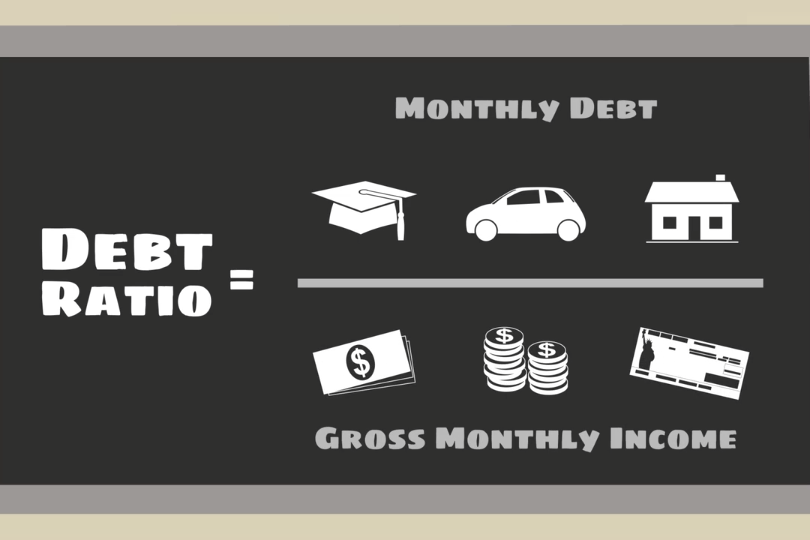

Your debt-to-income ratio (DTI) is an important part of how mortgage lenders evaluate your financial health. DTI ratios represent how much debt you have compared to your income.

It’s important to know your DTI as you consider buying a home. If you have a high amount of debt compared to income, consider `lowering your debt before applying for a loan. Even if you’re prepared to apply for a loan, you may struggle to find a lender willing to work with a high DTI.

Let’s look at DTI, how it works and how it impacts your mortgage application so you can prepare to start shopping for homes.

The debt-to-income (DTI) ratio is one of the most important factors lenders look at when determining eligibility for an FHA loan. The DTI ratio gives lenders an idea of how much debt you have compared to your income It essentially shows whether or not you can afford the mortgage payment for the home you want to buy

In this complete guide we will explain everything you need to know about FHA DTI ratios. We’ll cover what it is how it’s calculated, FHA’s specific DTI limits, and tips for improving your ratio.

What is a Debt-to-Income Ratio?

The debt-to-income ratio compares your total monthly debt payments to your gross monthly income It shows what percentage of your income is being used to pay off debts like credit cards, auto loans, student loans, existing mortgages, etc

There are two types of DTI ratios lenders look at:

-

Front-end DTI: This includes only housing-related debts like your mortgage, property taxes, homeowners insurance, and HOA fees.

-

Back-end DTI: This includes all of your monthly debt obligations including housing expenses plus credit cards, auto loans, student loans, legal settlements, etc.

The back-end DTI gives lenders the full picture and is generally given more weight in the mortgage approval process. Keep reading to learn how lenders calculate these important ratios.

How is the FHA DTI Ratio Calculated?

Calculating your DTI is actually quite simple. Here are the steps:

Front-end DTI:

- Add up your total monthly housing expenses (mortgage payment, property taxes, homeowners insurance, HOA fees)

- Divide this number by your gross monthly income

Back-end DTI:

- Add up all monthly debt payments (housing expenses plus credit cards, auto, student loans, etc.)

- Divide this number by your gross monthly income

Let’s look at an example. Let’s say Michael has:

- Gross monthly income: $5,000

- Monthly housing expenses:

- Mortgage payment: $1,300

- Property taxes: $250

- Homeowners insurance: $100

- Total housing expenses: $1,650

- Other monthly debts:

- Credit card payment: $200

- Auto loan: $350

- Student loan: $150

- Total other debts: $700

Front-end DTI = $1,650 / $5,000 = 33%

Back-end DTI = ($1,650 + $700) / $5,000 = 46%

As you can see, Michael’s front-end DTI is 33% while his back-end DTI is 46%. Now let’s look at FHA’s specific DTI requirements.

