Dividend stocks can be a great choice for investors looking for passive income and portfolio stability. View our list of the best high-dividend stocks and learn how to invest in them.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

When the stock market is rocky, investors may want to consider stable investments that offer a regular stream of income. The best dividend stocks often provide both.

Hey there, fellow investors! If you’re like me, you’ve probably spent countless hours searching for those magical high-dividend stocks that can provide a steady stream of passive income But let’s be real – what actually constitutes a realistic dividend yield in today’s market?

I’ve been investing for years now, and I can tell you that the dream of massive dividend payouts often doesn’t align with reality. Today, we’re gonna cut through the noise and talk honestly about what dividend yields you can realistically expect in your portfolio.

What Exactly Is a Dividend Yield?

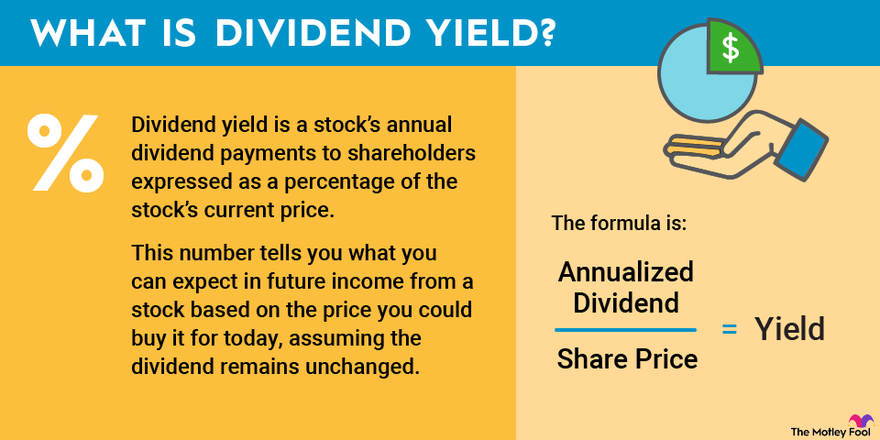

Before we dive deeper, let’s make sure we’re all on the same page about what a dividend yield actually is.

A dividend yield is a percentage figure that shows how much a company pays out in dividends each year relative to its stock price It’s calculated by dividing the annual dividend payment per share by the current share price

For example:

- If Company XYZ pays $4 per share annually in dividends

- And its current stock price is $100

- The dividend yield would be: $4 ÷ $100 = 4%

Simple right? But knowing what’s actually realistic is where things get interesting.

The Realistic Dividend Yield Range

So what’s considered a realistic dividend yield? Based on current market conditions and historical trends, a dividend yield ranging from 2% to 6% is generally considered realistic and sustainable for most stable companies.

Let me break this down for you:

- Below 2%: Often seen in growth-focused companies that reinvest most profits

- 2% to 4%: Common among stable, established blue-chip companies

- 4% to 6%: Typically found in mature industries like utilities, telecommunications, and some REITs

- Above 6%: May indicate higher risk or special situations (more on this later!)

Benchmarking Dividend Yields

One way I like to evaluate if a dividend yield is realistic is by comparing it to these important benchmarks:

1. The S&P 500 Dividend Yield

The S&P 500’s dividend yield serves as a useful barometer for the overall market. As of this writing, the S&P dividend yield is approximately 1.25%, which is actually unusually low. The long-term average hovers around 1.81%.

This tells me that any stock paying more than 2% dividend yield is worth a closer look in the current market.

2. U.S. Treasury Yields

Another great comparison is with U.S. Treasury yields. Many income-focused investors look at both government bonds and dividend stocks, so this comparison makes sense.

Currently, U.S. Treasuries are paying up to 4.93%. When dividend yields exceed this level, they might look attractive – but you need to weigh the additional risk you’re taking compared to the virtually risk-free Treasury.

3. Industry Comparisons

Companies in the same sector typically have similar dividend yields. For example:

- Utilities: Often 3-5%

- Consumer Staples: Usually 2-4%

- Technology: Frequently 0-2%

- REITs: Commonly 3-7%

If you spot a company with a yield significantly higher than its peers, it warrants investigation – it could be either an opportunity or a warning sign.

