Have you ever wondered if you’re “rich” by official standards? Like, what’s the magic number that puts you in that coveted high-net-worth category? Well, I’ve done some digging to update you on what’s considered high net worth in 2025, how it’s changed since 2021, and whether you might qualify for this exclusive club.

High-Net-Worth Individuals: The Official Definition

Let’s cut straight to the chase – a high-net-worth individual (HNWI) is someone who owns liquid assets valued at $1 million or more. When financial pros talk about HNWIs, they’re referring to a specific class of wealthy folks who meet this threshold.

But here’s the thing – your primary residence art collection or that vintage car you’ve been babying don’t count toward this number. We’re talking liquid assets like

- Stocks

- Mutual funds

- ETFs

- Cash in checking/savings accounts

- CDs (certificates of deposit)

- Good old-fashioned cash under the mattress (though I don’t recommend this storage method!)

The Wealth Hierarchy: Beyond Just “Rich”

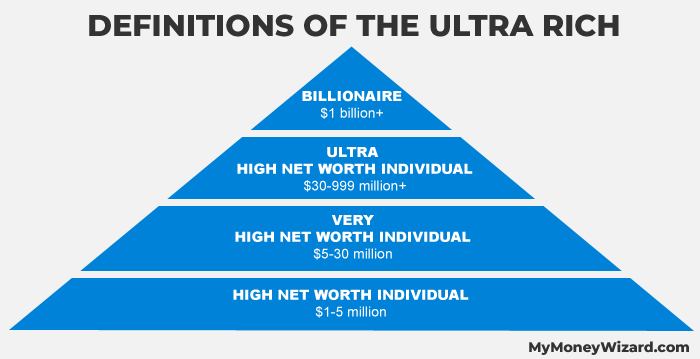

The financial world breaks down wealth into several tiers

| Category | Net Worth Range |

|---|---|

| High-Net-Worth Individual (HNWI) | $1 million to $5 million |

| Very-High-Net-Worth Individual (VHNWI) | $5 million to $30 million |

| Ultra-High-Net-Worth Individual (UHNWI) | More than $30 million |

And if you’ve got over $1 billion? Well, you’re in a special bracket of the UHNWI club – congrats on your billionaire status!

What Americans Think It Takes to Be “Rich”

Here’s something interesting – what financial institutions define as “wealthy” and what regular folks think it takes to be rich are two different things

According to Schwab’s 2024 Modern Wealth Survey, Americans believe you need an average net worth of about $2.5 million to be considered wealthy. That’s up from $2.2 million in 2021-2023.

The generations also have different ideas about what makes someone rich:

- Baby Boomers think you need $2.8 million

- Gen X says $2.7 million

- Millennials set the bar at $2.2 million

- Gen Z is the most modest, saying just $1.2 million

And what about just being “financially comfortable” rather than rich? Americans say that takes about $778,000 in average net worth.

How Many HNWIs Are There?

As of 2024, there are approximately 23. 4 million high-net-worth individuals worldwide, controlling a massive $90. 5 trillion in wealth. That’s a pretty exclusive club – less than 0. 5% of the global population!.

The United States leads the pack with around 6 million HNWIs, followed by China with over 6 million. The UK comes in third with 3 million.

Looking at the ultra-wealthy (UHNWIs), they make up just 0. about 1.3 percent of the world’s population but hold about 13 percent of the world’s total wealth. Talk about concentration of resources!.

How to Calculate Your Net Worth

Wanna see where you stand? The formula is actually pretty simple:

Net Worth = Assets – Liabilities

Let’s break it down:

- Add up all your assets (investments, bank accounts, property, vehicles, etc.)

- Subtract all your liabilities (mortgage, student loans, credit card debt, etc.)

- The number you get is your net worth

For example, if you have $2 million in assets and $250,000 in debts, your net worth would be $1.75 million – congrats, you’d qualify as an HNWI!

Most wealth managers say that you shouldn’t count your main home as part of your “investable” net worth because you need a place to live and probably aren’t going to sell it to pay for your investments.

Where the HNWIs Live

New York City takes the crown as the wealthiest city in the world, home to about 385,000 HNWIs as of 2025. If we look at the ultra-wealthy specifically, NYC again leads with over 16,630 people worth $30 million or more.

