When you retire, a pension gives you a steady stream of income, which makes it easier to pay your bills and live the life you’ve always dreamed of. For most retirees, receiving a pension wont affect the amount of your Social Security payouts. You can enjoy both.

However, if your pension comes from a certain type of job, your benefits could be impacted. If youre retiring with a pension and Social Security, its important to determine whether your benefits are affected so you can plan for a solid financial future.

Are you worried about your pension cutting into your Social Security benefits? Well I’ve got some fantastic news for you! Thanks to recent legislative changes, you can now collect both your full pension and your full Social Security benefits. This is a major change that affects millions of retirees across America.

As someone who’s spent years helping people navigate retirement planning, I can tell you this is one of the biggest positive changes to Social Security in decades. Let me walk you through everything you need to know about this new development

The Game-Changing Social Security Fairness Act

When it became law on January 5, 2025, the Social Security Fairness Act completely changed how pensions and Social Security benefits work together. This new legislation:

- Eliminated the Windfall Elimination Provision (WEP)

- Repealed the Government Pension Offset (GPO)

- Applied retroactively to benefits payable for months after December 2023

Why does this matter? It means that if you get a pension from a government job where you didn’t pay into Social Security, your benefits will not be cut. This is the exact opposite of what happened before.

Who Benefits from This Change?

You’ll benefit from this change if you:

- Worked in “non-covered” government employment (jobs where FICA taxes weren’t withheld)

- Also worked enough in “covered” jobs to qualify for Social Security benefits

- Are receiving or expecting a government pension

Typically, this affects:

- State and local government employees from agencies that don’t participate in FICA withholding

- Federal workers hired before 1984 (when the U.S. civil service was brought under Social Security)

- People who had two careers – one in government and one in the private sector

How Much More Money Will You Get?

The financial impact of this change is significant. According to the Congressional Budget Office:

- WEP elimination: Increases monthly benefits by about $360 (on average) for 2.1 million beneficiaries

- GPO elimination: Increases monthly benefits by about $700 for 380,000 spouses and $1,190 for 390,000 surviving spouses

That’s real money back in retirees’ pockets!

If You’re Already Getting Benefits

If you’re already receiving Social Security and your payments were previously reduced because of WEP/GPO:

- The Social Security Administration will automatically add that amount back to your monthly payment

- You’ll receive a lump-sum repayment for amounts withheld since January 2024

- Most eligible retirees should have received their retroactive payment by the end of March 2025

- Regular monthly benefits at the higher amount should start arriving in April 2025

The SSA is speeding up these changes for most of the people who will be affected by them by using an automated process. About 85% of eligible retired public sector employees (approximately 2. Four million retirees have already gotten their back pay and seen their monthly benefits go up.

If You Haven’t Applied for Social Security Yet

If you haven’t applied for Social Security benefits yet, you’re in luck! Your benefits won’t be reduced at all because of your pension. You’ll receive your full Social Security benefit along with your full pension when you decide to claim.

This change might make filing for Social Security more attractive now for those who were delaying because of potential WEP/GPO reductions.

Understanding What Changed: WEP and GPO Explained

To truly appreciate this change, it helps to understand what the WEP and GPO were and how they affected retirees.

The Windfall Elimination Provision (WEP)

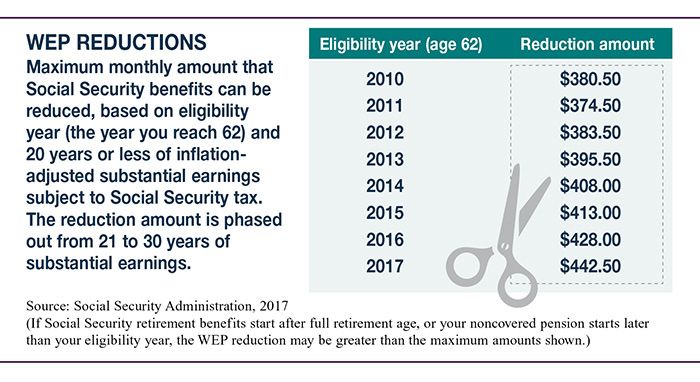

Previously, the WEP reduced Social Security benefits for people who:

- Received a pension from “non-covered” employment (jobs where Social Security taxes weren’t paid)

- Had fewer than 30 years of “substantial earnings” in jobs covered by Social Security

Because of the WEP, your Social Security benefit could go down by as much as half. This was a significant hit to many retirees’ income.

The Government Pension Offset (GPO)

The GPO affected people who:

- Received a government pension from non-covered work

- Were eligible for Social Security spousal or survivor benefits

The GPO would reduce spousal or survivor benefits by two-thirds of the pension amount. If that two-thirds exceeded the Social Security payment, the benefit could be eliminated entirely.

Why Did These Rules Exist in the First Place?

The WEP and GPO were originally implemented in the 1980s to prevent what Congress saw as “double-dipping” – receiving both a full pension from a job that didn’t contribute to Social Security AND full Social Security benefits.

The formulas were designed to replicate the progressive nature of Social Security’s benefit calculation for workers with split careers. However, many argued that these provisions unfairly penalized public servants like teachers, police officers, and other government employees.

Important Things to Remember

While your pension no longer reduces your Social Security benefit, there are still some important considerations:

- Earnings test still applies: If you’re under full retirement age and still working while claiming Social Security, your benefits may still be reduced based on your earnings.

