James joined Citizens Securities Inc. founded in 2022 and is in charge of selecting and managing the ETFs, mutual funds, and portfolio models made with these investment products. As a strategic partner, he has over 30 years of experience in financial markets focused on a broad array of public and private equity and fixed income products.

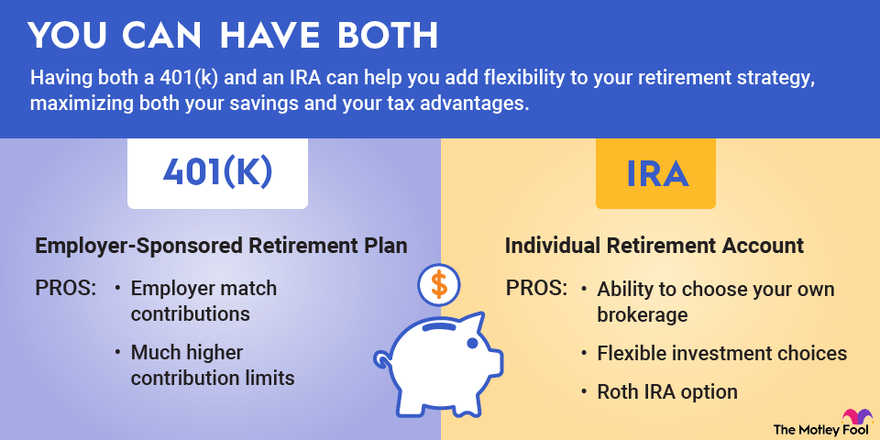

A 401(k) lets you save for retirement. What if your job doesn’t offer one or you want to save even more? An IRA savings account or an IRA CD could be ideal for you.

An IRA can give your retirement savings a boost. And just like 401(k)s, IRAs have tax advantages. You can also pick where to put your money, like in a savings account, stocks or other investments, or a CD.

Whether youre starting from scratch or building on the savings you already have, you can use IRA savings accounts and IRA CDs to help you meet your goals. Heres what to know about these retirement savings options.

Do you want to move the money from your IRA to a regular savings account? Maybe you need cash quickly or are worried about how the market will react. No matter the reason, it’s very important to know what happens when you put your retirement savings in a regular savings account.

I’ve helped many clients navigate this decision, and trust me – there are significant consequences that might make you reconsider. Let’s dive into everything you need to know about transferring your IRA to a savings account.

Understanding the Basics of IRAs

Before jumping into whether you can transfer your IRA to a savings account, let’s refresh our understanding of what an IRA actually is.

An Individual Retirement Arrangement (IRA) is a tax-advantaged account that is designed to help you save for retirement over the long term. IRAs are different from other savings accounts because they offer tax breaks that make saving for the future more appealing.

There are two main types of IRAs:

-

Traditional IRAs: Most of the time, your contributions are tax-deductible, which means your current taxable income is less. The money grows tax-free, and you only pay taxes on the money you take out when you retire.

-

Roth IRAs Contributions are made with after-tax dollars (no immediate tax benefit) but the money grows tax-free and qualified withdrawals in retirement are completely tax-free.

In 2025, you can only put $7,000 into all of your IRAs each year if you are under 50 years old and $8,000 if you are 50 or older.

Can You Actually Move IRA Funds to a Savings Account?

The short answer is: Yes, you can transfer your IRA to a savings account – but it’s not really a “transfer” in the technical sense. It’s considered a withdrawal or distribution from your retirement account.

When you move money from an IRA to a standard savings account, you’re effectively taking that money out of its tax-advantaged retirement wrapper and placing it into a regular taxable account. This has serious implications.

The Costs of Transferring Your IRA to a Savings Account

Taxes and Penalties

Here’s where things get expensive:

For Traditional IRAs:

- You’ll pay ordinary income tax on the entire amount withdrawn

- If you’re under 59½, you’ll face an additional 10% early withdrawal penalty

- This can easily eat up 30-40% of your withdrawal amount!

For Roth IRAs:

- You can withdraw your contributions (but not earnings) at any time without taxes or penalties

- However, if you withdraw earnings before age 59½ and before the account has been open for 5 years, you’ll pay both taxes and a 10% penalty on those earnings

Let me give you a real example. If you withdraw $50,000 from your traditional IRA at age 45 and you’re in the 22% tax bracket, you could end up paying:

- $11,000 in federal income tax (22%)

- $5,000 in early withdrawal penalty (10%)

- Plus potential state taxes

That means potentially $16,000+ gone from your $50,000! Ouch!

Exceptions to the Early Withdrawal Penalty

There are some situations where you might avoid the 10% early withdrawal penalty (though you’ll still pay income taxes on traditional IRA withdrawals):

- Permanent disability

- Qualified higher education expenses

- Unreimbursed medical expenses exceeding 7.5% of your adjusted gross income

- First-time home purchase (up to $10,000)

Even with these exceptions, the process has strict rules and paperwork requirements.

