Hey there! If you’ve been wondering whether to put your hard-earned cash into mutual funds, you’re definitely not alone As someone who’s spent years navigating the investment landscape, I can tell you that mutual funds remain one of the most popular investment vehicles out there – and for good reason

But are they actually a good investment for YOU? That’s what we’re gonna explore today.

What Are Mutual Funds Anyway?

Before diving into whether mutual funds make sense for your portfolio, let’s get clear on what they actually are

A mutual fund is basically a professionally managed investment portfolio made up of various asset classes. Think of them as baskets filled with stocks, bonds, real estate investments, and sometimes other assets too.

When you buy shares of a mutual fund, your money gets pooled together with other investors’ money. The return you receive depends on how well the fund performs overall and how many shares you own.

One important thing to note: mutual funds trade only once a day, with prices based on their net asset value (NAV) calculated after markets close. And most funds require minimum investments ranging from $500 to $5,000 to get started.

The Good Stuff: Pros of Mutual Fund Investing

Let’s start with the advantages that make mutual funds so attractive to many investors

1. Built-in Diversification

One of the biggest selling points of mutual funds is instant diversification. Instead of putting all your eggs in one company’s basket, mutual funds spread your investment across dozens or even hundreds of securities.

This diversification helps reduce risk – if one company in the fund tanks, it won’t destroy your entire investment.

2. Professional Management

When you invest in a mutual fund, you’re essentially hiring professionals to manage your money. Fund managers spend their days researching investments and making decisions based on their expertise and market analysis.

This is perfect if you don’t have the time, knowledge, or desire to pick individual stocks and bonds yourself.

3. Dividend Reinvestment Potential

Many mutual funds offer dividend reinvestment programs. This means any dividends earned by the fund can automatically be used to purchase more shares, potentially accelerating your portfolio’s growth over time.

4. Accessibility and Simplicity

For beginner investors especially, mutual funds offer a relatively easy entry point into the market. They’re widely available through brokerages, retirement accounts, and financial advisors, and the concept is easier to grasp than some other investment vehicles.

The Not-So-Good: Cons of Mutual Fund Investing

As with any investment, mutual funds come with their fair share of drawbacks:

1. Those Pesky Fees

Mutual funds can be expensive! There are several types of fees to watch out for:

- Expense ratios: These annual fees typically range from 0.5% to 1.5% of your assets to cover management and operating expenses.

- Load fees: Some funds charge front-end loads (when you buy) or back-end loads (when you sell), ranging from 4% to 8% of your investment.

- 12b-1 fees: Some expense ratios include these marketing fees (up to 1%).

These fees might seem small, but they can significantly reduce your returns over time. A Morningstar study even suggests that low fees may be the best predictor of mutual fund performance!

2. Limited Control Over Taxes

When you invest in mutual funds in taxable accounts, you might get hit with capital gains taxes even if you haven’t sold your shares. This happens when the fund manager sells securities within the fund that have appreciated, creating “distributions” that are taxable to you.

This lack of control over tax timing can be frustrating and potentially costly.

3. Delayed Trade Execution

Unlike stocks that trade throughout the day, mutual funds only trade once daily after market close. If the market is tanking and you want to sell, your order won’t execute until the end of the day – potentially at a much lower price than when you placed the order.

4. Risk of Poor Management

Not all fund managers are created equal! Some may engage in excessive trading (increasing costs) or make questionable end-of-quarter moves to make their performance look better. Active management doesn’t guarantee good management.

Types of Mutual Funds: Finding Your Match

There are thousands of mutual funds out there, but they generally fall into a few main categories:

Stock Funds

These invest primarily in company stocks. They can focus on companies of different sizes (large-cap, mid-cap, small-cap), different sectors (technology, healthcare, etc.), or different regions.

Bond Funds

These focus on fixed-income securities like government, municipal, or corporate bonds. They typically distribute interest payments monthly, though the amount can fluctuate.

Balanced Funds

These invest in a mix of stocks, bonds, and sometimes other securities. The asset allocation usually stays relatively fixed based on the fund’s strategy, ranging from conservative to aggressive.

Active vs. Passive: An Important Distinction

When choosing mutual funds, you’ll need to decide between:

Active Funds

These aim to outperform the market, with managers actively selecting securities they believe will perform well. This approach typically comes with higher fees due to the research and trading involved.

Passive Funds

These track a market index (like the S&P 500) rather than trying to beat it. They typically have lower fees since they require less active management.

Despite the appeal of beating the market, studies repeatedly show that most actively managed funds fail to outperform their benchmark indexes over long periods, especially after accounting for fees. However, active funds may offer better risk management during market downturns.

When Do Mutual Funds Make the Most Sense?

