If you are about to turn 70, congratulations on reaching a big milestone. Also, if you have put off getting your Social Security retirement benefits until now, you are one of only 6 people who have done that. 5 percent of Social Security recipients put off collecting their benefits until they reach three score and ten, the age at which they can collect the maximum benefit. If you want to join the elite group of people who claim to be ninety years old, you should know when and how to claim.

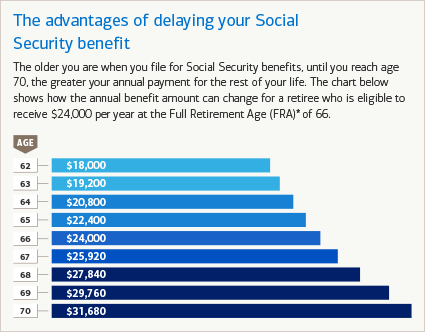

How long you wait to start getting Social Security benefits depends on a lot of things, like how long you expect to live and if you have any other sources of income in retirement. But Social Security experts advise waiting as long as possible to start collecting benefits, up to age 70. This is because if you wait to retire past your full retirement age (66 for people born between 1943 and 1954), you earn “delayed retirement credits” that raise your benefit by 8% each year you wait, on top of the annual inflation adjustments. Your checks will be about 76 percent more than had you claimed at age 62, the earliest you can file. It’s tough to find a better and more reliable investment than that. (However, keep in mind that if you are collecting benefits based on the work record of a current or ex-spouse, there is no point in waiting until 70 — you won’t accrue delayed retirement credits beyond your full retirement age. ).

If you’re approaching your 70th birthday and have delayed claiming Social Security benefits until now, you’re joining a select group. According to the provided information, only about 6.5% of Social Security recipients delay collecting their benefits until age 70, which is when you can receive the maximum benefit amount.

You should know this important fact, though: Social Security benefits DO NOT start automatically when you turn 70, but there is one exception.

The One Exception: Previously Suspended Benefits

There is only one scenario where benefits will automatically begin at age 70:

- If you previously claimed benefits after reaching your full retirement age

- Then suspended those benefits to earn delayed retirement credits

- In this case, the Social Security Administration (SSA) should automatically restart your benefits at 70

For everyone else, you must apply for your benefits, even at age 70.

Why You Shouldn’t Wait Past 70

There are several important reasons not to delay claiming beyond age 70:

- Delayed retirement credits stop accumulating at age 70

- You won’t increase your monthly benefit by waiting longer

- If you wait more than six months after turning 70, you’ll permanently forfeit some benefits

- The SSA will only pay retroactively for benefits up to six months after your 70th birthday

- Any benefits beyond that six-month window are permanently lost

How to Apply for Benefits at Age 70

Since benefits don’t start automatically, you need to take action:

- You can begin the application process up to four months before you want benefits to start

- For maximum benefits, request that they begin the month you turn 70

- Application options include:

- Online at the Social Security website

- By phone: 1-800-772-1213 (TTY 1-800-325-0778)

- In person at your local Social Security office

When Will Your First Check Arrive?

Because the SSA sends checks one month late, your benefits will usually come the month after you turn 70. For example:

- If your birthday is July 17, request benefits to start in July and your first check will come in August

- If you were born on the 1st of a month, there’s a small bonus: the SSA treats you as if you were born the previous month, so your payments can begin in your birth month

Working Past Age 70

If you continue working after claiming benefits at age 70

- It won’t reduce your Social Security benefits

- It might actually increase your benefit amount during the SSA’s annual recalculation

- This happens if your current earnings replace a lower-earning year in your top 35 years of earnings

- However, your Social Security benefits are taxable, so higher earnings might increase your tax rate

The Value of Waiting Until 70

For those who can afford to wait, delaying benefits until 70 can be financially advantageous:

- If you delay taking retirement beyond your full retirement age, you earn “delayed retirement credits”

- These increase your benefit by 8% for every year you wait

- This is on top of annual inflation adjustments

- By waiting until 70, your checks will be approximately 76% larger than if you had claimed at 62

Full Retirement Age vs. Age 70

Your full retirement age (FRA) depends on your birth year:

- For those born 1943-1954: FRA is 66

- For those born 1955: FRA is 66 and 2 months

- For those born 1956: FRA is 66 and 4 months

- For those born 1957: FRA is 66 and 6 months

- For those born 1958: FRA is 66 and 8 months

- For those born 1959: FRA is 66 and 10 months

- For those born 1960 or later: FRA is 67

Important Documentation

You will need certain information and papers when you apply for Social Security benefits. The SSA gives a list of documents that are needed, which could include:

- Your Social Security number

- Birth certificate

- Proof of U.S. citizenship or lawful alien status

- Military discharge papers if you served

- W-2 forms or self-employment tax returns for the previous year

Medicare Considerations

Even if you decide to delay Social Security benefits until age 70, you should still apply for Medicare within 3 months of your 65th birthday. Waiting longer may result in higher costs for:

- Medicare medical insurance (Part B)

- Prescription drug coverage (Part D)

In most cases, your Medicare premiums will be deducted directly from your Social Security check once you begin receiving benefits.