- Tax implications: Pension income does count toward determining whether your Social Security benefits are taxable. Up to 85% of your Social Security benefits could be subject to federal income tax, depending on your combined income.

- Trust fund impact: The CBO estimates that repealing WEP and GPO will increase spending by $101 billion over the 2024-2034 period and may advance the Social Security trust fund’s exhaustion date by about half a year.

What If Someone Has Died?

If someone who was affected by WEP/GPO has passed away, they may still be due a repayment. The Social Security Administration has a process for this:

- Sign in to your my Social Security account

- Search for form “Claim for Amounts Due in the Case of a Deceased Beneficiary (SSA-1724-F4)”

- Complete the form and submit it along with any additional required documents

How to Apply for Benefits Now

If you’re receiving a public pension and want to apply for Social Security benefits, you can:

- Apply online through the SSA website

- Visit your local Social Security office in person

- Call the Social Security Administration

The application process is the same as before, but now you don’t need to worry about your benefits being reduced because of your pension.

Checking Your Benefit Amount

If you want to see how much you might receive in Social Security benefits:

- Create or log into your my Social Security account at ssa.gov

- View your Social Security Statement

- Check your earnings record to ensure it’s accurate

- Use the benefit calculators to estimate your payment amount

Final Thoughts

This change to Social Security policy represents a significant win for public employees. After years of advocacy by organizations representing government workers, teachers, and other public servants, the WEP and GPO have finally been eliminated.

For many retirees, this means hundreds of dollars more in monthly income. It also simplifies retirement planning for those with split careers between the public and private sectors.

I’m thrilled to see this positive change for retirees who dedicated their careers to public service. If you’re among those affected, make sure you’re receiving your full benefits, and if you haven’t seen an adjustment yet, contact the Social Security Administration to check on the status.

Remember, retirement planning is always a personal journey, but it’s nice when policy changes make that journey a little easier and more rewarding. Now you can enjoy both the pension you earned AND your full Social Security benefit – just as you deserve!

Have you received your adjusted benefit yet? I’d love to hear about your experience in the comments below!

Social Security reduction from GPO

If you receive Social Security benefits based on your spouses or widows earnings record, the SSA will reduce your benefits by two-thirds of your government pension. For instance, if you receive a pension of $2,400, youll see a $1,600 reduction in your monthly Social Security payout.

In cases where two-thirds of your noncovered pension is greater than your Social Security benefit, the SSA would decrease your benefit to zero. The SSA calculator can help you determine the amount of the Social Security reduction based on your monthly pension benefit. Why timing your Social Security matters Wondering when you should start collecting Social Security? Its one of the most important decisions retirees face. Consider these factors, including age, health, marital status and taxes.

Windfall Elimination Provision (WEP)

The Windfall Elimination Provision (WEP) is a Social Security benefit deduction that comes into play if you claim benefits based on your own earnings. For the WEP to apply, you must have held one or more jobs that did withhold FICA taxes—in addition to your “noncovered” employment.

Under this provision, the Social Security Administration uses a slightly different formula when calculating your primary insurance amount (PIA), resulting in a smaller benefit. The WEP can take away up to half of your pension, but not the whole thing.

How Do Pensions Affect Your Social Security Benefits?

FAQ

Will my Social Security be reduced if I have a pension?

No, your Social Security benefits will likely not be reduced by a pension due to the new Social Security Fairness Act (SSFA), which repealed the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO).

Can I get both pension and Social Security?

How does Social Security work if I have a pension?

If you didn’t pay Social Security taxes on your job and get a pension after January 2024, that pension won’t cut into your or your spouse’s Social Security benefits. This change is because of the Social Security Fairness Act (SSFA) of 2023, which was signed into law in January 2024.

Does a pension count as earned income?

The short answer is no—pension income is generally not classified as earned income for tax purposes. Earned income includes things like wages, salaries, tips, and money from self-employment. Unearned income includes things like pensions.

Does a private pension affect social security?

Most private-sector pensions will not affect the amount you receive from Social Security. Some government and overseas jobs do not withhold Social Security taxes, which can reduce your Social Security monthly benefit. If you receive a spouse or surviving spouse benefit from Social Security, your government pension can reduce benefits.

How does a pension affect Social Security benefits?

You may or may not lose Social Security benefits if you have a pension from a job where you paid Social Security taxes. There are two types of pensions: covered pensions and unfunded pensions. Covered pensions come from employers who took Social Security taxes out of your paychecks.

What if my pension income exceeds social security?

Their benefits could be reduced by up to two-thirds of their pension amount and would have been eliminated if that two-thirds exceeded the Social Security payment. Pension income does not count toward the Social Security earnings test, which can reduce your Social Security payments if you continue to work after claiming benefits.

Does pension income count toward Social Security income?

Pension income does not count toward the Social Security earnings test, which can reduce your Social Security payments if you continue to work after claiming benefits. Pensions do count toward income for the purpose of determining whether you pay taxes on your Social Security benefits.

Can I retire with a pension and Social Security?

You can enjoy both. However, if your pension comes from a certain type of job, your benefits could be impacted. If you’re retiring with a pension and Social Security, it’s important to determine whether your benefits are affected so you can plan for a solid financial future.

Can I receive a pension and Social Security simultaneously?

Yes, you can receive both a pension and Social Security benefits simultaneously. However, if your pension is from non-covered employment, your Social Security benefits may be reduced by the WEP or GPO. 3. Does a pension count as earned income for Social Security? No, a pension does not count as earned income for Social Security purposes.