The top five cities for ultra-high-net-worth individuals are:

- New York City (16,630)

- Hong Kong (12,546)

- Los Angeles (8,955)

- Tokyo (6,445)

- Paris (data not specified in the sources)

How to Become a High-Net-Worth Individual

I’m not gonna lie – becoming an HNWI requires some serious financial discipline and usually many years of consistent effort. But it’s not impossible! Here are some strategies that can help:

1. Start Early and Use Time to Your Advantage

The magic of compound interest is real, y’all. The more time you spend investing and the earlier you start, the more money you could make.

As Andy LaPointe, a former registered investment advisor, puts it: “The top tip for retail investors to become an HNWI is first to have a long-term mentality. No matter your age when you start, all of your investment choices should have at least a 20-year time horizon.”

2. Become a Disciplined Investor

Setting up a systematic investment strategy and contributing consistently can lead to impressive results over time.

Get this – a 25-year-old who saves just $400 per month could potentially have around $1 million by age 65, assuming a 7% annual return. That’s the power of starting early and staying consistent!

3. Minimize Debt

One thing that separates HNWIs from the rest is their approach to debt. While they might use strategic debt for investments, they typically avoid high-interest consumer debt that eats away at wealth.

Perks of Being an HNWI

So what do you get for joining this exclusive club? Quite a lot, actually:

- VIP Treatment: Financial institutions roll out the red carpet for HNWIs, offering dedicated wealth advisors and personalized service.

- Access to Exclusive Investments: Many investment opportunities are only available to accredited investors or those with significant assets.

- Lower Fees: Many investment firms offer reduced fees for their wealthier clients.

- Special Events and Networking: Invitations to exclusive events where you can network with other wealthy individuals.

For example, to invest in Vanguard’s Admiral share class funds (which have lower expense ratios), you’ll need at least $100,000. These kinds of investment opportunities with lower fees can help the wealthy grow their assets even faster.

What’s Changed Since 2021?

If we compare 2021 data to 2025, we can see some interesting trends:

- More HNWIs: The global HNWI population has grown from about 22.5 million in 2021 to 23.4 million in 2024.

- More Wealth: Total HNWI wealth has increased from about $86 trillion in 2021 to $90.5 trillion in 2024.

- Higher Threshold for Being “Rich”: The amount Americans think you need to be wealthy has increased from $2.2 million to $2.5 million.

The Average American’s Net Worth

To put all this in perspective, the average net worth of an American household (excluding home equity) is $371,200, according to the most recent U.S. Census Bureau data. The median figure is much lower at $60,000.

That shows just how exceptional HNWI status really is – even the average American net worth is well below the $1 million HNWI threshold.

Final Thoughts: Is Being an HNWI Worth Pursuing?

I think it’s worth remembering what David Rockefeller (former CEO of Chase Bank) once said about wealth: “It’s not about the money, it’s about the legacy you leave behind.”

While having high net worth certainly provides financial security and opens doors, many wealthy individuals find that once their basic needs are met, additional wealth doesn’t necessarily translate to greater happiness.

As they say, “You will never see a hearse with a luggage rack.” You can’t take it with you when you go!

Whether you’re aiming for HNWI status or just working toward financial security, the principles remain the same: invest consistently, minimize debt, and make your money work for you over the long term.

Are you on your way to HNWI status? Or do you think the whole concept of measuring worth by net worth is overrated? I’d love to hear your thoughts!

FAQs About High Net Worth

Does my 401(k) count toward HNWI status?

Yes! Even though 401(k)s aren’t completely liquid until retirement, they’re still considered part of your net worth calculation for HNWI status.

Is $1 million still a meaningful threshold in 2025?

While $1 million doesn’t buy what it used to, it’s still the official threshold for HNWI status in the financial industry. However, many Americans feel it takes $2.5 million or more to truly be “wealthy.”

Do HNWIs pay more or less in taxes?

This is complicated and depends on the source of their wealth. Many HNWIs have strategies to minimize tax burdens legally, but the highest income earners do pay the highest marginal tax rates on ordinary income.

What percentage of Americans qualify as HNWIs?

Based on the data, less than 5% of American households would qualify as HNWIs. It’s an exclusive club!