For some fortunate reason, you find yourself with $10,000 just sitting there, burning a hole in your pocket. Now you face the decision of whether to spend it or save it.

Opting for the sensible choice, you decide to deposit the entire amount at the bank, either in cash or by check. However, it’s not as straightforward as it seems. Your money is now on hold, and the IRS has been notified.

But don’t let that intimidate you. It doesn’t mean you’ve committed a financial crime. You’re simply trying to put your money in the bank, which is ideally allowed, regardless of the amount.

Banks are vigilant about potential bank fraud or suspicious activity, and $10,000 is a significant threshold that attracts attention.

While the concern is sometimes warranted, there are instances where depositors can inadvertently get into trouble if they don’t handle large deposits correctly.

Have you ever wondered what would happen if someone handed you a check for $20,000? Maybe you sold your car, received an inheritance, or got a hefty tax refund. Whatever the reason, depositing a large check like $20K isn’t as simple as dropping it in the ATM and going about your day. There’s actually quite a bit you should know before making that deposit.

I recently helped a friend navigate this exact situation, and I was surprised by how many regulations and potential issues come with large deposits. Let’s break down everything you need to know if you’re about to deposit a $20,000 check.

The Bank Secrecy Act and Large Deposit Reporting

First things first – yes, your bank will definitely take notice when you deposit $20,000.

According to the Bank Secrecy Act financial institutions are required to file Currency Transaction Reports (CTRs) for any cash deposits over $10000. Since your $20K check exceeds this threshold, your bank will need to report this transaction to the Financial Crimes Enforcement Network (FinCEN), which is part of the U.S. Department of Treasury.

The CTR will include your

- Full name

- Account number

- Social Security number

- Taxpayer identification number

The bank will verify and record all this information. This doesn’t mean you’re in trouble or doing anything wrong! It’s just standard procedure that helps prevent money laundering and other financial crimes.

As Lyle Solomon, principal attorney at Oak View Law Group, explains: “According to the Bank Secrecy Act, banks are required to file Currency Transaction Reports for any cash deposits over $10,000.”

Don’t Try to Avoid Reporting Requirements

Some people think they can outsmart the system by breaking up their large deposit into smaller amounts. For example, instead of depositing $20,000 at once, they might deposit $9,000 today and $11,000 tomorrow.

DON’T DO THIS!

This practice is called “structuring,” and it’s actually illegal. Banks are trained to watch for this kind of behavior.

Sean K. August, CEO of The August Wealth Management Group, warns: “If the bank suspects that you are trying to avoid the $10,000 limit by making multiple deposits of less than $10,000, they may still report the transaction to FinCEN, and you may face penalties and legal consequences.”

If your bank suspects structuring, they may file a Suspicious Activity Report (SAR). Unlike with a CTR, the bank is not required to tell you if they file a SAR about your account.

Be Prepared to Provide Documentation

When depositing a large check like $20K, you might need to explain where the money came from. This isn’t because the bank is being nosy – it’s part of their due diligence.

“You may be asked to provide additional information about the source of the funds, such as invoices, receipts or other documentation,” says August.

Documentation you might need could include:

- Bill of sale (if you sold something valuable)

- Gift letter (if it was a gift)

- Court documents (for legal settlements)

- Inheritance paperwork

- Loan documents

Having these documents ready can make the process smoother. I’ve found that being upfront and transparent with bank employees about the source of funds makes things go much quicker.

Hold Periods: When Can You Access Your Money?

After depositing your $20K check, you might be eager to use those funds. However, you probably won’t have immediate access to the full amount.

Herman (Tommy) Thompson Jr., a certified financial planner at Innovative Financial Group, notes: “Large transactions usually have a hold period of two to seven days to verify the authenticity of the check and the ability of the payor to meet the obligation.”

The hold period allows your bank to:

- Verify the check is legitimate

- Ensure the check writer has sufficient funds

- Process the transaction through the banking system

During this hold period, a portion of the funds (typically $200-$500) might be available immediately, while the rest becomes available incrementally or all at once after the hold period expires.

My friend who deposited a $22K check from selling her boat had access to $500 immediately, and the remaining funds were released after 5 business days. Your mileage may vary depending on your bank and account history.

Check Your Bank’s Deposit Limits

Before heading to the bank with your $20K check, it’s worth checking if your specific account has any deposit limits. Some accounts have maximum deposit restrictions.

Call your bank or check your account agreement to verify:

- Daily deposit limits

- Monthly deposit limits

- Any fees associated with large deposits

Most standard checking accounts can handle a $20K deposit, but it’s always better to confirm beforehand rather than being surprised at the teller window.

Make Sure Your Bank Account Is Secure

When depositing large sums, security becomes even more important. Ensure your bank is FDIC-insured, which means your deposits are protected up to $250,000 per depositor, per bank, per ownership category.