FHA Debt-to-Income Ratio Limits

The FHA has set maximum DTI ratios that borrowers need to fall under in order to qualify for an FHA loan. Here are the standard DTI limits:

- Front-end DTI: 31%

- Back-end DTI: 43%

So in Michael’s example above, his front-end DTI of 33% would be too high to meet FHA’s standard limits. However, the FHA does allow for some flexibility if you have compensating factors.

Compensating Factors for Higher DTI Ratios

The FHA will allow DTIs higher than 31% and 43% if you have certain compensating factors that help offset the additional risk. Here are some examples:

- You make a large down payment of at least 10%

- You have significant cash reserves after closing

- Your total monthly debts are decreasing

- You have excellent credit scores above 740

With compensating factors, the FHA will allow total DTIs up to 50%. However, each lender sets their own maximum DTI so you may not qualify unless you shop around. Our company works with a network of FHA lenders that will approve DTIs up to 55% in certain scenarios.

Tips for Improving Your DTI to Qualify

If your DTI is too high, here are some tips for improving it so you can qualify:

- Pay down revolving credit card balances

- Pay off installment loans like auto loans

- Make extra principal payments to reduce mortgage balances

- Refinance high-interest debt to lower monthly payments

- Ask lenders to exclude medical collections or disputed accounts

- Add a co-borrower with good DTI to boost household income

- Limit new credit inquiries while mortgage shopping

Even a couple percentage points decrease in your DTI can mean the difference between qualifying or not. Our loan officers can provide a free consultation to go over your specific situation and provide tips tailored to your scenario.

Does the FHA Allow Non-Borrowing Household Income?

Yes, the FHA does allow you to use non-borrowing spouse or partner income to help qualify. Their income can offset your debts and improve the DTI. However, their debts must also be included in the total debt calculation.

Can I Exclude Certain Debts from the FHA DTI Calculation?

Yes, not all debts have to be included in the DTI. Here are some examples of debts that can often be excluded:

- Collections or charged-off accounts, especially if older than 2 years

- Medical collections

- Federal student loans currently in deferment or forbearance

- Alimony payments with less than 10 months remaining

- Disputed derogatory accounts

FHA Student Loan Debt Calculation

Most lenders will allow you to use a lower student loan payment than what is listed on your credit report. They can use 1% of your total student loan balance instead of the actual monthly payment. This helps lower your DTI.

For example, if you have $50,000 in student loans, 1% of that balance is $500. The lender could use $500 for the monthly payment instead of your actual payment of $600. This would lower your DTI.

Our FHA Loan Experts Can Help

As you can see, FHA DTI ratios are complex but manageable if you understand the intricacies. Our team has over 15 years experience with FHA loans and can guide you through the process.

We work with a nationwide network of FHA lenders willing to approve higher DTIs with compensating factors. Pre-qualification is free and only takes 15 minutes.

Click below to start a pre-qualification and get a head start on getting approved!

FAQs about debt-to-income ratios

Here are a few frequently asked questions about DTI to help you prepare for the application process.

Convert your result to a percentage

Your initial result will be a decimal. To express your DTI ratio as a percentage, multiply the result by 100. In this example, your gross monthly income is $3,000, and your minimum monthly payment total is $900. When you divide $900 by $3,000, you’ll get 0.30. Multiply 0.30 by 100 to get 30, making your DTI ratio 30%.

You’d likely meet a lender’s DTI requirement because the DTI ratio falls below 43%.

NEW FHA Loan Requirements 2024 – Debt To Income Ratio – FHA Loan 2024

FAQ

What is the maximum debt-to-income ratio for a FHA loan?

What is a Good Debt-to-Income Ratio for an FHA Loan? The maximum DTI ratio allowed for an FHA loan varies by lender and is typically between 43% to 50%. At Better Mortgage, there are circumstances where up to 57% is allowed.

What is the FHA 75% rule?

The 75% rule for FHA loans is a guideline that states that 75% of a property’s rental income must cover the monthly mortgage payment. This rule only applies to properties with three or four units. When purchasing a multiunit property with an FHA loan, you’re still required to live in one of the units.

What disqualifies you for an FHA loan?

What is the FHA 3.5% rule?

… even if you qualify for a 3.5% down payment, you also have to pay annual mortgage insurance for the life of the loan unless you make a 10% down payment at …Jan 16, 2025