Choosing the right retirement plan for your employees is an important decision, and requires thorough research. To evaluate different options, such as SIMPLE IRA vs. 401(k) plans, here are some key preliminary questions to ask:

As a small business owner looking into retirement plans, I’ve spent countless hours researching the age-old question: is a SIMPLE IRA better than a 401(k)? The answer isn’t straightforward – it depends on your unique business situation and goals. In this comprehensive guide, I’ll break down everything you need to know to make an informed decision for your business and employees.

Quick Answer: Is a SIMPLE IRA Better Than a 401(k)?

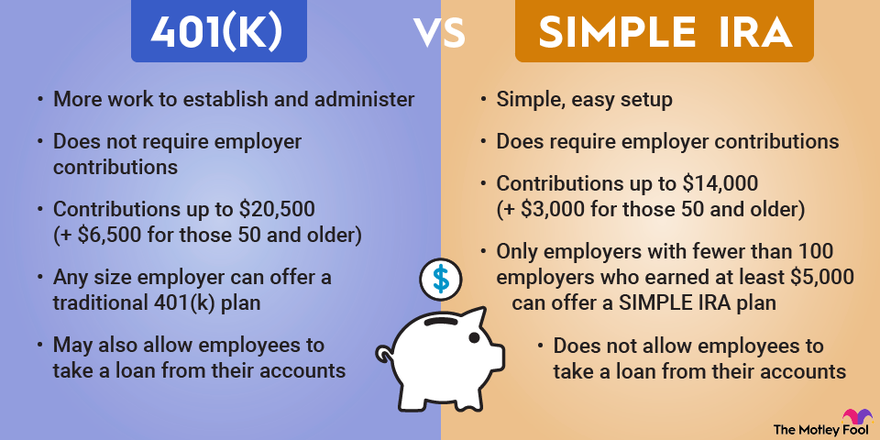

The SIMPLE IRA is better for small businesses that want to keep things simple, cut down on costs, and make setting it up as easy as possible. Businesses that want higher contribution limits, more flexible employer contributions, and extra plan features like loans should choose the 401(k).

SIMPLE IRA vs. 401(k): The Basics

Before diving deeper let’s clarify what these retirement plans actually are

SIMPLE IRA (Savings Incentive Match Plan for Employees): This plan is made for small businesses with 100 or fewer workers who make at least $5,000 a year. It’s characterized by mandatory employer contributions but simplified administration.

401(k) Available to businesses of any size these plans offer higher contribution limits and more flexibility in design, but typically come with more complex administration and potentially higher costs.

Key Differences at a Glance

| Feature | SIMPLE IRA | 401(k) |

|---|---|---|

| Employer Eligibility | 100 or fewer employees | Any employer |

| 2025 Employee Contribution Limit | $16,500 ($20,000 if 50+, $21,750 if 60-63) | $23,500 ($31,000 if 50+, $34,750 if 60-63) |

| Employer Contributions | Mandatory | Optional |

| Setup & Administration | Simpler, less expensive | More complex, potentially costlier |

| Vesting | Immediate 100% vesting | Employer can set vesting schedule |

| Loans | Not permitted | May be permitted |

| Roth Option | Available since 2023 | Available |

Employer Contribution Requirements

One of the biggest differences between these plans is how employer contributions work:

SIMPLE IRA Requirements

With a SIMPLE IRA employers MUST contribute in one of two ways

- Matching contribution: Match employee contributions dollar-for-dollar up to 3% of their compensation. (Can be reduced to as low as 1% in any 2 of 5 years)

- Nonelective contribution: Contribute 2% of each eligible employee’s compensation (up to $350,000 in 2025), regardless of whether they contribute themselves.

401(k) Requirements

With a 401(k), employer contributions are completely optional. If you do contribute, you have more flexibility in designing your contribution formula, and you can implement a vesting schedule to reward longer-term employees.

Contribution Limits Comparison

The 401(k) plan allows for significantly higher contributions, which is a major advantage for business owners and high-earning employees who want to maximize retirement savings:

2025 SIMPLE IRA Contribution Limits

- Employee deferrals: $16,500

- Catch-up for ages 50+: $3,500

- Special catch-up for ages 60-63: $5,250

2025 401(k) Contribution Limits

- Employee deferrals: $23,500

- Catch-up for ages 50+: $7,500

- Special catch-up for ages 60-63: $11,250

- Combined employer/employee limit: $70,000 ($77,500 if 50+)

As you can see, the 401(k) allows employees to defer $7,000 more annually than a SIMPLE IRA, which really adds up over time!

Administrative Complexity and Costs

Here’s where the SIMPLE IRA really shines—it’s easy to use, just like its name says:

SIMPLE IRA Administration

- No annual compliance testing

- No annual IRS filings

- Minimal ongoing maintenance

- Lower setup and operational costs

401(k) Administration

- Subject to nondiscrimination testing (ADP/ACP tests)

- Required annual Form 5500 filing

- Top-heavy testing requirements

- Higher setup and maintenance costs

- More complex plan documents

For many small businesses, the reduced administrative burden of a SIMPLE IRA is a significant advantage.

Vesting Schedules

Another important distinction:

- SIMPLE IRA: All contributions (both employer and employee) are immediately 100% vested.

- 401(k): While employee contributions are always immediately vested, employers can implement vesting schedules for their contributions that require employees to remain employed for a certain period before fully owning those contributions.

This gives 401(k) plans an advantage for businesses concerned about employee retention.

