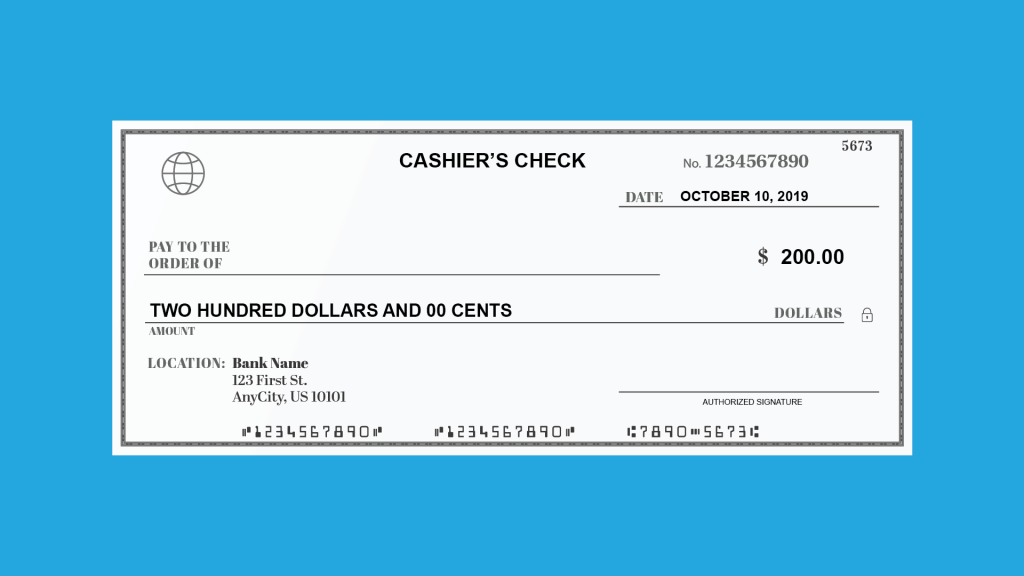

Imagine this—you’re closing on your first home, paying for a car in cash, or making a large payment where a regular check is not accepted.

You need a payment method that’s secure, guaranteed, and widely accepted. This is where a cashiers check can come in.

But how does a cashier’s check work, and why do people trust it over personal checks?

If you’re unsure about how to get one or when to use it, you’re not alone. Many people aren’t familiar with this payment method until they need it.

Keep reading to learn how to get a cashier’s check, why it’s different from other checks, when to use it—and how to protect yourself from fraud.

We’ve all been there – you need funds available quickly and someone tells you, “Just get a cashier’s check – they’re available instantly!” But is that actually true? As someone who’s worked with various payment methods for years, I want to clear up this common misconception and explain the real deal with cashier’s checks and when you can actually access those funds.

The Basic Promise of Cashier’s Checks

Cashier’s checks are often presented as the “sure thing” of banking. Unlike personal checks, which are written against your own account, cashier’s checks are drawn against the bank’s funds. This makes them seem more secure and trustworthy – after all, it’s the bank promising to pay, not just some random person.

Because of this perceived security, many people believe that cashier’s checks clear immediately. And while they do typically clear faster than personal checks, the reality is a bit more nuanced

So, Are Cashier’s Checks Really Available Instantly?

The short answer: Generally, but not always.

According to the official guidance from HelpWithMyBank.gov (managed by the Office of the Comptroller of the Currency), the general rule is pretty straightforward

“Generally, if you make a deposit in person to a bank employee, then the bank must make the funds available by the next business day after the banking day on which the cashier’s check is deposited.”

Notice that key phrase – “by the next business day.” That’s not quite instant, but it’s still pretty fast compared to other types of checks that might take several days to clear.

Exceptions to the Next-Day Rule

Before you count on having access to those funds the next day, you should know there are several circumstances where banks can legally place longer holds:

1. Large Deposits Over $5,525

If you’re depositing cashier’s checks that total more than $5,525 in a single day the bank can hold the amount over that threshold. The first $5,525 should still follow the standard availability schedule, but anything above that might take longer.

2. Reasonable Suspicion

If the bank has “reasonable cause” to believe the check might be uncollectible from the paying bank, they can place a hold on the entire amount. This is a subjective determination by the bank.

3. Special Circumstances

The bank may also impose longer holds if:

- The deposit was made under emergency conditions

- It’s going into a new account (less than 30 days old)

- You’re depositing to an account that’s been repeatedly overdrawn

- The check was previously returned unpaid and is being re-deposited

4. Special Deposit Slip Requirement

Some banks may require you to use a special deposit slip if you want next-day availability. Make sure to ask about this requirement when making your deposit!

The Real Danger: Available ≠ Verified

Here’s something many people don’t realize: funds becoming “available” in your account doesn’t necessarily mean the check has been fully verified or cleared.

As HelpWithMyBank.gov warns:

“Funds may become available to you before the bank has been able to verify the check. You could end up withdrawing the funds before the bank knows that the check is fraudulent.”