The Long-Term Impact on Your Retirement

Beyond the immediate tax hit, there’s an even bigger long-term cost: the loss of tax-advantaged growth potential.

When money sits in an IRA, it grows either tax-deferred (Traditional) or tax-free (Roth). This tax advantage accelerates your growth through compounding.

Let’s look at a simple example:

Imagine you have $25,000 in an IRA that could grow at about 7% annually for 20 more years. If left untouched, that could become around $96,742!

But if you withdraw it now, paying roughly 30% in taxes and penalties, you’d only have $17,500 to put in your savings account. Even with high-yield savings interest (let’s say 3%), after 20 years you’d only have about $31,589.

That’s a difference of over $65,000 in your retirement funds! Is accessing the money now really worth that much?

Better Alternatives to Consider

Instead of moving your IRA to a savings account, consider these alternatives:

1. IRA to IRA Transfers

If you’re unhappy with your current IRA provider, you can transfer your IRA to another IRA without penalties:

- Move from one Traditional IRA to another Traditional IRA

- Move from one Roth IRA to another Roth IRA

These IRA-to-IRA transfers don’t trigger taxes or penalties as long as you follow the rules. Keep in mind you’re limited to one transfer per 12-month period.

2. Use a 72(t) Distribution Plan

For those who need regular income before age 59½, the IRS allows “substantially equal periodic payments” (SEPP or 72(t) distributions) without the 10% penalty. However, this is complex and requires a long-term commitment.

3. Consider a Loan Instead

If you need short-term funds, personal loans or home equity lines of credit might be less expensive than raiding your retirement account.

4. Tap Into Other Savings First

Before touching retirement funds, exhaust other savings options:

- Emergency funds

- Regular savings accounts

- Brokerage accounts (which might have more favorable tax treatment than IRA withdrawals)

How to Make the Transfer (If You Still Decide To)

If after understanding all the implications, you still want to move forward, here’s how:

- Contact your IRA provider and inform them you want to take a distribution

- Specify the amount you want to withdraw

- Provide your savings account information for the transfer

- Complete any required paperwork, including tax withholding forms

- Prepare for the tax consequences in your next tax return

Many financial institutions allow you to complete this process online, but having a conversation with a representative might help you understand all implications.

Final Thoughts: Is It Worth It?

I’ll be straight with you – in most cases, transferring your IRA to a savings account isn’t a good financial move. The immediate tax consequences and long-term opportunity costs usually outweigh the benefits of having the money now.

Think of your IRA as a specialized vehicle designed for a specific journey: your retirement. Taking it off that path is costly.

Before making this decision, I strongly recommend speaking with a financial advisor who can analyze your specific situation and help you explore all alternatives. Sometimes what feels like an urgent need for cash can be addressed in ways that don’t compromise your future security.

Remember: Your retirement savings took years to build. Try not to undo all that hard work in a moment of short-term thinking.

Have you considered all your options? What specific financial need is driving you to consider this move? Sometimes just talking through your motivations can help you find better solutions that preserve your retirement savings while still addressing your current needs.

FAQs About Transferring IRA Funds to Savings Accounts

Q: Can I avoid penalties if I only need the money temporarily?

A: Yes! The IRS allows a 60-day rollover. If you return the entire distribution to an IRA within 60 days, you can avoid taxes and penalties. However, this is risky timing-wise and you can only do this once per 12-month period.

Q: What if I’m using the money for a first home purchase?

A: You can withdraw up to $10,000 from an IRA penalty-free for a first-time home purchase. However, with a Traditional IRA, you’ll still owe income taxes on the withdrawal.

Q: Are there any exceptions for financial hardship?

A: Unlike 401(k)s, IRAs don’t have specific “hardship” provisions. However, the exceptions mentioned earlier (medical expenses, disability, etc.) might apply to your situation.

Q: Is there any difference in penalties between Traditional and Roth IRAs?

A: Yes, significant differences! With Roth IRAs, you can withdraw your contributions (but not earnings) at any time without taxes or penalties, which provides much more flexibility than Traditional IRAs.

Q: What about putting my IRA into an IRA Savings Account instead?

A: An IRA Savings Account is different from a regular savings account – it’s still an IRA, just invested conservatively. This maintains the tax advantages while reducing investment risk, which might be a better option if market volatility concerns you.

Explore your options for retirement savings

When it comes to saving for retirement, youve got choices. An IRA savings account or IRA CD can help your nest egg grow and give you peace of mind, especially if you’re getting close to retirement and need to know how much money you’ll have each month. For any choice you make, starting to save for retirement early can give your money a lot of time to grow.

Ready to open an IRA and start saving? Request a call from a Citizens Wealth Advisor to help you prepare for the road ahead.

How to choose a financial planner

A financial planner can be a valuable resource to help you with your financial goals.