Spousal Benefits Exception

It’s worth noting that if you’re collecting benefits based on the work record of a current or ex-spouse, there is no advantage to waiting until age 70. You won’t accrue additional delayed retirement credits beyond your full retirement age in this situation.

Final Thoughts

Putting off Social Security until you turn 70 can greatly increase your monthly benefit, but you have to do something to start getting those benefits. The system isn’t automatic, and if you don’t apply, you could lose benefits forever.

When approaching age 70, take the time to understand your options and apply for benefits up to four months before you want them to begin. This small administrative task can ensure you receive the maximum benefit you’ve earned through years of work and patience.

If you’re unsure about the best approach for your specific situation, consider consulting with a financial advisor or elder law attorney who specializes in retirement planning.

Don’t Wait Any Longer

Delayed retirement credits stop at age 70, so there is no advantage to putting off starting benefits any longer. You won’t get more credits if you claim after age 70, and if you wait more than six months, you’ll start losing the monthly benefits you would have gotten otherwise. The Social Security Administration (SSA) will pay you retroactively for benefits accrued up to six months after your 70th birthday, but that’s it. If you wait any longer, benefits you would have received are permanently forfeited.

The next thing to know is that the SSA won’t automatically start sending you checks once you turn 70. You need to apply for benefits. You can do this starting four months before the date that you want your benefits to begin. To get the maximum amount, you’ll want the benefits to start the month you turn 70. There is, however, one scenario where benefits will automatically kick in at 70: those who took benefits after reaching their full retirement age and then suspended their benefits to earn delayed credits until age 70. For them, the SSA should automatically restart benefits at 70.

You can apply online — click here. If you can’t submit your application online, you can call 1-800-772-1213 (TTY 1-800-325-0778). Another alternative is to visit your local Social Security Office (assuming the office has re-opened after pandemic closure.) The SSA will want certain information and documents when you apply. For a checklist of what may be required, click here.

When will you get your first check? The SSA issues checks a month behind, so your benefits should start arriving the month after the month you turned 70. For example, if you were born July 17, you should ask that your benefits start in July and your first check will come in August. People born on the first of the month, on the other hand, get a small bonus: the SSA treats them as if they were born the month before and starts paying them benefits in the month they were born. So, for example, if you were born July 1, you’d request benefits to start in June and the payments would begin in July.

Social Security Filing at Age 70

FAQ

Do Social Security benefits start the month you turn 70?

No, you do not receive your Social Security benefit check the same month you turn 70; benefits are paid a month behind the month they are due.

Is there really a downside to claiming Social Security at 70?

Your life expectancy Taking Social Security early reduces your benefits, but you’ll also receive monthly payments for a longer period of time. Taking it later, on the other hand, means you will get fewer Social Security checks over the course of your life, but each one will be bigger.

What will my Social Security payment be at age 70?

Your Social Security benefit at age 70 will depend on how much you earned and when you were born, but it will be more than if you started getting benefits at your full retirement age (FRA). For those born in 1960 or later, your FRA is 67, and delaying until 70 provides a significant increase, while those born earlier may have a slightly different increase schedule.

At what age do you automatically get Social Security?

You can receive Social Security retirement benefits as early as age 62. However, we’ll reduce your benefits if you start receiving them before your full retirement age. For example, if you turn age 62 in 2025, your benefit would be about 30% lower than it would be at your full retirement age of 67.

When can I start receiving Social Security benefits?

You can start receiving your Social Security retirement benefits as early as age 62. However, you are entitled to full benefits only when you reach your full retirement age. If you delay taking your benefits from your full retirement age up to age 70, your benefit amount will increase.

Do I have to start collecting Social Security at 70?

Although you don’t have to start getting Social Security at age 70, if you wait until after that date, your benefit will not go up.

What if I don’t sign up for Social Security at 70?

Despite the lack of financial incentive to delay claiming benefits past age 70, Social Security does not automatically enroll you at this age. If you fail to sign up, you risk missing out on valuable benefits. It’s crucial to take proactive steps to ensure you begin receiving your benefits at the appropriate time.

When do Social Security benefits kick in?

In one scenario, however, benefits will automatically kick in at age 70: Those who took benefits after reaching their full retirement age and then suspended their benefits to earn delayed credits until age 70. For them, the SSA should automatically restart benefits at 70. You can apply online for Social Security.

When should I file for Social Security if I’m 70?

Marking your calendar to file for benefits as you approach your 70th birthday can help you avoid unnecessary delays. Many people mistakenly believe that Social Security enrollment is automatic at age 70. If you find yourself past this age without having received any benefits, it’s essential to file immediately.

Will Social Security pay you if you turn 70?

The Social Security Administration (SSA) will pay you retroactively for benefits accrued up to six months after your 70th birthday, but that’s it. If you wait any longer, benefits you would have received are permanently forfeited. The next thing to know is that the SSA won’t automatically start sending you checks once you turn 70.