This mindset leads to:

- Overtrading to capture small price movements

- Taking positions without thorough research

- Ignoring long-term investment opportunities

- Chasing “hot tips” and market rumors

Remember, true wealth in the markets is usually built through patience and discipline, not frantic trading.

5. Market Volatility

High market volatility creates an environment where traders feel compelled to constantly react to price changes. When markets swing dramatically, many traders believe they must “do something” rather than sticking to their plan.

During the 2020 pandemic market crash, we saw trading volumes explode. Many investors who normally made a few trades per month were suddenly making multiple trades daily, often to their detriment.

6. Technology and Accessibility

Modern trading platforms make it incredibly easy to execute trades with just a few clicks or taps. This frictionless process removes the natural barriers that once gave traders time to reconsider impulsive decisions.

Additionally, 24/7 market news and social media create a constant stream of “actionable information” that can trigger excessive trading behavior.

7. Commission-Motivated Brokers (Churning)

While most individual traders overtrade due to psychological factors, it’s worth mentioning that sometimes excessive trading comes from outside influence. Brokers who earn commissions on each trade might encourage clients to trade more frequently than necessary – a prohibited practice known as churning.

This is why working with fee-based advisors or using flat-fee trading platforms can sometimes help reduce external pressure to overtrade.

The Real-World Impact of Overtrading

Let’s be real – excessive trading hurts your financial performance in multiple ways:

1. High Transaction Costs

Every trade comes with costs:

- Brokerage fees

- Taxes

- Spread costs

- Slippage

These expenses might seem small individually, but they add up quickly with frequent trading. A trader making 20 trades monthly might spend 3-5% of their capital on transaction costs alone!

2. Increased Risk Exposure

More trades mean more opportunities for mistakes. When you’re constantly entering and exiting positions, you’re exposing yourself to additional market risk without necessarily improving your return potential.

3. Emotional and Mental Fatigue

Constant trading takes a psychological toll. Decision fatigue sets in, leading to poorer choices as the day progresses. The stress of monitoring multiple positions can also lead to anxiety, sleep problems, and even trading burnout.

4. Poor Portfolio Performance

Studies consistently show that frequent traders typically underperform compared to those who trade less often. A famous study by Barber and Odean found that the most active traders earned annual returns 6.5% lower than the least active traders!

Overtrading vs. Undertrading: Finding the Balance

It’s worth noting that while overtrading is problematic, the opposite extreme – undertrading – can also limit your financial success. The key is finding the right balance for your situation.

| Aspect | Overtrading | Balanced Trading | Undertrading |

|---|---|---|---|

| Trade Frequency | Multiple trades daily | Strategic entries based on plan | Very rare trades, missed opportunities |

| Risk Level | High risk, poor analysis | Calculated risks with proper analysis | Too cautious, minimal exposure |

| Emotional State | Anxious, impulsive | Calm, methodical | Fearful, hesitant |

| Results | Capital erosion from fees and losses | Steady growth with manageable drawdowns | Limited growth, missed potential |

How to Avoid Excessive Trading: Practical Solutions

Now for the good stuff – how to actually break the overtrading cycle:

1. Develop and Stick to a Trading Plan

Create a detailed trading plan that outlines:

- Specific criteria for entering trades

- Clear exit strategies (both profit-taking and stop-loss)

- Position sizing rules

- Maximum number of open positions

- Trading frequency limits

Write this plan down and review it regularly. Some traders even post it near their trading station as a constant reminder.

2. Implement Trading Limits

Set hard limits on your trading activity:

- Maximum number of trades per day/week

- Minimum time between trades

- Required research time before each trade

- Trading-free days each week

I personally limit myself to no more than 3 trades per week and take Mondays completely off from trading. These boundaries have dramatically improved my performance.

3. Keep a Trading Journal

Document every trade with:

- Entry and exit reasons

- Emotional state before/during/after

- What you learned

- Whether you followed your plan

Reviewing this journal regularly helps identify patterns of overtrading and emotional decision-making.

4. Practice Mindfulness and Emotional Awareness

Before executing any trade, pause and ask yourself:

- Why am I making this trade right now?

- Does it align with my trading plan?

- Am I feeling fearful, greedy, or bored?

- Would I make this same trade tomorrow?

This simple mindfulness check can prevent many impulsive trades.

5. Focus on Quality Over Quantity

Train yourself to value the quality of trades rather than the quantity. A successful trader isn’t measured by how often they trade, but by their risk-adjusted returns over time.

6. Use Technology Wisely

Set up alerts for specific conditions that match your trading plan rather than watching charts all day. This reduces the temptation to trade based on random price movements.

Some traders even use apps that limit their trading platform access during certain hours to prevent impulsive decisions.

Real Talk: My Personal Experience with Overtrading

I’ll be honest – I’ve fallen into the overtrading trap myself. During my early trading years, I was making 20+ trades weekly, convinced that more activity meant more profit. My broker certainly loved me!

The turning point came when I tracked my results and realized my best-performing months were actually when I traded less frequently. By cutting my trading volume by 80% and focusing on quality setups that matched my strategy, my annual returns improved dramatically.

Final Thoughts: Balance is Key

Excessive trading is a common pitfall, but awareness is the first step toward improvement. By understanding the psychological drivers behind overtrading, you can implement strategies to trade more intentionally.

Remember, successful trading isn’t about constant activity – it’s about making the right moves at the right time for the right reasons.