Plan Features and Flexibility

The 401(k) offers more bells and whistles:

Loan Provisions

- SIMPLE IRA: Does not permit loans

- 401(k): Can include loan provisions

Roth Options

- SIMPLE IRA: Roth options available since January 2023

- 401(k): Roth 401(k) option available

Eligibility Requirements

- SIMPLE IRA: Must include employees who earned $5,000 in any 2 prior years and are expected to earn $5,000 in current year

- 401(k): Can set age requirements (up to 21) and service requirements (up to 1 year/1,000 hours)

Who Should Choose a SIMPLE IRA?

A SIMPLE IRA might be better for your business if:

- You have fewer than 100 employees

- You want a retirement plan with minimal administrative headaches

- Your budget can accommodate mandatory employer contributions

- Simplicity is more important than maximum contribution flexibility

- You don’t need plan features like loans or vesting schedules

- Your employees (and you) don’t need to save more than the SIMPLE IRA limits

Who Should Choose a 401(k)?

A 401(k) might be better for your business if:

- You want maximum tax-deferred saving potential (higher contribution limits)

- You prefer flexibility in deciding whether and how to make employer contributions

- You want to implement a vesting schedule to reward loyalty

- Your plan needs to include loan provisions

- You’re willing to handle more administrative complexity for greater plan design flexibility

- You expect your business to grow beyond 100 employees

Real World Example

Let’s look at how this plays out with a real-world example:

ABC Company has 15 employees including the owner, Jane. Jane needs to choose between a SIMPLE IRA and a 401(k) in order to save the most for retirement.

Jane’s annual compensation is $350,000. If she sets up a SIMPLE IRA and contributes the maximum for 2025:

- Her employee deferral: $16,500

- Company matching contribution (3%): $10,500

- Total annual contribution: $27,000

If Jane sets up a 401(k) and maximizes for 2025:

- Her employee deferral: $23,500

- Company profit sharing contribution: up to $46,500

- Total annual contribution: up to $70,000

That’s a potential difference of $43,000 per year in retirement savings! However, Jane would need to provide proportional benefits to her employees with the 401(k) and handle the more complex administration.

Common Questions About SIMPLE IRAs vs. 401(k)s

Can a business offer both a SIMPLE IRA and a 401(k)?

No, employers cannot maintain both plans simultaneously for the same group of employees. If you have a SIMPLE IRA, you generally cannot maintain any other retirement plan.

Can employees participate in both a SIMPLE IRA and a Roth IRA?

Yes! The IRS allows participants to save in both a SIMPLE IRA and a Roth IRA at the same time, as long as they meet the eligibility requirements for both.

What happens to a SIMPLE IRA if my business grows beyond 100 employees?

You can continue the SIMPLE IRA for up to 2 calendar years after you exceed the 100-employee limit. After that, you’ll need to transition to another plan type.

Are there early withdrawal penalties?

Yes, both plans have a 10% early withdrawal penalty for distributions before age 59½. However, SIMPLE IRAs have an increased 25% penalty if withdrawals are made within the first two years of participation.

Other Retirement Plan Options

Don’t forget there are other retirement plan options that might work for your business:

Solo 401(k): For self-employed individuals with no employees, this plan allows contributions of up to $70,000 ($77,500 for those 50+) in 2025.

SEP IRA: Another option for small businesses that allows for high contribution limits but requires proportional contributions for all eligible employees.

The Bottom Line: Which Is Better?

So, is a SIMPLE IRA better than a 401(k)? There’s no one-size-fits-all answer. The “better” plan depends entirely on your business’s unique situation.

If you’re prioritizing simplicity and lower administrative costs, and the contribution limits are adequate for your needs, a SIMPLE IRA might be your best bet. It’s particularly well-suited for very small businesses with limited HR resources.

If maximum saving potential, plan design flexibility, and features like vesting schedules and loans are important to you, a 401(k) might be worth the additional complexity and cost.

I always recommend consulting with a financial advisor or employee benefits specialist before making your final decision. They can help you navigate the complexities and choose the plan that best aligns with your business goals and employee needs.

Remember, the best retirement plan is the one that works for YOUR business – not just what works for others!

Have you implemented either of these retirement plans at your business? What has been your experience? I’d love to hear your thoughts in the comments below!

SIMPLE 401(k) vs. SIMPLE IRA: Which is better for small business?

Both SIMPLE plans allow small employers to provide employees with a retirement savings option. They both permit employees to contribute to a retirement savings account via salary reductions and allow for catch-up contributions to participants over 50 years old. Some key differences include the following:

- A SIMPLE 401(k) plan might let you borrow money, but a SIMPLE IRA doesn’t.

- Companies that offer a SIMPLE IRA can’t offer another plan, but workers covered by collective bargaining agreements can.

- SIMPLE IRA participants don’t have to be a certain age, but SIMPLE 401(k) plan participants do have to be at least 21 years old.

What is a SIMPLE IRA and how does it work?

A SIMPLE IRA plan allows employees and employers to make contributions to Individual Retirement Arrangements (IRAs) set up for employees. SIMPLE IRA plans allow smaller employers to avoid the more complex structure and regulations surrounding traditional retirement plans and still provide a desired benefit to their staff.

Under a SIMPLE IRA plan:

- The employer puts money into an account set up specifically for each eligible worker;

- Some employees put some of their pay into a retirement plan;

- The plan is paid for by contributions from both employers and employees.

- Each employee is always 100 percent vested.

An employer is required to make a contribution to the plan and can choose to:

- Make a non-elective contribution of at least 2% of all eligible employees’ pay that is at least $5,000; or

- Match the amount of the donation by at least 10% up to the first 3% of the compensation.