Mutual funds might be a good fit for you if:

- You’re investing for long-term goals like retirement

- You prefer a hands-off approach to investing

- You want built-in diversification

- You don’t have enough money to create a diversified portfolio of individual stocks

- You value professional management

They might not be ideal if:

- You’re extremely fee-conscious

- You want intraday trading capability

- You need complete control over the tax implications of your investments

- You’re a tactical, short-term trader

How to Find the Best Mutual Funds

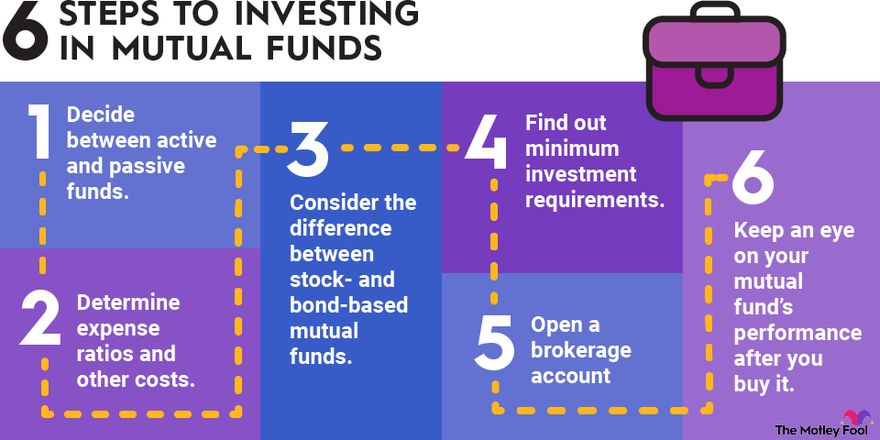

If you decide mutual funds are right for you, here are some tips for finding good ones:

- Look for low expense ratios compared to similar funds

- Check the manager’s tenure – experienced managers who’ve been with the fund for years are often preferable

- Examine long-term performance (5-10 years), not just recent returns

- Read the fund prospectus to understand the investment strategy, fees, and risks

- Consider using research firms like Morningstar that provide detailed fund analysis

My Take: Are Mutual Funds Actually Worth It?

In my opinion, mutual funds can be a solid investment option for many people – especially those who want a relatively simple way to invest with professional oversight. They’re particularly well-suited for retirement accounts like 401(k)s and IRAs.

That said, I don’t think all mutual funds are created equal. The fees you pay really matter! For most investors, low-cost index funds often make more sense than expensive actively managed funds that may or may not outperform their benchmarks.

And honestly, mutual funds aren’t necessarily the only option to consider. Exchange-traded funds (ETFs) offer many similar benefits, often with lower costs and more trading flexibility.

Bottom Line: Should You Invest in Mutual Funds?

Whether mutual funds are a good investment for you depends on your individual circumstances, goals, and preferences.

Here’s my practical advice:

-

Consider your goals: What are you investing for? Short-term or long-term?

-

Assess your risk tolerance: Different funds carry different levels of risk.

-

Watch those fees: Higher fees don’t guarantee better performance.

-

Compare alternatives: Look at ETFs and other investment vehicles too.

-

Start small if you’re uncertain: Many brokerages now offer fractional shares or funds with low minimums.

-

Consider working with a financial advisor: They can help you develop a strategy that incorporates mutual funds in a diversified portfolio.

Remember, the “best” investment is one that helps you reach your financial goals while letting you sleep at night. For many investors, mutual funds check both those boxes – but you’ve got to choose wisely!

What’s your experience with mutual funds? Have you found them to be a good investment in your own portfolio? I’d love to hear your thoughts in the comments below!

What are mutual funds?

A mutual fund is an investment that pools your money with that of other investors who share similar investment goals. Professional money managers use the pool of money to buy securities that can help achieve the mutual funds specified objectives.

Mutual funds offer professional management and diversification, but they involve investment risks, including possible loss of principal and fluctuation in value.

Pros and cons of mutual funds

Mutual funds can be an efficient and cost-effective means of investing money; however they also come with risks and tradeoffs. Some pros and cons of mutual funds include:

|

Potential benefits |

Risks and considerations |

|---|---|

|

|

View a complete list of mutual funds and fund families that are available at Ameriprise Financial with our Mutual Fund Screener tool. View mutual funds https://www.ameriprise.com/financial-news-research/fund-screeners

Why Mutual Funds Over Index Funds?

FAQ

Is investing in mutual funds worth it?

All investments carry some risk, but mutual funds are typically considered a safer investment than purchasing individual stocks. Since they hold many company stocks within one investment, they offer more diversification than owning one or two individual stocks.

What if I invest $5000 in mutual funds for 5 years?

5 Years: Your investment can grow to approximately Rs. 4.12 lakh. 10 Years: Over 10 years, the same SIP can grow to Rs. 11.61 lakh.

What is the downside in mutual funds?

The down-market or downside capture ratio is the opposite of the up-market ratio. It measures how well an investment performs compared to a benchmark index during negative market conditions. If a mutual fund has a down-market ratio below 100, it means it performed better than the index.

How much is $1000 a month invested for 30 years?