Have you struggled with overtrading? What strategies helped you overcome it? Share your experiences in the comments below!

Begin your investing journey today. Your Demat account is the first step.

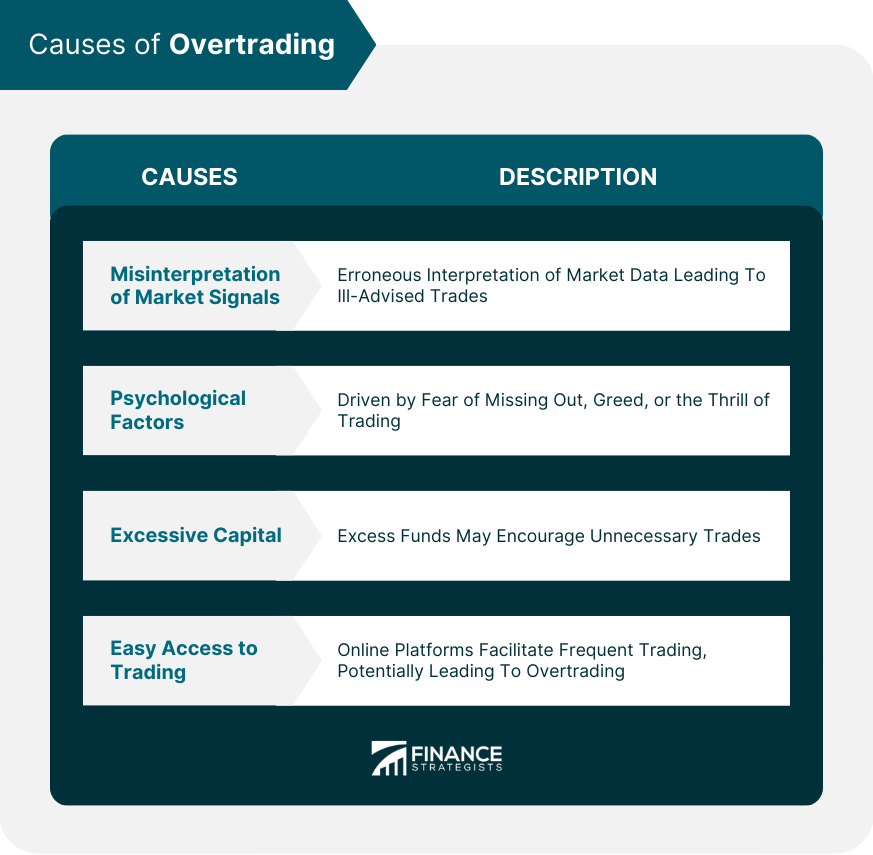

Understanding the causes of overtrading can help traders identify and address this behaviour. Here are some common factors that contribute to overtrading problems:

What are the Problems Associated With Overtrading?

Overtrading can cause various problems for traders, both financially and psychologically. Understanding these issues is crucial to avoid falling into excessive trading. Here are the key issues associated with overtrading problems:

High Transaction Costs

Frequent trading increases transaction costs, including brokerage fees, taxes, and other charges. These costs can quickly erode profits, making it difficult for traders to achieve their financial goals. For instance, every trade executed incurs a fee, and when trades are numerous, these fees add up, significantly reducing the net gain from trading activities. Considering these costs when planning trading strategies is essential to ensure that expenses don’t entirely consume profits.

Overtrading exposes traders to higher risks. By taking numerous trades, traders may not have the time to conduct thorough research and analysis, leading to poor investment decisions and significant losses. When traders constantly enter and exit positions, they might miss critical information that could impact their decisions.

The pressure to constantly monitor the market and execute trades can cause emotional stress and fatigue. This stress can impair decision-making abilities, leading to further losses and a cycle of overtrading.

Traders may find themselves glued to their screens, trying to catch every market movement, which can be mentally exhausting and detrimental to their overall well-being. Managing emotional stress is crucial for maintaining a clear, focused mindset for successful trading.

Overtrading often results in suboptimal portfolio performance. Instead of holding on to high-quality investments for the long term, traders may frequently buy and sell, missing out on potential gains and compounding their losses.

This constant churning of the portfolio can prevent the investments from realising their full potential, as frequent trades may disrupt the growth trajectory of otherwise solid assets.

Continuous trading without a clear strategy can deplete trading capital. This not only affects current trading activities but also limits future profit opportunities. When capital is eroded due to excessive trading, it reduces the trader’s ability to participate in new opportunities, thereby hindering long-term growth and profitability.

The Danger of Overtrading – Why Less Is More

FAQ

What is considered excessive trading?

How do you stop yourself from over trading?

- Pause before each trade: Ask yourself – is this part of my plan? …

- Stay invested: Instead of hopping between stocks, choose a few quality ones and give them time to grow.

- Track performance: Focus not on how many trades you made but on how your overall investment is doing.

What is the 90% rule in trading?

The Rule of 90 is a grim statistic that serves as a sobering reminder of the difficulty of trading. According to this rule, 90% of novice traders will experience significant losses within their first 90 days of trading, ultimately wiping out 90% of their initial capital.

Why is excessive trading bad?

Excessive trading – also known as overtrading – can eat away at your returns through higher fees, tax bills and risk. Frequent in-and-out trades, pattern day trading flags and emotional decision-making are common signs of overtrading.