Beyond this basic protection, consider:

- Setting up account alerts for unusual activity

- Using strong, unique passwords for online banking

- Enabling two-factor authentication

- Keeping your deposit receipt

I always recommend taking a photo of large check deposits (front and back) before handing them over, just in case there are any issues later.

Watch Out for Scams and Fraud

Unfortunately, large checks are sometimes used in scams. Be extremely cautious if:

- The check comes from someone you don’t know

- The sender asks you to send back part of the money

- The check seems too good to be true

- You’re pressured to deposit it quickly

Solomon warns: “If the source of the funds is unclear or suspicious, be careful. For example, if someone offers to pay you a large sum of money for a service or product, or if you receive an unexpected windfall from an unknown source, it’s important to be cautious and investigate the situation further.”

A common scam involves sending victims a fraudulent check, asking them to deposit it, and then requesting they return a portion of the money. By the time the check is discovered to be fake (which could take weeks), the victim has already sent real money to the scammer.

Tax Implications of Large Deposits

A $20K deposit might have tax implications depending on the source of the funds. While the deposit itself isn’t taxable, the money might be depending on how you got it.

For example:

- Income from work is taxable

- Gifts under $18,000 (2025 limit) per person are not taxable to the recipient

- Inheritance might be subject to estate taxes (but usually not income tax)

- Proceeds from selling possessions may involve capital gains taxes

I’m not a tax professional, so you should consult with an accountant about your specific situation. But it’s good to be aware that large deposits might need to be explained when tax season comes around.

Different Banking Methods for Your $20K Check

You have several options for depositing your check:

-

In-person at a branch: This is usually the best option for a check this large, as you can speak directly with a bank representative.

-

ATM deposit: Many banks allow large check deposits via ATM, but there might be daily limits. Plus, you won’t get a receipt with an image of the check.

-

Mobile deposit: Convenient, but many banks have daily mobile deposit limits below $20K. Check your bank’s app for limitations.

-

Direct deposit to multiple accounts: If applicable, you might ask the check issuer to split the funds between different accounts.

When I helped my friend with her large check, we went to the branch during a less busy time (Tuesday morning) and were able to speak directly with a banker who explained everything and made the process smooth.

What About Business Accounts?

If you’re depositing a $20K check into a business account, there’s one more thing to be aware of.

Businesses must file Form 8300 with the IRS within 15 days of receiving cash payments over $10,000. This isn’t typically necessary for check deposits, but if you’re converting that check to cash, or if your business regularly deals with large sums, you should be familiar with these requirements.

Failing to file required forms can result in penalties, so it’s best to consult with your accountant if you’re unsure.

Tips for a Smooth Large Check Deposit Experience

Based on my experience helping friends with large deposits, here are some tips:

- Call ahead: Let your bank know you’ll be making a large deposit.

- Visit during slow hours: Early morning weekdays are usually less busy.

- Bring ID: You’ll definitely need government-issued photo ID.

- Ask about the hold period: Get clear information about when funds will be available.

- Keep your deposit receipt: Store it in a safe place until the funds clear.

- Monitor your account: Check your balance regularly after the deposit.

Final Thoughts

Depositing a $20K check isn’t complicated, but it does involve more scrutiny and paperwork than smaller deposits. The most important things to remember are:

- The bank will report deposits over $10K to the government (this is normal)

- Never try to structure deposits to avoid reporting

- Be prepared to explain the source of the funds

- Expect a hold period before accessing all your money

- Watch out for potential scams

- Consider potential tax implications

If you follow these guidelines, your large check deposit should go smoothly. And remember, having “problems” with depositing a large check is what most people would call a good problem to have!

Have you ever had to deposit a large check? What was your experience like? I’d love to hear about it in the comments!

The Bank Secrecy Act

If you plan on depositing more than $10,000 in cash, it’s advisable to learn more about the Bank Secrecy Act and other relevant regulations.

Additionally, you may want to explore whether there are any differences if you deposit the same amount in the form of a check.

It’s called the Bank Secrecy Act (aka. The $10,000 Rule), and while that might seem like a big secret to you right now, it’s important to know about this law if you’re looking to make a large bank deposit over five figures.

The Bank Secrecy Act, officially called the Currency and Foreign Transactions Reporting Act, started in 1970.

It states that banks must report any deposits (and withdrawals, for that matter) that they receive over $10,000 to the Internal Revenue Service. For this, they’ll fill out IRS Form 8300. This begins the process of Currency Transaction Reporting (CTR).

Essentially, any transaction you make exceeding $10,000 requires your bank or credit union to report it to the government within 15 days of receiving it — not because they’re necessarily wary of you, but because large amounts of money changing hands could indicate possible illegal activity.

This includes theft, money laundering, or helping fund criminal organizations or terrorists.