When High Dividend Yields Are Too Good to Be True

I’ve fallen into this trap before – seeing a stock with an 8% or 10% yield and getting excited! But here’s the truth: abnormally high dividend yields often signal potential trouble.

The Dividend Yield Trap

When a company’s stock price drops sharply while the dividend payout remains the same, the yield percentage automatically increases. This can create misleadingly high yields.

Let’s look at a real example:

Imagine a stock trading at $100 with a quarterly dividend of $1 (so $4 annually). That’s a 4% yield.

If bad news hits and the stock drops to $50, suddenly that same $4 dividend represents an 8% yield! Looks attractive, right? But the high yield is only due to the collapsing share price – not because the company is more generous.

The Payout Ratio: Your Reality Check

One of my favorite metrics to assess whether a dividend yield is realistic and sustainable is the dividend payout ratio. This tells you what percentage of a company’s earnings is being paid out as dividends.

The payout ratio is calculated by dividing the quarterly dividend per share by quarterly earnings per share.

For example:

- If a company earns $2 per share each quarter

- And pays $1 per share in dividends

- The payout ratio is 50%

Generally speaking:

- Under 50%: Very sustainable, room for dividend growth

- 50-75%: Sustainable for mature companies

- 75-100%: May be cause for concern, limited room for growth

- Over 100%: Red flag! The company is paying more than it earns

When I see a company with an attractive yield but a payout ratio over 100%, I run the other way. They’re either dipping into savings or borrowing to maintain that dividend – neither of which is sustainable.

Building a Portfolio with Realistic Dividend Yields

So how do we actually use this knowledge? I’ve found that building a balanced dividend portfolio requires thinking about both income and growth potential.

Here’s an example of how I would approach building a $500,000 portfolio:

Balanced Approach:

- 50% ($250,000) in dividend stocks averaging 3% yield = $7,500 annual income

- 50% ($250,000) in growth stocks with minimal/no dividends but higher capital appreciation potential

Income-Focused Approach:

- 70% ($350,000) in dividend stocks averaging 4% yield = $14,000 annual income

- 30% ($150,000) in growth stocks for some long-term appreciation

Growth with Some Income:

- 30% ($150,000) in dividend stocks averaging 3% yield = $4,500 annual income

- 70% ($350,000) in growth stocks for maximum appreciation potential

Which approach is best depends on your age, goals, and how much you need that income now versus later.

Dividend Reinvestment: The Secret Weapon

One of my favorite strategies is dividend reinvestment, especially if you don’t need the income immediately. By reinvesting dividends to purchase additional shares, you can harness the power of compounding.

For example, if you invest $100,000 in stocks with an average 4% yield and reinvest all dividends, assuming 2% annual share price growth, after 20 years you’d have about $220,000. Without reinvesting, you’d only have about $140,000 plus the dividends you received.

This is why I always tell my friends – if you don’t need the income now, reinvest those dividends!

Realistic Expectations by Investment Type

Let’s get specific about what dividend yields are realistic for different investment types:

Individual Stocks

- Blue-chip stocks: 1.5-4%

- Utility stocks: 3-5%

- Bank stocks: 2-5%

- Consumer staples: 2-4%

ETFs and Mutual Funds

- Broad market dividend ETFs: 1.5-3%

- High-dividend ETFs: 3-5%

- Sector-specific dividend funds (utilities, REITs): 3-6%

REITs (Real Estate Investment Trusts)

- Residential REITs: 3-5%

- Commercial REITs: 4-6%

- Specialized REITs: 3-7%

Fixed Income

- Corporate bonds: 3-5%

- Municipal bonds: 2-4% (tax advantages make effective yield higher)

- Preferred stocks: 4-7%

Red Flags: When Dividends Aren’t Sustainable

Through my years of investing, I’ve learned to watch for these warning signs that a dividend might not be sustainable:

- Extremely high yields (8%+) compared to industry peers

- Payout ratios above 100% for multiple quarters

- Declining revenue and earnings but stable or increasing dividends

- Increasing debt to maintain dividend payments

- Negative free cash flow while still paying dividends

I once invested in a company with a juicy 9% yield, ignoring the fact that they had a 120% payout ratio. Guess what happened six months later? Dividend cut, and the stock crashed. Lesson learned!