This is a critical point! If you withdraw money based on a cashier’s check that later turns out to be fraudulent, the bank can:

- Charge the amount back against your account

- Obtain a refund directly from you

- Charge you overdraft fees if your account becomes overdrawn as a result

I’ve seen this happen to clients who assumed a cashier’s check was as good as cash – they spent the money quickly after it became “available” only to find out weeks later that it was fraudulent. The bank pulled the funds back, and they were suddenly in a deep financial hole.

Bank Policies Vary

Different banks have different policies around holds and availability. While they must comply with federal regulations, they have some discretion in how they implement these rules.

The deposit account agreement you received when opening your account explains your bank’s specific availability process. If you can’t find it, call your bank and ask for clarification on their cashier’s check policy.

Real-World Example: What Typically Happens

Let’s walk through a typical scenario:

- Monday morning: You deposit a $3,000 cashier’s check in person with a teller

- Monday afternoon: The deposit is processed

- Tuesday: Funds become available in your account

- Tuesday-Friday: Behind the scenes, the bank is still verifying the check

- If all goes well: Nothing else happens, and you can use the money

- If the check is fraudulent: Even weeks later, the bank can remove the funds from your account

Protection Tips When Using Cashier’s Checks

Since cashier’s checks aren’t quite the guaranteed payment method many think they are, here are some protective measures:

For Recipients:

- Verify the check with the issuing bank before accepting it

- Be wary of checks for more than expected amounts (common in scams)

- Wait longer than the “available” date before spending the funds on major purchases

- Know your bank’s specific policies on cashier’s check holds

For Purchasers:

- Keep your receipt

- Know the procedures for reporting a lost or stolen cashier’s check

- Understand that if you lose a cashier’s check, you might need to purchase an indemnity bond before getting a replacement

Alternatives for “Instant” Funds Transfer

If you truly need instant funds availability, consider these alternatives:

- Wire transfers: Typically available the same day (though they come with fees)

- Electronic transfers (ACH): Can be faster than checks but still take 1-3 business days

- Person-to-person payment apps: Services like Zelle, Venmo, or Cash App can be nearly instant, though they have their own risks

- Cash: Still the only truly instant payment method (though obviously not suitable for all situations)

Common Scenarios Where Cashier’s Check Holds Matter

Real Estate Transactions

Many real estate closings require cashier’s checks. Plan ahead and understand that while the funds may be available the next day, you should allow extra time for any potential complications.

Vehicle Purchases

Private sellers often require cashier’s checks for vehicle purchases. If you’re the seller, consider meeting at the buyer’s bank to verify the check’s authenticity before signing over the title.

Large Purchases from Private Parties

For any major purchase between individuals, know that cashier’s checks provide some protection but aren’t foolproof.

The Legal Framework

The rules governing check holds, including those for cashier’s checks, come from the Expedited Funds Availability Act and its implementing regulation, Regulation CC. These federal regulations establish the maximum hold periods banks can impose, though banks are free to make funds available sooner if they choose.

Final Thoughts

So, to answer the original question – no, cashier’s checks aren’t truly “instant,” but they are typically available by the next business day in most normal circumstances. Just remember that “available” doesn’t mean “verified,” and protect yourself accordingly.

The next time someone tells you cashier’s checks are as good as cash or instantly available, you’ll know better. While they’re certainly more secure than personal checks and generally available more quickly, they’re not quite the instant solution many people believe them to be.

I’ve learned through years of experience that understanding these nuances can save you from serious financial headaches down the road. Whether you’re accepting a cashier’s check or writing one yourself, going in with realistic expectations about availability timeframes is key to avoiding unpleasant surprises.

Quick Reference Chart: Cashier’s Check Availability

| Situation | Typical Availability | Notes |

|---|---|---|

| Standard deposit under $5,525 | Next business day | Must be deposited in person to a bank employee |

| Portion over $5,525 | May be held longer | First $5,525 follows standard schedule |

| New account (under 30 days) | May be held longer | Varies by bank |

| Repeated overdrafts | May be held longer | For accounts repeatedly overdrawn |

| Reasonable suspicion | Entire check may be held | Bank’s discretion |

| Emergency conditions | May be held longer | Rare situations |

Remember to always check with your specific bank about their policies, as they can vary within the boundaries allowed by federal regulations. And when in doubt, give yourself extra buffer time before counting on funds from any type of check – even one from a bank!

Have you ever had an experience with delayed availability of a cashier’s check? I’d love to hear about it in the comments below!

Step 4: Pay Any Applicable Fees

Fees vary by bank and account type, but most banks charge a small fee for issuing a cashier’s check.

How to Get a Cashier’s Check

If you need a cashiers check, the process is straightforward, but there are a few important steps:

What is a CASHIER’S CHECK? ( Cashier’s Check vs. Personal Check)

FAQ

Do cashier’s checks go through immediately?

Can you get a cashier check quickly?

You can order a cashier’s check online quickly and easily.

When you need a cashier’s check for a major transaction, there’s no need to find a branch.

What is the downside of a cashier’s check?

While cashier’s checks are usually a safe form of payment, there is the risk of fraud. For example, scammers can create counterfeit cashier’s checks.Jul 24, 2024

How long does it take for a $30,000 cashier check to clear?