Your bank must cover its bases for any large “reportable transaction” that passes through.

Note: Private businesses must go through a similar reporting process if a customer makes a large, big-ticket purchase, cash only, like a car, a house, or other major amenities.

Not a major concern for most people

The reality is that a cash deposit of $10,000 will typically go without incident.

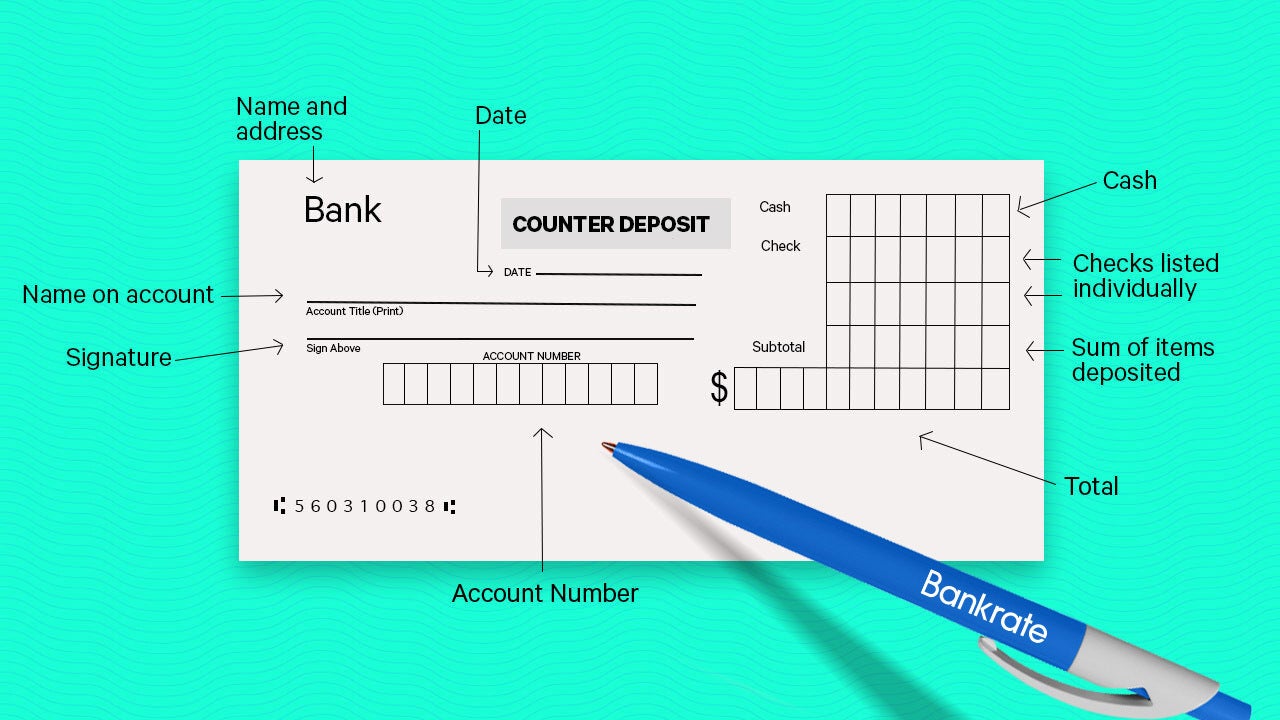

If it’s at your bank walk-in branch, your teller banking representative will verify your account information and ask for identification. As usual, you’ll fill out a deposit slip, and the money is deposited into your account.

Their reporting to the IRS happens after you make the deposit. You should have immediate access to your funds depending on the banking institution.

You won’t be kept in the dark about it. Your bank will notify you that your cash deposit has been reported for the above reasons and provide you with contact information (phone, email) to follow up with any questions.

Note: It doesn’t matter who deposits into the account. Many banks have caught onto suspicious activity where a person deposits a large amount of cash into another person’s account. In the case of Chase Bank, for example, you can’t make cash deposits into someone else’s account anymore — the bank’s customary way of reducing illegal activity.

What is the hold time for a $10,000 check deposit?

FAQ

Can I deposit a $20,000 check?

If you have already spent the money, you’ll have to pay it back, in addition to possible NSF and overdraft fees. While you can deposit checks over $10,000 at any bank or ATM, cashing this requires the bank to report it to the Internal Revenue Service (IRS), a rule for all cash transactions over $10,000.

How long does it take for a $20,000 check to clear?

check can take up to seven to ten business days to fully clear, though some funds may be available sooner.

The firstis typically available after five business days, while the remaining amount can take an additional five business days to clear.

How much check can I deposit without being flagged?

Is it okay to deposit 20k cash?

Key Takeaways. The majority of banks don’t limit how much cash you can deposit, but all institutions have to report deposits of $10,000 or more to the federal government.