Current Market Realities (2025)

In today’s market environment, it’s important to note that dividend yields have been generally lower than historical norms. This is partially due to:

- Extended periods of low interest rates (though they’ve risen recently)

- Strong share price performance in many sectors

- Companies favoring share buybacks over dividend increases

- Growth-oriented market sentiment

As interest rates have increased, bond yields have become more competitive with dividend yields. This has put pressure on dividend-paying stocks to maintain their appeal to income-seeking investors.

Building Your Dividend Strategy

Here’s my practical advice for building a realistic dividend strategy:

- Start with a core of reliable dividend payers (2-4% yields with decades of consistent payments)

- Add some dividend growers (companies consistently raising dividends, even if starting yield is lower)

- Sprinkle in a few higher-yield options (5-6% range) after thorough research

- Avoid chasing the highest yields without understanding the risks

- Diversify across sectors to reduce industry-specific risks

Final Thoughts

So what’s a realistic dividend yield? In my experience, expecting 3-4% from a well-constructed dividend portfolio is realistic and sustainable in today’s market. Some investors might push that to 5-6% with careful security selection and acceptance of somewhat higher risk.

The true magic of dividend investing isn’t just the yield today – it’s the potential for those dividends to grow over time. A company paying a 2.5% yield today that increases its dividend by 8% annually will be yielding 5.4% on your original investment in 10 years!

Remember, dividend investing is a marathon, not a sprint. Focus on quality companies with sustainable payout ratios, consistent earnings growth, and management teams committed to returning capital to shareholders.

I’d love to hear your thoughts on what dividend yields you’re targeting in your portfolio! What’s been your experience with dividend investing?

Happy investing!

Top 7 high-dividend stocks this week

|

The best high-dividend stock is currently Lument Finance Trust Inc (LFT), which has a forward dividend yield of 16.88%. This is based on our screen that includes only U.S.-based stocks in the S&P 500 and Russell 2000, with payout ratios below 100%. |

||

|

Ticker |

Company |

Dividend Yield |

|

LFT |

Lument Finance Trust Inc |

16.88% |

|

TWO |

Two Harbors Investment Corp |

16.09% |

|

SUNS |

Sunrise Realty Trust Inc |

12.61% |

|

MITT |

AG Mortgage Investment Trust Inc |

11.52% |

|

MKTW |

Marketwise Inc |

9.04% |

|

OXM |

Oxford Industries, Inc |

8.62% |

|

DIN |

Dine Brands Global Inc |

8.44% |

|

Source: Finviz. Stock data is current as of November 4, 2025, and is intended for informational purposes only. |

||

If you want to invest in dividend stocks, youll need to have a brokerage account to do so. Brokerage accounts are free to open (though youll have to deposit enough money to buy the stocks). It typically takes about 15 minutes to set up a brokerage account.

How to invest in dividend stocks

Building a portfolio of individual dividend stocks takes time and effort, but for many investors its worth it. Here’s how to buy a dividend stock:

Are Dividend Investments A Good Idea?

FAQ

What is the 5% dividend rule?

The statement explains that the rule of 5% guides an investor to classify dividend-paying stocks; with high dividends, a good dividend yield falls between 2% and 6%.

How much in dividends to make $1000 a month?

a month (or

annually) in dividends, you need to invest a varying amount of capital depending on the dividend yield of your investments.

For example, a 4% dividend yield requires approximatelyin investment, while a 3% yield requires about

.

Is a 25% stock dividend large or small?

A Large Stock Dividend refers to a distribution of additional shares to shareholders, typically exceeding 20-25% of the existing shares. Unlike a small stock dividend, which is less than 20-25%, a large stock dividend significantly alters the equity structure, impacting market perception and stock price.

Is 30% a good dividend yield?

A lower payout ratio (e.g., 10% – 30%), could signal that the company is retaining more earnings for growth, while a higher ratio can indicate a strong commitment to paying dividends. However, extremely high payout ratios (e.g., 55%-75%) may not be sustainable.